UnitedHealthcare Medicare Advantage Plans Pennsylvania 2025

Are you evaluating the potential UnitedHealthcare Medicare Advantage plans in Pennsylvania for 2025? This concise overview may detail the options available, from HMOs to PPOs and SNPs, outlining possible features and costs.

We’ll navigate through eligibility requirements, enrollment steps, and potential benefits, equipping you with essential information without overwhelming detail. Tap into insights that could help you choose a plan that fits your healthcare needs and will likely assure peace of mind.

Key Takeaways

- UnitedHealthcare offers various Medicare Advantage plans in Pennsylvania in 2025, each with specific benefits catered to different healthcare needs – HMO plans emphasize coordinated care, PPO plans offer more flexibility, and SNPs provide tailored services for individuals with specific needs like those eligible for both Medicare and Medicaid.

- The potential costs that may be associated with certain UnitedHealthcare Medicare Advantage plans may vary, including monthly premiums (with the possibility of Part B reductions for some), deductibles, and co-pays, though a majority of the plans may have annual out-of-pocket maximums that might prevent excessive medical spending.

- UnitedHealthcare will likely enhance some of its Medicare Advantage plans with comprehensive benefits including prescription drug coverage, and coverage for dental, vision, and hearing services, alongside potential support features like a 24/7 nurse hotline and accessible tools and resources.

Compare Plans in One Step!

Enter Zip Code

Exploring the Potential UnitedHealthcare Medicare Advantage Plans in Pennsylvania for 2025

UnitedHealthcare, a leading Medicare Advantage organization, will likely provide a variety of Medicare Advantage plans in Pennsylvania, which may include the Allegheny Armstrong Beaver Bedford region.

These plans may include Health Maintenance Organization (HMO) options, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each of these plans will likely come with its unique features, catering to a wide range of healthcare needs and preferences.

Let’s examine this in detail.

Health Maintenance Organization (HMO) Options

HMO plans offered by UnitedHealthcare prioritize coordinated care. As a member, you’ll select a primary care provider within the network who will guide your healthcare journey. This provider will also coordinate your access to specialists, often requiring referrals.

UnitedHealthcare’s HMO plans for 2025 in Pennsylvania are insured through UnitedHealthcare Insurance Company or its affiliated companies.

One of the potential advantages of these plans could be the possibility of having annual routine eye exams and allowances for contact lenses or designer frames also come with certain limitations and network restrictions.

Preferred Provider Organization (PPO) Plans

For those seeking more flexibility in their healthcare, UnitedHealthcare offers PPO plans. These plans allow you to seek care from out-of-network providers, albeit with potentially higher costs. However, the advantage of these plans is that they do not require referrals for specialist visits, streamlining access to specialist care.

Additionally, PPO plan members benefit from coverage during travel, with access to the UnitedHealthcare Medicare National Network and UnitedHealth Passport®, without requiring referrals. An excellent example of a PPO plan is the UnitedHealthcare Dual Complete PA-S001, a Dual Special Needs Plan (D-SNP) that caters to individuals who have both Medicare and Medicaid.

Special Needs Plans (SNPs)

For individuals with specific diseases or characteristics, UnitedHealthcare offers Special Needs Plans (SNPs).

These plans provide additional support and benefits that align with the unique healthcare needs of their members.

These plans provide additional support and benefits that align with the unique healthcare needs of their members.

To qualify, enrollees must meet specific eligibility criteria, focusing on individuals who have both Medicare and Medicaid. Some key features of Special Needs Plans include:

- Personalized care coordination

- Disease management programs

- Prescription drug coverage

- Access to a network of specialized providers

- Transportation assistance

- Dental and vision coverage

These plans are designed to provide comprehensive and tailored healthcare for individuals with specific needs.

One such plan is the UnitedHealthcare Dual Complete PA-S002, an HMO-POS Dual Special Needs Plan (D-SNP) that caters to those who have both Medical Assistance from the State and Medicare. These plans ensure full and equal access to covered services, complying with the Americans with Disabilities Act of 1990.

Understanding Potential Premiums and Costs

Grasping the cost structure of your healthcare plan is vital. With some of the UnitedHealthcare Medicare Advantage plans, the potential premiums and costs may vary depending on the specifics of the plan chosen, such as whether a premium for Medicare Part B is required. Some plans may offer Part B premium reductions, while others might entail out-of-pocket expenses such as co-pays for doctor visits and procedures.

However, a majority of these plans may offer annual out-of-pocket maximums that could potentially protect beneficiaries from excessive medical costs throughout the year.

Monthly Premium Structure

The possible structure of your Medicare Part B premium could play a significant role in your overall healthcare costs. This will likely become a crucial factor when budgeting for your healthcare expenses.

Possible Part B Premium Reductions

One of the potential benefits of Dual Special Needs Plans (D-SNPs) that may be provided by UnitedHealthcare could be the potential reduction in Medicare Part B premiums. These possible premium reductions might apply to enrollees who qualify for Extra Help (Low Income Subsidy).

However, take into account that some income-related monthly adjustment amounts may affect about 8% of people with Medicare Part B, possibly leading to varying premiums that could be based on individual income levels.

Potential Out-of-Pocket Costs and Caps

While monthly premiums may constitute a significant portion of your healthcare costs, it’s just as crucial to comprehend your potential out-of-pocket expenses.

Apart from this, certain UnitedHealthcare Medicare Advantage plans might involve other out-of-pocket expenses such as co-pays for doctor visits and procedures, which will likely vary by plan, and deductibles, and may include fixed costs before the plan covers services. However, rest assured that there may also be annual out-of-pocket maximums in place that may protect you from excessive medical costs.

Potential Enhanced Plan Benefits

In addition to basic coverage, some of the UnitedHealthcare Medicare Advantage plans may also come with a host of enhanced benefits, which may include a Medicare supplement. These potential benefits might include prescription drug coverage, and coverage for vision, dental, and hearing aid services.

These possible perks, acting as benefits features, might add value to certain plans and could cater to a broader spectrum of healthcare needs.

Prescription Drug Coverage

Some of the UnitedHealthcare Medicare Advantage plans may also include:

- Prescription drug coverage, possibly reducing the need to enroll in a separate Medicare Part D plan

- The convenience of managing all healthcare needs under one plan

- The ability to manage prescriptions through the UnitedHealthcare app, will likely allow services like setting up and refilling home delivery orders, tracking prescription history, and comparing medication prices.

Possible Vision, Dental, and Hearing Aid Coverage

Beyond medical and prescription drug coverage, certain UnitedHealthcare Medicare Advantage plans may include routine eye exams, dental cleanings, and hearing aid services. These potential benefits could underscore the comprehensive nature of these plans, and could potentially cover a wide range of healthcare needs.

Members may also receive allowances for eye wear frames, contact lenses, and hearing aids, which could make these items more affordable.

Service and Support Features

UnitedHealthcare’s commitment to its members will likely involve providing their members with the necessary support to manage their health effectively.

This commitment could be reflected in UnitedHealthcare’s service and support features, which could potentially include a 24/7 nurse hotline and a suite of member resources and tools. These features will likely be designed to provide members with the information, advice, and tools they may need to make informed healthcare decisions.

Nurse Hotline Availability

With the Optum® Nurse Hotline, members could have access to health-related advice 24/7. The nurses at the hotline may be able to offer information that could help members prepare questions for their doctor’s visits, although the nurses cannot diagnose problems or suggest specific treatments. For those who require assistance, please use tty 711 to access the hotline.

The possibility of having this service could help members decide on the appropriate level of preventive care for issues they may be facing, potentially reducing the need for unnecessary visits to hospitals or the emergency room.

Member Resources and Tools

To empower members in managing their healthcare, UnitedHealthcare will likely provide an array of resources and tools. From easily finding plan documents by entering a ZIP code on their website, to managing prescriptions through the UnitedHealthcare app, members could be equipped with the necessary tools for efficient healthcare management.

Moreover, members can access the provider directory to find doctors and healthcare facilities within the plan’s network.

Accessibility and Convenience

Accessibility and convenience could be fundamental to UnitedHealthcare’s service commitment. These aspects will likely be achieved through a wide network of providers, the availability of paper directories, and compliance with the Americans with Disabilities Act (ADA).

Some of these measures could potentially ensure that all members, regardless of their healthcare needs or personal circumstances, may be able to conveniently access the care they need.

Network of Providers

UnitedHealthcare could offer an extensive network that might include a wide variety of dental, eye care, and hearing specialists, which may be accessible to members and distributed across various counties. This could mean that no matter where a member resides, they could have access to a diverse range of healthcare professionals.

Members should, however, confirm the provider’s participation status and prior authorization availability before seeking care.

Requesting Paper Directories

While digital resources have become increasingly popular, UnitedHealthcare understands that some members may prefer physical directories. Members could request paper copies of the network provider directory by contacting customer service.

This could potentially ensure that members may have the flexibility to access information in the format that suits them best.

ADA Compliance and Support

In line with the Americans with Disabilities Act of 1990 and Section 504 of the Rehabilitation Act of 1973, UnitedHealthcare will likely provide equitable access to all covered services, ensuring a non-discrimination environment for individuals with disabilities.

This commitment could guarantee total and equal service access to their covered services, and will likely continue to uphold a policy of non-discrimination against qualified individuals with disabilities.

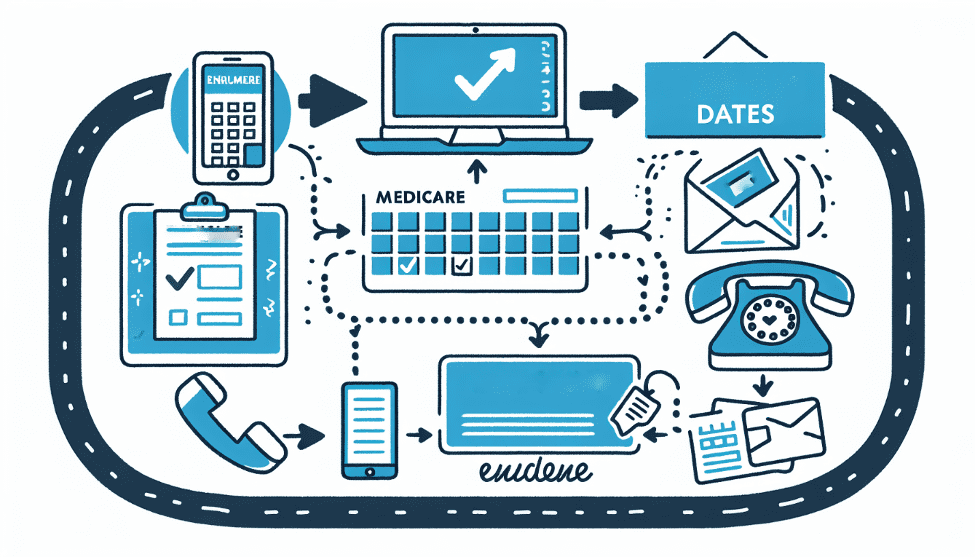

Enrollment and Eligibility

Comprehending the enrollment process and eligibility criteria is key to accessing healthcare coverage. To be eligible for UnitedHealthcare Medicare Advantage plans, individuals must be enrolled in both Medicare Part A and Part B.

Moreover, residents of Pennsylvania who live in the service area of the plan are eligible to enroll in UnitedHealthcare Medicare Advantage plans. However, eligibility is not based on medical history or current health status, except for end-stage renal disease (ESRD) unless certain exceptions apply.

Who is Eligible for Medicare Advantage?

Medicare is available to:

- U.S. citizens and legal residents who have lived in the United States for at least 5 consecutive years before applying

- Individuals who are age 65 or older

- Individuals under 65 who qualify due to a disability or certain medical conditions such as End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)

To enroll in a Medicare Advantage plan, an individual must already be enrolled in both Medicare Part A and Part B.

How to Enroll

Enrollment in UnitedHealthcare Medicare Advantage plans can be accomplished by calling 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. One of our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

This simple process could guarantee that you may secure your healthcare coverage with minimal hassle.

Dual Special Needs Plans

UnitedHealthcare will likely offer Dual Complete Special Needs Plans (SNPs), specifically targeting individuals who qualify for both Medicare and Medicaid.

These plans offer a range of healthcare benefits tailored to members who have both Medicare and Medicaid, providing coverage for various healthcare needs.

Eligibility for UHC Dual Complete plans in Pennsylvania requires having both Medical Assistance from the State and Medicare, with a potential need for a Medicaid member number when enrolling in a D-SNP.

Navigating Plan Ratings and Performance

Comprehending the potential plan ratings and performance could significantly aid in selecting the right Medicare Advantage plan for your needs. Medicare will likely use a Star Rating System to measure the performance of Medicare Advantage and Part D plans, possibly focusing on quality of care and customer service. This system awards ratings ranging from one to five stars – with five being the highest rating.

Importance of Star Ratings

Medicare Star Ratings may be designed to help beneficiaries compare the quality of health and drug services received by consumers enrolled in Medicare Advantage and Prescription Drug Plans. These ratings could potentially provide information about quality alongside details about potential benefits and costs, empowering Medicare consumers to make informed healthcare decisions.

If a plan is assigned fewer than three stars for three consecutive years, it is flagged as low-performing, alerting beneficiaries that they may want to reassess the plan’s suitability.

UnitedHealthcare Plan Ratings

Specific star ratings for UnitedHealthcare’s Medicare Advantage and Part D plans could be compared using the Medicare Plan Finder tool. By using these overall star ratings to compare UnitedHealthcare’s plans with others, enrollees can make comprehensive comparisons.

As of 2023, around 72% of MA-PD enrollees were in contracts that had around 4 or more stars, showing a significant majority in high-quality plans.

Summary

Navigating the landscape of healthcare coverage may be complex, but UnitedHealthcare could make the journey smoother with its range of Medicare Advantage plans in Pennsylvania. With a variety of plan options including HMO, PPO, and SNP options, UnitedHealthcare will likely cater to diverse healthcare needs.

Moreover, with the potential benefits such as prescription drug coverage, and vision, dental, and hearing aid coverage, UnitedHealthcare could potentially provide comprehensive healthcare solutions for its members. So, take the first step towards a healthier future by choosing a UnitedHealthcare Medicare Advantage plan that best suits your needs.

Frequently Asked Questions

→ What is the advantage of UnitedHealthcare?

Some of the main advantages of UnitedHealthcare could be its above-average customer satisfaction ratings, along with its offering of a reasonably large network of providers. This may be a consideration when choosing a healthcare provider.

→ Is UnitedHealthcare Medicare Advantage a good plan?

Yes, certain UnitedHealthcare Medicare Advantage plans, especially AARP plans, may be able to offer extensive disease management programs and good coverage, with an average overall rating of 4 stars.

→ What is the best Medicare Advantage plan for seniors?

Based on data from previous years, the best Medicare Advantage plan for seniors will likely be UnitedHealthcare, known for its good ratings and affordable costs.

→ What types of Medicare Advantage plans does UnitedHealthcare offer in Pennsylvania?

UnitedHealthcare offers a variety of Medicare Advantage plans in Pennsylvania, including HMOs, PPOs, and SNPs. You can choose the plan that best fits your needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company