Aetna Medicare Advantage Plans California 2026

Are you a California resident seeking the right Medicare coverage? Aetna Medicare Advantage Plans California could offer various options tailored to meet your specific healthcare needs. This article will break down the types of plans available, discuss their potential benefits, compare the possible costs, and guide you through the enrollment process to help you make an informed decision.

Key Takeaways

- Aetna will likely offer various Medicare Advantage plans in California, including HMO, PPO, and Special Needs Plans, providing tailored options for beneficiaries’ health needs.

- Some plans might come with comprehensive benefits that may go beyond Original Medicare, such as prescription drug coverage, and vision, hearing, and dental care.

- Cost comparisons could highlight the potential advantages of Aetna plans, which might include a maximum out-of-pocket limit and regional variations in pricing, which will likley be important for beneficiaries to consider.

Compare Plans in One Step!

Enter Zip Code

Overview of Aetna Medicare Advantage Plans in California

Aetna will likely offer a variety of Medicare Advantage plans designed to cater to the diverse health needs of beneficiaries in California. These plans include Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNPs). Each plan type offers unique features and benefits, allowing members to choose the one that best fits their healthcare requirements.

Selecting the right Medicare Advantage plan is essential for managing healthcare costs and getting suitable care. Aetna will likely offer plans with comprehensive coverage and a broad network of providers. Aetna provides options whether you need coordinated HMO care, flexible PPO services, or specialized plans for chronic conditions.

The following sections will detail each type of plan, highlighting their features and potential benefits to help guide your healthcare coverage decisions.

What are HMO Plans?

Aetna’s Health Maintenance Organization (HMO) plans are designed to provide coordinated and efficient healthcare. These plans require members to choose a primary care physician (PCP) who acts as the gatekeeper for all healthcare services. The PCP coordinates care and provides referrals to specialists within the network, ensuring that members receive the right care at the right time.

A significant advantage of HMO plans is their network-based approach, which may result in lower out-of-pocket costs. Utilizing a network of contracted providers, Aetna offers comprehensive and high-quality care while keeping costs manageable, including advantage HMO POS plans.

Understanding PPO Plans

Aetna’s PPO plans provide more flexibility than HMO plans, allowing members to see any provider without a referral. This is especially beneficial for those needing frequent specialist care or preferring more healthcare provider choices.

Aetna’s Elite PPO plan combines flexibility with comprehensive coverage, offering members the freedom to choose their providers along with benefits like prescription drug coverage.

Special Needs Plans (SNPs)

Aetna’s SNPs cater to individuals with chronic conditions or special healthcare needs, providing tailored services and support. These plans offer benefits beyond standard Medicare, including care coordination and specialized provider access.

SNPs focus on the unique needs of members with chronic conditions, ensuring they receive the necessary care and resources to maintain their health. These plans are ideal for those needing ongoing medical attention and support.

Possible Benefits of Aetna Medicare Advantage Plans

Some Aetna Medicare Advantage plans may provide numerous benefits that may go beyond Original Medicare, such as potentially reduced out-of-pocket costs and copays that could reduce certain financial burdens. The potential maximum out-of-pocket limits could help members budget and manage healthcare expenses more effectively.

Besides potential cost savings, some Aetna Medicare Advantage plans may also offer additional benefits like prescription drug coverage, vision, dental, and hearing services, possibly ensuring comprehensive care for diverse member needs in a medicare plan.

Aetna has been committed to providing comprehensive health benefits and services, ensuring members receive the care and support needed for their well-being.

Prescription Drug Coverage

Some Aetna Medicare Advantage plans might include Part D prescription drug coverage, possibly ensuring access to necessary medications for managing chronic conditions and maintaining health. Aetna’s Part D plans could offer an affordable option for beneficiaries.

During the Annual Open Enrollment period, members can enroll through this website or by calling our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Potential Health Benefits

Some Aetna Medicare Advantage plans might offer additional health benefits not typically covered by Original Medicare, such as vision, dental, and hearing services. Vision coverage could include annual eye exams and allowances for glasses or contact lenses, while dental coverage might include routine checkups, cleanings, and X-rays.

Possible hearing benefits might include hearing aids, fittings, and annual exams, are essential for maintaining overall health and quality of life, especially for older adults experiencing age-related vision and hearing loss.

Cost Comparison of Aetna Medicare Advantage Plans

Comparing Aetna Medicare Advantage plans to Original Medicare, one potential advantage might be maximum out-of-pocket limit, which could provide a cap on annual healthcare expenses and possibly offering financial predictability and protection against high medical costs.

Regional cost variations are crucial for California beneficiaries. Certain Aetna Medicare Advantage plan costs may vary significantly by location, with urban areas like the Bay Area might have higher prices compared to regions like Los Angeles, affecting overall affordability.

Aetna Medicare Advantage plans will likely offer structured cost approaches and potential benefits, possibly providing a compelling alternative to Original Medicare for those seeking comprehensive coverage and financial protection.

Comparing Costs with Original Medicare

Aetna Medicare Advantage plans will likely offer a structured approach to managing healthcare costs with some plans offering a maximum out-of-pocket limit, which could be a significant advantage over Original Medicare, which lacks an annual spending cap. This potential limit could help members predict annual expenses and avoid unexpected financial burdens.

Beyond the spending cap, some Aetna Medicare Advantage plans may also offer competitive costs, possibly making them an attractive option for comprehensive and cost-effective healthcare coverage.

Regional Cost Variations

The possible costs of Aetna Medicare Advantage plans may vary significantly by location within California. Urban areas like the Bay Area generally have higher prices compared to regions like Los Angeles or rural parts of the state. These regional variations could impact overall affordability and should be considered when selecting a plan.

Understanding cost differences could help beneficiaries make informed healthcare coverage choices, ensuring they select a plan that fits their money budget and needs. To compare costs in your area, enter your zip code into the Plan Finder Tool on this website.

Network and Access to Care

Aetna Medicare Advantage plans will likely provide a range of provider networks, including primary care physicians, specialists, and hospitals, possibly ensuring members have access to diverse healthcare services.

Using in-network providers could help members manage healthcare costs effectively while still receiving comprehensive care. Aetna’s network structure ensures high-quality care while keeping costs manageable.

Contracted Providers and Hospitals

Aetna’s network may include various provider types, possibly offering a broad selection of healthcare professionals and facilities. Members can access services through a network of contracted providers and hospitals, facilitating local care access.

This network might include specialists, primary care physicians, and diverse hospitals, allowing members to visit Medicare-approved providers and receive comprehensive services. Aetna’s wide array of providers could potentially ensure members can choose the right professionals for their needs.

How to Enroll in Aetna Medicare Advantage Plans

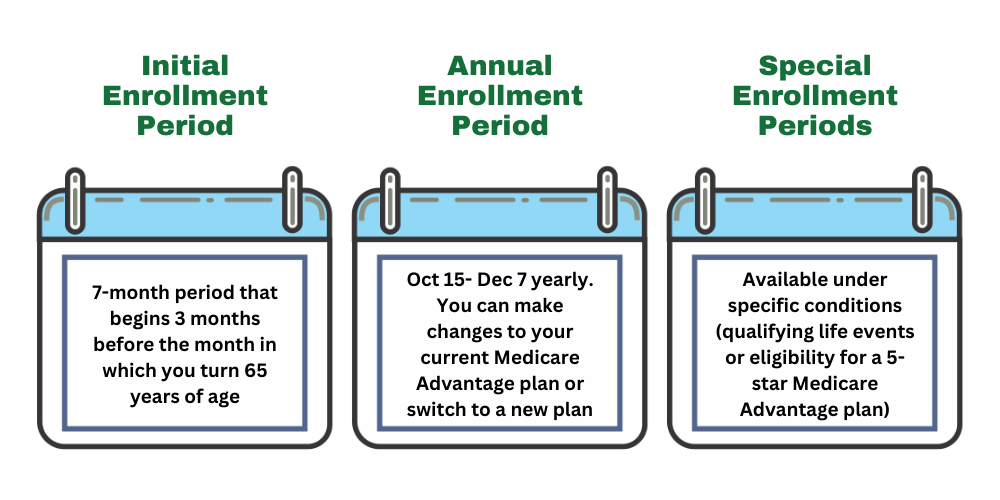

Enrolling in Aetna Medicare Advantage plans is straightforward and can be done during specific enrollment periods. Beneficiaries can enroll online through this website or contact a licensed insurance agent through the phone number on this website.

Being aware of enrollment periods is crucial for joining or switching eligible plans. Understanding these timelines and the form process helps beneficiaries select the best plan for their needs.

Annual Open Enrollment Period

The Annual Open Enrollment Period, from October 15 to December 7 each year, is the primary time to make changes to Medicare Advantage plans. Individuals can switch plans, enroll in a new plan, or adjust existing coverage.

This period is crucial for ensuring your healthcare coverage aligns with your current health needs and financial situation. Reviewing and adjusting your plan during this time helps make informed decisions and optimize healthcare benefits.

Summary

Aetna Medicare Advantage plans in California could offer a wide array of benefits, from lower out-of-pocket costs and extensive provider networks to additional health services and specialized plans for chronic conditions. By choosing Aetna, beneficiaries can access comprehensive healthcare coverage that could go beyond what Original Medicare offers.

As you consider your Medicare options, remember to evaluate the specific needs and preferences that matter most to you. Whether it’s the coordinated care of an HMO, the flexibility of a PPO, or the targeted support of an SNP, Aetna will likely offer a plan that can meet your healthcare needs. Take action during the Annual Open Enrollment Period to ensure you have the best coverage for the upcoming year.

Frequently Asked Questions

→ What types of Medicare Advantage plans could Aetna offer in California?

Aetna will likely offer HMO, PPO, and Special Needs Plans (SNPs) in California, providing options to meet various healthcare requirements. These plan types ensure that you can find coverage that fits your specific needs.

→ What are the benefits of choosing an Aetna HMO plan?

Choosing an Aetna HMO plan offers the benefit of coordinated care managed by a primary care physician, which can lead to comprehensive and organized healthcare services. This structure often results in better health outcomes and simplified access to specialists within the network.

→ How does Aetna’s PPO plan differ from an HMO plan?

Aetna’s PPO plan provides more flexibility by allowing members to visit any healthcare provider without needing referrals, unlike HMO plans that require referrals for specialist appointments. This distinction makes PPOs a more versatile option for those who prefer a wider choice of healthcare providers.

→ What additional benefits could Aetna Medicare Advantage plans offer?

Some Aetna Medicare Advantage plans may offer additional benefits such as prescription drug coverage, vision, dental, and hearing services. This potential coverage could enhance your overall health and wellness experience.

→ When can I enroll in an Aetna Medicare Advantage plan?

You can enroll in an Aetna Medicare Advantage plan during the Annual Open Enrollment Period from October 15 to December 7 each year. This is the key time to ensure you have the coverage you need.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.