Medicare Advantage Plans North Dakota 2026

Wondering which Medicare Advantage plans in North Dakota may be available

Key Takeaways

- Medicare Advantage Plans in North Dakota will likely offer comprehensive coverage for seniors and individuals with disabilities, requiring dual enrollment in Medicare Part A and B.

- Several types of Medicare Advantage Plans are available, including HMO, PPO, PFFS, and SNP, each with unique benefits and eligibility criteria.

- Some of the top-rated plans like Align powered by Sanford Health Plan and Humana, demonstrate strong quality ratings from CMS, guiding beneficiaries in selecting suitable healthcare options.

Compare Plans in One Step!

Enter Zip Code

Overview of Medicare Advantage Plans in North Dakota

Medicare Advantage Plans, also known as Medicare Part C, are a type of health insurance offered by private companies. These plans are designed for adults aged 65 and older, as well as certain younger individuals with disabilities.

They must cover all the benefits provided by Original Medicare, though they may reimburse services at different rates. This means you’ll likely receive comprehensive healthcare coverage.

In North Dakota, certain Medicare Advantage plans may have become increasingly popular. Some plans may offer various Medicare benefits that could cater to the unique needs of Medicare beneficiaries. From the possible inclusion of prescription drug coverage, dental, vision, and hearing coverage, some of these plans could offer a wide range of options to suit different healthcare needs.

Understanding the general structure and potential benefits of these plans is the first step toward making an informed choice.

Next, this article explores the specific types of Medicare Advantage Plans available in North Dakota and the eligibility criteria for enrollment. These details will help you understand your possible options and decide which plan best fits your healthcare needs.

Types of Medicare Advantage Plans Available

North Dakota will likely offer a variety of Medicare Advantage Plans to cater to the diverse needs of its residents. The main types of plans available include:

- Health Maintenance Organizations (HMO)

- Preferred Provider Organizations (PPO)

- Private Fee-For-Service (PFFS)

- Special Needs Plans (SNP)

Each type has its own set of rules and benefits, making it crucial to understand their differences.

There will likely be several Medicare Advantage Plans available in North Dakota. These plans might vary based on geographic location, particularly by ZIP code, which means the availability of specific plans could differ significantly depending on where you live in the state.

Members should consider their potential monthly premium rates and out-of-pocket maximums, which could also vary based on your location. These could help you determine which plan offers the best value for your healthcare needs.

Eligibility Criteria for Medicare Advantage Plans

To enroll in a Medicare Advantage Plan in North Dakota, you must meet certain eligibility criteria. Primarily, you must be a senior aged 65 or older or have a qualifying disability. Additionally, you need to be enrolled in both Medicare Part A and Part B. This dual enrollment is a prerequisite for joining any Medicare Advantage Plan.

Individuals with a qualifying disability may also enroll in Medicare Advantage Plans if they have received 24 Social Security Disability payments. This provision ensures that those with disabilities have access to comprehensive healthcare coverage that meets their specific needs.

Understanding these eligibility criteria is essential for ensuring you qualify for the plan you choose. After confirming your eligibility, explore the various options available and select the one that best fits your healthcare requirements.

Leading Medicare Advantage Providers in North Dakota

North Dakota residents will likely have access to Medicare Advantage Plans offered by private insurance companies. These companies could provide comprehensive healthcare options that will likely cater to the needs of Medicare beneficiaries in the state. Among these providers may be NextBlue of North Dakota, Humana, and Sanford Health Plan.

NextBlue of North Dakota could provide a variety of Medicare Advantage Plan options designed to meet the diverse needs of its enrollees. Their plans have been known for comprehensive coverage and flexibility, which might make them a popular choice among North Dakota residents.

On the other hand, Humana has been a significant provider that offered several highly rated Medicare Advantage Plans in recent years. Their plans have been well regarded for their extensive network of doctors and hospitals.

Sanford Health Plan will likely be another key player in the North Dakota Medicare Advantage market. Catering primarily to the senior population, Sanford Health Plan has been recognized for its robust healthcare services and commitment to quality care.

These providers will likely ensure that North Dakota residents could have access to high-quality Medicare Advantage plans.

Top-Rated Medicare Advantage Plans

The Centers for Medicare & Medicaid Services (CMS) uses a star rating system to evaluate the quality of Medicare Advantage and Part D plans. This system rates plans on a scale from 1 to 5 stars, with 5 being the highest. These ratings could help you choose a plan that meets your healthcare needs and provides reliable service.

In North Dakota, Align powered by Sanford Health Plan stands out with a rating of 4.5 stars from CMS for its Medicare Advantage Plans. This high rating reflects the plan’s excellent service, comprehensive coverage, and high level of customer satisfaction.

Humana and Medica may also offer highly rated plans, each receiving a rating of 4 stars from CMS. These ratings could indicate that these plans provide quality healthcare services and benefits.

How to Choose the Right Medicare Advantage Plan

Selecting the right Medicare Advantage Plan will likely involve evaluating your health requirements, financial constraints, and available plan options. This decision is not one-size-fits-all; what works for one person may not be the best choice for another. Take the time to assess your needs and compare the details of each plan.

Consider your health needs and how often you visit doctors or specialists. Evaluate your budget and the various costs associated with each plan, which might include premiums, copayments, and out-of-pocket maximums.

North Dakota beneficiaries can get assistance from our licensed agents by calling us now at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

The next section will compare the potential plan costs and coverage, and the importance of considering provider networks. These various factors could be crucial for making an informed decision and selecting the right Medicare Advantage Plan for you.

Comparing Possible Plan Costs and Coverage

When comparing Medicare Advantage Plans, members should examine the potential cost and coverage each plan offers. Some plans may charge a monthly premium in addition to the standard Medicare premiums. These premiums might vary widely, so it’s essential to understand what you’re paying for.

Members should also consider the out-of-pocket costs such as copayments, coinsurance, and deductibles in addition to premiums. These costs could increase quickly, particularly if you require frequent medical services. Evaluating these costs against your budget could help determine which plan offers the best value.

Additionally, you should consider the specific benefits each plan might offer. Some plans may provide additional benefits like vision, dental, and hearing coverage, which could be valuable based on your healthcare needs.

Carefully comparing these factors will likely help you choose a plan that meets both your health and financial requirements.

Considering Provider Networks

When choosing a Medicare Advantage Plan, members should ensure that their preferred doctors and hospitals are within the plan’s network. If your healthcare providers are out-of-network, you may incur higher costs or find that certain services may not be covered at all.

Before enrolling in a plan, verify that your preferred healthcare providers and facilities are included. This step will likely be crucial to potentially avoid unexpected expenses and continuity of care. Investigate the provider network thoroughly to confirm that it meets your healthcare needs.

Confirming your healthcare providers are in-network may also help you avoid unexpected costs and potentially provide access to necessary medical services. This step is vital for maintaining your health without facing financial surprises.

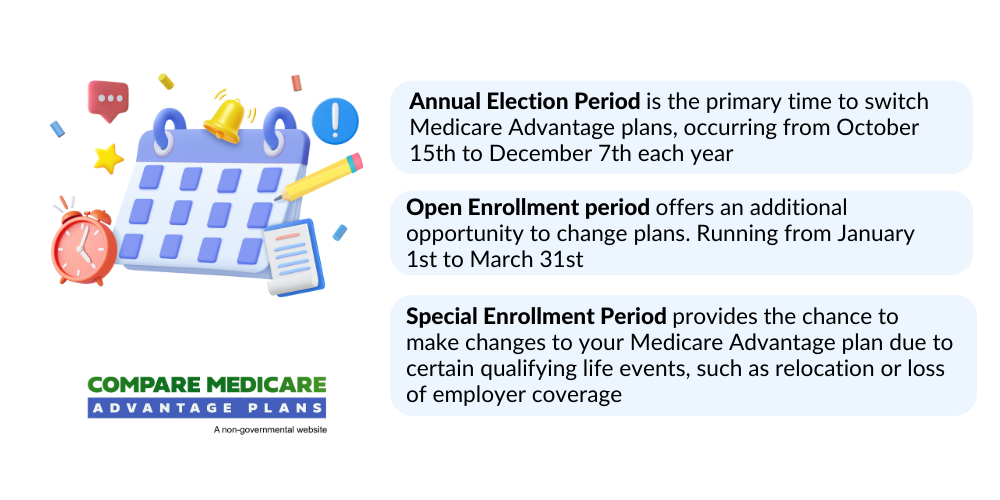

Enrollment Process for Medicare Advantage Plans

Enrolling in a Medicare Advantage Plan is a process that takes place during specific periods. These include the Initial Coverage Election Period, the Annual Election Period, and the Open Enrollment Period. Understanding these periods and their significance ensures a smooth enrollment process.

The Medicare Advantage Open Enrollment period runs from January 1 to March 31 each year. During this time, you can switch Medicare Advantage Plans or revert to Original Medicare.

Another critical period is the Annual Election Period, from October 15 to December 7, when you can make changes to your Medicare coverage.

If you wish to change from a Medicare Advantage Plan back to Original Medicare, you can do so during the annual Open Enrollment period. Knowing these dates and preparing in advance ensures you make the best choices for your healthcare needs.

Summary

Understanding the potential Medicare Advantage Plans in North Dakota will likely involve knowing the types of plans available, who is eligible, and how to choose the right plan for your needs. By considering various factors such as possible costs, coverage, and provider networks, you can make an informed decision that suits your healthcare requirements.

Some of the top providers in North Dakota, such as NextBlue, Humana, and Sanford Health Plan, may offer a variety of plans with high ratings. There will likely be several excellent options available that provide comprehensive coverage and possible benefits.

As you prepare for enrollment, keep in mind the specific periods and steps involved. By taking the time to evaluate your options and plan, you can ensure that you select the right Medicare Advantage Plan

Frequently Asked Questions

→ Who is eligible for Medicare Advantage Plans in North Dakota?

You are eligible for Medicare Advantage Plans in North Dakota if you are 65 or older or if you are under 65 and have received 24 months of Social Security Disability payments.

→ What types of Medicare Advantage Plans are available in North Dakota?

In North Dakota, the main types of Medicare Advantage Plans available are Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), Private Fee-For-Service (PFFS), and Special Needs Plans (SNP). Each plan offers distinct features to cater to different healthcare needs.

→ How are Medicare Advantage Plans rated?

Medicare Advantage Plans are rated by the Centers for Medicare & Medicaid Services (CMS) on a scale of 1 to 5 stars, reflecting the quality of services provided. Higher star ratings indicate better performance and member satisfaction.

→ When can I enroll in a Medicare Advantage Plan?

You can enroll in a Medicare Advantage Plan during the Initial Coverage Election Period, the Annual Election Period from October 15 to December 7, and the Open Enrollment Period from January 1 to March 31. Ensure you take advantage of these specific timeframes to secure your coverage.

→ What should I consider when choosing a Medicare Advantage Plan?

When choosing a Medicare Advantage Plan, it’s important to evaluate your health needs, budget, possible plan costs, potential coverage options, and the inclusion of your preferred healthcare providers in the plan’s network to ensure it meets your requirements effectively.

ZRN Health & Financial Services, LLC, a Texas limited liability company