Devoted Medicare Advantage Plans 2026

Devoted Medicare Advantage Plans

Key Takeaways

- Some of the Devoted Medicare Advantage Plans may offer comprehensive coverage by potentially integrating benefits such as dental, vision, and wellness programs, likely enhancing beneficiary access to healthcare.

- Different plan types, such as HMO, PPO, and SNPs, cater to diverse healthcare needs, allowing beneficiaries to choose based on flexibility, cost, and specific health conditions.

- Devoted Medicare Advantage Plans emphasize customer support and potential cost-saving benefits, which might include low co-pays for primary care visits and an out-of-pocket maximum, possibly providing financial protection for members.

Compare Plans in One Step!

Enter Zip Code

Understanding Devoted Medicare Advantage Plans

Medicare Advantage Plans, known as Part C, could be an alternative to Original Medicare, provided by private companies approved by Medicare. These plans cover all the services that Original Medicare does, but some might include additional benefits like prescription drug coverage, vision, and dental care. For Medicare beneficiaries, the choice between Original Medicare and Medicare Advantage plans could be crucial for managing healthcare needs effectively.

Devoted Health has been one of the leading Medicare Advantage organizations dedicated to offering comprehensive and affordable healthcare solutions. Some Devoted Medicare Advantage plans might integrate various services and supplemental benefits, likely aiming to provide a more holistic approach to healthcare compared to Original Medicare. This potential integration could simplify the healthcare process, likely making it a popular choice among Medicare beneficiaries.

Types of Devoted Medicare Advantage Plans Available

Devoted Medicare Advantage plans come in various types to cater to diverse healthcare needs. Medicare beneficiaries can choose from Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type offers unique structures and benefits, ensuring that there is a suitable option for everyone.

Each of these plans offers unique benefits to meet diverse healthcare needs.

HMO Plans

HMO plans are designed to provide coordinated care through a network of doctors and hospitals. Members are required to choose a primary care physician who oversees their healthcare and provides referrals to specialists when necessary. This model streamlines patient care and keeps all healthcare providers informed of the patient’s medical history and needs.

HMO plans may be advantageous due to their cost-effectiveness. These plans typically offer lower premiums and out-of-pocket costs compared to other Medicare Advantage plans. HMO plans generally require members to use in-network providers, except in emergencies, which can limit provider choice.

PPO Plans

PPO plans offer more flexibility in choosing healthcare providers compared to HMO plans. Members can see any doctor or specialist without needing referrals, and they have the option to receive care from out-of-network providers, although at a higher cost. This flexibility might make PPO plans an attractive option for those who prioritize having a wide range of choices for their healthcare needs.

PPO plans, despite their higher premiums and out-of-pocket expenses, may include additional benefits such as vision and dental care. This comprehensive coverage could potentially enhance the overall healthcare experience for Medicare beneficiaries, providing them with access to essential services that are not typically covered under Original Medicare.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific health conditions or circumstances, such as chronic illnesses or dual eligibility for Medicare and Medicaid. These plans offer specialized care and benefits designed to meet the unique requirements of their members.

Focusing on specific groups, SNPs provide targeted support and services to help beneficiaries manage their health effectively.

Overview of Devoted Medicare Advantage

Devoted Health has been committed to providing high-quality healthcare through its Medicare Advantage plans. These plans will likely be designed to offer comprehensive coverage that may go beyond what Original Medicare provides. Focusing on the potential integration of various services, Devoted Medicare Advantage plans could simplify the healthcare process for their members.

A possible advantage of certain Devoted Medicare Advantage plans might be the additional benefits. Some plans may include services like dental, hearing, vision, and prescription drug coverage. This holistic approach could potentially ensure that Medicare beneficiaries could have access a wide range of healthcare services under one plan, making it a convenient and effective option for managing their health.

Covered Services and Possible Benefits

Devoted Medicare Advantage Plans cover all standard hospital and medical benefits provided under Original Medicare, ensuring that members receive comprehensive medical care. Certain plans may also include integrated Part D coverage for prescription drugs, possibly allowing members to access necessary medications without additional hassle.

Enrollment Process for Devoted Medicare Advantage Plans

To enroll in a Devoted Medicare Advantage Plan, individuals must have Medicare Part A and Part B, reside within the plan’s service area, and be U.S. citizens or legally present. Members can enroll by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Knowing the enrollment process and timing ensures continuous and comprehensive coverage.

When to Enroll

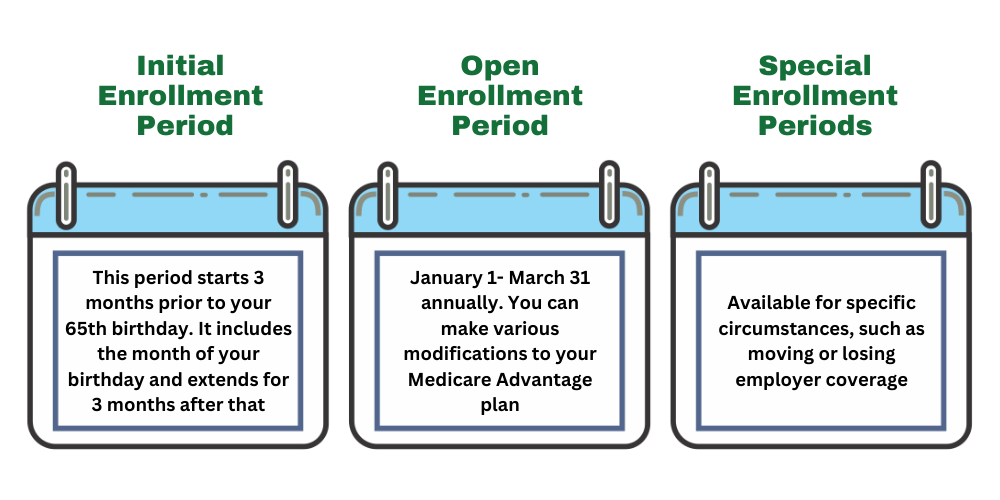

The Initial Enrollment Period for Medicare Advantage Plans starts three months before the individual becomes eligible for Medicare and ends three months after. New Medicare beneficiaries can enroll in a plan that suits their needs during this period.

The Open Enrollment Period from October 15 to December 7 allows individuals to switch or drop their Medicare Advantage plans. Beneficiaries already enrolled in a Medicare Advantage plan can make changes from January 1 to March 31 each year.

Certain life events can trigger a Special Enrollment Period, allowing enrollment or plan changes outside regular periods.

Different Enrollment Periods

There are specific enrollment periods, including the Open Enrollment Period from October 15 to December 7, during which individuals can join, switch, or drop plans. The Initial Enrollment Period lasts seven months, beginning three months before turning 65 and ending three months after.

During the Annual Enrollment Period from October 15 to December 7, individuals can make changes to their Medicare coverage. The Medicare Advantage Open Enrollment Period from January 1 to March 31 allows switching between Medicare Advantage plans or Original Medicare.

A Special Enrollment Period can be triggered by life events, such as moving out of a service area or losing existing coverage.

OEP, AEP, Special Enrollment

The Special Enrollment Period allows individuals to enroll or switch plans due to life events, such as moving or losing other insurance coverage. The Annual Election Period (AEP) allows Medicare beneficiaries to enroll in or switch their Medicare Advantage plans each year.

The Open Enrollment Period (OEP) allows beneficiaries to make changes to their Medicare Advantage plans outside the AEP. Special Enrollment Periods (SEPs) allow beneficiaries to enroll in a Medicare Advantage plan outside of the typical enrollment periods due to qualifying events.

Costs Associated with Devoted Medicare Advantage Plans

Devoted Medicare Advantage plans offer comprehensive medical coverage similar to Original Medicare, which may also offer additional benefits that could potentially lower overall healthcare costs. Knowing the possible costs associated with these plans, including premiums and out-of-pocket expenses, will likely be crucial for making an informed decision.

Premiums and Co-Pays

Some of the Devoted Health Medicare Advantage plans may offer low premiums and co-pays for primary care visits. This financial accessibility might make it easier for Medicare beneficiaries to manage their healthcare costs. However, certain Medicare Advantage Plan costs, including premiums and out-of-pocket expenses, might differ significantly from one plan to another.

Medicare Advantage Plans typically require enrollees to continue paying the Part B premium to maintain coverage.

The out-of-pocket limit for Medicare Advantage Plans will likely vary by plan. Once reached, the plan covers all eligible services for the rest of the year. Some Medicare Advantage Plans might involve co-pays, which are a fixed fee per service or visit.

Out-of-Pocket Maximums

Certain Devoted Medicare Advantage plans might set an annual out-of-pocket maximum, possibly protecting members from excessive healthcare costs within a given year. This potential feature could have a significant advantage over Original Medicare, which lacks out-of-pocket spending limits. By potentially capping the total costs members pay for covered services, some plans could provide a safety net beneficial for those with high healthcare needs.

The out-of-pocket maximum for Devoted Medicare Advantage plans will likely vary by plan. This cap could provide peace of mind, knowing that financial exposure is limited.

How to Qualify for Devoted Medicare Advantage Plans

To qualify for Devoted Medicare Advantage plans, individuals must generally be enrolled in Medicare Part A and Part B. Eligibility for these plans may also be restricted to specific times of the year, unless you qualify for a Special Enrollment Period or are within your Initial Election Period. Check specific enrollment periods to ensure you can join or switch plans when needed.

Devoted Medicare Advantage plans will likely be available in certain counties across 13 states, affecting eligibility based on location. Those eligible for Special Needs Plans must often have specific health conditions or qualify for both Medicare and Medicaid.

Check eligibility for Devoted Medicare Advantage plans through this website or by contacting one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Contracted Network and Access to Care

Medicare Advantage plans must have a sufficient network of providers to ensure enrollees can access covered services effectively. This network must align with typical care patterns in the area, ensuring beneficiaries have access to healthcare services without significant barriers. Devoted Health will likely ensure its network of providers is comprehensive and accessible, providing members with the care they need when they need it.

In areas with multiple network-based plans, specific network requirements may be established for Private Fee-for-Service (PFFS) plans. CMS releases the list of network areas for Medicare Advantage plans two contract years in advance. This advance notice could allow beneficiaries to make informed decisions about their healthcare coverage, ensuring access to a sufficient network of providers.

Comparing Devoted Medicare Advantage Plans to Original Medicare

Medicare Advantage plans, including Devoted Medicare, could provide coverage through private insurers and might include additional benefits not found in Original Medicare. These potential benefits, such as dental and vision care, could make certain Medicare Advantage plans attractive for many beneficiaries.

The following subsections detail the coverage differences and possible cost comparisons between Devoted Medicare Advantage plans and Original Medicare.

Coverage Differences

Some Medicare Advantage plans might cover services like dental, vision, and hearing, which are not included in Original Medicare. Traditional Medicare does not impose network restrictions, allowing beneficiaries to choose any doctor or hospital that accepts Medicare, while certain Medicare Advantage plans may have specific network limitations. This flexibility in provider choice could be a significant factor for many beneficiaries when deciding between the two options.

Cost Comparisons

Certain Medicare Advantage plans may have low or even zero monthly premiums, but beneficiaries still need to pay the Medicare Part B premium. Out-of-pocket costs under Traditional Medicare might be significant due to potential caps on spending, whereas Medicare Advantage plans include an annual out-of-pocket maximum. This cap could provide financial protection for beneficiaries, ensuring their healthcare costs do not become unmanageable.

Emergencies and Referrals

In the event of an emergency, Devoted Medicare Advantage plans typically cover services even if they are received outside the network. This ensures that members have access to necessary care when they need it most.

Referrals for specialist services are often required in HMO plans, ensuring that all care is coordinated through the primary care physician. This coordination helps streamline patient care and likely ensures that all providers involved are aware of the patient’s medical history and needs.

Summary

Devoted Medicare Advantage Plans could offer a comprehensive and integrated approach to healthcare, possibly providing benefits that could go beyond what is available under Original Medicare. With options tailored to meet diverse healthcare needs, these plans will likely ensure that Medicare beneficiaries receive the care and support they need to manage their health effectively. From potential benefits like dental and vision care to financial protections like out-of-pocket maximums, Devoted Health will likely offer a robust solution for those seeking comprehensive healthcare coverage. Consider exploring Devoted Medicare Advantage Plans to find a plan that meets your healthcare needs and provides peace of mind.

Frequently Asked Questions

→ What are Devoted Medicare Advantage Plans?

Devoted Medicare Advantage Plans are comprehensive healthcare plans that may offer additional benefits beyond those provided by Original Medicare.

→ What types of Devoted Medicare Advantage Plans are available?

Devoted Medicare Advantage Plans include HMO, PPO, and Special Needs Plans, each designed to address different healthcare requirements effectively. Consider these options to find the plan that best suits your needs.

→ What is the Initial Enrollment Period for Medicare Advantage Plans?

The Initial Enrollment Period for Medicare Advantage Plans begins three months before you become eligible for Medicare and extends three months after. It’s crucial to pay attention to these timelines to ensure you secure your coverage.

→ How do out-of-pocket maximums work in Medicare Advantage plans?

Out-of-pocket maximums in certain Medicare Advantage plans could provide financial protection by capping the total amount you pay for covered services within a year. Once you reach this limit, your plan covers 100% of the costs for remaining covered services.

→ How do Devoted Medicare Advantage Plans compare to Original Medicare?

Some Devoted Medicare Advantage Plans may provide additional benefits such as dental and vision care and sometimes an annual out-of-pocket maximum, possibly enhancing cost management compared to Original Medicare. This could make these plans a compelling option for those seeking comprehensive coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company