Aetna Medicare Advantage Plans Massachusetts 2026

Want to learn about the potential Aetna Medicare Advantage Plans in Massachusetts

Key Takeaways

- Aetna will likely offer a diverse range of Medicare Advantage Plans in Massachusetts, including HMO, PPO, and specialized plans to meet diverse healthcare needs.

- Some Aetna plans may offer additional benefits such as prescription drug coverage, and comprehensive dental, vision, and hearing care.

- Aetna will likely provide specialized plans like Dual Eligible Special Needs Plans (D-SNPs) and Chronic Condition Special Needs Plans (C-SNPs) to address the unique healthcare needs of beneficiaries.

Compare Plans in One Step!

Enter Zip Code

Overview of Aetna Medicare Advantage Plans in Massachusetts 2026

Aetna, serving Medicare beneficiaries since 1966, currently supports around 10.5 million members nationwide, likely highlighting its commitment to quality healthcare services. In Massachusetts, Aetna will likely offer a diverse range of Medicare Advantage Plans, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNPs). These plans could provide comprehensive coverage that surpasses traditional Medicare to meet all your healthcare needs.

One possible feature of some Aetna Medicare Advantage Plans may be the access to affordable plans for Medicare-eligible beneficiaries

These plans could serve as an excellent alternative to Medicare supplement plans, possibly offering numerous benefits and services tailored to the diverse needs of Medicare beneficiaries and Medicare coverage options. Aetna will likely ensure comprehensive coverage options backed by decades of experience and a commitment to member health and well-being.

Possible Features of Aetna Medicare Advantage Plans

Some Aetna Medicare Advantage Plans might include features designed for comprehensive and convenient healthcare. Potential benefits might include coverage for dental, vision, and hearing services. These possible enhancements could ensure members receive essential medical care and services that boost overall well-being and quality of life.

These potential features will likely make Aetna Medicare Advantage Plans a compelling choice for beneficiaries seeking more than traditional Medicare coverage. The additional benefits, and focus on accessibility and convenience could highlight Aetna’s dedication to meeting its members’ evolving needs.

Specialized Plans for Diverse Needs

Aetna recognizes the diverse healthcare needs of Medicare beneficiaries and may offer specialized plans to meet these unique requirements. These could include Dual Eligible Special Needs Plans (D-SNPs), Chronic Condition Special Needs Plans (C-SNPs), and plans that could offer dental, vision, and hearing coverage. Selecting the right specialized plan could significantly enhance care quality and address individual health needs.

Specialized plans will likely provide comprehensive and coordinated care, possibly ensuring beneficiaries receive necessary services and support. Whether qualifying for both Medicare and Medicaid or having specific chronic conditions, Aetna will likely offer plans to cater to your healthcare needs.

Dual Eligible Special Needs Plans (D-SNPs)

Dual Eligible Special Needs Plans (D-SNPs) cater to individuals who qualify for both Medicare and Medicaid, especially those over 65 with low income or under 65 with specific medical conditions. These plans could potentially ensure comprehensive healthcare coverage, which may include benefits beyond Original Medicare.

D-SNPs allow beneficiaries to retain current Medicaid benefits while accessing additional Medicaid services through a separate Medicare Advantage Plan. This dual coverage likely creates a robust safety net, meeting all healthcare needs without excessive out-of-pocket costs.

Chronic Condition Special Needs Plans (C-SNPs)

Chronic Condition Special Needs Plans (C-SNPs) cater to Medicare beneficiaries with chronic or disabling health conditions. These plans offer specialized care and coordinated services tailored to the unique needs of these individuals, possibly ensuring focused and effective care.

Focusing on the specific healthcare needs of chronically ill individuals, C-SNPs could help manage and treat chronic conditions more effectively, improving overall health outcomes and quality of life.

Dental and Vision Coverage

Some Aetna Medicare Advantage Plans may offer dental and vision coverage. Dental coverage might include routine checkups, cleanings, X-rays, and more complex procedures like dentures and crowns, often with an annual limit, helping manage dental health expenses.

Vision benefits may include annual eye exams and assistance with eyewear costs like glasses or contact lenses. Routine eye exams may also be provided at no cost, making vision health maintenance easier for members.

Hearing Coverage

Hearing coverage could be another potential benefit in certain Aetna Medicare Advantage Plans. This could potentially include annual hearing exams and coverage for hearing aids and fittings, ensuring affordability of necessary hearing devices. Comprehensive coverage supports maintaining hearing health, crucial for overall well-being.

These potential hearing benefits could help ensure that members have the necessary support to maintain hearing health, contributing to a better quality of life.

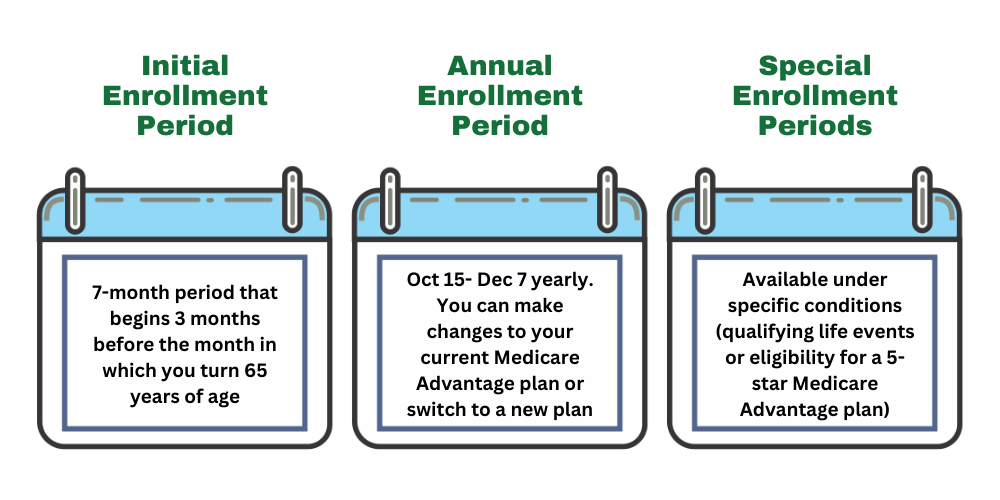

Simplified Enrollment Process

Enrolling in Aetna Medicare Advantage Plans is now easier. The Annual Enrollment Period (AEP) runs from October 15 to December 31, providing ample time to enroll in the right plan. Medicare Advantage enrollment before the deadline is crucial to avoid a lapse in coverage.

Members can enroll through Comparemedicareadvantageplans.org by entering your zip code into the zip code box on this website. Our licensed insurance agents are also available to assist with pre-enrollment questions and offer post-enrollment support, ensuring you select a plan tailored to your needs. Just call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Accessing Care Through CVS Health Resources

Aetna will likely leverage CVS Health resources to enhance patient access to care. One possible service might be the annual Healthy Home Visit, assessing members’ health and home safety at no additional cost. These visits can be scheduled online or by phone, providing convenient personalized healthcare assessments.

Additionally, CVS Health’s extensive network of healthcare providers could potentially ensure Aetna members access a wide range of healthcare services, improving access to quality care.

Understanding Plan Costs and Savings

Understanding the potential costs and savings of Aetna Medicare Advantage Plans could be crucial for informed decisions. Members may receive a maximum out-of-pocket cost limit for covered medical services, which could protect against excessive expenses.

How to Choose the Right Plan

Choosing the right Medicare Advantage Plan might seem overwhelming, but it doesn’t have to be. By entering your zip code into the zip code box on this website, members can compare plan details and evaluate different Medicare Advantage Plans to find one that aligns with your health goals and needs.

Members should consider their specific healthcare requirements and preferences when selecting a plan. Consulting with our licensed agent can provide valuable insights and help you make an informed decision.

Summary

Aetna Medicare Advantage Plans in Massachusetts

Choosing the right plan will likely involve understanding your healthcare needs, comparing different options, and considering the associated costs and savings. With Aetna’s commitment to providing comprehensive and affordable healthcare solutions, you can confidently select a plan that best suits your needs and enjoy peace of mind knowing that your health is in good hands.

Frequently Asked Questions

→ What is the Annual Enrollment Period for Aetna Medicare Advantage Plans?

The Annual Enrollment Period for Aetna Medicare Advantage Plans is from October 15 to December 31. Be sure to review your options during this time to make any necessary changes to your plan.

→ Are routine dental checkups covered under Aetna Medicare Advantage Plans?

Yes, some Aetna Medicare Advantage Plans may offer coverage for routine dental checkups, cleanings, and X-rays. Member should also review the specific plan details for any limitations or additional services.

→ Can I enroll in Aetna Medicare Advantage Plans online?

Yes, you can enroll in Aetna Medicare Advantage Plans through Comparemedicareadvantageplans.org or by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

→ What are Dual Eligible Special Needs Plans (D-SNPs)?

Dual Eligible Special Needs Plans (D-SNPs) will likely offer specialized healthcare coverage for individuals eligible for both Medicare and Medicaid, likely ensuring they receive comprehensive benefits that could go beyond those provided by Original Medicare. Choosing a D-SNP could potentially enhance your access to necessary medical services.

ZRN Health & Financial Services, LLC, a Texas limited liability company