Medicare Advantage Plans Colorado 2026

Wondering about Medicare Advantage plans Colorado

Key Takeaways

- Colorado Medicare Advantage plans require enrollment in both Medicare Parts A and B and offer additional benefits like dental and vision coverage, which are not included in Original Medicare.

- Various plan types are available, including HMO, PPO, and Special Needs Plans (SNPs), each designed to meet different healthcare needs with varying levels of flexibility and coverage.

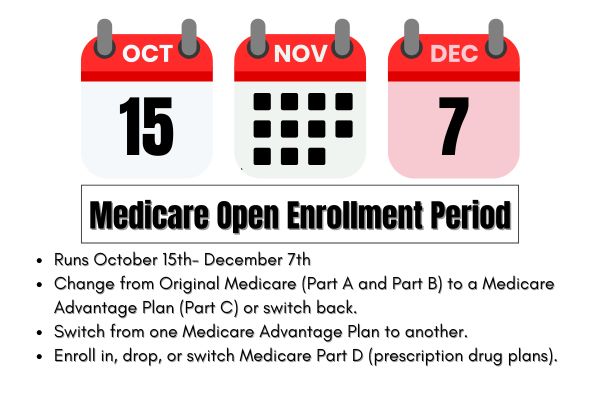

- Enrollment occurs during specific periods, notably the Annual Open Enrollment Period from October 15 to December 7, and costs vary by plan, with many enrollees seeing no premium in 2025

Compare Plans in One Step!

Enter Zip Code

Understanding Colorado Medicare Advantage Plans 2026

Colorado’s Medicare Advantage plans include a variety of options that cater to the diverse needs of its residents. Individuals must have both Medicare Parts A and B to qualify for these plans, including part c. Enrollment can occur during specific periods, including the Annual Open Enrollment Period from October 15 to December 7. These plans often incorporate additional benefits beyond standard Medicare coverage, such as dental and vision services.

Residents can enroll in various Medicare Advantage Plans in Colorado that provide coverage for health services not typically included under Original Medicare. These plans may be structured as HMOs or PPOs, each offering different levels of flexibility in choosing healthcare providers. Moreover, the availability of plans can vary by county, emphasizing the need to compare options annually as coverage and costs may change.

Types of Colorado Medicare Advantage Plans Available

Colorado offers various types of Medicare Advantage plans, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each plan type addresses different healthcare needs, giving residents options that fit their circumstances.

HMO Plans

HMO plans typically require members to select a primary care physician and obtain referrals for specialist services. These plans combine hospital and doctor coverage along with additional benefits, all in one plan. Members are often required to use a network of doctors and hospitals, which keeps costs lower and typically features no deductibles for in-network services. Many HMO plans include prescription drug coverage, as well as benefits for dental, vision, and hearing care.

HMO plans often include wellness programs like SilverSneakers, promoting fitness and health benefits alongside core medical services. Generally, these plans have lower copays for in-network primary care visits and may feature $0 or reduced monthly premiums. However, care is usually restricted to in-network providers, requiring members to stay within the network for most services.

PPO Plans

PPO plan offers more flexibility in choosing healthcare providers, allowing members to see out-of-network doctors at a higher cost. Unlike HMO plans, PPOs do not require referrals for specialist visits, providing greater freedom in accessing healthcare services.

This flexibility makes PPO plans appealing to those who seek more control over their healthcare options.

Special Needs Plans (SNPs)

Special Needs Plans target individuals with chronic conditions, disabilities, or dual eligible special for Medicare and Medicaid, providing tailored healthcare support. These plans ensure members receive specialized treatment through focused care and support. SNPs are divided into three main categories: Chronic Condition SNPs (C-SNPs), Dual Eligible SNPs (D-SNPs), and Institutional SNPs (I-SNPs), each addressing different special needs.

SNPs must adhere to standard Medicare Advantage program regulations, ensuring compliance with guidelines from the Centers for Medicare & Medicaid Services. These plans are mandated to provide prescription drug coverage to ensure that special needs individuals have access to necessary medications.

Established under the Medicare Modernization Act, SNPs have been helping individuals requiring specialized care since 2006.

Overview of Colorado Medicare Advantage

Medicare Advantage plans in Colorado offer a robust alternative to Original Medicare, providing a variety of additional services and benefits. Often, these plans include additional benefits like vision, dental, and hearing coverage not provided by Original Medicare. They also integrate prescription drug coverage and wellness programs, promoting better health outcomes through coordinated care.

Combining all services under one health plan, Medicare Advantage plans offer a compelling option for many Colorado residents.

Covered Services and Benefits

Medicare Advantage plans typically cover hospital stays, doctor visits, preventive services, and emergency care. Most plans also include additional benefits like vision, dental, and hearing services. Prescription drug coverage is often part of these plans, although specific medications covered can vary. Some plans may require prior authorization for certain treatments, meaning you might need approval before proceeding with particular procedures.

Besides medical services, Medicare Advantage plans often include wellness programs and health education, promoting a holistic approach to health. These plans cover a broad range of health needs, ensuring members access to essential and beneficial healthcare services.

Key Benefits of Colorado Medicare Advantage Plans

A significant benefit of Colorado Medicare Advantage plans is the inclusion of services beyond Original Medicare, such as dental, vision, and hearing coverage. Many plans also feature wellness programs and fitness memberships to encourage healthy lifestyles among beneficiaries. Typically, these plans have lower out-of-pocket costs than traditional Medicare, with caps on total expenses providing financial peace of mind.

Coordinated care under Medicare Advantage plans often results in better health outcomes, as healthcare providers collaborate to manage patients’ health more effectively. Some plans may even include coverage for alternative therapies and services not typically covered by Medicare, offering a broader range of healthcare options.

Additional Health Services

Medicare Advantage plans in Colorado offer additional services such as wellness programs and preventive care that go beyond standard coverage. These plans often include mental health services, encompassing counseling and therapy sessions, which are crucial for overall well-being. Fitness and wellness benefits, like gym memberships and exercise classes, are also common, promoting active lifestyles.

Some Colorado Medicare Advantage plans offer access to alternative therapies, transportation services, and meal delivery programs. Chronic disease management programs often assist members in managing long-term health conditions, ensuring they get the ongoing support they need.

Enrollment Process for Colorado Medicare Advantage Plans

To enroll in Colorado Medicare Advantage Plans, select a plan and notify the provider via call or online registration. The process can be completed online, via phone, or by directly contacting the chosen plan.

When to Enroll

Enrollment in Medicare is encouraged during the Initial Enrollment Period, spanning seven months around the 65th birthday. This period allows new beneficiaries to sign up for Medicare Parts A and B and choose a Medicare Advantage plan that fits their needs.

Individuals losing Medicaid or CHIP coverage due to the end of continuous enrollment can enroll in Marketplace coverage through a Special Enrollment Period (SEP) from March 31, 2023, to November 30, 2024. Eligible consumers have 60 days after submitting their application during the Unwinding SEP to select a plan that will begin coverage on the first day of the following month.

Consumers do not need to provide documentation for a qualifying life event to access the Unwinding SEP.

Different enrollment periods

Specific enrollment periods include the Annual Open Enrollment Period from October 15 to December 7, allowing individuals to enroll or switch plans. This period allows beneficiaries to review their options and make changes to their Medicare coverage. New Medicare beneficiaries can enroll within three months before or after their Medicare Part A and/or Part B start date during the Initial Enrollment Period.

During the Open Enrollment Period from October 15 to December 7, individuals can join, switch, or drop Medicare Advantage Plans. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31, allowing members to switch or return to Original Medicare.

Special Enrollment Periods are available for those experiencing significant life changes, such as moving or losing other coverage.

OEP, AEP, Special Enrollment

Special Enrollment Periods allow individuals to enroll or change their plans outside of the regular periods due to qualifying life events such as moving or losing other coverage. The Medicare Advantage Open Enrollment Period allows changes from January 1 to March 31 for those already enrolled in a Medicare Advantage Plan.

The Annual Enrollment Period (AEP) runs from October 15 to December 7, allowing individuals to enroll in or switch their Medicare plans. In some cases, individuals may qualify for multiple Special Enrollment Periods, allowing them to switch or enroll in Medicare plans under specific circumstances.

Medicare coverage usually starts the month after a beneficiary makes a plan change during a Special Enrollment Period.

Costs Associated with Colorado Medicare Advantage Plans

Medicare Advantage plan costs in Colorado vary widely based on location and specific coverage options. Costs can include premiums, copayments, and out-of-pocket maximums, differing significantly among plans.

Premiums and Co-Pays

In 2024, the average monthly premium for Medicare Advantage plans in Colorado is approximately $15.84, with some individuals qualifying for $0 premiums. Stand-Alone Part D plan premiums in Colorado can range from $0 to $132, while Medicare Health Plans with drug coverage have premiums between $0 and $116. Copayments in Colorado Medicare Advantage plans typically follow a tiered system, where costs for generic drugs are lower than those for brand-name medications.

The average monthly premium for Medicare Advantage plans is expected to decrease from $18.23 in 2024 to $17.00 in 2025. Approximately 60% of Medicare Advantage plan enrollees will not pay a premium in 2025. Around 83% of individuals will maintain the same or a lower premium if they remain in their current Medicare Advantage plan.

People enrolled in Medicare Advantage plans will see an average decrease of $2.06 in their total Part D premiums for 2025. The Inflation Reduction Act is expected to lower out-of-pocket costs for beneficiaries by capping individual out-of-pocket spending at $2,000 for covered Part D drugs in 2025.

Out-of-Pocket Maximums

Many Medicare Advantage plans include an out-of-pocket maximum, limiting the total costs an enrollee pays for covered services annually. This feature provides a financial safety net, ensuring beneficiaries are not overwhelmed by unexpected medical expenses. Out-of-pocket maximums in Colorado Medicare Advantage Plans limit the total expenses beneficiaries pay for covered services within a plan year.

Out-of-pocket charges for Medicaid services typically do not apply to emergency services, family planning, pregnancy-related care, or preventive care for children. Medicaid enrollees with incomes above 100% of the federal poverty level may face higher out-of-pocket expenses under alternative cost-sharing arrangements. States may set varying out-of-pocket expenses for Medicaid-covered services based on service type and recipient income levels.

Covered Services and Benefits

Medicare Advantage plans in Colorado typically cover hospital stays, outpatient care, preventive services, and sometimes additional benefits like vision or dental care. Coverage options can vary significantly by plan, especially regarding specifics of additional benefits. Preventive services, such as annual wellness visits, are generally covered without any cost-sharing under Medicare Advantage plans.

Many Medicare Advantage plans also include prescription drug coverage, bundled into the overall health plan. Some plans may offer extra support services, including care management or telehealth options, enhancing healthcare access. This comprehensive coverage ensures members access a wide range of necessary healthcare services.

How to Qualify for Colorado Medicare Advantage Plans 2026

Individuals eligible for Medicare can enroll in a Medicare Advantage plan if they have both Medicare Part A and Part B. To qualify, applicants must reside in the service area of the Medicare Advantage plan they wish to enroll in.

Newly eligible individuals can enroll during their Initial Enrollment Period, spanning seven months. Special Enrollment Periods may be available for individuals who experience qualifying life events, such as moving or losing prior coverage.

Typically, enrolling in a Medicare Advantage plan requires applying directly with the insurance provider or through Medicare.

Contracted Network and Access to Care

Managed care organizations (MCOs) primarily provide services to Medicaid recipients, with 74% of beneficiaries enrolled in these plans. In April 2024, new regulations were introduced to enhance access standards and monitor managed care plans’ compliance. States have flexibility in deciding which services to include in managed care contracts, leading to significant variations between states.

Most Medicaid MCOs offer a comprehensive array of services, though some specific services may be excluded from these contracts. CMS has emphasized the importance of MCOs in helping Medicaid recipients retain coverage during the unwinding process of continuous enrollment. This approach ensures beneficiaries continue to access necessary healthcare services despite changes in enrollment status.

Comparing Colorado Medicare Advantage Plans to Original Medicare

Colorado Medicare Advantage plans often include additional benefits like vision and dental coverage not provided by Original Medicare. These plans offer different coverage options compared to Original Medicare, often including extra services like wellness programs and fitness memberships.

Coverage Differences

Original Medicare primarily covers hospital and outpatient services, while Medicare Advantage plans may offer a broader range, including preventive care and additional health programs. They frequently offer extra services like wellness programs and fitness memberships, not typically covered by Original Medicare.

Medicaid enrollment peaked at 94 million due to continuous enrollment during the pandemic, allowing states to pause disenrollments. The unwinding of continuous enrollment started in March 2023, allowing states to reassess eligibility and potentially disenroll individuals.

As of October 2024, national Medicaid enrollment decreased by 16% from March 2023, yet remained 11% above pre-pandemic figures. States that improved contract renewal processes during unwinding managed to retain more eligible enrollees despite the potential for disenrollment.

Cost Comparisons

Medicare Advantage plans may have lower premiums but can include additional out-of-pocket costs compared to Original Medicare. Typically, these plans have lower out-of-pocket costs for certain services compared to Original Medicare, although they may require beneficiaries to use a network of providers. Approximately two-thirds of individuals who switched from Medicaid to other insurance reported higher out-of-pocket costs compared to previous Medicaid coverage.

Among those who lost Medicaid coverage, 54% found it challenging to afford their new monthly premiums. A significant number (76%) of individuals with new non-Medicaid insurance expressed concerns about affording healthcare services.

Those transitioning from Medicaid to other forms of coverage were more likely to worry about unexpected medical bills than those retaining their Medicaid. Over half of previous Medicaid enrollees now under different insurance reported difficulties managing out-of-pocket expenses.

Emergencies and Referrals

In HMO plans, members are usually required to use a specified network of local providers for care, except in emergency situations. Certain HMO plans may allow members to seek specialty care without needing a referral.

PPO plans provide greater flexibility by allowing members to access both in-network and out-of-network services without referrals for specialty care. Emergency services are typically covered without requiring prior authorization, regardless of network restrictions.

Summary

As we conclude this comprehensive guide, it’s clear that Colorado Medicare Advantage Plans offer a robust array of benefits, additional services, and cost-saving opportunities compared to Original Medicare. From understanding the different types of plans available to navigating the enrollment process and costs, this guide aims to equip you with the knowledge needed to make informed healthcare decisions. Remember, choosing the right plan can significantly impact your health and well-being, so take the time to review your options carefully.

Frequently Asked Questions

→ What are the eligibility requirements for Colorado Medicare Advantage plans?

To be eligible for Colorado Medicare Advantage plans, you must have Medicare Parts A and B and live within the plan’s service area. This ensures you receive tailored healthcare options suited to your location.

→ When can I enroll in a Colorado Medicare Advantage plan?

You can enroll in a Colorado Medicare Advantage plan during the Initial Enrollment Period, from October 15 to December 7 during the Annual Open Enrollment Period, or during a Special Enrollment Period if you experience qualifying life events. Ensure you check your eligibility to make the most of these options.

→ What types of additional benefits do Colorado Medicare Advantage plans offer?

Colorado Medicare Advantage plans often provide additional benefits like dental, vision, and hearing services, as well as wellness programs and fitness memberships. These extras can enhance your healthcare experience beyond what Original Medicare offers.

→ Are there out-of-pocket maximums for Colorado Medicare Advantage plans?

Yes, Colorado Medicare Advantage plans typically have out-of-pocket maximums that limit the total annual costs an enrollee is responsible for regarding covered services. This feature helps protect you from excessive healthcare expenses.

→ How do HMO and PPO plans differ in terms of provider flexibility?

HMO plans limit you to a network of providers and require referrals for specialists, offering less flexibility. In contrast, PPO plans allow you to see both in-network and out-of-network doctors without needing referrals, providing greater freedom in choosing healthcare providers.

ZRN Health & Financial Services, LLC, a Texas limited liability company