Humana Medicare Advantage Plans Idaho 2026

Searching for details on the potential Humana Medicare Advantage Plans in Idaho for 2026? This article covers the available plans, potential benefits, and their possible impact on your healthcare coverage and costs.

Key Takeaways

- Humana will likely offer diverse Medicare Advantage plans in Idaho with potential benefits such as dental, vision, and hearing coverage, and sometimes prescription drug coverage.

- The potential benefits and high-quality ratings for various Humana plans may impact coverage, likely highlighting the importance of members reviewing their plan options in 2026.

- Enrollment in Humana Medicare Advantage plans can be done online or via phone, and understanding coverage details and costs could be crucial for maximizing benefits.

Compare Plans in One Step!

Enter Zip Code

Humana Medicare Advantage Plans in Idaho for 2026

Humana will likely offer a variety of Medicare Advantage plans in Idaho, each designed to meet different healthcare needs and budgets.

For those needing outpatient hospital services, the variability in costs will likely allow for flexibility in managing healthcare expenses. Additionally, deductibles could potentially make certain medication costs more predictable and manageable.

Evaluating these details may be crucial to determine if Humana’s potential offerings align with your healthcare needs and financial situation.

Possible Changes in 2026

There is currently no information about the potential plan changes in 2026 because the plan details for 2026 have not been released, but make sure to check back into this article/website for updated information for the 2026 calendar year.

Possible Coverage and Benefits

Some of Humana’s Medicare Advantage plans in Idaho may offer coverage and additional benefits that could enhance the healthcare experience. One potential benefit might be the integration of prescription drug coverage options, which might lower co-pays for essential medications. This coverage could make vital medications more accessible and affordable.

Dental services may cover routine exams, cleanings, and basic procedures, providing substantial value to enrollees. Ensuring good oral health will likely be an essential component of overall wellness, and these potential dental benefits could be a testament to Humana’s commitment to comprehensive healthcare.

Some Humana plans may also offer hearing and vision coverage. Be sure to consider these potential benefits when evaluating the overall value of a Medicare Advantage plan.

While these potential benefits may provide additional value, understanding the possible costs and budget implications is also essential. Members should carefully review their plan options to ensure they meet healthcare needs without straining finances.

Enrollment Periods and Deadlines

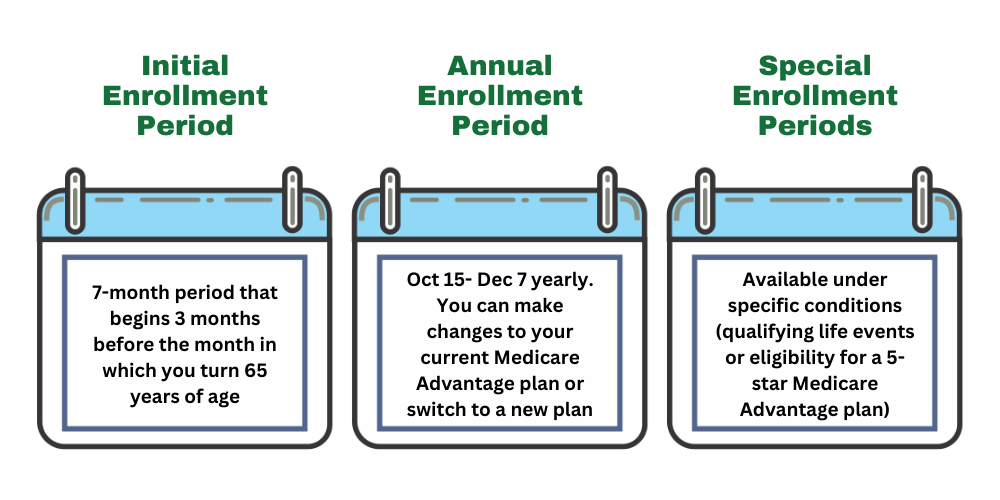

Knowing the enrollment periods and deadlines for Medicare Advantage plans is crucial for making timely and informed decisions. The annual enrollment period runs from October 15 to December 7 each year. During this time, individuals can switch or enroll in a new plan, making it an essential window for reviewing and updating coverage.

For new beneficiaries, the Initial Enrollment Period spans three months before and after their Medicare eligibility date. This period offers flexibility for those new to Medicare to join a plan that suits their needs. Additionally, the Medicare Advantage Open Enrollment Period from January 1 to March 31 allows those already enrolled to switch plans or revert to Original Medicare. This provides an additional opportunity to make changes if the initial choice doesn’t meet expectations.

Special Enrollment Periods (SEPs) are available for individuals who experience specific life events, such as moving to a new area or losing other healthcare coverage. These periods have varying timeframes depending on the situation, offering additional flexibility for members to adjust their coverage as needed. Knowing these key enrollment periods ensures timely decisions and avoids lapses in coverage.

Comparing Humana with Other Carriers in Idaho

When comparing Humana’s Medicare Advantage plans with other carriers in Idaho, consider both the possible benefits and costs. Humana’s premium revenue will likely depend on the available Medicare Advantage plans.

UnitedHealthcare, another major carrier, might decrease its membership by approximately 2% due to competitive Medicare plans and Humana’s market exits. Additionally, Aetna’s retreat from some markets due to profitability concerns may prompt current policyholders to explore alternatives like Humana’s plans. The exit of major carriers could create opportunities for remaining insurers to attract customers searching for comprehensive Medicare coverage.

Comparing these carriers will likely involve evaluating the potential benefits, costs, and provider networks. Each company has its strengths and weaknesses, and understanding these differences could help you choose the plan that best meets your needs.

How to Choose the Right Plan for You

Choosing the right Medicare Advantage plan will likely require considering your specific health conditions and the types of healthcare services you frequently use. If you have ongoing medical needs, you may prioritize plans with lower co-pays for doctor visits and prescriptions. Reviewing the plan’s network of healthcare providers could help ensure your preferred doctors and hospitals may be included.

Additionally, consider the potential benefits, such as dental, vision, and hearing coverage. These could significantly enhance your healthcare experience and possibly provide added value. Weighing these various factors could help you select a plan that aligns with your healthcare needs and financial situation.

Reading reviews and seeking recommendations from trusted sources may also provide valuable insights. Understanding the experiences of current members could help you make a more informed decision and choose a marketing plan that could offer both quality and access value.

Summary

Navigating the landscape of Medicare Advantage plans likely requires staying informed and proactive. Humana’s potential offerings in Idaho for 2026 may include a variety of plans with potential benefits and costs.

Comparing Humana with other carriers like UnitedHealthcare and Aetna could highlight the competitive nature of the Medicare market. Each carrier may offer unique advantages and challenges, and understanding these differences could be crucial for making the best choice. Key enrollment periods provide opportunities to review and adjust your coverage, ensuring it meets your evolving needs.

The right Medicare Advantage plan may significantly impact your healthcare experience and financial well-being. By considering your health needs, reviewing plan details, and staying informed about potential changes, you can make a confident and informed decision. Remember, the goal is to choose a plan that provides the best coverage and value for your specific situation.

Frequently Asked Questions

→ What are the key enrollment periods for Medicare Advantage plans?

The key enrollment periods for Medicare Advantage plans include the annual enrollment period from October 15 to December 7, the Medicare Advantage Open Enrollment Period from January 1 to March 31, and Special Enrollment Periods for specific life events. It’s important to be aware of these dates to ensure you have the coverage you need.

→ What are the maximum out-of-pocket costs for Humana Medicare Advantage plans in Idaho?

The plan details have not been released, but make sure to check back in to this website for updated information for the 2026 calendar year.

→ Are preventive care services covered under Humana Medicare Advantage plans?

Yes, some Humana Medicare Advantage plans may cover routine preventive care services for some in-network providers, which might include dental, vision, and hearing services.

→ What options do I have if I want to switch my Medicare Advantage plan?

You can switch your Medicare Advantage plan during the annual enrollment period from October 15 to December 7, the Medicare Advantage Open Enrollment Period from January 1 to March 31, or through a Special Enrollment Period if you encounter qualifying life events.

ZRN Health & Financial Services, LLC, a Texas limited liability company