Medicare Advantage Plans for 2025

If you’re looking to learn about and compare Medicare Advantage plans in your area, this website can help.

Medicare Advantage plans could serve as an alternative way to get Original Medicare coverage and will likely offer at least the same coverage as Original Medicare Part A and Medicare Part B. However, some of these plans may also offer additional benefits.

Some of the basic benefits that may be provided include:

- Medicare Part A – Hospital Coverage

- Medicare Part B – Medical Services

This article will help you learn how to compare Medicare Advantage plans as well as insurance companies to compare options. Finding the right plan for you and even enrolling has never been easier.

How to Compare Medicare Advantage Plans

To compare Medicare Advantage plans you’ll likely need to know:

- If you have both Medicare Part A and Medicare B in place

- If you reside in the same area that the Medicare Advantage plan network provides coverage

- If your chosen plan could provide the potential benefits you might need

- If your doctor accepts the plan

Medicare Advantage Plan Enrollment

If you are new to Medicare, the best time to enroll in a Medicare Advantage plan is between the time period three months before turning age 65, your birthday month, and three months after your 65th birth month. This is called the Initial enrollment period.

Your coverage will begin on the first of the month after the date that you sign up during your Initial Enrollment Period.

Already Enrolled in Medicare?

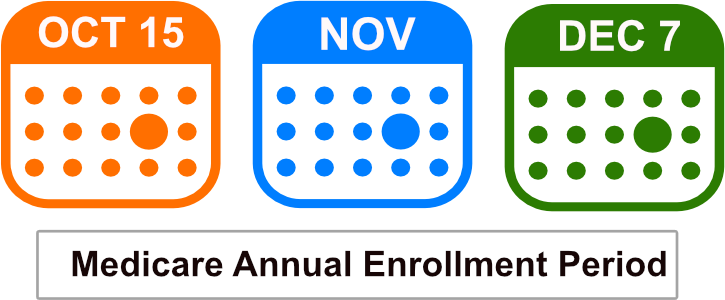

If you are already enrolled in Medicare and want to enroll in a Medicare Advantage plan (also called Medicare Part C), then you can switch and enroll in one during the Medicare Annual Enrollment period. This period runs between October 15th and December 7th of every year.

Your coverage will then begin on January 1st of the following year.

Medicare Advantage Plans for 2024

The potential Medicare Advantage plans for 2024 may change slightly from previous years, so members should always compare the potential plans and possible benefits for their chosen plan each year. Some plans may differ depending on the insurance company and your area.

Medicare Advantage Plan Networks

Medicare Advantage plans will likely use networks with their coverage. The coverage rules may vary by the type of Medicare Advantage plan you’re enrolled in.

Medicare Advantage plans must provide coverage that at least matches what Medicare Part A and Medicare B cover. However, some plans may also include additional benefits.

View plans & rates

Enter Zip Code

Medicare Advantage Plan Types

There will likely be different types of Medicare Advantage plans.

Several different insurance companies will likley offer these plans:

- Health Maintenance Organization Plans (HMO)

- Preferred Provider Organization Plans (PPO)

- Private Fee-for-Service Plans (PFFS)

- Special Needs Plans (SNPs)

Health Maintenance Organizations (HMOs)

HMO plans usually involve getting your services from a primary care physician and hospital within the plans’ network.

This applies unless you need emergency care or urgent care outside of the plan’s network. Many HMO’s may include prescription drug coverage built into the plan. If you enroll in an HMO without prescription drug coverage in it, you cannot enroll in a separate Medicare Part D prescription drug plan.

Preferred Provider Organization (PPO)

PPO plans also use a network, however, you have the ability to see providers outside the network but it may be at a higher cost.

Prescription drugs are covered in most PPO plans, and it’s important to see the cost of your own personal medications in the plans you’re considering, as well as to check if your doctors do in fact accept the plan. You do not need to choose a primary care doctor with a PPO plan.

Medical costs are typically lower with a PPO plan if you use providers within the network.

Private Fee-for-Service Plans (PFFS)

PFFS plans are different than HMOs or PPOs, in which the plan decides how much it will pay doctors and providers. The doctors must agree to the terms and services of the plans.

If you visit a doctor, hospital, or provider that does not belong to the plan’s network you may end up paying much higher costs. Prescription drugs may be included in the PFFS plan, but if they’re not you can enroll in a separate Medicare Part D prescription drug plan for coverage.

With a PFFS plan, you may visit any Medicare-approved doctor or health care provider, or hospital that approves the plan’s payment terms and agrees to see you, that has not opted out of Medicare. You may see a provider outside of the network but you may have to pay more.

Special Needs Plans (SNPs)

Special Needs Plans are tailored to people with specific diseases or situations.

You must qualify to enroll in one of these plans.

Medicare Advantage Plans - How to Get Started Now

The Medicare Annual Enrollment Period (AEP) begins each October 15th and runs through December 7th.

During this time frame, you may enroll in a Medicare Advantage plan in 2025 or change to a different plan.

Your new plan will then go into effect on January 1st.

New to Medicare?

If you are new to Medicare, then you can enroll in a Medicare Advantage plan up to three months prior to your Medicare Part B effective date.

Call one of our licensed insurance agents to see what the best time frame is for you to enroll, based on your current situation. You can contact them at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Medicare Advantage Plans by State

Medicare Advantage Plan Companies

Geisinger Gold

HealthPartners

HealthSpring

Highmark

HMSA

IBX

Independent Health

Martins Point

Medica

Molina

MVP

Network Health

PacificSource

Point32Health

Premera

Presbyterian

Priority Health

Providence

Quartz

Regence

SelectHealth

Sharp

Tufts

UCLA

UPMC

ZRN Health & Financial Services, LLC, a Texas limited liability company