Medicare Advantage Plans 2025

What’s new with Medicare Advantage Plans 2025? And how do you compare Medicare Advantage plans? This article breaks down the essential updates, changes in cost, and new benefits you need to know.

This detailed guide will help you navigate the process of evaluating, comparing, and selecting the ideal plan that fits your needs. Discover how to save money while securing the coverage you deserve by choosing the perfect Medicare Advantage Plan today!

Key Takeaways

- Medicare Advantage plans in 2025 will see a 7% reduction in availability, leading to fewer choices and potential coverage gaps for beneficiaries.

- A $2,000 cap on out-of-pocket prescription drug costs will relieve beneficiaries from the financial burden of high medication expenses, with the coverage gap ending.

- Most Medicare Advantage plans will now include enhanced supplemental benefits like vision, dental, and hearing, with fundamental changes in structure for Special Needs Plans to improve care coordination.

Compare Plans in One Step!

Enter Zip Code

An Overview of Medicare Advantage Plans in 2025

In 2025, Medicare Advantage plans are evolving to better meet beneficiaries’ needs. One significant change is the expansion of mental health care, along with more resources for caregivers. These enhancements offer more comprehensive support for mental health issues and caregivers, who are vital in patient care.

Mental health support services will remain a priority, with ongoing coverage for telehealth, drug therapies, and counseling. This ensures uninterrupted access to essential mental health care, underscoring Medicare’s commitment to holistic health.

Financial support for caregivers is another key update. Reducing the burden and stress on families helps individuals age in place more effectively. These changes highlight the interconnected nature of health and caregiving, promoting better outcomes for everyone involved.

Reduction in Available Medicare Advantage Plans

In 2025, beneficiaries will notice a reduction in the availability of Medicare Advantage plans. Specifically, there will be a 7% decrease, affecting approximately 1.8 million enrollees. This reduction means fewer plan choices, which can impact how beneficiaries select their coverage.

The decrease in available plans also means fewer plans with over-the-counter benefits, dropping from 85% in 2024 to 73% in 2025. This underscores the need to carefully evaluate each plan’s benefits to ensure it meets your needs.

In 126 counties, only one firm will provide Medicare Advantage plans and Medicare plans, indicating a limited choice for beneficiaries. This limited availability could pose challenges, emphasizing the need to review all options thoroughly. Additionally, 5% of enrollees will find themselves in terminated plans, requiring a switch to new ones.

New Cap on Out-of-Pocket Prescription Drug Costs

One of the standout changes for 2025 is the introduction of a new cap on out-of-pocket prescription drug costs. The infamous coverage gap, often referred to as the ‘donut hole,’ will officially end on December 31, 2024. This change is a significant relief for many beneficiaries who have struggled with high drug costs.

Starting in 2025, there will be a $2,000 limit on out-of-pocket expenses for covered prescription drugs under Medicare. This cap includes all out-of-pocket costs, such as deductibles, copayments, and coinsurance for covered drugs. Once a beneficiary’s out-of-pocket spending reaches $2,000, they will qualify for catastrophic coverage for the remainder of the year.

This cap applies to all beneficiaries with Part D drug coverage, regardless of income level, but only covers drugs included in the Part D plan. This reduction in financial burden marks a significant improvement in the Medicare program, ensuring better access to necessary medications.

Changes in Medicare Part D Premiums

In 2025, beneficiaries will see changes in Medicare Part D premiums. The base beneficiary premium is set to be $36.78, which is an increase of $2.08 from the previous year. While this may seem like a small increase, it is important to consider how these costs add up over time.

The premium increase underscores the need to carefully review Part D coverage options and consider the overall costs of your Medicare Advantage plan. Weigh the benefits and costs to ensure you get the best value for your healthcare needs.

Enhanced Supplemental Benefits in Medicare Advantage Plans

In 2025, most Medicare Advantage plans will include enhanced special supplemental benefits, making them more attractive to beneficiaries. Approximately 97% of these plans will offer vision, dental, and hearing benefits, ensuring nearly all beneficiaries can access these essential services without additional benefits.

Moreover, over 99% of Medicare beneficiaries will have access to at least one plan offering supplemental benefits, including dental and vision care. This broad availability highlights the competitive nature of Medicare Advantage plans, encouraging providers to offer comprehensive coverage to attract enrollees.

Additionally, around 40% of Medicare Advantage prescription drug plan contracts have earned a rating of four stars or higher. These high ratings indicate the quality and satisfaction associated with these plans, offering beneficiaries reliable healthcare options.

Comparing HMO and PPO Medicare Advantage Plans

Understanding the key differences between HMO and PPO Medicare Advantage plans is crucial. PPO plans generally have higher costs but offer broader provider networks, providing more flexibility in choosing healthcare providers. This can be crucial for those who prefer to see specialists without referrals.

HMO plans usually have lower costs within their network, making them ideal for those who don’t mind specific network providers. Out-of-network care can be more expensive and often requires referrals for specialists.

Choosing between an HMO and a PPO plan depends on your healthcare needs and preferences. If you value lower costs and don’t mind network restrictions, an HMO plan may be best. If you prefer more flexibility and are willing to pay more, a PPO plan might be more suitable.

Special Needs Plans (SNPs) Updates

Special Needs Plans (SNPs) continue to offer more benefits compared to standard Medicare Advantage plans, often including support for food and housing, which can be crucial for those with specific needs. In 2025, 63% of SNPs will be D-SNPs for dual eligible individuals, offering integrated care coordinated between Medicare and Medicaid.

D-SNPs must have agreements with state Medicaid agencies to ensure coordinated care, streamlining the process for beneficiaries and providing a seamless healthcare experience.

Unified appeals and grievance processes are being implemented for D-SNPs to simplify care coordination between Medicare and Medicaid, ensuring beneficiaries receive the support they need without unnecessary complications.

Eligibility and Enrollment Periods for Medicare Advantage Plans

Individuals must be enrolled in Medicare Part A and Part B to qualify for Medicare Advantage. This includes those aged 65 or older, individuals under 65 with qualifying disabilities, and people with End-Stage Renal Disease.

Enrollment in Medicare Advantage plans is limited to specific periods unless you qualify for a Special Enrollment Period. The annual enrollment period runs from October 15th to December 7th, during which seniors can switch from Medicare Advantage to Original Medicare. Special Enrollment Periods are available for those experiencing significant life changes, such as moving or losing coverage.

Starting January 1, 2025, dual eligible individuals can choose a standalone prescription drug coverage plan at any time during the year. This flexibility ensures they can access the coverage they need without waiting for the annual enrollment period.

Cost Comparisons: Medicare Advantage vs Original Medicare

Understanding the cost differences between Medicare Advantage and Original Medicare is crucial for making an informed decision. With Original Medicare, beneficiaries pay separate premiums for Part B and Part D coverage, whereas many Medicare Advantage plans offer zero premiums and include drug coverage.

Medicare Advantage plans also impose an annual cap on out-of-pocket expenses, providing financial protections that Original Medicare does not offer. This cap ensures beneficiaries are not overwhelmed by high healthcare costs, making Medicare Advantage organization an attractive option for many.

However, beneficiaries in Original Medicare can acquire supplemental insurance, like Medigap, to cover additional costs. This option is not available for those with Medicare Advantage plans, so weighing the benefits and limitations of each option is crucial.

How to Choose the Right Medicare Advantage Plan

Choosing the right Medicare Advantage plan requires careful consideration of several factors. Begin by evaluating the coverage options of different plans, including services like prescription drugs and wellness programs. Ensure your preferred healthcare providers are included in the plan’s network to avoid unexpected expenses.

Look for a plan with a yearly maximum out-of-pocket expense to protect you from high healthcare costs and provide peace of mind. Comparing the benefits, costs, and provider networks of various plans will help you find the best fit for your healthcare needs.

Key Enrollment Periods for Medicare Advantage Plans in 2025

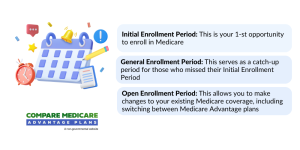

Initial Enrollment Period (IEP)

This is the first opportunity for most individuals to enroll in a Medicare Advantage plan. It begins three months before your 65th birthday, includes your birth month, and ends three months after. If you’re eligible due to disability, your IEP starts three months before your 25th month of receiving disability benefits and continues for seven months.

Annual Enrollment Period (AEP)

The AEP runs from October 15 to December 7, 2024, for coverage effective January 1, 2025. During this time, you can:

- Switch from Original Medicare to a Medicare Advantage plan.

- Change from one Medicare Advantage plan to another.

- Drop Medicare Advantage and return to Original Medicare.

Medicare Advantage Open Enrollment Period (OEP)

This occurs annually from January 1 to March 31, 2025. It’s specifically for those already enrolled in a Medicare Advantage plan. During the OEP, you can:

- Switch to a different Medicare Advantage plan.

- Return to Original Medicare and join a standalone Part D plan. This period does not allow for switching from Original Medicare to a Medicare Advantage plan.

Special Enrollment Periods (SEP)

SEPs are triggered by specific life events, such as:

- Moving out of your plan’s service area.

- Losing other health coverage.

- Gaining eligibility for Medicaid or Extra Help.

- Enrolling in a plan with a 5-star rating (available once per year).

Tips for Enrolling in 2025

- Review Your Options Annually: Plans and coverage details often change, so it’s essential to evaluate your current plan during the AEP.

- Consider Your Healthcare Needs: Think about your preferred doctors, hospitals, and medications to ensure the plan covers them.

- Utilize Medicare Resources: Use tools like the Medicare Plan Finder to compare options or seek assistance from a Medicare counselor.

By staying informed about these enrollment periods and reviewing your options, you can secure the best Medicare Advantage plan tailored to your healthcare and financial needs in 2025.

Summary

Navigating the changes in Medicare Advantage plans for 2025 can be challenging, but staying informed is key. From major updates in mental health care and caregiver resources to new caps on out-of-pocket prescription drug costs, these changes aim to improve the overall healthcare experience for beneficiaries.

As you consider your options, remember to evaluate the coverage, costs, and provider networks of various plans. Making an informed decision will ensure you get the best value and care for your healthcare needs. Stay proactive and review your options regularly to adapt to any changes in the Medicare landscape.

Frequently Asked Questions

→ What are the major changes to Medicare Advantage plans in 2025?

Medicare Advantage plans may have limited provider networks, co-payment requirements, and annual caps on out-of-pocket spending, making them less flexible than Original Medicare.

→ What is the new cap on out-of-pocket prescription drug costs for 2025?

Beginning in 2025, the out-of-pocket cost for covered prescription drugs under Medicare Part D will be capped at $2,000, encompassing deductibles, copayments, and coinsurance.

→How do Medicare Advantage plans compare to Original Medicare?

Medicare Advantage plans, also known as Part C, offer an all-in-one alternative to Original Medicare, typically including Part A, Part B, and often Part D prescription drug coverage. These plans often provide additional benefits like vision, dental, and hearing care, which are not covered by Original Medicare. However, Medicare Advantage plans may require you to use a network of doctors and hospitals and often have a cap on out-of-pocket expenses. In contrast, Original Medicare allows more flexibility in choosing healthcare providers but may require separate premiums for Part D and supplemental insurance like Medigap to cover additional costs.

→ When can I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the annual enrollment period from October 15th to December 7th, or during Special Enrollment Periods if you qualify due to significant life changes. Remember, those who are dual-eligible will have additional enrollment options starting January 1, 2025.

→What are the differences between HMO and PPO Medicare Advantage plans?

HMO Medicare Advantage plans offer lower costs within their network and require referrals for specialists, while PPO plans provide greater flexibility and a broader provider network without referrals but at higher costs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.