Humana Medicare Advantage Plans 2026

Updated December 30th, 2025

Wondering what Humana Medicare Advantage Plans offer for 2026? This article covers the types of plans, their benefits, and how they can meet your healthcare needs.

Key Takeaways

- Humana offers a variety of Medicare Advantage plans, including HMO, PPO, and Special Needs Plans, catering to diverse healthcare needs with specific features and flexibility.

- Key benefits of Humana Medicare Advantage Plans include integrated prescription drug coverage, comprehensive preventive services, and additional perks like dental and vision care, making them attractive alternatives to Original Medicare.

- When comparing Humana plans to Original Medicare, it’s essential to consider factors such as coverage options, costs, and access to care, as Humana plans often feature lower premiums but require adherence to network rules.

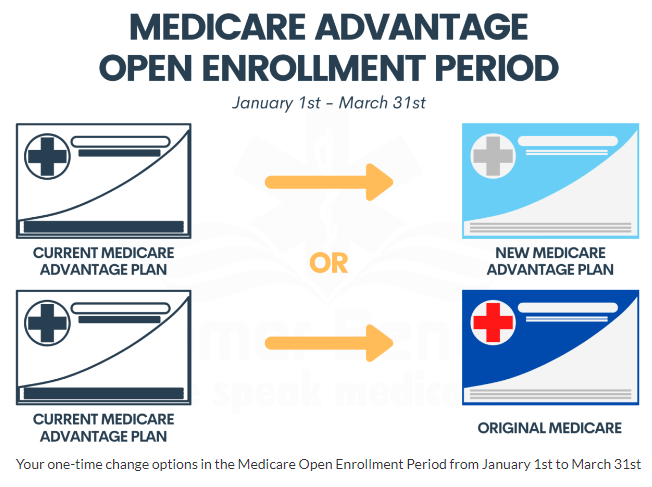

Medicare Advantage Open Enrollment Period 2026

The Medicare Advantage Open Enrollment Period for 2026 is a post-enrollment adjustment window that runs from January 1 through March 31 and is available exclusively to individuals who are currently enrolled in a Medicare Advantage plan.

This period exists to address situations where a plan that looked good during enrollment turns out to be a poor fit after real-world use, whether due to provider access, prescription coverage, out-of-pocket costs, or benefit structure.

During this time, beneficiaries may make one coverage change by either moving to a different Medicare Advantage plan or leaving Medicare Advantage and returning to Original Medicare.

Those who return to Original Medicare may also enroll in a standalone Medicare Part D prescription drug plan. The rules are intentionally limited: you cannot enroll in Medicare Advantage if you were not already in one, and only one change is allowed, making it important to carefully review options before making a decision.

Overview of Humana Medicare Advantage Plans

Humana offers an array of Medicare Advantage plans designed to cater to various healthcare needs, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). These Medicare Advantage HMO PPO plans provide a range of benefits and coverage options, allowing beneficiaries to choose a plan that best fits their individual health requirements.

Each type of plan comes with its own set of features and benefits. For instance, HMO plans require members to use a network of providers and obtain referrals for specialist care, while PPO plans offer more flexibility in choosing healthcare providers. SNPs are specifically tailored for individuals with chronic health conditions or dual eligibility for Medicare and Medicaid.

Health Maintenance Organization (HMO) Plans

Humana’s Health Maintenance Organization (HMO) plans are designed to help manage healthcare costs by requiring members to use a network of doctors and hospitals. This network-based approach means that members must choose a primary care physician (PCP) who coordinates their care and provides referrals to see specialists. This can be a cost-effective option, but it does limit the flexibility to see out-of-network providers.

One of the significant benefits of HMO plans is the potential for lower overall healthcare costs due to the coordinated care within the network. However, it’s essential to remember that these plans require adherence to the network rules and obtaining referrals, unlike Original Medicare, which offers more freedom in choosing healthcare providers.

Preferred Provider Organization (PPO) Plans

Preferred Provider Organization (PPO) plans offered by Humana provide greater flexibility compared to HMO plans. Members can see any healthcare provider, but using out-of-network services may result in higher costs. This flexibility allows members to choose providers both inside and outside the plan’s network, making it a suitable option for those who travel frequently or have preferred doctors not within the network.

While PPO plans offer more freedom in selecting healthcare providers, it is crucial to be aware that out-of-pocket costs can be higher when using out-of-network services. Balancing flexibility and potential costs is an essential consideration when choosing between HMO and PPO plans.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific chronic conditions or those who are dual eligible for Medicare and Medicaid. These plans provide specialized care and services designed to meet the unique needs of these populations. For example, SNPs might offer enhanced benefits for managing chronic diseases or additional support for those who qualify for both Medicare and Medicaid.

Humana’s SNPs ensure that members receive comprehensive, coordinated care tailored to their specific health needs. These plans are particularly beneficial for individuals requiring specialized medical attention or those who need additional support due to dual eligibility.

Key Benefits of Humana Medicare Advantage Plans

Humana Medicare Advantage Plans offer a plethora of benefits that make them an attractive option for many beneficiaries. These plans often provide lower costs, comprehensive coverage for various healthcare services, and additional perks not typically available under Original Medicare. Understanding these key benefits can help you determine if a Humana plan is the right fit for your healthcare needs.

From prescription drug coverage and preventive services to additional benefits like dental and vision care, Humana plans are designed to offer comprehensive healthcare solutions. Let’s delve into some of these benefits in more detail.

Prescription Drug Coverage

One of the standout features of Humana Medicare Advantage Plans is their integrated prescription drug coverage. These plans include a formulary, which is a list of covered medications and their associated costs. This comprehensive formulary helps members manage their prescription drug expenses effectively.

Moreover, Humana offers the Extra Help program to assist eligible individuals with their Medicare Part D costs, significantly reducing prescription drug expenses. Beneficiaries should review their plan’s formulary to ensure their medications are covered and use preferred pharmacies for additional savings.

Preventive Services

Preventive services are a cornerstone of Humana Medicare Advantage Plans. These services include essential health screenings and vaccinations aimed at early detection and health maintenance. Promoting proactive healthcare helps Humana members stay healthier and avoid more severe health issues down the line.

Humana plans typically cover a wide range of preventive services that may not be fully covered by Original Medicare, such as wellness programs and routine screenings. This emphasis on preventive care underscores Humana’s commitment to promoting overall wellness among its members.

Additional Benefits

In addition to standard healthcare coverage, Humana Medicare Advantage Plans often include extra benefits like dental, vision, and hearing coverage, as well as fitness programs. These additional services enhance the overall value of the plans and contribute to the well-being of members.

Dental and vision care are crucial aspects of healthcare that Original Medicare does not typically cover. Including these benefits allows Humana plans to offer more comprehensive coverage, meeting members’ diverse health needs.

This comprehensive approach can lead to better overall health outcomes and lower costs in the long run.

Comparing Humana Medicare Advantage Plans to Original Medicare

When choosing between Humana Medicare Advantage Plans and Original Medicare, it’s essential to understand the differences in coverage and benefits. Humana Medicare Advantage Plans often feature lower premiums and additional benefits compared to Original Medicare. These plans are designed to provide comprehensive healthcare coverage while managing costs effectively.

However, selecting the right plan requires careful evaluation of specific coverage options and benefits. Let’s explore how Humana Medicare Advantage Plans stack up against Original Medicare in terms of coverage differences, cost comparisons, and access to care.

Coverage Differences

Humana Medicare Advantage Plans may have specific network providers, which can limit choices for healthcare services compared to Original Medicare. For example, members typically need to follow procedures for referrals to specialists and emergency care under Humana plans. These network restrictions are designed to manage costs but can limit flexibility.

On the other hand, Original Medicare allows more freedom in choosing healthcare providers, but this flexibility often comes with higher out-of-pocket costs. Understanding these coverage differences is crucial for making an informed decision about which plan best suits your healthcare needs.

Cost Comparisons

Cost is a significant factor when comparing Humana Medicare Advantage Plans to Original Medicare. Humana plans often feature lower premiums and out-of-pocket expenses, providing greater financial protection for beneficiaries. For instance, out-of-pocket limits under Humana plans can help manage healthcare costs more effectively than Original Medicare.

However, it’s essential to understand the comprehensive cost structure of each plan, including premiums, copayments, and any additional costs for out-of-network services. Prospective members should carefully compare these costs to determine which plan offers the best value for their specific needs.

Access to Care

Access to care is another critical consideration when comparing Humana Medicare Advantage Plans to Original Medicare. Humana plans often have a contracted network of doctors and hospitals, which can lead to cost savings but may limit provider options. The geographic coverage area of Humana plans also influences access to care, as services may vary by location.

In contrast, Original Medicare typically offers broader network options, allowing beneficiaries to choose from a wider range of providers. However, this flexibility may come with additional limitations, such as the need for referrals and higher out-of-pocket costs for certain services.

Eligibility and Enrollment

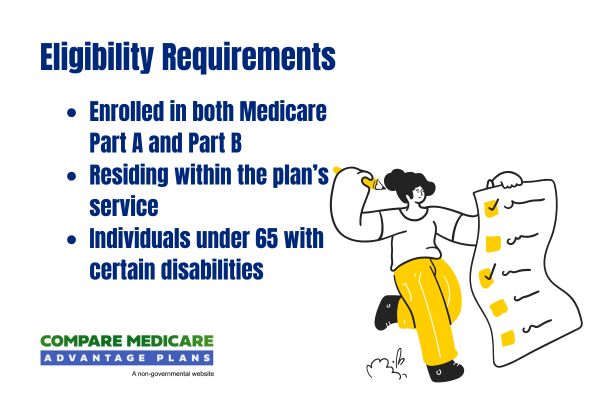

Enrolling in a Humana Medicare Advantage Plan requires meeting specific eligibility criteria and following defined enrollment periods. Eligibility is primarily determined by age, residency, and specific health conditions. Individuals must be at least 65 years old, a U.S. citizen or legal resident, and enrolled in Medicare Parts A and B to qualify.

Eligibility for Humana Medicare Advantage Plans can vary based on age, disability, sex, sexual orientation, disability status, and residency. Individuals under 65 may qualify due to disabilities, while others must reside within the plan’s service area. Additionally, those with specific health conditions or dual eligibility for Medicare and Medicaid may qualify for Special Needs Plans (SNPs).

Understanding these criteria helps determine your eligibility and ensures you meet the requirements for enrollment in a Humana plan.

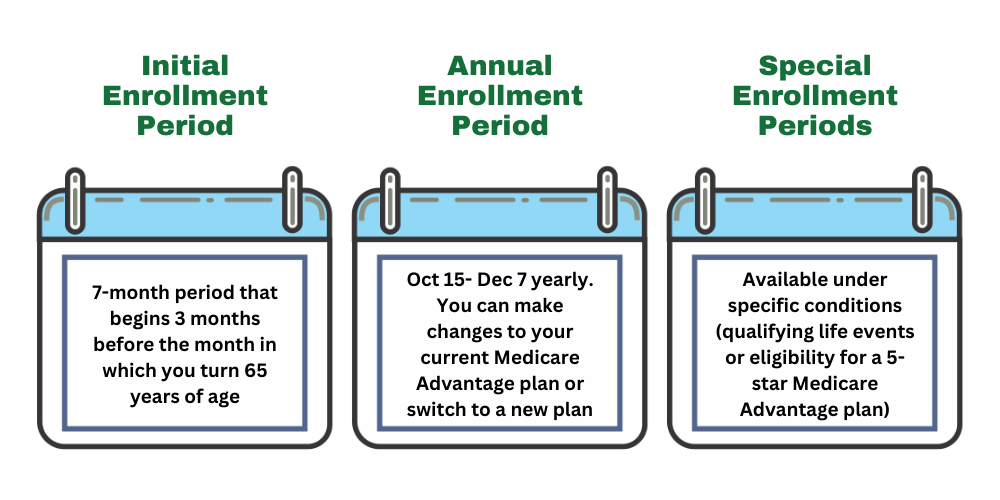

Enrollment Periods

There are specific enrollment periods for Humana Medicare Advantage Plans, including the Initial Enrollment Period (IEP), Annual Election Period (AEP), and Special Enrollment Periods (SEPs). The IEP is when individuals first become eligible for Medicare, while the AEP allows for changes to be made to existing plans each year

The Open Enrollment Period (OE) is a crucial time for individuals eligible for Medicare to review and make changes to their healthcare plans. Typically occurring annually from October 15 to December 7, this period allows beneficiaries to switch between Medicare Advantage Plans, enroll in a new plan, or return to Original Medicare. During OE, individuals can also make changes to their prescription drug coverage, ensuring their healthcare needs align with any changes in their health or financial situation.

For those considering Humana Medicare Advantage Plans, the OE is an excellent opportunity to explore the various options available, such as HMO, PPO, and Special Needs Plans. Each plan offers unique benefits, coverage, and costs, allowing beneficiaries to find a plan that best fits their healthcare requirements. It’s important to carefully evaluate the plans’ network restrictions, additional benefits, and potential savings opportunities during this period to make an informed decision. By taking advantage of OE, beneficiaries can ensure they have the most suitable healthcare coverage for the upcoming year, potentially leading to lower costs and improved access to necessary services.

Annual Election Period (AEP)

The Annual Election Period (AEP) is a critical time for Medicare beneficiaries to review and make changes to their healthcare coverage. Occurring annually from October 15 to December 7, AEP allows individuals to switch between Medicare Advantage Plans, enroll in a new plan, or return to Original Medicare. This period is an opportunity to reassess healthcare needs and ensure that the chosen plan aligns with any changes in health, financial circumstances, or personal preferences.

During AEP, beneficiaries can also make adjustments to their prescription drug coverage, ensuring their plan covers necessary medications at the lowest possible cost. It’s essential to evaluate the network of providers, coverage options, and any additional benefits offered by different plans. By taking advantage of AEP, beneficiaries can optimize their healthcare coverage, potentially reducing overall costs and improving access to essential services. This proactive approach ensures that individuals have the most suitable healthcare plan for the upcoming year, tailored to their specific needs and circumstances.

Necessary documentation for enrollment typically includes Medicare card details and proof of residency. Applying within these periods ensures timely coverage and avoids potential gaps in healthcare services.

Special Enrollment Periods (SEPs)

Special Enrollment Periods (SEPs) offer Medicare beneficiaries the flexibility to make changes to their healthcare coverage outside of the standard enrollment windows. These periods are triggered by specific life events such as moving to a new area, losing other health coverage, or experiencing changes in eligibility, like qualifying for Medicaid or Extra Help. SEPs are crucial for ensuring that individuals can adapt their healthcare plans to suit their evolving needs and circumstances.

During a Special Enrollment Period, beneficiaries have the opportunity to switch Medicare Advantage plans, enroll in a new plan, or return to Original Medicare. The duration and rules of SEPs can vary based on the triggering event, so it’s essential for beneficiaries to understand the specific conditions and timeframes associated with their situation. By taking advantage of SEPs, individuals can maintain continuous healthcare coverage and avoid potential gaps, ensuring they have access to necessary medical services when needed.

Costs and Savings Opportunities

Humana Medicare Advantage Plans offer various strategies to help manage healthcare expenses, making them an attractive option for many beneficiaries. These plans often feature lower out-of-pocket costs compared to Original Medicare, potentially offering significant savings.

Understanding the costs associated with premiums, copayments, and the use of preferred pharmacies can help you maximize your savings and ensure you get the most value from your plan. Let’s explore these cost-saving opportunities in more detail.

Premiums and Copayments

Members of Humana Medicare Advantage Plans are required to pay their Medicare Part B premium in addition to their Humana plan premium. Premiums can vary greatly, with members having the option to pay either half or the full premium amount. Understanding these premium variations is essential for anticipating overall out-of-pocket costs.

Additionally, copayments for services can differ based on the specific plan and the type of healthcare service received. Being aware of these costs can help members manage their healthcare expenses more effectively.

Lower Cost Preferred Pharmacies

Using lower-cost preferred pharmacies can significantly reduce prescription expenses under Humana plans. By utilizing these preferred pharmacies, members can benefit from lower out-of-pocket costs for their medications, which is especially valuable for those on multiple prescriptions.

Preferred pharmacies are a key component of Humana’s strategy to help members manage their healthcare costs. Members should identify and use these pharmacies within the network to maximize their savings on prescription drugs.

Financial Assistance Programs

Financial assistance programs, such as Extra Help, are available to aid eligible individuals in covering costs associated with Medicare Advantage Plans. These programs can help with premiums, copayments, and other out-of-pocket expenses, making healthcare more affordable for those who qualify.

Programs like Medicaid and Medicare Savings Programs also provide financial assistance, ensuring that beneficiaries have access to necessary healthcare services without facing financial hardship. Utilizing these assistance programs can lead to significant savings and better healthcare access.

Important Considerations

When selecting a Humana Medicare Advantage Plan, it’s important to consider several key factors. Understanding the network of doctors and hospitals contracted with Humana is crucial, as it affects the availability of services and potential costs involved.

In addition to network considerations, members should be aware of the geographic coverage area and guidelines for handling emergencies and referrals. Let’s delve into these important considerations in more detail.

Contracted Network

Humana’s network includes a wide range of doctors and hospitals, which can greatly influence access to care and costs. Knowing the contracted network ensures members have access to necessary medical services without incurring higher out-of-pocket costs.

Services from out-of-network providers may incur higher costs, making it crucial for members to verify if their preferred providers are within the Humana network. This can help manage healthcare expenses and ensure continuity of care.

Service Area

Humana plans have specific geographic limitations that determine where services can be accessed. Understanding these geographic boundaries is crucial, as the availability of specific providers and services can vary by location.

Members should verify if their preferred healthcare providers are within the service area of their chosen Humana plan to ensure they have access to necessary medical services. This can prevent potential issues with accessing care and help manage healthcare costs effectively.

Emergencies and Referrals

Handling emergencies and obtaining referrals are significant considerations in Humana Medicare Advantage Plans. Knowing the procedures for emergency care and the referral process for specialist visits avoids unexpected costs and ensures timely care.

Members should familiarize themselves with the guidelines for handling emergencies and referrals under their Humana plan to ensure they receive the necessary care when needed. This knowledge can help manage healthcare expenses and improve overall health outcomes.

Summary

In summary, Humana Medicare Advantage Plans offer a range of options and benefits designed to meet diverse healthcare needs. From HMO and PPO plans to Special Needs Plans, Humana provides comprehensive coverage and additional benefits that can enhance your overall healthcare experience.

Choosing the right plan requires careful consideration of various factors, including costs, coverage options, network restrictions, and additional benefits. By understanding these elements, you can make an informed decision and select a plan that best fits your healthcare needs. As you navigate your Medicare choices, remember that the right plan can make all the difference in your health and financial well-being.

Frequently Asked Questions

→ What types of Medicare Advantage plans does Humana offer?

Humana offers a variety of Medicare Advantage plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Special Needs Plans (SNPs), ensuring options for diverse healthcare requirements.

→ How do Humana’s HMO plans work?

Humana’s HMO plans function by requiring members to utilize a network of providers and secure referrals for specialist visits, which effectively helps manage healthcare costs. This structured approach ensures coordinated care within the network.

→ What additional benefits do Humana Medicare Advantage Plans offer?

Humana Medicare Advantage Plans provide added benefits such as dental, vision, and hearing coverage, along with fitness programs, enhancing your overall healthcare experience. These additional services can significantly contribute to your well-being and health management.

→ How can I enroll in a Humana Medicare Advantage Plan?

To enroll in a Humana Medicare Advantage Plan, you can do so online, by phone, or by submitting a paper application during designated enrollment periods. Ensure you have your Medicare card details and proof of residency ready for a smooth process.

→ Are there financial assistance programs available for Humana Medicare Advantage Plans?

Yes, financial assistance programs such as Extra Help and state-specific options are available to support eligible individuals in managing costs associated with Humana Medicare Advantage Plans, including premiums and copayments.

Humana Medicare Advantage Plan By State

Indiana

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

ZRN Health & Financial Services, LLC, a Texas limited liability company