Medicare Advantage Plans South Dakota 2026

Are you trying to find the right Medicare Advantage Plans in South Dakota? This article will provide an overview your potential options, possible benefits, and enrollment periods to help you make an informed decision.

Key Takeaways

- Medicare Advantage Plans in South Dakota combine Medicare Parts A and B and some might include additional benefits like prescription drug coverage, dental, vision, and hearing services.

- There are four main types of Medicare Advantage Plans available, including HMO, PPO, PFFS, and SNP, each with varying levels of provider access and specific coverage options tailored to different healthcare needs.

- Choosing a top-rated Medicare Advantage Plan is crucial, as ratings from CMS reflect quality care and customer satisfaction, and understanding the potential benefits available versus Original Medicare could lead to better healthcare decisions.

Compare Plans in One Step!

Enter Zip Code

Overview of Medicare Advantage Plans in South Dakota

Medicare Advantage Plans, also known as Part C, combine the benefits of Medicare Parts A and B, and might include Medicare Part D for prescription drug coverage. These plans are offered by private insurance companies approved by Medicare and might include additional benefits not covered by Original Medicare, such as vision, dental, and hearing services.

South Dakota residents will likely have access to four Medicare Advantage Plan providers. These plans might vary in terms of the extra benefits they might offer, but they all include the essential services covered by Original Medicare. Understanding the options available could help you choose a plan that best meets your healthcare needs and preferences.

Types of Medicare Advantage Plans Available

Medicare Advantage Plans come in several types, each designed to meet different healthcare needs and preferences. The four main types include Health Maintenance Organization (HMO) and Preferred Provider Organizations (PPO). Additionally, there are Private Fee-for-Service (PFFS) and Special Needs Plans (SNP). Each type offers the same basic services, but the specifics of coverage and provider networks may vary significantly.

Availability of these plans could differ depending on your location in South Dakota. HMOs typically require members to use a network of doctors and hospitals and often need referrals for specialist visits. PPOs offer more flexibility by allowing members to see providers outside the network at a higher cost.

PFFS plans determine how much they will pay providers and how much members must pay for services. SNPs cater to individuals with specific diseases or characteristics, offering tailored benefits and provider choices.

Top-Rated Medicare Advantage Plans in South Dakota

Choosing a top-rated Medicare Advantage Plan could significantly affect your healthcare experience. In South Dakota, the highest-rated plans received 4.5 stars from the Centers for Medicare & Medicaid Services (CMS), though none achieved a perfect five-star rating. Providers like Humana and Medica may offer plans with 4-star ratings, indicating strong performance and customer satisfaction.

With several private insurers potentially offering Medicare Advantage Plans in South Dakota, including Aetna and UnitedHealthcare, residents will likely have a variety of options to choose from. Evaluating these plans based on their ratings and reviews could help you find a plan that aligns with your healthcare needs and expectations.

Plan Ratings and Reviews

The CMS rating system is an essential tool for assessing the quality of Medicare Advantage Plans. CMS evaluates these plans on a scale of one to five stars, with higher ratings indicating better performance in areas such as customer service, care quality, and plan administration. These ratings can guide Medicare beneficiaries in selecting plans that offer high standards of care and service.

High-performing plans typically receive higher star ratings, reflecting their ability to provide quality care and services consistently. By considering these ratings, you can make an informed decision that prioritizes your health and satisfaction.

Potential Benefits and Coverage of Medicare Advantage Plans

Some Medicare Advantage Plans may offer additional benefits compared to Original Medicare. Certain plans may include prescription drug coverage, dental, vision, and hearing services, which are not covered by Original Medicare. Such comprehensive coverage could potentially ensure that beneficiaries could receive a broad range of healthcare services under one plan.

Understanding the potential benefits and coverage options of certain Medicare Advantage Plans could help you choose a plan that fits your medical needs. The following subsections will delve deeper into the specific aspects of prescription drug coverage and other potential benefits.

Prescription Drug Coverage

Prescription drug coverage could be a significant benefit of certain Medicare Advantage Plans. These plans may include integrated coverage for prescription drugs, which could help manage the cost of medications.

When selecting a Medicare Advantage Plan, it’s crucial to check if your regular prescription medications are covered. Evaluating the formulary, or list of covered drugs, could ensure that you have access to the medications you need at an affordable cost.

Potential Benefits

Besides prescription drug coverage, some Medicare Advantage Plans may offer various additional benefits that could enhance the overall healthcare experience. These might include routine dental, vision, and hearing coverage which are not typically covered by Original Medicare. Such benefits could potentially reduce out-of-pocket costs for these essential services.

The range of additional benefits might vary among different Medicare Advantage Plans, so it’s important to compare the options available to find a plan that best meets your needs. Whether you require regular dental check-ups or vision care, these extra benefits could provide valuable coverage that enhances your overall health and well-being.

Eligibility and Enrollment for Medicare Advantage in South Dakota

To qualify for Medicare Advantage Plans, you must meet certain eligibility criteria. Typically, individuals must be:

- Senior citizens aged 65 or older

- Legal permanent residents who have lived in the U.S. for at least five years

- Individuals under 65 who receive Social Security benefits or have qualifying disabilities

This ensures that a wide range of individuals may access the benefits provided by Medicare Advantage Plans.

In South Dakota, the amount of eligible individuals are enrolled in Medicare Advantage Plans likely reflect a significant participation rate. With approximately 44,048 South Dakota Medicare beneficiaries currently enrolled, it’s clear that many South Dakota residents might find value in these plans.

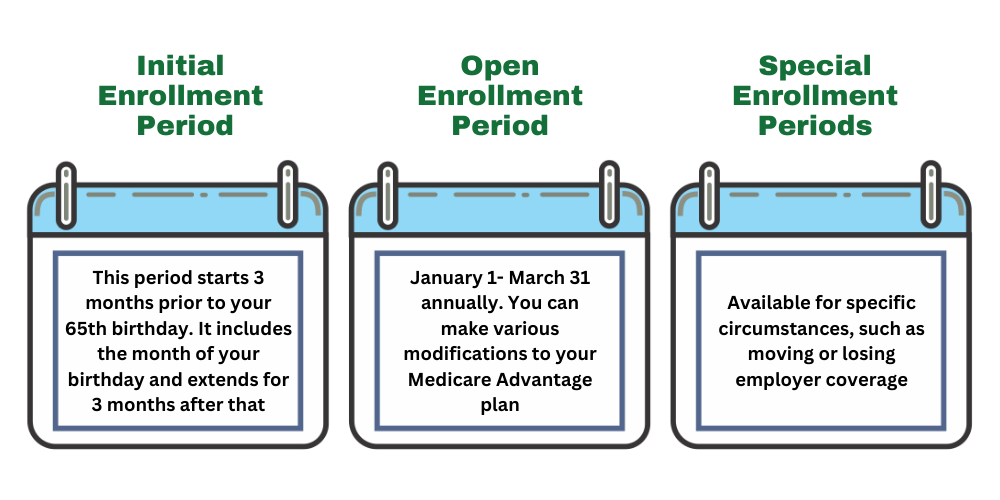

Understanding the enrollment periods, such as the Initial Enrollment Period and Special Enrollment Periods, is crucial for timely and penalty-free registration.

Initial Enrollment Period

The Initial Enrollment Period (IEP) for Medicare is a seven-month window that starts three months before your 65th birthday, includes the month you turn 65, and ends three months after your birth month. Enrolling during this period ensures you have access to Medicare benefits as soon as you’re eligible without facing late enrollment penalties.

Taking advantage of the IEP ensures you secure your Medicare Advantage Plan early. Missing this window can result in higher premiums and delayed coverage, which can be particularly burdensome if you require immediate medical attention.

Special Enrollment Periods

Special Enrollment Periods (SEPs) provide an opportunity to enroll in Medicare Advantage Plans outside the standard enrollment windows under certain circumstances. For example, if you lose your employer-based health insurance, you qualify for a SEP, allowing you to enroll in a Medicare Advantage Plan without waiting for the next open enrollment period.

SEPs offer flexibility for beneficiaries who experience life changes that impact their health coverage. This ensures that you can maintain continuous coverage and access to healthcare services when you need them the most.

Comparing Medicare Advantage Plans to Original Medicare

When deciding between Medicare Advantage Plans and Original Medicare, it’s essential to consider the differences in potential costs, coverage, and provider flexibility. Some Medicare Advantage Plans might include additional benefits like dental and vision care, which are not covered by Original Medicare. However, they may also come with network restrictions that could limit your choice of healthcare providers.

Comparing these aspects could help you determine which type of Medicare coverage best suits your needs. The following subsections will delve into the potential out-of-pocket costs and possible network restrictions to provide a clearer comparison.

Potential Out-of-Pocket Costs

Out-of-pocket costs may vary significantly between Medicare Advantage Plans and Original Medicare. Under Original Medicare, beneficiaries typically pay up to 20% coinsurance after meeting their deductible. In contrast, some Medicare Advantage Plans may offer an annual cap on out-of-pocket expenses, possibly providing more predictable healthcare costs.

Understanding your specific healthcare needs, including medications and services, is crucial when evaluating these costs. By comparing the potential premiums, deductibles, and copays of different plans, you can find an option that aligns with your financial situation and healthcare requirements.

Flexibility and Network Restrictions

Flexibility in choosing healthcare providers will likely be another difference between Medicare Advantage Plans and Original Medicare. Original Medicare will likely allow beneficiaries to see any doctor or hospital that accepts Medicare, possibly offering greater freedom in provider choice. In contrast, some Medicare Advantage Plans may require you to use a network of providers and might need referrals for specialist visits.

These potential network restrictions might limit your access to preferred healthcare providers, especially if you travel frequently or live in a rural area. Evaluating whether the network of a Medicare Advantage Plan includes your preferred doctors and hospitals is essential for making an informed decision.

How to Choose the Best Medicare Advantage Plan

Choosing the best Medicare Advantage Plan will likely require thoroughly evaluating your healthcare needs and financial situation. Start by considering the types of healthcare services you may use most frequently and whether your preferred providers are included in the plan’s network. Additionally, assess the plan’s potential coverage for prescription drugs, dental, vision, and other essential services.

Comparing the possible costs, benefits, and provider networks of different plans could help you find an option that offers the best value and meets your healthcare needs.

Evaluating Your Healthcare Needs

When selecting a Medicare Advantage Plan, it’s crucial to assess your specific healthcare requirements. Consider possible factors such as the frequency of doctor visits, the need for specialized care, and whether your preferred providers are within the plan’s network. Individuals with specific health conditions may benefit from specialized plans tailored to their needs.

Your financial situation will likely be another important consideration. Evaluate the potential premiums, deductibles, and out-of-pocket limits of different plans to ensure they fit within your budget. By carefully assessing these factors, you can select a Medicare Advantage Plan that could offer comprehensive coverage and financial protection.

Summary

Understanding the potential Medicare Advantage Plans in South Dakota is crucial for making informed healthcare decisions. These plans may offer a range of benefits that could go beyond Original Medicare, possibly including prescription drug coverage and additional services like dental and vision care. Evaluating the top-rated plans based on CMS ratings can guide you to high-quality options that meet your healthcare needs.

Taking the time to assess your healthcare requirements, financial situation, and preferred providers could help you choose the best Medicare Advantage Plan. By staying informed and proactive, you could potentially ensure that you receive the comprehensive coverage and care you deserve.

Frequently Asked Questions

→ What is the Initial Enrollment Period for Medicare Advantage Plans?

The Initial Enrollment Period for Medicare Advantage Plans is a seven-month window that begins three months before you turn 65, includes your birth month, and ends three months afterward. It’s crucial to enroll during this time to ensure you have coverage.

→ What additional benefits could Medicare Advantage Plans offer compared to Original Medicare?

Some Medicare Advantage Plans may provide additional benefits such as prescription drug coverage, dental, vision, and hearing services that Original Medicare does not cover. This could potentially enhance your overall healthcare experience and accessibility.

→ How are Medicare Advantage Plans rated?

Medicare Advantage Plans are rated by the Centers for Medicare & Medicaid Services (CMS) on a scale from one to five stars, with higher ratings reflecting superior performance in customer service, care quality, and plan administration. This rating system could help you choose a plan that meets your healthcare needs effectively.

→ What is a Special Enrollment Period?

A Special Enrollment Period (SEP) permits individuals to enroll in Medicare Advantage Plans when specific circumstances arise, like losing employer-based health insurance, outside the usual enrollment periods. This flexibility likely ensure you can secure coverage when you need it most.

→ How do out-of-pocket costs compare between Medicare Advantage Plans and Original Medicare?

Some Medicare Advantage Plans might offer an annual cap on certain out-of-pocket expenses, possibly making costs more predictable than Original Medicare, which might lack a cap and may lead to higher overall expenses.

ZRN Health & Financial Services, LLC, a Texas limited liability company