Medicare Advantage Plans North Carolina 2026

If you’re looking for Medicare Advantage Plans in North Carolina, this guide is here to help. There will likely be several plans to choose from.

This article will walk you through the potential benefits, possible costs, and key details regarding Medicare Advantage Plans in North Carolina, helping you find the right plan for your healthcare needs.

Key Takeaways

- North Carolina will likely offer numerous Medicare Advantage Plans, providing diverse options that could cater to various health and financial needs.

- Top-rated plans, including Humana and UnitedHealthcare, have received high marks for quality and member satisfaction in recent years, potentially making them popular choices among beneficiaries.

- Understanding plan types, possible costs, and eligibility periods is crucial for selecting the most suitable Medicare Advantage Plan for individual health requirements.

Compare Plans in One Step!

Enter Zip Code

Medicare Advantage Plans in North Carolina

North Carolina residents will likely have more choices than ever when it comes to Medicare Advantage Plans. With several plans available, the options will likely be broad and varied, catering to different health needs and financial situations.

A recent rise in enrollment likely reflects the growing demand for more comprehensive Medicare coverage than what Original Medicare provides.

Medicare Advantage Plans cover all the benefits of Original Medicare, including urgent and emergency care. Some Medicare Advantage plans may also include prescription drug coverage (Part D), which could be a significant advantage for those with ongoing medication needs.

Some plans may also include additional benefits like vision, dental, and hearing coverage, potentially enhancing their attractiveness to many Medicare beneficiaries.

These plans are provided by private insurance companies, but they must adhere to Medicare’s regulations and guidelines. Some out-of-pocket costs and service rules might vary widely among plans, so reviewing each plan’s details could be essential before deciding.

Introduction

Medicare Advantage Plans will likely be offered by private insurance companies to act as a possible alternative to traditional Medicare.

These plans provide comprehensive health coverage that includes Medicare Part A (hospital insurance) and Part B (medical insurance) benefits, occasionally including additional benefits like prescription drug coverage, vision, dental, and Medicare Part C.

These plans consolidate various healthcare aspects into one plan, which could offer additional perks and potentially reduce certain out-of-pocket costs.

Overview of Medicare Advantage Plans in North Carolina

North Carolina will likely stand out as one of the states with a significant Medicare population. With approximately 2.1 million Medicare beneficiaries as of 2023, it ranks ninth in the nation. The state offers numerous Medicare Advantage plans, showcasing the state’s commitment to providing diverse healthcare options.

These plans cover all Original Medicare benefits, including urgent and emergency care, and may also add perks such as vision, dental, and hearing coverage. Certain Medicare Advantage Plans may also include prescription drug coverage (Part D), potentially making them a comprehensive solution for beneficiaries.

These potential benefits might make these Medicare plans particularly appealing to those looking for more than Original Medicare could offer.

The financial structure of Medicare Advantage Plans deserves attention. Medicare pays a fixed amount monthly to the companies offering these plans, which must follow Medicare’s rules and regulations.

Out-of-pocket costs, service rules, and referral requirements may differ between plans. Reviewing each plan’s specifics is crucial to finding what works best for your healthcare needs.

Top-Rated Medicare Advantage Plans

Choosing the right Medicare Advantage Plan might seem daunting, but looking at top-rated plans could make the decision easier.

The Centers for Medicare & Medicaid Services (CMS) annually rate these plans, and five plans in North Carolina received a perfect rating of 5 stars in recent years. This rating indicates the plan’s quality, customer satisfaction, and overall performance.

Several major insurers may also offer highly rated plans, each could provide unique features and benefits. The top-rated Medicare Advantage plans in North Carolina likely earned their 5-star ratings based on comprehensive coverage, possible benefits, and high member satisfaction. These ratings could provide a valuable guide when choosing the best Medicare Advantage plans for your needs.

Best Overall Plans

When it comes to the best overall Medicare Advantage Plans in North Carolina, Humana, and UnitedHealthcare have stood out in recent years. Both companies have earned a rating of 4.5 stars, reflecting their commitment to quality and member satisfaction. These plans may also provide comprehensive benefits, such as prescription drug, vision, dental, and hearing coverage.

Additionally, Care N’ Care Insurance Company and Experience Health have also received a 4.5-star rating, possibly making them excellent choices for those looking for top-tier coverage. They will likely offer robust healthcare options, ensuring North Carolina residents have access to high-quality medical services.

Best Low-Cost Plans

For those seeking affordable options, North Carolina may offer certain Medicare Advantage Plans with low monthly premium. Some of Humana’s plans might be particularly noteworthy for their affordability and high member satisfaction, with a member experience rating of 4.04 in 2023.

These plans could provide comprehensive coverage without the burden of high out-of-pocket costs.

Care N’ Care Insurance Company and Experience Health may also offer plans that have received high member satisfaction ratings in North Carolina. These affordable options will likely allow beneficiaries to access essential healthcare services without financial strain.

Plans with Best Member Experience

Alignment Health Plan has been renowned for its focus on enhancing member experience. Their Medicare Advantage options emphasize comprehensive care, ensuring that members receive the attention and services they need.

This focus on member satisfaction could make Alignment Health Plan a popular choice among North Carolina residents.

Major Providers Offering Medicare Advantage Plans

Several major providers will likely offer Medicare Advantage Plans in North Carolina, each potentially bringing unique features and benefits to the table. This variety could potentially ensure that beneficiaries can find a plan that meets their specific health needs and financial situations.

Some of the major providers might include UnitedHealthcare, Humana, and Alignment Health Plan, among others. Each of these providers may offer diverse plans with different benefits, possibly making it easier for Medicare beneficiaries to find a plan that suits them best.

Whether you’re looking for comprehensive coverage, low-cost options, or plans with high level of member satisfaction, these providers will likely have something to offer.

UnitedHealthcare

UnitedHealthcare is one of the largest providers of Medicare Advantage Plans in North Carolina. They will likely offer a variety of plans to cater to diverse healthcare needs, boasting an extensive network of healthcare providers to ensure quality care.

Their offerings include both Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) options, ensuring flexibility and accessibility.

AARP Medicare Advantage plans, managed by UnitedHealthcare, are tailored for individuals aged 50 and over. Some of these plans may offer comprehensive benefits, such as hearing, vision, and dental coverage. Members often report high satisfaction levels due to the comprehensive coverage and excellent customer support provided by UnitedHealthcare.

Humana

Humana will likely be another major provider of Medicare Advantage Plans in North Carolina, known for offering a range of plans that cater to different needs and budgets. Their plans have been noted for their affordability, possibly making them an attractive option for many beneficiaries.

Humana’s high member experience ratings may also indicate above-average satisfaction among its users.

Alignment Health Plan

Alignment Health Plan has been recognized for its commitment to enhancing member experience through comprehensive care. Some of their plans may offer low premiums and out-of-pocket caps. They have received high ratings, including a 5-star rating and the Senior Choice Gold Award, reflecting their excellence in Medicare Advantage benefits.

Alignment Health NC will likely serve various counties across the state, ensuring broad accessibility to their high-quality plans.

Types of Medicare Advantage Plans Available

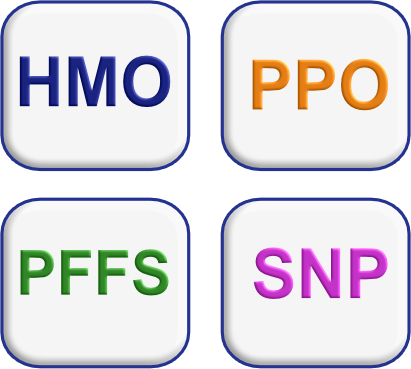

Medicare Advantage Plans come in several types, each designed to meet different healthcare needs. The most common types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS), and Special Needs Plans (SNPs). HMOs typically require referrals for specialists and provide coordinated care among providers.

PPOs offer greater flexibility by allowing members to see out-of-network providers at a higher cost, while PFFS plans allow members to see any doctor who agrees to treat them, with fewer restrictions than HMOs and PPOs.

SNPs are specifically designed for individuals with certain health needs, providing tailored services and support. Knowing these types could help in choosing a plan that best fits your healthcare needs.

How to Choose the Right Medicare Advantage Plan

Selecting the right Medicare Advantage Plan might require evaluating personal health needs and understanding available coverage options. Members should begin by identifying essential services they might need, like prescription drugs, vision, or dental coverage.

Members should also consider the plan’s network of doctors and hospitals to ensure their preferred healthcare providers are included.

Examine the potential costs of each plan, including the possible premiums, deductibles, and out-of-pocket maximums. By entering their zip code into the plan finder tool on this website, users can assess different plans side by side based on coverage and costs.

This thorough evaluation will likely aid in making an informed decision, possibly ensuring the plan meets your health and financial needs.

Enrollment Periods and Eligibility

Knowing the enrollment periods and eligibility criteria for Medicare Advantage Plans is essential. The Initial Enrollment Period lasts seven months, starting three months before you turn 65, including your birthday month, and extends three months after.

The General Enrollment Period occurs from January 1 through March 31 each year, allowing individuals to enroll in Medicare if they missed their initial enrollment period.

The Open Enrollment Period for Medicare Advantage and Medicare Part D takes place annually from October 15 to December 7. During this time, beneficiaries have the guaranteed ability to buy any plan from any company that sells them, regardless of health problems.

If you are actively working at age 65 with an Employer Group Health Plan, you can delay signing up for Medicare Part B without penalty and may qualify for a Special Enrollment Period. Knowing these periods and criteria helps in enrolling in the plan that best fits your needs.

Summary

Navigating the potential Medicare Advantage Plans in North Carolina will likely involve understanding the variety of plans available, the benefits they could offer, and how to choose the right one for your needs. With several plans available, residents will likely have a wealth of options to choose from, whether they are looking for comprehensive coverage, low-cost options, or plans with high member satisfaction.

Some of the top-rated plans and major providers like UnitedHealthcare, Humana, and Alignment Health Plan may also offer unique benefits that could cater to diverse healthcare needs.

By understanding the types of plans available, evaluating your personal health needs, and knowing the enrollment periods and eligibility criteria, you can make an informed decision that ensures you receive the best possible care. Take the time to review your options and choose a plan that aligns with your healthcare and financial goals.

Frequently Asked Questions

→ What are Medicare Advantage Plans?

Medicare Advantage Plans, or Medicare Part C, are privately offered alternatives to traditional Medicare that combine hospital and medical insurance benefits, occasionally adding features like prescription drug coverage, vision, and dental services.

These plans could provide a comprehensive approach to health coverage, possibly making them a beneficial choice for many.

→ What are the enrollment periods for Medicare Advantage Plans?

The enrollment periods for Medicare Advantage Plans include an Initial Enrollment Period lasting seven months around your 65th birthday, a General Enrollment Period from January 1 to March 31 each year, and an Open Enrollment Period from October 15 to December 7 annually.

Knowing these dates is crucial for ensuring your coverage.

→ What are some of the top-rated Medicare Advantage plans in North Carolina?

Based on data from recent years, some of the top-rated Medicare Advantage plans in North Carolina might include offerings from Humana, UnitedHealthcare, Care N’ Care Insurance Company, and Experience Health. These plans have been recognized for their quality and effectiveness.

→ How can I choose the right Medicare Advantage Plan?

To select the right Medicare Advantage Plan, assess your health needs, explore the network of providers, and review potential costs such as premiums and out-of-pocket maximums.

Utilizing online comparison tools on this website can also help you make an informed decision.

ZRN Health & Financial Services, LLC, a Texas limited liability company