Medicare Advantage Plans Mississippi 2026

Curious about Medicare Advantage plans Mississippi

Key Takeaways

- Mississippi has 72 Medicare Advantage plans available for 2025, down from 88 in 2024, with average monthly premiums slightly increasing to $21.32.

- The plans offer various types including HMO, PPO, and Special Needs Plans, each catering to different healthcare needs, with many including additional benefits like dental and vision coverage.

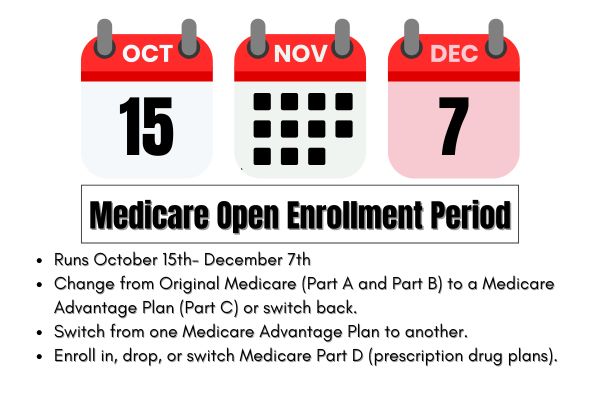

- Enrollment for Medicare Advantage can occur during specific periods, such as the Annual Enrollment Period from October 15 to December 7, 2024, to avoid coverage gaps and ensure access to needed health services.

Compare Plans in One Step!

Enter Zip Code

Understanding Mississippi Medicare Advantage Plans 2026

Medicare Advantage plans, also known as MA plans or Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies and must cover all the benefits included in Original Medicare, plus additional services. In Mississippi, there are 72 Medicare Advantage plans available for 2025, a reduction from 88 the previous year. Despite this decrease, all residents eligible for Medicare in Mississippi can access a Medicare Advantage plan, including options with no monthly premiums.

Currently, 636,926 residents of Mississippi are enrolled in Medicare. The average monthly premium for these plans increased slightly from $20.34 in 2024 to $21.32 in 2025. Given that Medicare Advantage plans are provided by private insurance companies, they often include extra benefits such as dental, vision, and hearing services, which are not covered by Original Medicare.

Types of Mississippi Medicare Advantage Plans Available

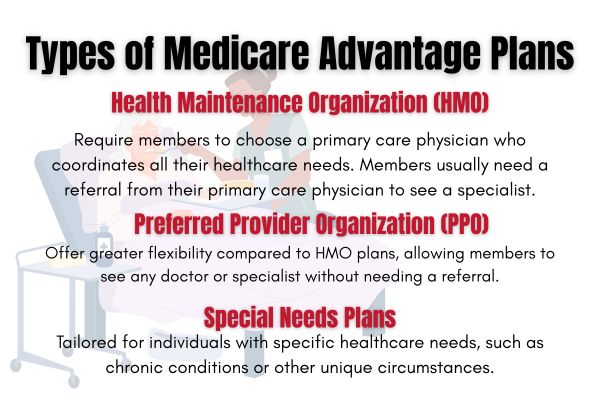

Mississippi offers a variety of Medicare Advantage plans to meet the diverse needs of its residents. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type of plan comes with its own set of benefits and requirements, catering to different healthcare needs and preferences.

HMO Plans

HMO plans are a popular choice among Medicare beneficiaries due to their cost-effectiveness and emphasis on coordinated care. These plans often require members to choose a primary care physician (PCP) and obtain referrals to see specialists.

For 2025, some Aetna Medicare Advantage HMO plans will no longer be available, prompting members to find alternative options by December 31, 2024, to avoid coverage gaps. HMO plans typically include additional benefits like dental, vision, and hearing services, and cover prescription drugs.

PPO Plans

PPO plans offer greater flexibility in choosing healthcare providers and do not require referrals to see specialists. These plans generally have higher premiums but allow members to see any healthcare provider, including out-of-network providers, although at a higher cost.

PPO plans also often include additional benefits like vision and dental coverage, which are not part of Original Medicare.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific healthcare needs, including those with chronic conditions, disabilities, or who are dual eligible (qualify for both Medicare and Medicaid). These plans are structured to provide targeted care and must include Part D prescription drug coverage.

SNPs can be either HMO or PPO plans and are designed to meet the unique healthcare needs of their members.

Overview of Mississippi Medicare Advantage Plans 2026

The landscape of Medicare Advantage in Mississippi for 2025 includes 72 available plans, down from 88 in the previous year. The average monthly premium has seen a slight increase to $21.32 from $20.34.

Major providers such as Aetna, Cigna, and UnitedHealthcare offer these plans, ensuring that all residents enrolled in Medicare have access to comprehensive healthcare coverage, including some with $0 premiums.

Covered Services and Benefits

Mississippi Medicare Advantage plans cover a wide range of services and benefits, going beyond what Original Medicare offers. For instance, Aetna’s plans for 2025 include both medical and prescription drug coverage under HMO and PPO structures. Benefits often extend to dental, vision, and hearing services, along with over-the-counter product allowances.

Preventive services like vaccinations and screenings are typically covered without additional cost to members, and wellness programs such as SilverSneakers provide access to fitness classes and resources. Additionally, medication therapy management helps members manage their prescriptions effectively.

Key Benefits of Mississippi Medicare Advantage Plans 2026

Medicare Advantage plans in Mississippi offer several key benefits over Original Medicare. These include additional coverage for vision, dental, and hearing services, which are not covered by Original Medicare. Many plans also feature an out-of-pocket spending limit, protecting beneficiaries from excessive healthcare costs.

Some plans are specifically designed for individuals with chronic conditions, offering tailored benefits to meet their health needs. In 2024, there were a total of 72 Medicare Advantage plans available to seniors in Mississippi, ensuring a variety of options to meet different healthcare needs, which can be explored using the medicare plan finder.

Additional Health Services

In addition to the standard benefits, Mississippi Medicare Advantage plans often include various added health services. For example, Aetna’s plans cover dental care, including oral exams, cleanings, and X-rays. Members can also access fitness services through SilverSneakers, which offers access to over 15,000 fitness locations and online resources.

The plans provide an over-the-counter benefit, allowing members to purchase select health items like pain relievers and first aid supplies. Vision benefits include annual eye exams and coverage for eyewear, such as glasses or contacts. Hearing services feature annual hearing exams and coverage for hearing aids, highlighting the overall plan benefits.

Enrollment Process for Mississippi Medicare Advantage Plans 2026

Enrolling in a Mississippi Medicare Advantage plan involves a straightforward process. First, individuals must be enrolled in Original Medicare (Parts A and B). If your current plan is being discontinued, like some Aetna plans for 2025, it’s crucial to enroll in a new plan by December 31, 2024, to avoid any coverage gaps.

When to Enroll

Enrollment in Medicare can occur during specific times, such as three months before your 65th birthday or during the annual enrollment period. The Annual Enrollment Period for Medicare Advantage plans in 2025 runs from October 15, 2024, to December 7, 2024. The Initial Enrollment Period starts three months before the month you turn 65 and lasts for seven months.

Additionally, a Special Enrollment Period can be triggered by certain life events, such as moving out of a service area or losing other health coverage.

Different Enrollment Periods

There are multiple enrollment periods for Medicare Advantage plans, including the Initial Enrollment Period, Annual Enrollment Period, and Special Enrollment Periods. Special Enrollment Periods allow individuals to enroll in a new plan from December 8, 2024, to February 28, 2025, if their previous plan is no longer available.

The Medicare Advantage Open Enrollment Period runs from January 1 to March 31, permitting those already enrolled in a Medicare Advantage plan to switch plans or revert to Original Medicare.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) allows beneficiaries to make changes to their Medicare Advantage plans from January 1 to March 31 each year. The Annual Enrollment Period (AEP) occurs from October 15 to December 7, during which individuals can enroll, switch, or drop Medicare plans.

Special Enrollment Periods (SEPs) allow beneficiaries to enroll in or change their Medicare plans due to qualifying life events, such as moving or losing other coverage. These opportunities to enroll in a Medicare plan often last for two full months after the qualifying event.

Costs Associated with Mississippi Medicare Advantage Plans 2026

The costs associated with Medicare Advantage plans in Mississippi can vary significantly based on the type of plan selected. In 2025, the average monthly premium increased slightly to $21.32 from $20.34 in 2024. Some plans offer $0 premiums, making them accessible without upfront costs.

Premiums and Co-Pays

Medicare Advantage plans in Mississippi may charge premiums as low as $0, allowing access to coverage without upfront costs. Aetna’s plans for 2025 feature premiums starting at $0, alongside co-pays that may be as low as $5 for certain prescription drugs. However, individuals must continue to pay their Medicare Part B premium along with any additional premiums specific to their chosen plan.

Cost-sharing for services can vary based on whether the provider is in-network or out-of-network.

Out-of-Pocket Maximums

Most Medicare Advantage plans in Mississippi have an out-of-pocket maximum limit, providing financial protection against high healthcare expenses. Aetna’s plans for 2025 typically include an out-of-pocket maximum limit, which can vary by plan. This limit helps protect members from high medical costs by capping their financial responsibility.

Covered Services and Benefits

Aetna Medicare Advantage plans provide various medicare coverage options, including HMO, PPO, and SNPs, reflecting the diverse health needs of members. These plans typically include essential medical services such as hospital stays, outpatient care, and preventive services. Many plans also incorporate additional benefits like dental, vision, and hearing coverage.

Prescription drug coverage is often integrated within these plans, helping members manage their medication needs. Extra benefits such as fitness programs and over-the-counter allowances enhance overall member health and wellness.

How to Qualify for Mississippi Medicare Advantage Plans 2026

To qualify for a Mississippi Medicare Advantage plan, individuals must meet the following criteria:

- Be enrolled in both Medicare Part A and Part B

- Be aged 65 or older

- Have qualifying disabilities

- Meet special conditions such as End-Stage Renal Disease (ESRD) or amyotrophic lateral sclerosis (ALS)

These criteria ensure that individuals are eligible for these plans.

Enrollment occurs during specific periods: Initial Coverage Election Period, Annual Election Period, and Open Enrollment Period. Special enrollment periods are available for significant life changes like job loss or relocation.

Contracted Network and Access to Care

Aetna’s PPO plans allow members to seek care from any provider who accepts Medicare, while HMO plans typically require using network providers for non-emergency services. Choosing in-network providers can lead to lower costs compared to out-of-network options.

With Aetna Medicare Advantage plans, referrals are generally not needed for specialist visits in PPO plans. Additional benefits like dental, vision, and fitness services are available through network providers.

Comparing Mississippi Medicare Advantage Plans to Original Medicare

Mississippi Medicare Advantage Plans typically offer additional benefits beyond what Original Medicare covers, such as vision, dental, and wellness programs. These plans also provide more comprehensive coverage and financial protection through out-of-pocket maximums.

Coverage Differences

Unlike Original Medicare, which primarily covers hospital and medical services, Medicare Advantage plans often include extra services such as dental, vision, and hearing care. While Original Medicare does not cover most dental and vision services, Aetna’s plans include options for routine checkups and eyewear.

Additionally, Medicare Advantage plans typically include a maximum out-of-pocket limit, offering financial protection that Original Medicare lacks. Telehealth services are also part of many Medicare Advantage plans, enhancing accessibility compared to traditional Medicare.

Prescription drug coverage is standard with these Medicare prescription drug plans, unlike Original Medicare, which requires separate Part D enrollment.

Cost Comparisons

Medicare Advantage plans may provide lower out-of-pocket costs for certain services compared to Original Medicare, depending on the plan’s design and network restrictions. Mississippi Medicare Advantage plans can offer lower overall costs when considering premiums, deductibles, and additional coverage options.

Plans with higher star ratings often correlate with better member experiences and satisfaction, impacting long-term costs for beneficiaries. Some plans may offer $0 premiums but include additional costs for services, affecting the overall value.

Annual out-of-pocket maximums can differ widely among plans, influencing total yearly healthcare costs.

Emergencies and Referrals

Aetna Medicare Advantage plans cover emergency services globally, ensuring members can access necessary care anywhere. Members in HMO plans typically need a referral from their primary care physician to see specialists, but this requirement does not apply in emergency situations.

Aetna Medicare Advantage plans may offer limited out-of-network benefits, which can be utilized during emergencies. Access to urgent care facilities is also included, ensuring members can receive immediate attention when necessary.

During a declared public health emergency, Aetna plans may waive referral requirements and reduce out-of-network costs to in-network levels.

Summary

In summary, Mississippi Medicare Advantage plans

As you consider your healthcare coverage options

Frequently Asked Questions

→ When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7, during your Initial Enrollment Period around your 65th birthday, or during a Special Enrollment Period for specific life events.

→ What are the costs associated with Medicare Advantage plans?

Medicare Advantage plans can have varied costs, including $0 premiums; however, you must continue to pay your Medicare Part B premium and may incur additional copays and out-of-pocket expenses.

→ What benefits do Medicare Advantage plans offer that Original Medicare does not?

Medicare Advantage plans provide valuable additional benefits like dental, vision, and hearing care, fitness programs, and prescription drug coverage that Original Medicare does not offer. This comprehensive coverage can enhance your healthcare experience.

→ How do I qualify for a Medicare Advantage plan in Mississippi?

To qualify for a Medicare Advantage plan in Mississippi, you must be enrolled in both Medicare Part A and Part B, and be either 65 years or older or have a qualifying disability, such as ESRD or ALS.

→ What happens in an emergency with a Medicare Advantage plan?

In an emergency, Medicare Advantage plans typically cover services globally, waive referral requirements, and may include out-of-network benefits. It’s important to seek immediate care without worrying about network restrictions.

ZRN Health & Financial Services, LLC, a Texas limited liability company