Aetna Medicare Advantage Plans Alabama 2026

Are you exploring the potential Aetna Medicare Advantage Plans in Alabama? This article explains what these plans cover, how they compare to Original Medicare, and how to choose the right plan for you.

Key Takeaways

- Aetna Medicare Advantage plans in Alabama will likely offer comprehensive healthcare benefits that may go beyond Original Medicare, which might include dental, vision, and hearing coverage.

- The plans are structured in various formats like HMO, PPO, and SNPs, catering to different healthcare needs and preferences.

- Understanding enrollment periods and potential plan costs, such as premiums and out-of-pocket maximums, is crucial for effective decision-making in choosing a plan.

Compare Plans in One Step!

Enter Zip Code

Understanding Aetna Medicare Advantage Plans in Alabama

Aetna Medicare Advantage plans will likely provide Medicare benefits through private insurance companies which operate under Medicare’s rules. Before enrolling in an Aetna Medicare Advantage plan, individuals must first be enrolled in Original Medicare, which includes Parts A and B. These plans not only cover the basics of Medicare but some may also extend their services to include benefits like vision, dental, and hearing coverage, possibly making them a comprehensive alternative to Original Medicare.

The beauty of Aetna Medicare Advantage plans might lie in their flexibility and added value. Some plans might include services that may not be covered by Original Medicare, such as dental checkups, eye exams, and hearing aids. This could be particularly beneficial for seniors looking to maintain their overall health without incurring significant out-of-pocket expenses.

Understanding the different types of Aetna Medicare Advantage plans available in Alabama could also help you choose the right one for your needs. These plans might come in various forms, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Special Needs Plans (SNP), each catering to different healthcare requirements and preferences.

Types of Aetna Medicare Advantage Plans Available

Aetna will likely offer a diverse range of Medicare Advantage plans in Alabama, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO plan), and Dual-eligible Special Needs Plans (D-SNP). HMO plans require members to use a network of doctors and obtain referrals for specialists, ensuring coordinated care and often lower costs.

On the other hand, PPO plans offer more flexibility, allowing members to see out-of-network providers at a higher cost, which can be a significant advantage for those who travel frequently or have specific provider preferences.

Special Needs Plans (SNPs) are tailored for individuals with specific diseases or characteristics, providing specialized care and benefits that cater to their unique health needs. These plans ensure members receive the attention and services they need, making healthcare more manageable and effective.

How to Choose the Right Plan for You

Choosing the right Aetna Medicare Advantage plan likely involves assessing your individual health needs and preferences. Consider possible factors such as your current health conditions, the frequency of doctor visits, and whether you might need additional benefits like dental or vision coverage. It’s also crucial to evaluate the plan’s network of providers to ensure your preferred doctors and hospitals may be included.

Additionally, think about these potential benefits could offer. If you need regular prescription medications, choose a plan that might include comprehensive prescription drug coverage. Comparing the different Aetna Medicare Advantage plans available and their respective benefits could help you find the one that best fits your lifestyle and healthcare needs.

Potential Benefits of Aetna Medicare Advantage Plans

Some Aetna Medicare Advantage plans may go beyond the basics of healthcare coverage. Certain plans may focus on providing comprehensive health care that might include access to preventive care, possibly ensuring that members could maintain their health proactively. This holistic approach to health care could significantly enhance your quality of life.

Prescription Drug Coverage

Prescription drug coverage could be a critical component in certain Aetna Medicare Advantage plans. Some plans might offer prescription drug coverage that aligns with Medicare Part D requirements. This could potentially mean that members could get their medications seamlessly, without needing a separate prescription drug plan.

Aetna may also provide a comprehensive drug list, allowing members to check which medications may be covered under their plan. This extensive formulary could help ensure that you have access to the necessary medications, contributing to better health management and potentially reduced out-of-pocket expenses.

Additional Health Services

Some Aetna Medicare Advantage plans may also offer an array of additional health services that could go beyond what Original Medicare provides. These might include dental coverage for routine checkups and cleanings, vision benefits covering annual exams and eyewear, and hearing services including hearing aids and fittings.

Enrollment Process for Aetna Medicare Advantage Plans in Alabama

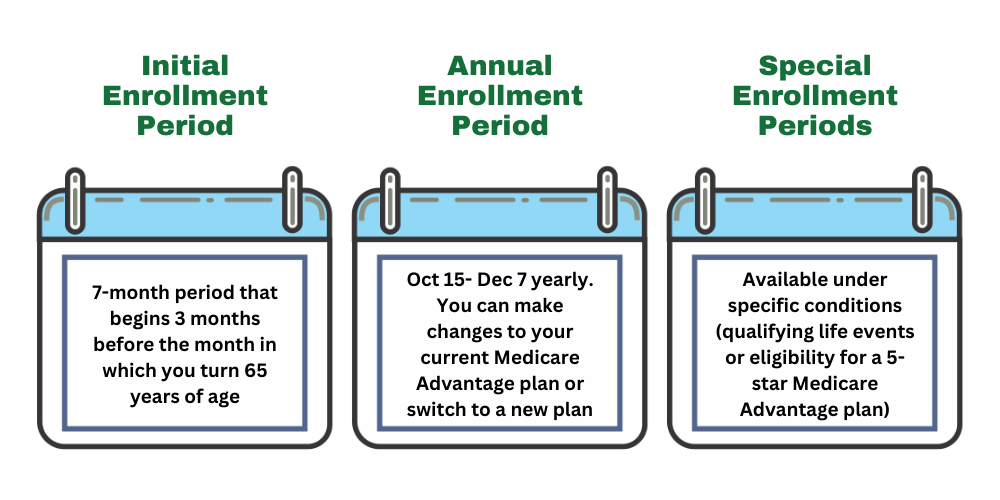

Enrolling in an Aetna Medicare Advantage plan requires some preparation and understanding of the enrollment periods. The Annual Enrollment Period for 2024 starts on October 15 and ends on December 31, marking the primary window for enrolling or making changes to your plan. Additionally, individuals may qualify for a Special Enrollment Period from December 8, 2024, to February 28, 2025, if their current plan is discontinued.

Before you can enroll in an Aetna Medicare Advantage plan, you must first be enrolled in Original Medicare, which includes Parts A and B. Understanding these prerequisites and enrollment windows ensures a smooth transition into the plan that best fits your needs.

When to Enroll

The specific enrollment windows for Medicare Advantage plans are crucial. The Annual Enrollment Period, from October 15 to December 7 each year, is the primary time to make changes to your Medicare coverage. During this period, you can switch from Original Medicare to a Medicare Advantage plan, change between Medicare Advantage plans, or adjust your prescription drug coverage.

For individuals turning 65, there’s a seven-month enrollment window that includes the three months before, the month of, and three months after your birthday. Additionally, the Medicare Advantage Open Enrollment Period runs from January 1 to March 31, allowing those already enrolled in a Medicare Advantage plan to make a one-time change.

Possible Costs Associated with Aetna Medicare Advantage Plans

Understanding the potential costs associated with certain Aetna Medicare Advantage plans is essential for making an informed decision. These costs may vary widely depending on the specific plan and individual healthcare needs. It’s important to assess the possible premiums, deductibles, and out-of-pocket expenses to determine which plan offers the best value for your situation.

Some Aetna Medicare Advantage plans may also have lower out-of-pocket costs for certain services compared to Original Medicare, which generally does not have a cap on out-of-pocket expenses. This potential feature could provide significant financial protection and peace of mind.

Premiums and Co-Pays

Premiums and co-pays could be critical factors to consider when choosing a Medicare Advantage plan. The copay amounts for services under certain Medicare Advantage plans that may differ by plan; some may charge a flat fee while others may have varying fees based on the type of service.

Understanding these potential costs and how they align with your healthcare needs is crucial. For example, if you require frequent medical services, selecting a plan that may have lower co-pays could lead to significant savings over time.

Out-of-Pocket Maximums

Out-of-pocket maximums will likely be another important aspect of Medicare Advantage plans. These caps could potentially limit the total amount you will pay for covered services in a year, possibly providing financial protection against high healthcare costs.

Finding Providers and Pharmacies in Alabama

Finding the right providers and pharmacies is a critical part of managing your healthcare. Aetna Medicare Advantage members can locate in-network providers and pharmacies through Aetna’s online directory or customer service. This will likely ensure that you receive covered care without unexpected costs.

Using in-network providers could be essential for maximizing your benefits and possibly minimizing out-of-pocket expenses. Aetna’s extensive network may also include a variety of healthcare professionals and facilities, making it easier to find the care you need.

Using the Provider Network

Aetna’s network of providers is designed to offer comprehensive care while keeping costs manageable. Sticking to the network will likely ensure that your healthcare is coordinated and covered under your plan, providing peace of mind and financial security.

Pharmacy Network and Drug List

Aetna will likely boast a network of over 65,000 pharmacies. This extensive network could potentially ensure that you have convenient access to your medications.

Members may also access a formulary that lists covered drugs when visiting participating pharmacies. Additionally, Aetna might offer mail-order services for long-term medications, which could allow you to receive a continuous supply delivered to your home.

Member Services and Support

Aetna Member Services is available to assist with any questions or concerns you may have about your Medicare Advantage plan. Members can reach Aetna Member Services at 1-800-282-5366 for assistance every day from 8 AM to 8 PM.

This dedicated helpline ensures that you have access to the information and support you need, making it easier to navigate your healthcare benefits and stay on top of your health.

Comparing Aetna Medicare Advantage Plans to Original Medicare

When comparing Aetna Medicare Advantage plans to Original Medicare, the potential benefits and cost savings could be significant factors to consider. Some Aetna Medicare Advantage plans may combine coverage from Medicare Parts A and B, with extra benefits like dental, vision, and hearing coverage.

Certain plans may also offer lower out-of-pocket costs compared to Original Medicare, which may include premiums and copayments, possibly making them a cost-effective alternative under a medicare plan and a medicare contract.

Coverage Differences

Aetna Medicare Advantage plans will likely provide a comprehensive coverage option that bundles hospital and medical services into one plan. Unlike Original Medicare, certain plans may also have a maximum limit on out-of-pocket spending, possibly providing financial protection throughout the year.

Potential Cost Comparisons

The cost structure of Aetna Medicare Advantage plans might include varying premiums, copays, and out-of-pocket maximums, allowing for tailored financial planning. Choosing a plan with lower premiums or copays could lead to significant savings over time.

Summary

Aetna Medicare Advantage plans in Alabama will likely offer a robust healthcare solution that could go beyond the basics of Original Medicare. With potential benefits such as prescription drug coverage, and dental, vision, and hearing coverage, and extensive support resources, these plans are designed to meet diverse healthcare needs.

Whether you are new to Medicare or considering switching plans, Aetna’s offerings could provide valuable options that could enhance your overall health and wellness. Evaluate your specific needs, compare the available plans, and take advantage of the support services to make the most informed decision for your healthcare.

Frequently Asked Questions

→ What additional benefits could Aetna Medicare Advantage plans offer beyond Original Medicare?

Some Aetna Medicare Advantage plans might offer additional benefits that could go beyond Original Medicare, including vision, dental, and hearing coverage. These additional benefits could significantly enhance your healthcare experience.

→ How can I find in-network providers and pharmacies for my Aetna Medicare Advantage plan in Alabama?

You can easily find in-network providers and pharmacies for your Aetna Medicare Advantage plan in Alabama by using Aetna’s online directory or by contacting their customer service for assistance.

→ What are the key enrollment periods for Aetna Medicare Advantage plans?

The key enrollment periods for Aetna Medicare Advantage plans include the Annual Enrollment Period from October 15 to December 7, and a Special Enrollment Period from December 8 to February 28 for affected individuals.

→ How could out-of-pocket maximums benefit members of Aetna Medicare Advantage plans?

Out-of-pocket maximums could potentially provide essential financial protection for Aetna Medicare Advantage plan members by capping their total expenses for covered services, possibly safeguarding them against exorbitant healthcare costs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.