UPMC Medicare Advantage Plans 2026

Curious about UPMC Medicare Advantage Plans

Key Takeaways

- UPMC Medicare Advantage Plans offer diverse plan types, including HMO, PPO, and Special Needs Plans, catering to various healthcare needs with added benefits beyond Original Medicare.

- Key features include a Flex Spend Card for health-related expenses, a broad network of healthcare providers, and comprehensive coverage including dental, vision, and wellness programs.

- Enrollment is facilitated through multiple user-friendly channels, with important timelines such as the Initial Enrollment Period and Annual Election Period guiding eligible individuals in accessing coverage.

Compare Plans in One Step!

Enter Zip Code

Understanding UPMC Medicare Advantage Plans 2026

UPMC Medicare Advantage Plans, also known as MA plans, offer a range of options, including HMO, PPO, and Special Needs Plans (SNPs), each tailored to meet diverse healthcare needs. These plans are designed to provide comprehensive coverage and additional benefits that go beyond what Original Medicare offers. UPMC for Life, part of UPMC Health Plan, stands out as one of Pennsylvania’s top Medicare Advantage insurers, providing high-quality care.

One of the standout features of UPMC Medicare Advantage Plans is the Flex Spend Card, which allows members to use allocated funds for various health-related expenses. Additionally, members have access to a network of healthcare providers, ensuring comprehensive care options.

These plans require annual contract renewals with Medicare, keeping them current with the latest healthcare standards and regulations.

Types of UPMC Medicare Advantage Plans Available

UPMC Medicare Advantage Plans come in three main types: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNPs). Each type of plan offers unique features and benefits, catering to different healthcare needs and preferences.

UPMC offers plans for those seeking flexibility in provider choice or specialized care for specific health conditions, including UPMC health benefits, UPMC health coverage, and UPMC health network.

HMO Plans

HMO Plans, or Health Maintenance Organizations, are a popular choice among Medicare enrollees. These plans typically require members to choose a primary care physician who will coordinate their care and provide referrals to specialists. This structure ensures that all aspects of a member’s healthcare are managed efficiently and effectively. Members must use a network of doctors and hospitals for their healthcare services, which helps keep out-of-pocket costs low.

UPMC’s HMO plans cover prescription drugs; make sure to select one that includes this coverage if necessary. Emergency services can be accessed outside of the HMO network without requiring prior authorization, providing peace of mind in urgent situations.

Some HMO plans may be structured as Point-of-Service (HMO-POS) plans, allowing for certain out-of-network services at a higher cost.

PPO Plans

Preferred Provider Organization (PPO) plans offer more flexibility compared to HMO plans. With UPMC’s PPO plans, members can see any healthcare provider without the need for referrals. This flexibility is particularly beneficial for those who want the freedom to choose their doctors and specialists without being restricted to a network.

These plans still offer comprehensive coverage and include prescription drug coverage as well.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific health conditions or needs, such as dual eligibility for Medicare and Medicaid, chronic conditions, or institutionalized individuals. These plans are designed to provide specialized care and additional services that address the unique needs of their members. UPMC’s SNPs include Dual Eligible SNPs for those with both Medicare and Medicaid, Chronic Condition SNPs for individuals with specific chronic diseases, and Institutional SNPs for those living in institutions.

To be eligible for SNPs, you must have Medicare Part A and Part B and live within the plan’s service area. These plans also include Part D prescription drug coverage to ensure access to necessary medications.

By offering tailored benefits and services, SNPs aim to improve the quality of care and overall health outcomes for their members.

Overview of UPMC Medicare Advantage

UPMC Medicare Advantage Plans aim to provide comprehensive coverage and high-quality care. These plans include access to a network of healthcare providers, ensuring that members receive coordinated and efficient care. UPMC for Life, a part of UPMC Health Plan, has been recognized as one of the best insurance companies for Medicare Advantage in Pennsylvania, highlighting its commitment to providing top-notch healthcare services.

Members also enjoy additional services and programs not provided by Original Medicare. These include dental, vision, and hearing services, as well as wellness programs like SilverSneakers for fitness and exercise activities. The plans are designed to meet the diverse healthcare needs of Medicare beneficiaries, providing comprehensive support and high-quality care.

Covered Services and Benefits

These plans offer a wide range of services and benefits, ensuring comprehensive healthcare support. These plans include coverage for dental, vision, and hearing services, which are not typically covered by Original Medicare. Members may also receive a Flex Spend Card, which can be used for additional healthcare purchases not covered by the plan.

These plans also include behavioral health services, providing access to mental health support. The plans also offer out-of-network services in emergencies, although these typically involve different cost-sharing arrangements.

By offering a broad range of services and benefits, these plans meet the diverse healthcare needs of their members.

Key Benefits of UPMC Medicare Advantage Plans

One of the key benefits of UPMC Medicare Advantage Plans is the high-quality coverage they offer at a low cost. Members receive a Flex Spend Card that can be used for various health services and products, providing additional financial support for healthcare expenses. UPMC for Life is recognized as one of Pennsylvania’s best Medicare Advantage insurers, underscoring the quality and reliability of their plans.

Another significant benefit is the comprehensive network of doctors, hospitals, and other providers under UPMC. This health system ensures that members have access to coordinated and efficient care. These plans include preventive services and wellness programs to help members maintain their health and well-being.

Additional Health Services

UPMC Medicare Advantage Plans include a range of additional health services designed to support the overall well-being of their members. These services often include dental, vision, and hearing needs, extending coverage beyond standard medical services. Members may also have access to a Flex Spend Card, which allows them to use allocated funds for various health-related expenses.

Wellness programs are another key feature of UPMC Medicare Advantage Plans. Programs like SilverSneakers provide fitness and exercise activities to help members stay active and healthy. By offering these additional health services, UPMC Medicare Advantage Plans aim to enhance the quality of life for their members and promote overall health and wellness.

Enrollment Process for UPMC Medicare Advantage Plans 2026

The enrollment process for UPMC Medicare Advantage Plans is straightforward. Individuals can apply online, in-person, or by phone. The enrollment process is designed to be user-friendly, ensuring that eligible individuals can easily access the healthcare coverage they need.

Whether you’re a first-time enrollee or looking to switch plans, UPMC offers multiple options to facilitate the enrollment process.

When to Enroll

Knowing when to enroll in Medicare Advantage plans is crucial. Eligible individuals can enroll during the Initial Enrollment Period, starting three months before turning 65 and lasting for seven months.

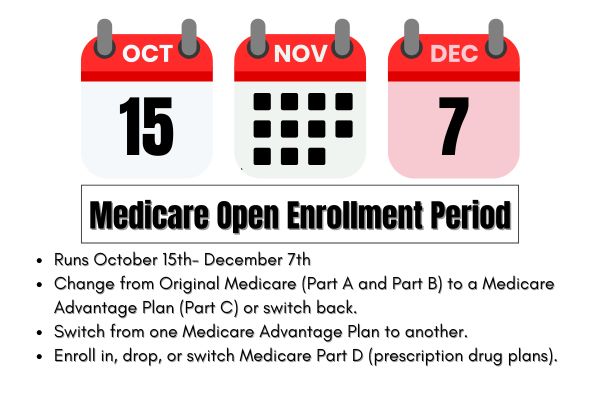

The Annual Election Period (AEP) from October 15 to December 7 allows beneficiaries to join or switch plans. Special Enrollment Periods (SEPs) enable individuals with qualifying life events to enroll outside regular periods.

Different enrollment periods

Medicare Advantage plans have several enrollment periods, each with specific eligibility criteria. The Initial Enrollment Period allows individuals to join a Medicare Advantage plan when they first become eligible for Medicare.

The Annual Election Period (AEP) from October 15 to December 7 allows beneficiaries to enroll in, switch, or drop plans. Special Enrollment Periods (SEPs) allow beneficiaries to change plans outside the usual windows if they experience qualifying events like relocation or loss of coverage.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) from January 1 to March 31 allows beneficiaries to change their Medicare Advantage plans. During this time, individuals can switch between Medicare Advantage plans or revert to Original Medicare.

The Annual Enrollment Period (AEP) from October 15 to December 7 provides another window for seniors to enroll in or switch plans. Special Enrollment Periods (SEPs), triggered by specific life events, offer flexibility for changes outside regular periods.

Costs Associated with UPMC Medicare Advantage Plans 2026

UPMC Medicare Advantage Plans generally offer lower costs compared to traditional Medicare options. They provide comprehensive coverage while keeping out-of-pocket expenses manageable.

Knowing the costs, including premiums, co-pays, and out-of-pocket maximums, is crucial for making an informed decision.

Premiums and Co-Pays

Monthly premiums for UPMC Medicare Advantage Plans vary based on the specific plan chosen. These premiums are typically lower than those for Medicare Supplement plans. Co-pays, fixed amounts for specific services, are often lower under UPMC Medicare Advantage Plans compared to Original Medicare. Co-pays vary by service type, ensuring predictable out-of-pocket costs.

Besides premiums and co-pays, members may face deductibles—the amount paid before the plan contributes to expenses. After meeting the deductible, cost-sharing measures like coinsurance apply, where members pay a percentage of the service costs.

Preventive services are covered at 100% with participating providers, meaning no co-pay is required.

Out-of-Pocket Maximums

These plans feature an out-of-pocket maximum, limiting the total amount members pay in a year. This cap offers financial protection by ensuring most covered services are provided at no additional cost once the limit is reached. The out-of-pocket maximum varies by plan type and is detailed in the plan’s benefits schedule.

Premiums and non-covered services do not count toward the out-of-pocket maximum. After reaching the out-of-pocket maximum, members have no further cost-sharing responsibilities for covered services, offering peace of mind and financial stability.

Covered Services and Benefits

These plans cover a wide range of medical services, including preventive care, hospital stays, and prescription drugs. Members have access to comprehensive healthcare support, including additional benefits like dental, vision, and hearing services. This extensive coverage is designed to meet the diverse healthcare needs of Medicare beneficiaries.

They also include access to specialized care and emergency services, ensuring comprehensive medical support. Preventive services like annual wellness visits and screenings are covered without out-of-pocket costs. Mental health services, including counseling and psychiatric care, are covered, providing well-rounded support for overall well-being.

How to Qualify for UPMC Medicare Advantage Plans 2026

To qualify for UPMC Medicare Advantage Plans, individuals must be enrolled in Medicare Parts A and B. Designed for Pennsylvania residents, these plans are tailored to meet their specific needs. UPMC offers both HMO and PPO plan options under its Medicare Advantage offerings, providing flexibility and choice for potential enrollees.

Individuals eligible for both Medicare and Medicaid can explore UPMC’s dual-eligible special needs plans (D-SNPs). Enrollment in these plans depends on UPMC’s contract renewal with Medicare, keeping them up-to-date with healthcare standards and regulations.

Contracted Network and Access to Care

These plans ensure their provider networks are adequate to meet the healthcare needs of their enrollees. Aligned with typical care patterns in their service area, these networks ensure members have access to necessary care. Under certain conditions, regional preferred provider organizations may offer care outside their network in specified areas, providing flexibility for members.

The Centers for Medicare & Medicaid Services (CMS) publish network area lists for Medicare Advantage plans, detailing regions with specific network adequacy requirements.

Comparing UPMC Medicare Advantage Plans to Original Medicare

These plans offer additional benefits not covered by Original Medicare, such as dental, vision, and fitness programs, as well as supplemental benefits. These plans provide comprehensive coverage and often include prescription drug coverage, which is not typically covered by Original Medicare.

Comparing the benefits and coverage options helps beneficiaries make informed decisions about which plan best suits their needs.

Coverage Differences

A primary difference between UPMC Medicare Advantage Plans and Original Medicare is the inclusion of prescription drug coverage in most Advantage plans. While Original Medicare includes only Part A and Part B coverage, Medicare Advantage plans often combine these with additional services like prescription drug coverage. Medicare Advantage plans generally have a set network of providers, while Original Medicare allows access to any doctor or facility that accepts Medicare.

The Value-Based Insurance Design (VBID) Model enables Medicare Advantage plans to adapt patient cost-sharing based on service value, promoting essential high-quality care. Participating Medicare Advantage plans in the VBID Model can offer tailored benefits like reduced medication costs and transportation services to help enrollees access care.

This model aims to improve care quality by addressing social determinants of health, which can affect patients’ ability to seek medical attention.

Cost Comparisons

Monthly premiums for these plans are generally lower than those for Medicare Supplement plans. These plans often have lower out-of-pocket costs per visit compared to Original Medicare, which requires a significant deductible before coverage starts. Many Medicare Advantage plans include a maximum out-of-pocket limit, absent in Original Medicare, potentially reducing overall costs for beneficiaries.

Medicare Advantage plans typically have preset copayments and coinsurance, ensuring predictable out-of-pocket costs from day one. While Original Medicare requires separate enrollment for prescription drug coverage, many Medicare Advantage plans bundle this coverage, offering a more streamlined and cost-effective option.

Emergencies and Referrals

UPMC Medicare Advantage plans cover emergency and urgent care services nationwide, providing peace of mind for members wherever they are. In a medical emergency, members receive care without needing a referral from their primary care physician, ensuring timely access to necessary services. Members should call 911 or visit the nearest emergency room in case of a medical emergency.

For non-emergency situations, these plans provide access to urgent care services without prior authorization. Referrals may be required for some specialties within the UPMC network, depending on the type of plan. This structure ensures that members receive coordinated care while maintaining the flexibility to access urgent services when needed.

Summary

In summary, UPMC Medicare Advantage Plans offer comprehensive coverage with a range of benefits designed to meet the diverse healthcare needs of Medicare beneficiaries. From HMO and PPO plans to Special Needs Plans, UPMC provides options that cater to different preferences and health conditions. The plans include additional services like dental, vision, hearing, and wellness programs, ensuring that members receive holistic care.

Choosing the right Medicare Advantage plan is a crucial decision, and UPMC Medicare Advantage Plans stand out for their high-quality coverage, extensive provider network, and cost-effective options. Whether you’re a new enrollee or considering switching plans, UPMC offers the flexibility and support needed to navigate your healthcare journey with confidence.

Frequently Asked Questions

→ What types of UPMC Medicare Advantage Plans are available?

UPMC Medicare Advantage Plans include HMO, PPO, and Special Needs Plans (SNPs) to address varying healthcare requirements. Choose the plan that best fits your specific health needs.

→ What additional benefits do UPMC Medicare Advantage Plans offer?

UPMC Medicare Advantage Plans offer additional benefits such as dental, vision, and hearing services, wellness programs like SilverSneakers, and a Flex Spend Card for healthcare purchases. These enhancements can significantly improve your overall healthcare experience.

→ When can I enroll in a UPMC Medicare Advantage Plan?

You can enroll in a UPMC Medicare Advantage Plan during the Initial Enrollment Period, the Annual Election Period from October 15 to December 7, or during Special Enrollment Periods if you experience qualifying life events.

→ How do UPMC Medicare Advantage Plans compare to Original Medicare?

UPMC Medicare Advantage Plans often provide additional benefits like dental, vision, and fitness programs that Original Medicare does not cover, along with prescription drug coverage. This can make them a more comprehensive option for many beneficiaries.

→ What are the costs associated with UPMC Medicare Advantage Plans 2026 ?

UPMC Medicare Advantage Plans involve costs such as monthly premiums, co-pays for certain services, and an annual out-of-pocket maximum to cap your expenses. Understanding these fees is essential for effective budgeting and planning.

ZRN Health & Financial Services, LLC, a Texas limited liability company