Medicare Advantage Plans California 2026

Looking for insights on Medicare Advantage Plans California

Key Takeaways

- California Medicare Advantage Plans provide additional coverage, including vision, dental, and wellness services, beyond standard Medicare, making them appealing to many beneficiaries.

- There are three main types of Medicare Advantage Plans in California: HMO Plans, which require network use and referrals; PPO Plans, which offer more flexibility but at a higher cost; and Special Needs Plans, designed for individuals with specific health needs.

- Enrollment in California Medicare Advantage Plans requires individuals to have Medicare Part A and Part B, with significant enrollment periods, such as the Initial Enrollment Period and Annual Enrollment Period, impacting access to these plans.

Compare Plans in One Step!

Enter Zip Code

Understanding California Medicare Advantage Plans 2026

California Medicare Advantage Plans, also known as MA plans, are designed to provide additional coverage beyond what standard Medicare offers. These plans are offered by private insurance companies approved by Medicare, ensuring they adhere to specific federal guidelines. Eligibility requires individuals to enroll in both Medicare Part A and Part B. These plans stand out for their array of supplemental benefits. Many include coverage for vision and dental services, which Original Medicare typically does not cover. This additional coverage can be a game-changer for many beneficiaries, reducing out-of-pocket costs for essential services.

Beyond vision and dental, California Medicare Advantage Plans often include other benefits such as fitness programs, wellness initiatives, and transportation services. These extras aim to enhance the overall well-being of enrollees.

Many plans also cover prescription drugs, helping to manage medication costs effectively. With these comprehensive benefits, Medicare Advantage Plans in California offer a robust alternative to standard Medicare, making them a popular choice among beneficiaries.

Types of California Medicare Advantage Plans Available

When it comes to choosing a Medicare Advantage Plan in California, understanding the types available is essential. Primarily, there are three main types: Health Maintenance Organization (HMO) Plans, Preferred Provider Organization (PPO) Plans, and Special Needs Plans (SNPs). Each type has its own set of features, benefits, and requirements designed to meet diverse healthcare needs.

Let’s delve into each type to help you identify which might be the best fit for your situation.

HMO Plans

HMO Plans are a popular choice for many Medicare Advantage enrollees in California. These plans require members to use a network of doctors and hospitals to receive coverage, except in emergencies. One of the key features of HMO Plans is the need for referrals to see specialists, which helps manage and coordinate care more effectively. This network-based approach can lead to lower out-of-pocket costs and streamlined care but may limit flexibility in choosing healthcare providers.

However, HMO Plans often come with the advantage of lower premiums and co-pays compared to other types of plans. They also tend to include additional benefits such as vision, dental, and various wellness programs, making them a comprehensive choice for those who are comfortable with the network restrictions.

HMO Plans offer a balanced mix of cost savings and comprehensive coverage for those who prefer a more coordinated approach to their healthcare.

PPO Plans

PPO Plans offer more flexibility compared to HMO Plans, allowing members to see any healthcare provider, either in or out of the plan’s network, without needing a referral. This flexibility can be particularly beneficial for those who have established relationships with non-network doctors or specialists. However, using out-of-network providers typically comes with higher out-of-pocket costs, making it essential to weigh the benefits against the potential expenses.

Although these plans often come with higher premiums than HMO Plans, they provide the advantage of broader access to healthcare providers. PPO Plans also include additional benefits such as vision and dental coverage, wellness programs, and prescription drug coverage, similar to HMO Plans.

PPO Plans are an excellent option for those who value flexibility and are willing to pay more to choose their healthcare providers.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific diseases or characteristics, such as chronic conditions, institutional living, or dual eligibility for Medicare and Medicaid. These plans are designed to provide specialized care that addresses the unique healthcare needs of these populations. SNPs often include customized benefits and provider choices to ensure that enrollees receive the most appropriate care.

SNPs provide a highly personalized and effective healthcare solution for those who meet the criteria.

Overview of California Medicare Advantage Plans 2026

The landscape of Medicare Advantage in California is evolving, with significant changes planned

Additionally, a new MA risk adjustment model and updated growth rate calculations related to medical education costs are set to be implemented, aiming to enhance the overall efficiency and effectiveness of Medicare Advantage Plans.

Covered Services and Benefits

California Medicare Advantage Plans are known for their comprehensive coverage, which goes beyond what Original Medicare offers. These plans typically include benefits such as vision, dental, and hearing services, which are not covered by Original Medicare. This expanded coverage ensures that beneficiaries have access to a wide range of necessary healthcare services without incurring significant out-of-pocket expenses. Additionally, many plans include prescription drug coverage, which can significantly reduce medication costs for enrollees.

The supplemental benefits offered by these plans can also include fitness programs, wellness initiatives, and transportation services. These extras enhance the overall well-being of enrollees by promoting healthy lifestyles and ensuring access to necessary medical appointments.

With such a broad array of covered services, Medicare Advantage Plans in California provide a robust alternative to standard Medicare, making them an attractive option for many beneficiaries.

Key Benefits of California Medicare Advantage Plans 2026

One of the standout features of California Medicare Advantage Plans is the additional benefits they offer that go beyond standard Medicare. These plans often include routine dental, vision, and hearing care, which are not typically covered by Original Medicare. This comprehensive coverage can make a significant difference in managing healthcare costs and maintaining overall health. Moreover, many plans offer wellness programs like SilverSneakers, which promote fitness and health among enrollees.

Another key benefit is the financial protection these plans provide. Many California Medicare Advantage Plans come with low or even $0 monthly premiums, making them accessible to a broad range of beneficiaries. Additionally, these plans have a limit on out-of-pocket expenses, protecting enrollees from high medical costs. Bundling various services into one plan simplifies healthcare management, easing beneficiaries’ navigation of their healthcare needs.

Additional Health Services

Beyond the standard coverage, California Medicare Advantage Plans offer additional health services that can significantly enhance the quality of care. These services include fitness programs, wellness initiatives, and transportation services, which aim to improve the overall well-being of enrollees.

Understanding the enrollment process and the timing of enrollment periods is crucial for those looking to maximize these benefits.

Enrollment Process for California Medicare Advantage Plans 2026

Enrolling in a California Medicare Advantage Plan is a straightforward process but requires attention to detail. Individuals can enroll through the Medicare online portal or by contacting the plans directly. To enroll, applicants need to provide personal information, including their Medicare number, and select a plan that fits their healthcare needs. It’s essential to ensure that the chosen plan covers necessary services and includes preferred doctors to avoid any disruptions in care.

Enrollment occurs during specific periods like the Initial Enrollment Period, which spans seven months around the time one first becomes eligible for Medicare. Other periods include the Annual Enrollment Period and Special Enrollment Periods, each offering opportunities to join or switch plans.

Applicants should verify their eligibility and the plan’s coverage details before submitting their application to ensure a smooth enrollment process.

When to Enroll

Timing is crucial when enrolling in a Medicare Advantage Plan. The Initial Enrollment Period (IEP) is a seven-month window that begins three months before you turn 65, includes your birth month, and ends three months after. This period allows first-time enrollees to sign up for Medicare Parts A and B and choose a Medicare Advantage Plan. Missing this window can lead to penalties and limited enrollment options until the next available period.

Other key times to enroll include the General Enrollment Period, which runs from January 1 to March 31 each calendar year, allowing those who missed their initial signup to enroll in Medicare and subsequently choose a Medicare Advantage Plan.

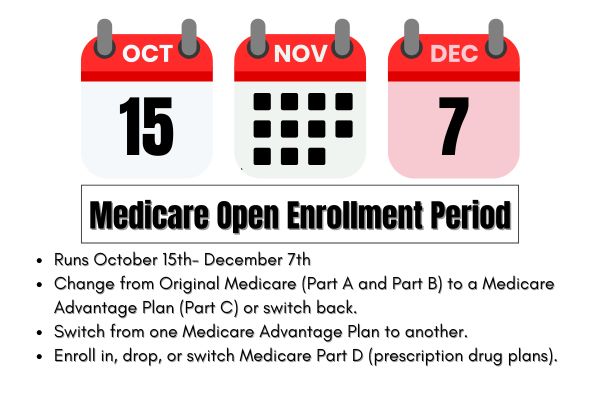

The Fall Open Enrollment Period from October 15 to December 7 is another critical time, providing an opportunity to review and change your Medicare coverage, including switching to a different Medicare Advantage Plan. Knowing when to enroll ensures you make the most of your healthcare options.

Different enrollment periods

Understanding the different enrollment periods is essential for managing your Medicare Advantage Plan effectively. Besides the Initial Enrollment Period and General Enrollment Period, there are Special Enrollment Periods triggered by specific life events, such as losing job-based health insurance or moving to a new service area.

These periods allow beneficiaries to enroll in or switch plans without facing penalties, ensuring continuous coverage and access to necessary healthcare services.

OEP, AEP, Special Enrollment

The Medicare Advantage Open Enrollment Period (OEP) and the Annual Enrollment Period (AEP) are critical times for beneficiaries to make changes to their Medicare coverage. The OEP runs from January 1 to March 31, allowing individuals to switch from one Medicare Advantage Plan to another or revert to Original Medicare.

The AEP, from October 15 to December 7, offers a chance to review and change Medicare coverage, including switching plans or enrolling in a Part D plan. Special Enrollment Periods (SEPs) are triggered by specific circumstances, such as moving out of a plan’s service area or losing other health coverage, providing additional opportunities to make necessary adjustments.

Costs Associated with California Medicare Advantage Plans 2026

Understanding the costs associated with California Medicare Advantage Plans is crucial for making an informed decision. These plans often come with additional fees such as co-pays and deductibles on top of monthly premiums.

Considering these costs in relation to the benefits provided helps determine the overall value of the plan.

Premiums and Co-Pays

Premiums for California Medicare Advantage Plans can vary significantly based on the specific plan and coverage level selected. Some plans offer low or even $0 monthly premiums, making them accessible to a broader range of beneficiaries. However, these plans may come with higher co-pays for services, so it’s essential to review the cost-sharing details carefully. Co-pays for services under these plans are typically lower than those found in Original Medicare, providing additional savings for beneficiaries.

Some plans may offer additional benefits, such as reduced co-pays for preventive services, leading to lower overall healthcare costs for enrollees.

Out-of-Pocket Maximums

California Medicare Advantage Plans include an out-of-pocket maximum that limits the total amount a member has to pay for covered services each year. This feature provides financial protection against high medical expenses, ensuring that beneficiaries have a clear cap on their healthcare spending.

The specific out-of-pocket maximum can differ between plans, affecting overall cost management for beneficiaries.

Covered Services and Benefits

California Medicare Advantage Plans offer a wide range of covered services and benefits. These plans typically include routine vision, dental, and hearing services, which Original Medicare does not cover. Additionally, many plans offer prescription drug coverage, reducing the cost of medications for enrollees. The comprehensive nature of these plans ensures that beneficiaries have access to essential healthcare services without incurring significant out-of-pocket expenses.

Beyond the standard coverage, these plans often include supplemental benefits such as fitness programs, wellness initiatives, and transportation services. These additional services aim to enhance the overall well-being of enrollees by promoting healthy lifestyles and ensuring access to necessary medical appointments.

With such a broad array of covered services, Medicare Advantage Plans in California provide a robust alternative to standard Medicare, making them an attractive option for many beneficiaries.

How to Qualify for California Medicare Advantage Plans 2026

Eligibility for Medicare Advantage plans in California requires enrollment in Medicare Part A and Part B. Applicants must also reside in the service area of the specific Medicare Advantage plan they wish to join. Certain factors, such as age and health status, can influence eligibility for specific plans, with most enrollees being 65 or older. Additionally, individuals must not be incarcerated to qualify for enrollment.

Some plans may have specific requirements, such as not having end-stage renal disease at the time of enrollment. Understanding these eligibility criteria is crucial for ensuring successful enrollment in a Medicare Advantage plan. By meeting these requirements, beneficiaries can take advantage of the comprehensive coverage and additional benefits offered by these plans.

Contracted Network and Access to Care

California Medicare Advantage Plans operate within a network of contracted healthcare providers, ensuring equitable access to care for enrollees. These networks include a range of doctors, hospitals, and specialists, offering comprehensive medical services.

Access to care can be a concern for those in rural areas, but many plans include provisions for rural hospitals and other essential services, ensuring necessary medical attention for all beneficiaries.

Comparing California Medicare Advantage Plans to Original Medicare

California Medicare Advantage Plans offer a range of additional benefits not typically found in Original Medicare. These plans often include vision, dental, and hearing services, as well as wellness programs and fitness benefits. These extra benefits enable Medicare Advantage Plans to offer more comprehensive coverage and potentially lower out-of-pocket costs for beneficiaries.

However, it’s essential to compare these plans to Original Medicare to determine which option best meets your healthcare needs.

Coverage Differences

One of the primary differences between Medicare Advantage Plans and Original Medicare is the range of services covered. Unlike Original Medicare, which does not cover routine vision or dental services, many Medicare Advantage Plans include these additional benefits. This expanded coverage ensures that beneficiaries have access to essential healthcare services that can significantly impact their overall health and quality of life. Additionally, Medicare Advantage Plans often include wellness programs and fitness benefits, promoting a healthier lifestyle for enrollees.

Another significant difference is that many Medicare Advantage Plans include prescription drug coverage, while Original Medicare requires separate enrollment in a Part D plan for this benefit. This bundling simplifies the management of healthcare services and can lead to cost savings for beneficiaries.

The comprehensive coverage provided by Medicare Advantage Plans makes them an attractive alternative to Original Medicare for many beneficiaries.

Cost Comparisons

When comparing the costs of Medicare Advantage Plans and Original Medicare, it’s important to consider both premiums and out-of-pocket expenses. Medicare Advantage Plans might have lower premiums but can come with higher out-of-pocket costs for services compared to Original Medicare. Beneficiaries in Medicare Advantage may face additional costs if they use out-of-network providers, a feature not present in Original Medicare. These factors can significantly impact the overall affordability of healthcare, making it essential to carefully review plan details before enrolling.

Out-of-pocket costs can vary significantly between Medicare Advantage Plans and Original Medicare, with Medicare Advantage typically having a maximum out-of-pocket limit. This limit provides financial protection by capping the total amount beneficiaries must pay for covered services each year.

In contrast, Original Medicare does not have a similar cap, potentially leading to higher out-of-pocket expenses for beneficiaries. Considering these cost comparisons helps individuals make informed decisions about the coverage that best meets their healthcare needs and financial situation.

Emergencies and Referrals

Handling emergencies and referrals within Medicare Advantage Plans involves specific procedures to ensure timely and appropriate care. In emergencies, beneficiaries can seek care from any provider, regardless of network restrictions, to ensure immediate medical attention.

For non-emergency situations, many plans require referrals from a primary care physician to see specialists, particularly in HMO Plans. This referral process helps coordinate care and manage healthcare costs effectively, ensuring that beneficiaries receive the appropriate level of care.

Summary

In summary, California Medicare Advantage Plans

Frequently Asked Questions

→ What are the main types of California Medicare Advantage Plans available?

The main types of California Medicare Advantage Plans include Health Maintenance Organization (HMO) Plans, Preferred Provider Organization (PPO) Plans, and Special Needs Plans (SNPs). Each type offers different levels of flexibility and network options to suit varying healthcare needs.

→ How do HMO Plans differ from PPO Plans?

HMO Plans require members to use a specific network of providers and typically need referrals for specialist care, while PPO Plans allow greater flexibility in provider choice but often at a higher cost. This distinction is crucial for selecting a plan that best fits your healthcare needs.

→ What additional benefits do California Medicare Advantage Plans offer?

California Medicare Advantage Plans provide additional benefits such as routine dental, vision, and hearing care, wellness programs, fitness benefits, and prescription drug coverage. These enhancements can greatly improve your overall health and well-being.

→ When can I enroll in a Medicare Advantage Plan?

You can enroll in a Medicare Advantage Plan during your Initial Enrollment Period, the General Enrollment Period, the Annual Enrollment Period, or during Special Enrollment Periods due to qualifying life events. Be sure to mark these dates on your calendar to ensure you don’t miss your chance to enroll.

→ What costs are associated with California Medicare Advantage Plans?

California Medicare Advantage Plans involve monthly premiums, co-pays, and deductibles, along with an out-of-pocket maximum that caps your total expenses for covered services annually. Understanding these costs is essential for effective financial planning.

ZRN Health & Financial Services, LLC, a Texas limited liability company