Medicare Advantage Plans 2026

As we look towards the

Key Takeaways

- Explore Upcoming Changes: Stay updated on potential new developments and potential modifications in Medicare Advantage plans

for 2026 .

- Understand Cost Adjustments: Gain insights into possible changes in premiums, copays, and other out-of-pocket costs.

- Enrollment Periods Explained: Learn about key enrollment periods, including the Annual Enrollment Period (AEP), Initial Enrollment Period (IEP), and Special Enrollment Periods (SEPs), to make decisions about your coverage.

Stay proactive to ensure your healthcare plan aligns with your needs in the evolving Medicare landscape

Compare Plans in One Step!

Enter Zip Code

Overview of Medicare Advantage Plans for 2026

Looking ahead to

Some changes might stem from the implementation of the Inflation Reduction Act, which could reshape annual out-of-pocket costs for Medicare Part D recipients. This may include a new capped maximum out-of-pocket limit, which could potentially reduce spending and deliver substantial savings to beneficiaries.

Elimination of the Coverage Gap

In past years, a significant change has been made to Medicare Part D: the elimination of the coverage gap phase, commonly known as the “donut hole.” Previously, beneficiaries who spent a specific amount on covered prescriptions entered this phase, likely resulting in higher out-of-pocket costs. This adjustment could potentially ensure a more affordable experience for Part D enrollees, possibly reducing financial burdens for seniors.

Expanded Coverage Areas for 2026

It’s not known at this time whether Medicare Advantage plans

- Aetna: The company has recently provided expanded coverage across 46 states and Washington, D.C., with 255 county options. This expansion brings Medicare Advantage to approximately 2.2 million additional beneficiaries, extending access to over 2,269 counties.

- UnitedHealthcare: The provider has recently grown its coverage area by adding 110 more counties, now serving approximately 96% of eligible areas nationwide.

- Wellcare: With a focus on reaching more Medicare-eligible adults, Wellcare has recently served 48 million individuals nationwide, potentially offering plan options that may have expanded benefits.

These potential expansions will likely ensure that beneficiaries have more choices to find plans tailored to their specific healthcare needs.

Potential Benefits

Although the rates and changes for Medicare Advantage plans in 2026 are yet to be released, there is speculation about the potential enhancements that may be introduced. These might include:

- Additional Coverage Options: Expanded dental, vision, and hearing benefits that could exceed the offerings of Original Medicare.

Stay tuned and refer back to this website for updates as Medicare providers unveil finalized

Possible Additional Benefits

Some of the leading Medicare Advantage providers may focus on enhancing their offerings to better serve their members. Over the years, these improvements likely include a range of supplemental benefits designed to meet the needs of beneficiaries. Some of the most notable features have been:

- Dental Coverage: Expanded dental benefits that could address more oral health needs.

- Vision Services: Enhanced coverage to support beneficiaries’ visual health, including eye exams and eyewear.

- Hearing Benefits: Discounts on hearing aids and exams.

When 2026 Medicare Advantage plan details become available, revisit this site to enter your zip code and compare updated plan options and costs effortlessly.

Compare Plans in One Step!

Enter Zip Code

Best Medicare Advantage Plans for 2026

Selecting the right Medicare Advantage plan will likely depend on each individual’s unique healthcare needs. While there isn’t a single “best” plan for everyone, several well-known providers stand out for their quality and reliability. Top providers from recent years will likely include:

- UnitedHealthcare

- Cigna

- Humana

- Anthem

- Wellcare

- Aetna

- Blue Cross Blue Shield

When the data has been released

These trusted companies have been known to expand their coverage areas and enhance their offerings to better serve Medicare beneficiaries. By using the Plan Finder tool on this website once the

UnitedHealthcare Medicare Advantage Plans 2026

UnitedHealthcare is a leader in Medicare Advantage, covering a significant portion of Medicare-eligible seniors.

Humana Medicare Advantage Plans 2026

Humana will likely offer a range of plan types, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), providing flexibility for seniors. Features may include:

- Availability in 49 states, Washington, D.C., and Puerto Rico.

- Dual Eligible Special Needs Plans (D-SNPs)for those eligible for both Medicare and Medicaid.

Aetna Medicare Advantage Plans 2026

In recent years, Aetna has continued to expand its reach, offering Medicare Advantage plans that might combine coverage for Parts A and B with supplemental benefits. Their expansion might include:

- Coverage in 46 states and Washington, D.C.

- Expansion to 255 new counties, totaling 2,269 counties

- Potential benefits like dental, vision, and hearing care, plus prescription drug coverage.

Wellcare Medicare Advantage Plans 2026

Wellcare might integrate Original Medicare (Parts A and B) with supplemental benefits to potentially provide robust, affordable coverage. Possible features to look for

- Focus on affordability and low monthly premiums.

- Additional benefits like dental, vision, and hearing coverage for qualifying members.

Navigating the Medicare Advantage Market in 2026

To make the most of your Medicare Advantage plan

Understanding Premiums and Cost-Sharing:

Monthly premiums for Medicare Advantage plans may vary based on individual needs and possible factors like the insurer and the coverage provided. Here’s a breakdown of the potential cost-sharing elements:

- Premiums: The monthly payment you make to maintain your plan.

- Deductibles: The amount you must pay out of pocket before your plan begins to cover services.

- Copayments: Fixed fees for specific services, such as doctor visits or prescription medications.

- Coinsurance: A percentage of the cost for healthcare services that you must pay after meeting your deductible.

Each Medicare Advantage plan likely has its own cost-sharing structure. By thoroughly reviewing plan details, beneficiaries can make educated decisions that align with their financial and healthcare needs.

2026 Medicare Advantage Payment Update

The Centers for Medicare & Medicaid Services (CMS) has finalized a 5.06% payment increase for Medicare Advantage plans

Star Ratings:

The Centers for Medicare & Medicaid Services (CMS) rates Medicare Advantage plans annually based on several criteria, including quality of care, customer service, and member satisfaction. Here’s what you need to know:

- Ratings range from 1 to 5 stars, with 5 stars indicating the highest quality.

- Updated star ratings are released every October, making it important to compare plans based on the most recent data.

- Higher-rated plans often offer better benefits and services, helping you select a plan that aligns with your healthcare priorities.

Stay informed about star ratings by visiting this website and using this website’s plan comparison tool to find options tailored to your zip code.

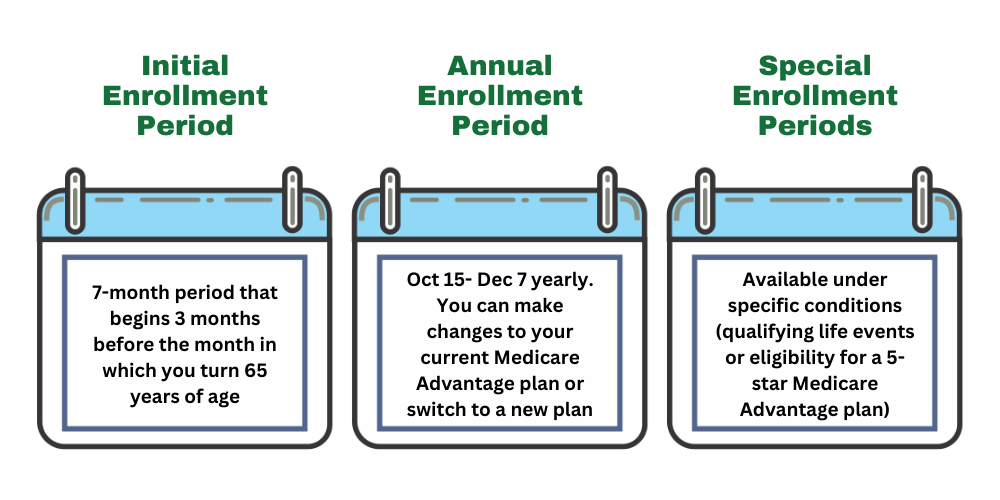

Enrollment Periods:

Understanding Medicare Advantage enrollment periods is critical for securing the right coverage. The two primary enrollment windows are:

- Initial Enrollment Period (IEP): Spanning seven months (three months before, the month of, and three months after you become eligible for Medicare), this period allows first-time enrollees to select a plan.

- Annual Enrollment Period (AEP): Held annually from October 15th to December 7th, this window lets beneficiaries adjust their plans, switch providers, or enroll in a new plan.

By understanding these enrollment periods, seniors could ensure they select a plan that meets their needs while taking advantage of the latest benefits.

Utilizing Extra Benefits:

Some Medicare Advantage plans

- Dental, Vision, and Hearing Coverage: Expanded access to preventive care and treatments that may go beyond Original Medicare.

- Prescription Drug Benefits: Comprehensive Part D coverage to help manage medication costs.

To make the most of these extra benefits:

- Learn to Utilize Them Efficiently: Understand how to access and use supplemental benefits effectively, maximizing the value of your plan.

- Stay Informed About Changes: Regularly monitor updates throughout

2026 to adapt to possible changes in coverage.

Understanding Coverage Limitations

Staying informed about coverage limitations and provider networks will likely be essential for getting the most value from your Medicare Advantage plan

- Provider Networks: Being aware of whether your Medicare Advantage plan might include a provider network is crucial. These networks determine which doctors, hospitals, and specialists are covered, helping you manage costs by choosing in-network providers.

- Service Limitations: Some plans may have restrictions on specific services or treatments. Understanding these limitations could ensure you’re not caught off guard when accessing care

in 2026 . - Potential Premium Changes: While premiums for Medicare Advantage plans may increase

in 2026 , not all beneficiaries will experience higher costs. Various factors like plan type and coverage area may influence these changes.

By understanding premium structures, provider networks, and possible service restrictions, beneficiaries could make well-informed decisions to select a plan that aligns with their healthcare needs and budget. Staying proactive will likely help you optimize your Medicare Advantage coverage

Summary

Navigating the evolving Medicare market

Compare Plans in One Step!

Enter Zip Code

Frequently Asked Questions

→ What is the 2026 Medicare Part B Premium?

The monthly premium for Medicare Part B

→ What Changes May Be Expected for Medicare Advantage Plans in 2026 ?

Changes may include adjustments to average monthly premiums, modifications in coverage, and updates to Part D prescription drug benefits. Please check back on this website for updated information.

→ When is the 2026 Medicare Advantage Annual Enrollment Period (AEP)?

The Medicare AEP, or Open Enrollment Period, runs annually from October 15th to December 7th. During this time, you can make changes to your Medicare Advantage plan.

→ Can I Enroll in a Medicare Advantage Plan in 2026 If I Have End-Stage Renal Disease (ESRD)?

Yes, individuals with ESRD can typically enroll in Medicare Advantage plans, though some restrictions may apply.

→ What’s the Difference Between the Initial Enrollment Period (IEP) and the Medicare Advantage Open Enrollment Period (OEP) in 2026 ?

Initial Enrollment Period (IEP): This seven-month window starts three months before, includes the month of, and extends three months after your 65th birthday, allowing new beneficiaries to enroll.

Open Enrollment Period (OEP): From January 1st to March 31st, existing Medicare Advantage members can switch plans or return to Original Medicare.

→ Can I Switch from Medicare Advantage to a Medicare Supplement (Medigap) Plan in 2026 ?

Yes, switching is possible, but it’s best to do so during specific enrollment periods to avoid medical underwriting. A guaranteed issue right may allow you to enroll in a Medigap plan without underwriting.

→ What is the Medicare Advantage Special Enrollment Period (SEP) in 2026 ?

The SEP allows you to enroll in, switch, or leave a Medicare Advantage plan outside the usual enrollment periods. SEPs are triggered by qualifying life events, such as:

- Moving to a new service area

- Losing employer-sponsored coverage

- Getting married

Medicare Advantage Plans by State

Vermont

Wisconsin

Medicare Advantage Plan Companies

HealthSpring

HMSA

IBX

Independent Health

Independent Blue Cross

Martins Point

Medica

MVP

Network Health

PacificSource

Point32Health

Premera

Priority Health

Providence

Quartz

SelectHealth

Sharp

Tufts

ZRN Health & Financial Services, LLC, a Texas limited liability company