Emblem Medicare Advantage Plans 2026

Are you wondering what the potential Emblem Medicare Advantage Plans

Key Takeaways

- Some Emblem Medicare Advantage Plans might provide additional benefits beyond Original Medicare, including dental, vision, and prescription drug coverage, with several plan types like HMO, PPO, and SNP to cater to diverse needs.

- Enrollment in Emblem Medicare Advantage Plans is subject to specific periods, such as the Initial Coverage Election Period and Annual Election Period.

- Certain Emblem plans may offer comprehensive covered services, as well as potentially lower out-of-pocket costs compared to Original Medicare, likely enhancing financial protection for members.

Compare Plans in One Step!

Enter Zip Code

Understanding Emblem Medicare Advantage Plans

Some Emblem Medicare Advantage Plans may provide benefits that could extend beyond the scope of Original Medicare. Certain plans might encompass additional health services such as prescription drugs, dental, vision, and hearing coverage. Eligibility for an Emblem Medicare Advantage Plan requires enrollment in both Medicare Part A and Part B.

EmblemHealth provides different types of Medicare Advantage plan that could be tailored to meet specific healthcare needs of its members. These plans often include access to a network of doctors and hospitals that provide coordinated care, likely ensuring members can receive comprehensive and efficient healthcare services.

Types of Emblem Medicare Advantage Plans Available

EmblemHealth provides a variety of Medicare Advantage plans to meet the diverse healthcare needs and financial situations of its members. These plans are categorized into Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type offers unique benefits and coverage options, catering to different preferences and healthcare requirements.

HMO Plans

EmblemHealth’s Health Maintenance Organization (HMO) plans usually require members to choose a primary care physician to coordinate all healthcare services. Referrals are required to see specialists, promoting a coordinated care approach for effective healthcare management. These plans might have lower premiums compared to other types of Medicare Advantage plans, possibly making them a cost-effective option for many individuals.

HMO plans, despite their lower premiums, may also include additional benefits like vision, hearing and dental care at no extra cost. However, coverage for out-of-network services might be limited, except in emergencies, which may be a consideration for those who travel frequently or prefer more flexibility in choosing healthcare providers.

PPO Plans

EmblemHealth’s Preferred Provider Organization (PPO) plans offer greater flexibility in selecting healthcare providers without requiring referrals. Members can visit any healthcare provider, offering more freedom compared to HMO plans. This flexibility comes at a cost, as PPO plans often have higher premiums than HMO plans.

PPO plans may include additional benefits such as dental and vision coverage. Cost-sharing may vary, with different copayments for in-network versus out-of-network services, possibly allowing members to manage their expenses based on their healthcare needs and preferences.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) cater to individuals with specific health conditions or low-income status, likely providing tailored benefits and services. EmblemHealth’s SNPs cater to those with dual eligibility for Medicare and Medicaid, likely ensuring they receive comprehensive care management and support.

These plans could be tailored to meet the unique healthcare needs of their members, providing specialized services that might not be available in standard Medicare Advantage plans. This targeted approach could ensure members receive the necessary care to manage their needs effectively.

Overview of Emblem Medicare Advantage

The potential Medicare Advantage plans from EmblemHealth will likely cater to diverse needs and budgets. Some plans may even include a range of benefits, such as coverage for dental, hearing aids, and vision services that are not included in Original Medicare. EmblemHealth’s Medicare Advantage plans will likely be structured to simplify healthcare access and enhance care coordination for members.

Low premiums could potentially make selected plans accessible for individuals with limited incomes. EmblemHealth plans comply with federal regulations and Medicare regulations and undergo annual performance evaluations to meet expected standards.

Covered Services and Possible Benefits

EmblemHealth Medicare Advantage plans will likely offer a comprehensive range of services, including preventive care, hospital stays, outpatient care, and emergency services. Certain plans may also include additional benefits that Original Medicare does not cover, such as dental, vision, hearing services, as well as prescription drug coverage.

Enrollment Process for Emblem Medicare Advantage Plans

Beneficiaries can enroll in an EmblemHealth Medicare Advantage plan through Comparemedicareadvantageplans.org or by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

It’s important to note that individuals can only enroll during designated enrollment periods throughout the year.

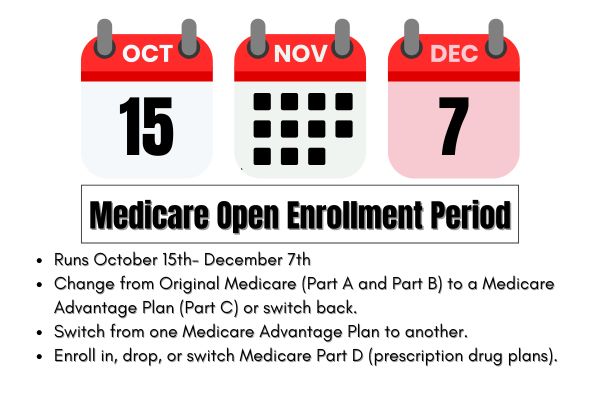

When to Enroll

Enrollment is available during specific periods, including three months before and after turning 65 for new Medicare beneficiaries. The Initial Coverage Election Period allows enrollment three months before and three months after turning 65.

From October 15 to December 7, the Annual Election Period allows eligible individuals to enroll or switch plans for the upcoming year. Special Enrollment Periods (SEPs) allow beneficiaries to alter their coverage due to significant life changes, like moving or losing other insurance.

Different enrollment periods

There are multiple enrollment periods, such as the Initial Coverage Election Period, when individuals can first join a Medicare Advantage plan. The Annual Election Period occurs from October 15 to December 7, allowing eligible individuals to enroll or switch plans.

The General Enrollment Period (GEP), occurring from January 1 to March 31 annually, allows those who missed their initial signup to enroll in Medicare, which is necessary before joining a Medicare Advantage Plan.

Special Enrollment Periods (SEPs) may be available for individuals who lose employer-based insurance, allowing enrollment without penalty for up to eight months post-coverage loss.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) and Annual Enrollment Period (AEP) are crucial for beneficiaries to change their Medicare Advantage plans. The OEP allows Medicare beneficiaries to make changes to their Medicare Advantage plans during the first quarter of the year.

Plan changes during Special Enrollment Periods are permitted due to specific life events like moving or losing other health coverage. The AEP typically runs from October 15 to December 7, during which individuals can enroll in or switch their Medicare plans.

Possible Costs Associated with Emblem Medicare Advantage Plans 2026

EmblemHealth might offer a variety of premium options in some of their Medicare Advantage plans, which may vary based on the type of enrollment selected. The potential costs associated with these plans may include premiums, co-pays, and out-of-pocket maximums.

Premiums and Co-Pays

Some HMO plans may offer services with a low copay, including primary and specialist office visits. Service co-pays could vary significantly based on the type of care, such as primary care visits or specialist appointments.

Other plans might feature a low monthly premium for eligible individuals, possibly reducing overall costs. The co-pay structure could differ significantly between HMO and PPO plans offered by EmblemHealth.

Out-of-Pocket Maximums

An out-of-pocket maximum in caps the total expenses an enrollee must pay for covered services annually. This could provide a safety net for high medical costs, likely ensuring that beneficiaries are protected from excessive financial burdens.

How to Qualify for Emblem Medicare Advantage Plans

Eligibility for Emblem Medicare Advantage Plans requires enrollment in Medicare Part A and Part B. Applicants must reside within the service area of the Emblem Medicare Advantage plans they wish to join.

Certain plans may have additional eligibility requirements related to age, disability, or special health conditions, including federal requirements. Documentation verifying Medicare enrollment, medical records, and residency status may be required for potential members.

Contracted Network and Access to Care

By entering your zip code into this website, members can:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your personal situation

For personal assistance, members can call our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Comparing Emblem Medicare Advantage Plans to Original Medicare

Some Medicare Advantage plans might include additional benefits not covered by Original Medicare, such as vision and dental care. These potential benefits could potentially make certain Emblem Medicare Advantage plans an attractive option for many beneficiaries.

Coverage Differences

While Original Medicare consists of Parts A and B, some Emblem Medicare Advantage plans might include Part D, possibly offering prescription drug coverage. This potential integration could simplify the process for beneficiaries by combining multiple types of coverage into one plan. Certain EmblemHealth Medicare Advantage plans may also offer additional benefits that Original Medicare typically does not cover, such as dental, hearing, and vision services.

Cost Comparisons

Certain Medicare Advantage plans may have lower out-of-pocket costs compared to Original Medicare, which may include reduced premiums and co-pays. Some Emblem Medicare Advantage plans may also feature lower out-of-pocket costs for certain services, depending on the specific plan chosen.

Emergencies and Referrals

Referrals are not required to see specialists under EmblemHealth Medicare Advantage plans, allowing direct access to care. This could be particularly beneficial for those who need to see specialists frequently, as it removes the extra step of obtaining a referral. Selecting a primary care physician is advisable even for plans that do not require it, as they can help coordinate care and facilitate specialist visits.

In emergencies outside the U.S., members must initially cover medical expenses out-of-pocket and can request reimbursement from EmblemHealth later. This ensures that members are covered even when traveling abroad, providing peace of mind during unexpected situations.

Summary

The Emblem Medicare Advantage Plans

Frequently Asked Questions

→ What are the main types of Emblem Medicare Advantage Plans available?

Emblem Medicare Advantage Plans primarily include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs), each designed to meet diverse healthcare requirements. Choose the plan that best aligns with your health needs for optimal coverage.

→ Do Emblem Medicare Advantage Plans cover prescription drugs?

Yes, some Emblem Medicare Advantage plans might include Part D coverage for prescription drugs. It’s important to review your specific plan details to ensure you have the necessary coverage for your medications.

→ Are there additional benefits provided by Emblem Medicare Advantage Plans 2026 that Original Medicare does not cover?

Yes, some Emblem Medicare Advantage Plans might integrate additional benefits like dental, vision, and hearing services that Original Medicare does not cover. This could potentially enhance your healthcare experience.

→ What is the cost structure for Emblem Medicare Advantage Plans 2026 ?

Certain Emblem Medicare Advantage Plans may have a cost structure that could include premiums, co-pays, and out-of-pocket maximums.

→ Can I change my Emblem Medicare Advantage Plan outside of the Annual Enrollment Period?

Yes, you can change your Emblem Medicare Advantage Plan outside of the Annual Enrollment Period if you qualify for a Special Enrollment Period (SEP) due to life events like moving or losing health coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company