Medicare Advantage vs Plan G

Navigating the world of Medicare may be overwhelming, especially when trying to decide if Medicare Advantage or Plan G is better.

Both options will likely be designed to supplement Original Medicare, but they may have different features and benefits. By the end of this article, you’ll have a better understanding of which plan aligns best with your personal needs.

In the upcoming sections, this article will compare some of the key aspects of Medicare Advantage and Medigap Plan G, such as potential coverage, costs, and eligibility requirements. You’ll also discover the importance of timing and medical underwriting in your decision-making process. So, let’s embark on this journey towards finding the perfect Medicare plan for you.

Key Takeaways

- Comparing Medicare Advantage and Plan G will likely require an evaluation of potential features, provider flexibility, cost-benefit analysis, and long-term value.

- Members may want to consider lifestyle needs, health requirements, provider preferences & financial situation when selecting a plan.

- State regulations could affect the availability & cost of Medigap plans. Guaranteed issue rights could protect consumers from being denied coverage due to preexisting conditions.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage and Plan G

Medicare Advantage and Medigap Plan G are both Medicare supplement insurance plans that may be designed to cover costs that might not be included by Original Medicare. Eligibility for Medicare Advantage requires enrollment in both Medicare Part A and Part B and residing in the plan’s service area provided by private health insurance companies.

The primary distinction between Medigap and Medicare Advantage could be that Medigap supplements Original Medicare, whereas Medicare Advantage replaces it.

The coverage that may be offered by each plan could be a key factor when comparing Medicare Advantage and Plan G.

Some of the Medicare Advantage plans may provide bundled coverage, including prescription drug coverage and extra benefits like dental, vision, and hearing care, but may have restrictions on out-of-network providers. On the other hand, Medigap Plan G could offer comprehensive coverage for out-of-pocket expenses and may have more predictable costs and greater provider flexibility.

Potential Features of Medicare Advantage Plans

Medicare Advantage plans are mandated to provide coverage for the same services as Medicare Part A and Part B, but some may offer distinct deductibles and copayments.

Some Medicare Advantage plans may also provide coverage for:

- Prescription drugs

- Routine dental care

- Hearing care

These additional services may not be covered under Original Medicare.

However, certain Medicare Advantage plans, including Medicare Advantage HMO, will likely operate within specific networks of physicians and hospitals. Utilizing in-network providers and facilities may be necessary for cost-effective care. This potential limitations may affect your ability to access care while traveling or needing specialized treatment.

Prescription Drug Coverage in Medicare Advantage

Some of the Medicare Advantage plans may also include Part D prescription drug coverage, which could make those plans a convenient option for comprehensive coverage.

Certain plans could potentially cover a wide range of prescription drugs, including HIV/AIDS treatments, antidepressants, antipsychotic medications, and anticonvulsants. Furthermore, Part D plans will likely be required to cover all drugs in six “protected” classes, which could include immunosuppressants, antidepressants, antipsychotics, and anticonvulsants.

The potential cost of certain Medicare Advantage Part D prescription drug coverage will likely vary depending on the specific plan selected. It is recommended to review the details of each plan to help determine the cost of prescription drug coverage.

Out-of-Network Considerations

Some Medicare Advantage plans might restrict access to out-of-network providers, which could limit care during travel or when specialized treatment is needed. Some of these plans may offer a provider network and might charge extra or not cover costs for doctors or facilities outside of the network.

Assessing different networks and choosing one that could offer the most beneficial perks for your health situation may be a key factor when deciding between Medicare Advantage and Medigap. Being aware of the potential effects of using out-of-network providers under a Medicare Advantage plan is necessary. These effects could include:

- Unexpected balance bills

- Limited provider options

- Care access delays

- Inaccuracies within provider directories

- The possibility of some hospitals discontinuing Medicare Advantage plans.

The Potential Benefits of Medigap Plan G

Medigap Plan G is a supplemental insurance plan that could provide coverage for out-of-pocket expenses that may not be included in Original Medicare.

Medigap Plan G is a supplemental insurance plan that could provide coverage for out-of-pocket expenses that may not be included in Original Medicare.

This plan might offer extensive coverage for certain out-of-pocket costs, that may have more predictable expenses and increased provider flexibility.

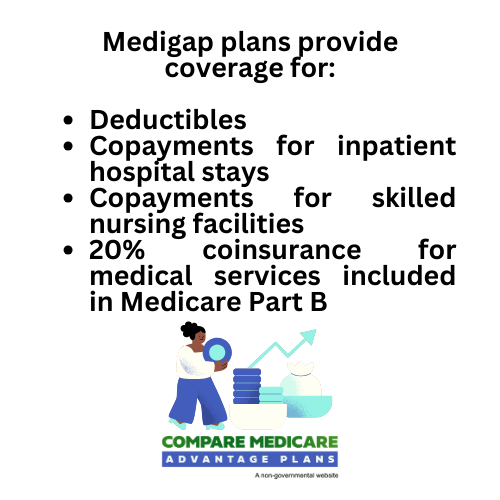

Some of these Medigap plans could provide coverage for:

- Deductibles

- Copayments for inpatient hospital stays

- Copayments for skilled nursing facilities

- 20% coinsurance for medical services included in Medicare Part B

Medicare beneficiaries are required to pay a monthly premium for a Medigap plan. The amount of the premium will likely be determined by factors such as their age and geographic location.

Comparing Costs: Possible Premiums and Out-of-Pocket Expenses

Plan G may have higher premiums than Medicare Advantage but may also provide more reliable out-of-pocket expenses and comprehensive coverage.

While the premiums may be higher, the predictability and comprehensive coverage that could be provided by Plan G might be advantageous for individuals who require extensive medical care or prioritize provider flexibility.

Provider Flexibility with Plan G

Beneficiaries of Plan G will likely have the freedom to select any doctor or hospital that accepts Medicare, which could provide greater flexibility in their healthcare provider options. This flexibility could be especially beneficial for those who travel frequently or have specific healthcare needs that require specialized care.

Under traditional Medicare and Plan G, doctors and hospitals must accept Original Medicare. This means that you will likely have access to a list of providers that accept Medicare payments, giving you a wide range of options to choose from.

Enrollment Considerations: Timing and Eligibility

When enrolling in Medicare Advantage and Plan G, some potential factors to take into account may include timing, eligibility, and the potential effect of medical underwriting on Plan G. Here are some options for enrollment:

- You can enroll in a Medicare Advantage plan when you first sign up for Medicare.

- Alternatively, you can make this enrollment within two months of losing any employer coverage you may have had.

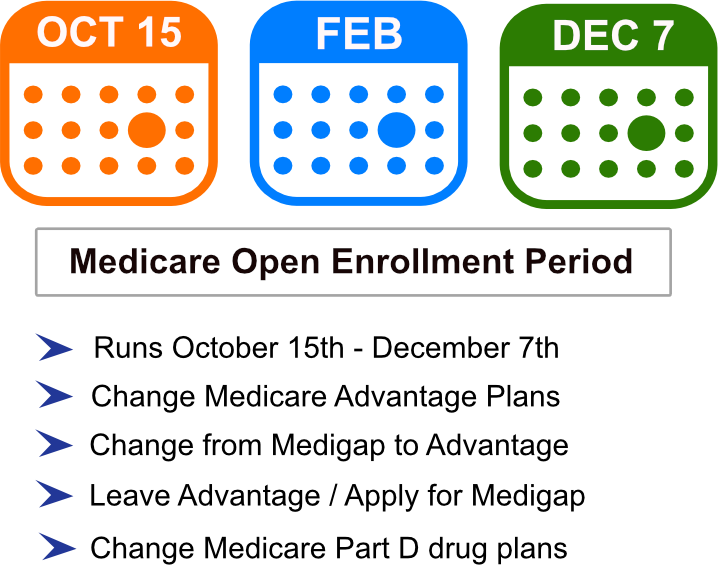

- Open enrollment from October 15 to December 7 is available for coverage commencing January 1.

If you’re contemplating enrolling in a Medigap plan like Plan G, try to do so during the open enrollment period for Medigap policies.

This period starts on the first day of the month when you turn 65 or older and are enrolled in Medicare Part B. This time frame is significant because obtaining a Medigap plan might become more expensive or impossible at a later date.

Potential Impact of Medical Underwriting on Plan G

Medical underwriting is the process of assessing an individual’s health status and medical history to determine eligibility and potential premiums for a policy. This process, which will likely be carried out by an insurance company, could affect Plan G premiums and availability, making it important to enroll during the open enrollment period or when guaranteed issue rights apply.

Some of the guaranteed issue rights in Medigap Plan G may include the right to enroll in a Medicare Supplement plan without medical underwriting, which could grant coverage regardless of health status.

These rights could ensure access to certain Medicare Supplement plans, possibly protecting consumers from being denied coverage based on preexisting conditions or health issues.

Lifestyle and Health Needs: Choosing What's Best for You

Choosing between Medicare Advantage and Plan G will likely depend on individual lifestyle, health needs, and preferences for additional services.

When making your decision, consider your preferred method of receiving medical care and your anticipated frequency of use. Your healthcare, travel, and financial needs should also be taken into account when determining the best fit for you.

Ultimately, the decision between Medicare Advantage and Plan G may come down to what aligns best with your personal needs and preferences.

If you value additional benefits like dental, vision, and hearing coverage, Medicare Advantage may be a better fit for you. On the other hand, if you prioritize provider flexibility, comprehensive coverage, and predictable costs, traditional Medicare plus Plan G may be more suitable.

Considering Medicare Advantage for Additional Services

Medicare Advantage may be a more suitable option for those who require additional services such as:

- Dental coverage, which might include cleanings, routine X-rays, extractions, and fillings

- Vision and hearing coverage, which may be offered by certain Medicare Advantage plans in addition to their other benefits

Some of these additional services could make Medicare Advantage a comprehensive option for those looking for more than just basic medical coverage.

When Traditional Medicare Plus Plan G Makes Sense

Traditional Medicare plus Plan G may be more suitable for those who prioritize provider flexibility, comprehensive coverage, and predictable costs.

Under traditional Medicare and Plan G, provider flexibility could enable beneficiaries to access care from any doctor or healthcare provider who accepts Medicare. There will likely be no network restrictions, possibly granting beneficiaries the freedom to select their healthcare providers.

Situations in which traditional Medicare plus Plan G may be a more suitable choice might include frequent travel, dual residences, or a desire to continue seeing your current physician. Plan G may also be beneficial for those who seek unlimited choices for care and are willing to pay higher premiums for the added flexibility and comprehensive coverage.

Switching Between Plans: What You Need to Know

Switching between Medicare Advantage and Plan G is possible, but may be subject to state regulations and eligibility requirements.

The Open Enrollment Period, which takes place from October 15 to December 7 annually, is the only time when one can switch from a Medigap plan to a Medicare Advantage plan. During this time, it is also possible to transition between Medicare Advantage and traditional Medicare.

However, if you switch from Medicare Advantage to Medigap, you may face challenges in acquiring a Medigap insurance policy. This highlights the importance of understanding the implications of switching between plans and being aware of the potential challenges involved.

To enroll or switch plans, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

The Role of State Regulations

State regulations could play a role in determining the ease of switching between Medicare Advantage and Plan G, as well as the availability of guaranteed issue rights.

While some of the federal minimum requirements and consumer protections may be in effect, states are authorized to regulate Medigap policies, including Plan G. As a result, the availability and potential costs of Plan G may vary from state to state due to these regulations.

Certain states may also offer guaranteed issue rights for Medigap, which may include:

California

California

- Connecticut

- Idaho

- Illinois

- Maine

- Massachusetts

- Missouri

- Nevada

- New York

- Oregon

- Rhode Island

- Washington

- and many others

These rights could provide the right to enroll in a Medicare Supplement plan without medical underwriting, possibly guaranteeing coverage regardless of health status. Understanding the regulations and options in your new state is necessary when considering a switch in Medicare plans.

Cost-Benefit Analysis: Medicare Advantage vs. Plan G

Determining the long-term value of Medicare Advantage versus Plan G may require a comparison of the potential costs, benefits, and personal preferences to ascertain the optimal fit for individual needs.

Here are some key points to consider:

- Some of the Medicare Advantage plans could provide the same coverage benefits as Original Medicare.

- Additionally, some of the Medicare Advantage plans may offer extra benefits like prescription drugs, vision, and dental coverage.

By evaluating these potential factors and considering your own healthcare needs and budget, you can make an informed decision about which plan is best for you.

Conversely, Plan G is a Medigap plan that may supplement Original Medicare but might not include additional benefits like prescription drugs or dental coverage.

When considering the balance between possible premiums, out-of-pocket expenses, provider flexibility, and additional benefits, individuals should weigh their personal preferences and healthcare needs to make an informed decision.

Evaluating Long-Term Value

For assessing the long-term value of Medicare Advantage and Plan G, members should weigh the balance between premiums, out-of-pocket expenses, flexibility in choosing providers, and additional benefits.

Some Medicare Advantage plans may provide a maximum on out-of-pocket expenses for covered services under Original Medicare.

This limit could help to protect consumers from high medical costs. Medigap Plan G does not have an out-of-pocket limit, however, it could be beneficial in reducing out-of-pocket costs in the long run. By considering these factors, you can make an informed decision on the best plan for your individual needs and preferences.

Summary

The choice between Medicare Advantage and Medigap Plan G will likely depend on your individual needs, lifestyle, and healthcare preferences.

Medicare Advantage might offer bundled coverage with additional benefits like dental, vision, and hearing care, but may have limitations on out-of-network providers. On the other hand, Medigap Plan G could provide comprehensive coverage for out-of-pocket expenses, greater provider flexibility, and predictable costs.

By considering the potential factors such as costs, benefits, provider flexibility, and additional services, you could make an informed decision about which plan best suits your individual needs. Remember, the right choice for you will depend on your unique healthcare, travel, and financial needs.

Frequently Asked Questions

→ Is Medicare Plan G better than an Advantage plan?

Medigap Plan G could offer more coverage for medical costs than Medicare Advantage, but it may be more expensive and could have limited provider networks. Medicare Advantage might be more affordable, especially for those with long-term health issues, and may also offer extra benefits that may not be available under Medigap plans.

It is important to consider your priorities, like budget, choice, travel, and health conditions when choosing between Medicare Advantage and Medigap.

→ What is the biggest advantage of Medicare Advantage?

Some of the Medicare Advantage plans may offer a broad range of choices for provider networks and location coverage, which might make it easy to access care when and where you need it.

→ Why would I choose Medigap over Medicare Advantage?

Medigap could offer flexibility and choice, which may allow you to visit any doctor who accepts Medicare, whereas some of the Medicare Advantage plans may limit you to a network of doctors and hospitals.

Additionally, Medigap may also cover out-of-pocket expenses that Original Medicare doesn’t pay, whereas Medicare Advantage could bundle additional benefits such as vision, dental, and hearing services.

→ Is it possible to switch between Medicare Advantage and Medigap Plan G?

Yes, it is possible to switch between Medicare Advantage and Medigap Plan G; however, the process may be subject to state regulations and eligibility requirements.

→ What additional services could be offered by Medicare Advantage?

Some of the Medicare Advantage plans may offer additional benefits such as dental, vision, and hearing coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company

California

California