UnitedHealthcare Medicare Advantage Plans North Dakota 2026

Want to know what the UnitedHealthcare Medicare Advantage plans in North Dakota for 2026 mightlook like? This article reveals the available plans, potential benefits, and how to enroll.

Key Takeaways

- UnitedHealthcare’s Medicare Advantage plans for North Dakota in 2026 will likely feature expanded health benefits, such as dental, vision, and hearing coverage.

- Potential inclusion of Medicare Part D into certain plans could result in lower out-of-pocket costs for beneficiaries, with potential caps on spending and improved drug coverage.

- Members can switch plans during designated enrollment periods, and our support resources can help members navigate their options and maximize their potential benefits.

Compare Plans in One Step!

Enter Zip Code

Overview of UnitedHealthcare Medicare Advantage Plans in North Dakota

UnitedHealthcare will likely offer a variety of Medicare Advantage plans that could be designed to cater to the unique needs of North Dakota residents. These plans could provide a range of potential health benefits and services that could meet the healthcare demands of the local population. Each plan could potentially ensure that beneficiaries receive the best possible care and coverage.

Enrollment in UnitedHealthcare’s Medicare Advantage plans will likely be contingent upon the renewal of contracts with Medicare. The availability of plans and their potential benefits may vary annually, depending on the ongoing agreement between UnitedHealthcare and Medicare. Beneficiaries should stay informed about contract statuses to ensure continued access to their preferred healthcare plans.

The potential benefits and services offered by UnitedHealthcare Medicare Advantage plans might differ based on the specific plan and geographic location. This variability likely allows for a more personalized approach to healthcare, possibly ensuring that individuals could receive coverage that best suits their needs. Whether it’s comprehensive preventive services or specialized care options, UnitedHealthcare likely aims to provide a robust and flexible range of plans for North Dakota residents.

Medicare Part D and Prescription Drug Coverage

The potential integration of Medicare Part D, also known as prescription drug coverage, into certain UnitedHealthcare Medicare Advantage plans could potentially impact some out-of-pocket expenses and drug coverage. This potential coverage could provide financial protection and possibly make prescription medications more affordable for beneficiaries.

Some plans might offer a cap on certain maximum out-of-pocket expenses for Medicare Advantage members, likely offering financial protection against high healthcare costs. This potential cap could ensure that beneficiaries may not be burdened with exorbitant out-of-pocket expenses, possibly making it easier to manage their healthcare budgets.

The potential elimination of the coverage gap phase could also make it easier for seniors to manage their prescription drug costs. This potential coverage could remove some of the financial barriers that beneficiaries might face when they reach the coverage gap, likely ensuring easy access to necessary medications.

Possible Benefits

Some UnitedHealthcare Medicare Advantage plans may offer a range of potential benefits, such as dental, vision, and hearing coverage.

Some plans might offer annual routine eye exams, with an allowance for contacts or frames, depending on the specific plan. These potential benefits could ensure that members have access to essential vision care services.

Certain plans may also offer lower out-of-pocket costs for beneficiaries. The caps on out-of-pocket spending could potentially enhance the affordability of healthcare services for UnitedHealthcare members. However, members should be aware that the maximum copays may vary vary based on the coverage stage.

Enrollment and Transition Considerations

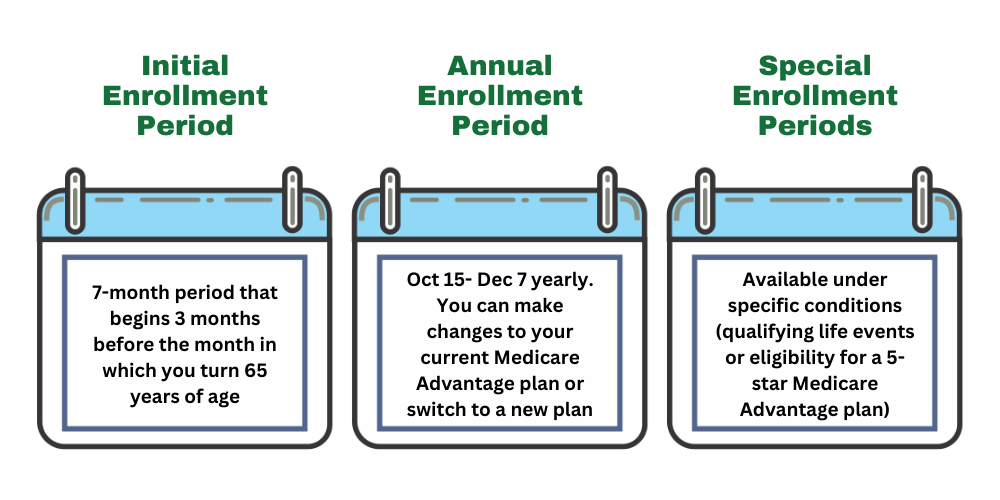

Enrollment and transitioning between Medicare Advantage plans require careful consideration and planning. Members will have several opportunities for members to switch plans and make informed healthcare decisions.

Members can switch Medicare Advantage plans during designated enrollment periods, such as the Annual Enrollment Period from October 15 to December 7 each year. This period allows beneficiaries to review their current coverage and make changes to better suit their healthcare needs. Additionally, if you’re in a Medicare Advantage Plan between January 1 and March 31, you can switch plans or return to Original Medicare and join a separate Medicare drug plan.

Transitioning between plans may involve understanding differences in coverage, particularly for out-of-network services. Effective transitioning involves assessing healthcare needs and evaluating the potential benefits offered by different organizations during enrollment periods.

Enrollment in UnitedHealthcare Medicare Advantage plans depends on the renewal of the plan’s contract with Medicare. Staying informed about the status of these contracts ensures continued access to preferred healthcare plans.

Summary

As we look towards 2026, UnitedHealthcare Medicare Advantage plans will likely continue to evolve to meet the changing healthcare needs of North Dakota residents. From various plan offerings and potential benefits, UnitedHealthcare has been committed to providing comprehensive and affordable healthcare options for its members.

The potential integration of Medicare Part D into certain plans might enhance the affordability of prescription medications, possibly providing financial protection and making healthcare more accessible. Understanding the possible benefits of these plans could be crucial for making informed decisions about your healthcare coverage.

Staying informed and utilizing available resources is key to navigating the complexities of Medicare Advantage plans. By taking advantage of enrollment periods and support resources, beneficiaries can ensure they receive the best possible care. As healthcare continues to evolve, staying updated and informed will empower members to make the best decisions for their health and well-being.

Frequently Asked Questions

→ When can I switch between Medicare Advantage plans?

You can switch between Medicare Advantage plans during the Annual Enrollment Period from October 15 to December 7 each year or from January 1 to March 31 if you are currently enrolled in a Medicare Advantage Plan.

→ What additional benefits could UnitedHealthcare Medicare Advantage plans provide?

Some UnitedHealthcare Medicare Advantage Plans may provide additional benefits such as dental, vision, and hearing coverage, possibly enhancing the overall healthcare experience beyond what Original Medicare might cover.

→ How could the potential integration of Medicare Part D impact my out-of-pocket costs?

Unfortunately, the plan details for 2026 have not been released, but make sure to check back in to this article/website for updated information for the 2026 calendar year.

→ How can I stay informed about possible changes to my Medicare Advantage plan?

To stay informed about potential changes to your Medicare Advantage plan, regularly check this website or call our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST and keep an eye on relevant legislative changes. This proactive approach ensures you have the latest information.

ZRN Health & Financial Services, LLC, a Texas limited liability company