Why Are Some Medicare Advantage Plans Free?

Medicare Advantage Plans, particularly those that may offer a $0 premium, could be essential for those who may be looking for affordable health coverage. But why are some Medicare Advantage plans free, and what does “free” really mean in this context? How could these plans be viable?

Key Takeaways

- A ‘free’ Medicare Advantage plan will likely mean a $0 monthly premium, but it doesn’t cover other expenses such as deductibles, copayments, and coinsurance, which may vary by plan.

- The existence of $0 premium Medicare Advantage plans may be due to government subsidies and the imposition of network restrictions that manage healthcare expenses by requiring care to be sought within a specific network.

- Eligibility for zero-premium Medicare Advantage plans requires enrollment in Original Medicare, and sign-ups will likely be limited to specified enrollment periods, with different options for alterations during specific times of the year.

Compare Plans in One Step!

Enter Zip Code

Understanding “Free” Medicare Advantage Plans

A ‘free’ Medicare Advantage plan implies a $0 premium plan where members may not be obligated to make monthly payments for the offered coverage. A majority of Medicare Advantage plans, including prescription drug coverage, may not have a premium other than the Part B premium.

However, the term ‘free’ only pertains to the absence of a monthly premium and does not encompass other possible expenses. With some Medicare Advantage plans being free, it is essential to be aware of these additional costs.

The eligibility for these plans usually depends on the Medicare taxes you or your spouse paid Medicare taxes during your working years.

The Economics Behind No-Premium Medicare Advantage Plans

Potential economic factors like government subsidies and network restrictions could potentially contribute to the existence of $0 premium Medicare Advantage plans, as they could help control the costs that may be tied to these plans.

Subsidies and Payments

Medicare Advantage Plans will likely receive subsidies from the government, which could help mitigate the expenses that might be associated with delivering healthcare services.

These subsidies, along with a predetermined rate of payment per individual, annually, could potentially facilitate these plans to offer Medicare Advantage free or at a low cost to beneficiaries. However, the impact of these subsidies and payments on the premium may vary.

In certain instances, Medicare Advantage plans may receive subsidies and bonuses based on their performance and quality, which could lead to a reduction in monthly premiums for beneficiaries.

Network Restrictions

The potential network restrictions in certain Medicare Advantage plans could mandate that patients seek medical care from doctors and providers within the plan’s network. This might help manage expenses and allow insurers to provide plans without a premium.

However, these plans may limit patients’ access to out-of-network doctors, possibly underscoring the need for patients to understand the restrictions that might be imposed on doctor visits.

Opting for an in-network provider may also result in decreased out-of-pocket expenses, whereas utilizing a provider outside of the network could lead to substantial out-of-pocket costs.

Potential Cost Considerations Beyond the Premium

While some Medicare Advantage plans that may offer a $0 premium may not necessitate payment for the plan itself, it’s important to realize that these plans may include additional medical costs like:

- Deductibles: the out-of-pocket expenses individuals need to cover before their plan starts covering costs for services outside of hospital care

- Copayments: the amount individuals are required to pay for medical services such as doctor visits

- Coinsurance: the portion of costs individuals may be responsible for specific medical equipment and procedures.

The possible costs of deductibles, copayments, and coinsurance may differ between different Medicare Advantage plans.

Eligibility and Enrollment for Zero-Premium Plans

Those who meet the qualifying criteria for Medicare and are currently enrolled in Original Medicare are eligible to enroll in a zero-premium Medicare Advantage plan.

Nonetheless, remember that enrollment in these plans is only possible during specified times of the year, known as enrollment periods.

Enrollment Periods

The enrollment periods for Medicare Advantage plans consist of:

- Initial Enrollment Period: occurs around the month of your 65th birthday as well as the three months before and after it

- General Enrollment Period: runs from January 1 to March 31 of each year

- Special Enrollment Period: applies to certain situations such as moving out of your plan’s service area or losing your employer group health plan coverage.

One can also make alterations to a Medicare Advantage plan during the Medicare Advantage Open Enrollment Period, spanning from January 1 to March 31 annually.

This period allows individuals to switch to a different Medicare Advantage plan (with or without drug coverage) or discontinue their Medicare Advantage plan and enroll in Original Medicare.

Furthermore, if a Medicare prescription drug plan is required, it can be signed up for during this period.

To enroll in a plan, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

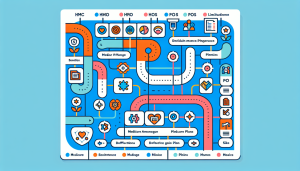

Comparing Plan Types: HMOs, PPOs, and More

While exploring Medicare Advantage plans, you’ll likely encounter two predominant types: HMO and PPO plans.

HMO Medicare Advantage plans are characterized by the necessity for prior authorization and typically reduced expenses compared to other healthcare plans. PPO Medicare Advantage plans, on the other hand, offer increased flexibility in selecting healthcare providers and eliminate the need for referrals to consult with specialists.

Understanding the differences between these plans is crucial in making an informed decision.

In addition to HMO (Health Maintenance Organization) and PPO, there are also MSA (Medicare Savings Account) and PFFS (Private Fee-for-Service) plans, which offer distinct benefits and structures.

Maximizing Potential Benefits While Minimizing Costs

Once you’ve grasped the basics of Medicare Advantage plans, you can move to the next step of optimizing your potential benefits and reducing costs.

This could be achieved by:

- Acquainting yourself with the drugs covered by the plan

- Confirming the inclusion of your preferred doctors in the plan’s provider directory

- Making use of preventative services and cost-saving opportunities.

Effective management of your prescription drug costs may also be essential.

This could be done by:

- Conducting a thorough comparison of available drug plans to identify one with more affordable costs

- Minimizing out-of-pocket expenses by comparing plans with varying cost structures

- Assessing the potential out-of-pocket costs for services

- Selecting plans that provide low costs for in-network services.

Transitioning from Original Medicare to Medicare Advantage

If you want to transition from Original Medicare to a Medicare Advantage plan, you have the option to enroll in a Medicare Advantage Plan during the Initial Enrollment Period or switch during the Annual Enrollment Period. There are no penalties for making this transition.

However, if you switch back to Original Medicare, there may be penalties if you didn’t have creditable drug coverage or if disenrollment occurs outside of the Medicare Advantage trial period.

Indeed, you have the option to revert to Original Medicare after enrolling in a Medicare Advantage plan, although this may be restricted to certain periods each year.

It’s important to note that while some Medicare Advantage plans may encompass all the services covered under Original Medicare, the specifics of these services may vary.

The Role of Prescription Drug Coverage

Prescription drug coverage will likely be an important element in various Medicare Advantage Plans. These plans may integrate both medical and drug benefits into a single comprehensive plan, unlike stand-alone Prescription Drug Plans, which could have a distinct list of covered drugs.

The potential impact of prescription drug coverage on the costs of certain Medicare Advantage Plans might include:

- Potential limitations on charges for medications within certain Medicare drug plans

- Potential variations in costs based on drug tiers

- Potentially higher expenses for standard Part D costs for individuals with higher incomes.

However, not all prescription medications may be included in these plans, and there could be limitations, such as opioid safety checks, prior authorizations, and specific formularies that may limit access to certain medications.

Navigating the Healthcare Marketplace

Navigating the healthcare marketplace to find the best plan for your needs could be a daunting task.

But don’t worry, you can consult with a licensed Medicare professional to get guidance in identifying the Medicare Advantage plan that would best suit your healthcare requirements.

Effective navigation of the marketplace requires:

- A clear understanding of your health plan needs

- Collection of details from your previous plan

- Usage of the call center to review the available plans

- Comparison of plans based on their costs, coverage, and provider networks

- Enrollment in the plan that aligns best with your needs

Medicare Advantage plans, a type of health insurance plan, will likely be available through the healthcare marketplace and may also offer advantages such as reduced out-of-pocket expenses, improved quality of care, and supplementary services.

Some Medicare Advantage plans might provide these benefits; nevertheless, awareness of potential restrictions on healthcare providers and treatments is also crucial, and scrutiny of the plan specifics is necessary before making a decision.

Summary

While some of the zero-premium Medicare Advantage plans could offer substantial benefits, it’s crucial to understand the intricacies of these plans, consider the other costs that might be associated, and make an informed decision that best suits your healthcare needs.

Frequently Asked Questions

→ What’s the catch with zero premium Medicare Advantage plans?

The catch with zero-premium Medicare Advantage plans is that you may still need to pay Original Medicare premiums for Part B.

→ What are the advantages of having a Medicare Advantage plan?

One of the potential advantages of a Medicare Advantage plan may include flexible networks, reduced out-of-pocket costs, and a lack of prior authorization requirements.

→ Do Medicare Advantage plans have no out-of-pocket costs?

Some Medicare Advantage plans might have out-of-pocket costs, but they could come with a yearly limit. Once you reach that limit, you likely won’t have to pay anything for covered services.

Keep in mind that each plan may have a different limit, which could change annually.

→ How can I enroll in a zero-premium Medicare Advantage plan?

You can enroll in a zero-premium Medicare Advantage plan during specific enrollment periods throughout the year.

→ What are the costs that could be associated with zero-premium Medicare Advantage plans?

While some zero-premium Medicare Advantage plans may not require payment for the plan itself, there will likely still be other expenses to consider like deductibles, copayments, and coinsurance.

Be aware of these additional costs before choosing a plan.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.