Humana Medicare Advantage Plans South Carolina 2026

Want to know about the potential Humana Medicare Advantage Plans in South Carolina for 2026? This article details the available plans, potential benefits, and important dates to help you choose the best coverage.

Key Takeaways

- Humana offers a variety of Medicare Advantage plans in South Carolina, including HMO, PPO, and SNP options, catering to diverse healthcare needs.

- Some plans may offer additional benefits, such as dental, vision, and hearing coverage, reflecting Humana’s commitment to personalized healthcare.

- The Annual Enrollment Period (AEP) from October 15 to December 7 is crucial for reviewing and adjusting coverage, as it allows members to optimize their healthcare plans and avoid potential lapses.

Compare Plans in One Step!

Enter Zip Code

Overview of Humana Medicare Advantage Plans in South Carolina 2026

Humana will likely offer a variety of Medicare Advantage plans in South Carolina, catering to different healthcare needs through HMO, PPO, and SNP options. Each plan type is designed to address specific requirements, possibly providing flexibility and tailored services to meet individual health conditions. Understanding these plans could help you make an informed decision about your healthcare coverage.

HMO plans typically require members to use a network of doctors and facilities, ensuring coordinated care and potentially lower costs. On the other hand, PPO plans offer greater flexibility, allowing members to visit any healthcare provider, although using in-network providers usually costs less. This flexibility may be particularly beneficial for those who need to see specialists or receive care outside their immediate area.

Special Needs Plans (SNPs) are tailored for individuals with specific conditions such as chronic illnesses. These plans will likely provide targeted care and additional support, ensuring that members receive the specialized services they need. The availability of SNPs likley highlights Humana’s commitment to addressing the unique healthcare needs of its members.

Potential Changes to Humana Medicare Advantage Plans in 2026

Unfortunately, there is currently no information about the potential changes to Human Medicare Advantage Plans in 2026 because the plan details have not been released. However, make sure to check back in to this article/website for updated information for the 2026 calendar year.

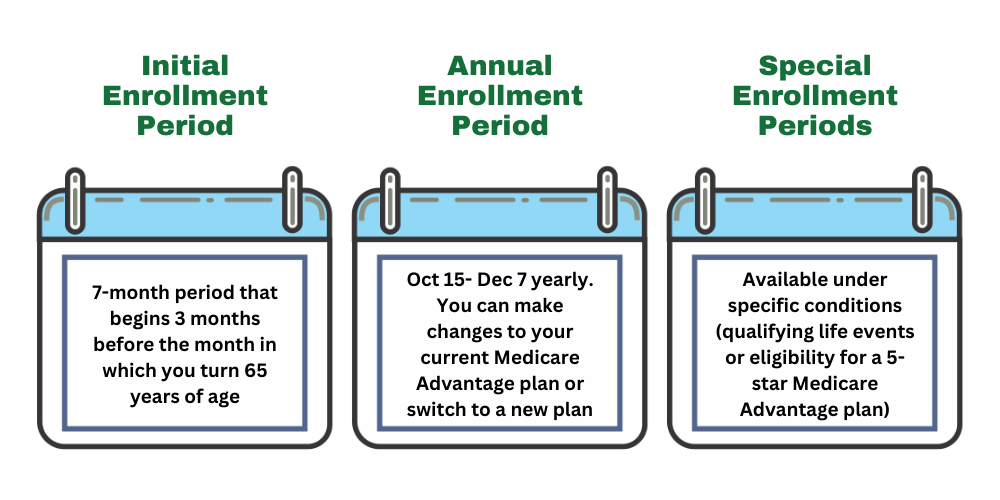

Enrollment Periods and Deadlines

The Annual Enrollment Period (AEP) is a critical time for Medicare Advantage plan enrollees to review and adjust their coverage. The AEP runs from October 15th to December 7th each year. This period allows enrollees to make changes to their plans, ensuring they have the coverage that best meets their healthcare needs for the upcoming year.

Beginning October 1st, individuals can schedule their annual review appointments for Medicare. This preparation time is crucial for gathering information, assessing healthcare needs, and exploring new plan options. Being proactive during this period can help avoid lapses in coverage and ensure that all healthcare needs are met.

Enrollees must stay aware of these deadlines and regulations to avoid missing important changes that could affect their coverage. Not staying informed may result in missed opportunities to optimize healthcare plans and potentially higher out-of-pocket costs. Reviewing and adjusting plans during the AEP is highly recommended.

Potential Benefits and Coverage Enhancements

Some Humana Medicare Advantage plans in South Carolina may offer additional benefits, including dental, vision, and hearing care. These potential enhancements will likely be designed to provide comprehensive coverage, possibly ensuring that members have access to essential health services that may not be covered under traditional Medicare.

Possible Cost Sharing and Premiums

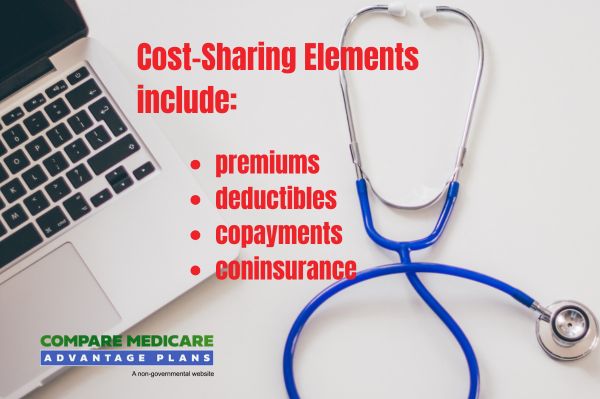

The Inflation Reduction Act may put a cap on annual out-of-pocket expenses for Medicare Part D enrollees. This potential cap might include deductibles, copayments, and coinsurance, possibly offering financial relief to beneficiaries.

Potential cost sharing might include copayments, coinsurance, and deductibles, which are the portion of healthcare expenses beneficiaries may be responsible for. Understanding these components could be crucial for managing healthcare costs effectively. Beneficiaries should understand these cost structures to avoid unexpected expenses and plan their healthcare budgets appropriately.

Star Ratings and Plan Performance

Star ratings will likely be an essential measure of Medicare Advantage plan performance, evaluating up to 40 distinct quality and performance indicators. The average overall star rating for Humana Medicare Advantage plans has been 4.37 stars. This trend likely highlights the competitive landscape among providers.

Additionally, approximately 40% of Medicare Advantage plans have received four stars or higher in recent years. This likely indicates that many plans perform well and could offer high-quality services to their members. Some non-profit organizations might have achieved higher star ratings compared to for-profit organizations, possibly suggesting a correlation between organizational structure and plan performance.

Contracts with ten or more years in the Medicare Advantage program may be more likely to receive higher ratings, likely demonstrating the value of experience and stability in delivering quality healthcare services. Understanding these ratings could help beneficiaries make informed decisions when choosing a Medicare Advantage plan.

How Humana Members Can Maximize Their Plan

Members should review their coverage during the Annual Enrollment Period to maximize their Humana Medicare Advantage plans. This review likely helps members avoid overpaying for unnecessary services. Staying proactive during this period could potentially ensure that members select the best possible plan for their healthcare needs.

Comparing Humana Medicare Advantage with Other Providers

When comparing Humana Medicare Advantage plans with other providers, Humana will likely offer a robust selection of supplemental benefits. Some Medicare Advantage plans may interlude supplemental benefits such as dental, vision, hearing coverage, and sometimes prescription drug coverage. These potential benefits likely highlight the competitive nature of the Medicare Advantage market.

Humana’s potential offerings might stand out due to its comprehensive nature and focus on personalized care. While other providers may offer similar benefits, Humana’s commitment to regional healthcare needs and tailored plans likely ensures that members receive the most relevant and effective care for their individual circumstances.

Summary

As we look ahead to 2026, it’s clear that Humana Medicare Advantage plans in South Carolina will likely offer a range of options designed to meet diverse healthcare needs. With potential benefits and cost-sharing adjustments, Humana has been committed to providing comprehensive and affordable healthcare solutions. By staying informed and proactive, both current and prospective Humana members can navigate these potential changes with confidence and make the most of their Medicare Advantage plans.

Frequently Asked Questions

→ What types of plans does Humana offer under Medicare Advantage in South Carolina for 2026?

Humana offers HMO, PPO, and SNP plans under Medicare Advantage in South Carolina for 2026, accommodating various healthcare needs. This variety could potentially ensure you can find a plan that aligns with your specific requirements.

→ When is the Annual Enrollment Period for Medicare Advantage plans?

The Annual Enrollment Period for Medicare Advantage plans is from October 15th to December 7th each year. Be sure to mark these dates to ensure you have the coverage you need.

→ What potential benefits may be offered in Humana Medicare Advantage plans?

Some Humana Medicare Advantage plan may offer additional benefits such as dental, vision, and hearing care, and sometimes prescription drug coverage. These potential benefits will likely aim to provide comprehensive support for members’ health needs.

→ How could Humana members maximize their Medicare Advantage plan?

Humana members may be able to maximize their Medicare Advantage plan by carefully reviewing their coverage during the Annual Enrollment Period and making use of notifications regarding unused supplemental benefits.

→ What changes may be coming to Medicare Part D in 2026?

The plan benefits for 2026 have not been released, but make sure to check back in to this article/website for updated information for the 2026 calendar year.

ZRN Health & Financial Services, LLC, a Texas limited liability company