Medicare Advantage Plans Nevada 2026

Looking into the potential Medicare Advantage Plans in Nevada

Key Takeaways

- Some Medicare Advantage plans in Nevada might combine hospital and medical services with additional benefits like dental and vision coverage.

- The three types of Medicare Advantage plans available—HMO, PPO, and Special Needs Plans—offer varying coverage options, flexibility, and specialized care for different healthcare needs.

- Enrollment in Medicare Advantage requires individuals to be enrolled in Original Medicare, with various enrollment periods allowing beneficiaries to choose or switch plans based on their needs.

Compare Plans in One Step!

Enter Zip Code

Understanding Nevada Medicare Advantage Plans 2026

Medicare Advantage plans might have become a cornerstone of healthcare for many Nevada residents, likely reflecting the plan’s broad appeal across diverse demographics. These plans combine hospital and medical services into a single, comprehensive package, sometimes offering additional benefits that are not available through Original Medicare.

Types of Nevada Medicare Advantage Plans Available

Nevada will likely offer a variety of Medicare Advantage plans to cater to different healthcare needs. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each plan type comes with its unique coverage options and cost structures, ensuring that there is something to fit everyone’s needs.

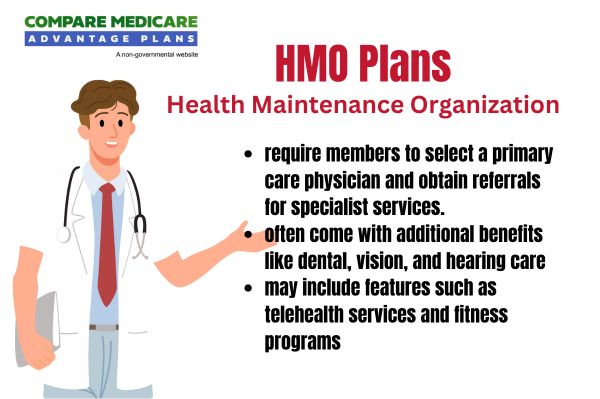

HMO Plans

HMO plans in Nevada require members to use a network of doctors and hospitals to benefit from lower costs. These plans typically require the selection of a primary care physician (PCP) who oversees all healthcare services and provides referrals to specialists when necessary. The emphasis on network-based care and the need for referrals will likely streamline healthcare management and keep costs down for members.

HMO plans could provide a structured approach to healthcare, likely combining comprehensive coverage with cost efficiency.

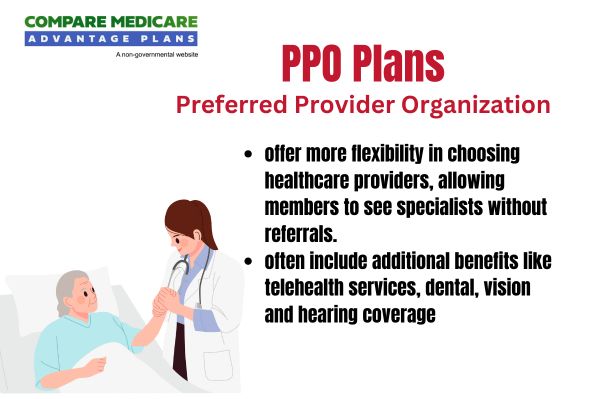

PPO Plans

PPO plans offer greater flexibility compared to HMO plans. Members can see both in-network and out-of-network providers without needing a referral. This flexibility comes at a cost, as out-of-network services might be more expensive, but it could provide a broader range of choices for those who want it.

This flexibility could make PPO plans an attractive option for those who prioritize having a wide array of healthcare options and supplemental benefits.

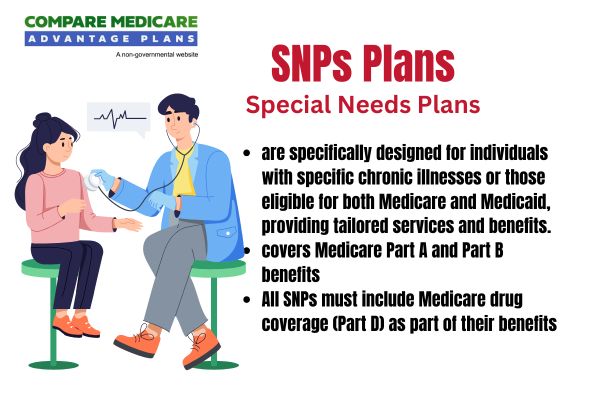

Special Needs Plans (SNPs)

SNPs are tailored for individuals with specific health needs, including those who are eligible for both Medicare and Medicaid. These plans offer coordinated care services which could significantly improve health outcomes for their members. There are three main types of SNPs: Chronic Condition SNPs, Dual Eligible SNPs, and Institutional SNPs, each designed to meet the unique needs of their respective populations.

SNPs will likely offer a streamlined process for dual eligible beneficiaries by integrating Medicare and Medicaid services, possibly ensuring comprehensive health coverage. This coordination could be particularly beneficial for managing chronic conditions and maintaining overall health.

Overview of Nevada Medicare Advantage Plans

Medicare Advantage plans in Nevada will likely offer a combination of hospital and medical coverage, sometimes including additional benefits in a single plan. Some plans may include additional benefits, such as prescription drug coverage, dental, vision, and hearing benefits, possibly making them a comprehensive choice for many beneficiaries.

Potential Benefits of Nevada Medicare Advantage Plans 2026

Medicare Advantage plans in Nevada will likely offer a compelling combination of hospital and medical coverage, sometimes with additional benefits such as dental, vision, and hearing care. Some plans may also incorporate prescription drug coverage, which could simplify medication management.

Enrollment Process for Nevada Medicare Advantage Plans 2026

Enrollment in Medicare Advantage plans in Nevada requires being enrolled in both Medicare Part A and Part B. The enrollment process typically begins three months before turning 65 and continues for three months after, providing ample time for individuals to choose the plan that best fits their needs.

When to Enroll

Eligibility for enrollment typically begins three months before turning 65 and lasts until three months after the birthday month, making the Initial Enrollment Period last seven months. This period allows individuals to sign up for Parts A and B, ensuring comprehensive coverage from the start.

Different Enrollment Periods

There are several enrollment periods to be aware of, each serving different purposes. The General Enrollment Period occurs from January 1 to March 31, allowing those who missed their initial enrollment to join Original Medicare.

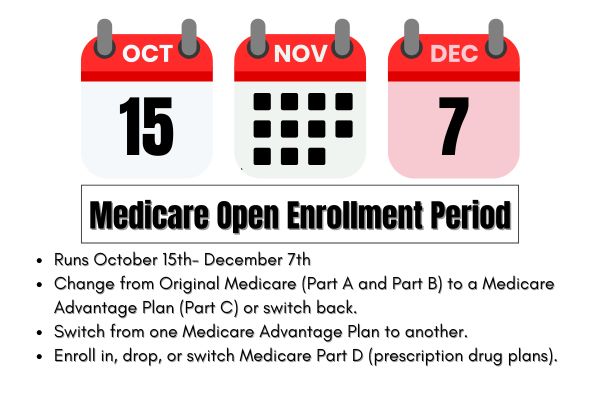

The Medicare Open Enrollment Period, from October 15 to December 7, provides an opportunity for interested parties to make a variety of coverage changes, including switching plans or enrolling in Medicare Advantage.

The Medicare Advantage Open Enrollment Period runs from January 1 to March 31, during which individuals can switch their Medicare Advantage plans or revert to Original Medicare. Special Enrollment Periods can also occur throughout the year, allowing for changes due to specific life events like losing employer coverage.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) allows beneficiaries to switch plans or make changes from October 15 to December 7 each year. During this time, individuals can review and adjust their Medicare Advantage plans and Part D coverage to better meet their needs. The Annual Enrollment Period (AEP) for Medicare Advantage and Part D also runs from October 15 to December 7 each year, allowing for similar adjustments.

Special enrollment period (SEPs) provide flexibility for those who experience qualifying life events, such as moving out of a plan’s service area or losing employer-based coverage. Enrollments during SEPs can occur within 60 days following the qualifying event, ensuring continuous coverage without significant gaps.

Costs Associated with Nevada Medicare Advantage Plans 2026

Some Medicare Advantage plans in Nevada may offer lower monthly premiums, possibly making them an attractive option for beneficiaries looking to manage their healthcare costs.

However, it’s important to understand the various costs involved, which may include premiums, co-pays, and out-of-pocket maximums.

Premiums and Co-Pays

While some plans may have lower monthly premium, beneficiaries are still responsible for their Part B premium. In-network services might come with lower copays under some plans, possibly making healthcare more accessible and affordable.

Out-of-Pocket Maximums

Certain Medicare Advantage plans might offer an annual out-of-pocket maximum, which could protect beneficiaries from excessive healthcare costs during the year.

Potential Services and Benefits

The extensive coverage offered by Medicare Advantage plans might incorporate prescription drug coverage, and dental, vision, and hearing coverage.

How to Qualify for Nevada Medicare Advantage Plans 2026

Qualification for a Medicare Advantage plan in Nevada requires enrollment in Original Medicare (Parts A and B). The enrollment can occur during the Initial Enrollment Period, which spans three months before and after an individual’s 65th birthday. This period provides ample opportunity to evaluate and choose the most suitable plan.

Additionally, the Medicare Annual Enrollment Period allows individuals to switch, add, or drop their plans from October 15 to December 7 each year. For those who qualify for Dual Special Needs Plans (D-SNPs) due to eligibility for both Medicare and Medicaid, this offers tailored and enhanced support.

Contracted Network and Access to Care

Medicare Advantage organizations are required to maintain a network of providers that adequately meets the healthcare needs of the enrolled population. This network must be aligned with the prevailing healthcare practices in the service area’s network, ensuring that beneficiaries have access to necessary services without undue hardship.

Regional preferred provider organizations could provide care beyond their network under specific conditions and with CMS approval, possibly enhancing flexibility while maintaining quality care.

The Centers for Medicare & Medicaid Services (CMS) annually publishes the list of network areas for Medicare Advantage plans, ensuring transparency and accessibility.

Comparing Nevada Medicare Advantage Plans to Original Medicare

Some Medicare Advantage plans may provide additional benefits that could go beyond those covered by Original Medicare, which might include services like dental and vision care. This potential coverage could make these plans an attractive option for many beneficiaries looking for more than the basic hospital and doctor visits covered by Original Medicare.

Coverage Differences

One of the potential differences between Medicare Advantage and Original Medicare could be that Medicare Advantage may offer additional benefits. While Original Medicare covers hospital and doctor visits, some Medicare Advantage plans might incorporate prescription drugs, and hearing, vision, and dental coverage. This added coverage could potentially enhance the quality of healthcare and overall well-being.

Medicaid could help cover costs that Medicare does not, such as deductibles and coinsurance, depending on various eligibility programs. Programs like the Qualified Medicare Beneficiary (QMB) and Specified Low-Income Medicare Beneficiary (SLMB) may assist with Part B premiums and other costs, possibly ensuring comprehensive financial support for eligible individuals.

Emergencies and Referrals

In Medicare Advantage plans, emergency care does not require a referral, allowing immediate access to necessary services. This ensures that in critical situations, beneficiaries can receive prompt treatment without administrative delays. However, most Health Maintenance Organization (HMO) Medicare Advantage plans mandate a referral from a primary care doctor to see a specialist.

Preferred Provider Organization (PPO) plans, on the other hand, allow members to see specialists without needing a referral, providing greater flexibility. Special Needs Plans (SNPs) typically require a referral for specialist visits as members must choose a primary care provider who coordinates their care.

Knowing these protocols could help beneficiaries navigate their healthcare more efficiently.

Summary

Navigating the various Medicare Advantage plans in Nevada

As healthcare needs evolve, staying informed about the potential changes and updates in Medicare Advantage plans is crucial. By understanding possible costs, enrollment periods, and potential coverage, beneficiaries can make well-informed decisions that enhance their health and financial well-being. With careful consideration, Medicare Advantage plans could offer a robust solution for managing healthcare needs.

Frequently Asked Questions

→ What are the main types of Medicare Advantage plans available in Nevada?

The main types of Medicare Advantage plans available in Nevada are Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). These options provide various coverage and provider network choices to fit different healthcare needs.

→ When can I enroll in a Medicare Advantage plan in Nevada?

You can enroll in a Medicare Advantage plan in Nevada during your Initial Enrollment Period, which spans three months before to three months after your 65th birthday, as well as during the Annual Enrollment Period from October 15 to December 7. Special Enrollment Periods may also apply for certain qualifying events.

→ What additional benefits could Medicare Advantage plans offer compared to Original Medicare?

Some Medicare Advantage plans may provide extra benefits that could go beyond Original Medicare, including dental, vision, and hearing coverage. These potential benefits could enhance your healthcare experience significantly.

→ How might costs compare between Medicare Advantage plans and Original Medicare?

Certain Medicare Advantage plans may offer lower overall costs compared to Original Medicare plans, sometimes including an annual out-of-pocket maximum for better financial protection. This could make Medicare Advantage an attractive option for those seeking cost predictability in their healthcare expenses.

ZRN Health & Financial Services, LLC, a Texas limited liability company