Medicare Advantage Plans List for 2025

Navigating the world of healthcare might feel overwhelming, especially when it comes to selecting the right Medicare plan. Some of the Medicare Advantage plans might have become increasingly popular in recent years, potentially offering a comprehensive alternative to Original Medicare that may come with additional benefits and coverage options.

But with so many choices and factors to consider, how can you be sure you’re making the best decision for your healthcare needs?

This article will explore some of the top Medicare Advantage plans list, discuss the various types of plans that may be included in the Medicare Advantage plans list, and potentially provide guidance on choosing the right plan for you from the Medicare Advantage plans list.

Key Takeaways

- Compare the possible Medicare Advantage plans to other coverage options, such as Original Medicare and Medigap plans.

- Understand the different types of plans that may be available, how to choose the right one for you, and when to enroll.

- Utilize in-network providers for reduced costs or potentially take advantage of preventive care services and certain Medicaid benefits.

Compare Plans in One Step!

Enter Zip Code

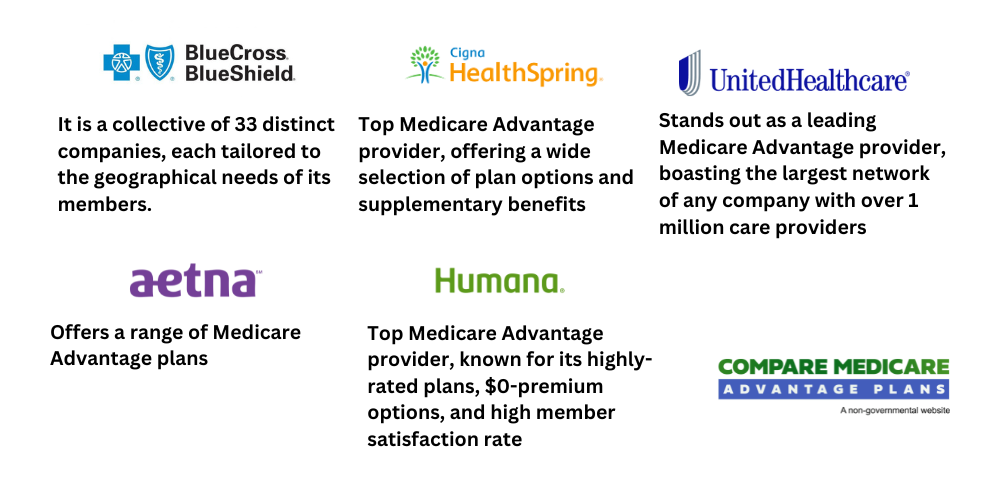

Top Medicare Advantage Providers for 2025

Choosing the optimal Medicare Advantage plan could be key to receiving the healthcare coverage that suits your needs. Based on a comprehensive evaluation by the Forbes Health editorial team, some of the top Medicare Advantage providers will likely include some of the best Medicare Advantage plans that may be offered by:

- UnitedHealthcare

- Aetna

- Blue Cross Blue Shield

- Humana

- Cigna

Each of these providers could offer a variety of plans and benefits, possibly ensuring that you could find the perfect fit for your unique healthcare needs.

UnitedHealthcare

UnitedHealthcare might stand out as a leading Medicare Advantage provider, potentially boasting the largest network of any company with over 1 million care providers. This extensive network could ensure that members could have access to a wide range of Medicare-covered services throughout the country.

Some of UnitedHealthcare Medicare Advantage plans will likely be available in 49 states and Washington, D.C., potentially offering extensive coverage to millions of Americans.

UnitedHealthcare will likely offer a variety of plan options, including Coordinated care plans, Health Maintenance Organization (HMO) plans, and Point of Service (POS) plans, catering to diverse needs and preferences.

UnitedHealthcare’s partnership with AARP might add to its appeal, as the company may provide insurance for the Medicare products that bear the AARP name. This collaboration could potentially ensure that UnitedHealthcare could remain a top choice for seniors looking for reliable, high-quality Medicare Advantage coverage.

Aetna

Aetna, established in 1819, will likely offer a range of Medicare Advantage plans that could include:

- Medical and prescription drug coverage

- Additional benefits tailored to meet your requirements

- Cost assistance for dental, vision, and hearing care

With a focus on providing comprehensive coverage, some of Aetna’s Medicare Advantage plans could offer a variety of benefits to meet your healthcare needs.

Aetna’s potential dental, vision, and hearing benefits might be particularly attractive, as they will likely include:

- Routine exams

- Fillings

- Eyeglasses

- Annual hearing exams

While the exact coverage varies according to the plan, ensuring that you can select the one best suited to your healthcare needs.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) will likely be tailored to the geographical needs of its members. This unique structure might allow BCBS to provide coverage that may be specifically designed for the local population, ensuring that members could receive the most relevant and cost-effective care possible.

However, it’s important to examine local BCBS providers, as member experience ratings may vary between companies. Regardless, BCBS will likely remain a popular choice for many Medicare Advantage enrollees due to its geographically specific benefits and above-average member experience ratings.

Humana

Humana, another top Medicare Advantage provider, may be known for its highly-rated plans and high member satisfaction rate.

With an average Medicare star rating of 4.34 out of 5 and a 96% satisfaction rate for plans rated 4 Stars or higher in 2023, Humana has demonstrated a commitment to providing quality healthcare coverage to its enrollees.

Humana will likely offer Medicare Advantage plans in all 50 states, Washington, D.C., and Puerto Rico, potentially providing extensive coverage options to millions of Americans. Humana could also make it easy for individuals to access affordable, high-quality healthcare coverage.

Cigna

Cigna is a top Medicare Advantage provider, and could potentially offer a wide selection of plan options and supplementary benefits. With some plans that include Medicare Advantage HMO and PPO plans, Part D Prescription Drug Plans (PDP), and Special Needs Plans (SNP) for individuals with specific health requirements, Cigna will likely cater to a diverse range of healthcare needs.

Some of Cigna’s Medicare Advantage plans may include additional benefits, such as dental, vision, and hearing coverage.

Some of these added benefits could make Cigna an attractive choice for individuals seeking comprehensive healthcare coverage through a Medicare Advantage plan.

Understanding Medicare Advantage Plans

Certain Medicare Advantage plans could provide an alternative to Original Medicare by potentially offering bundled health insurance plans with additional benefits such as:

- vision services

- hearing services

- dental services

- Part D coverage for prescription medications.

However, with so many options available, it’s essential to understand the different types of Medicare Advantage plans, how to choose the right plan for your needs, and when to enroll in a plan.

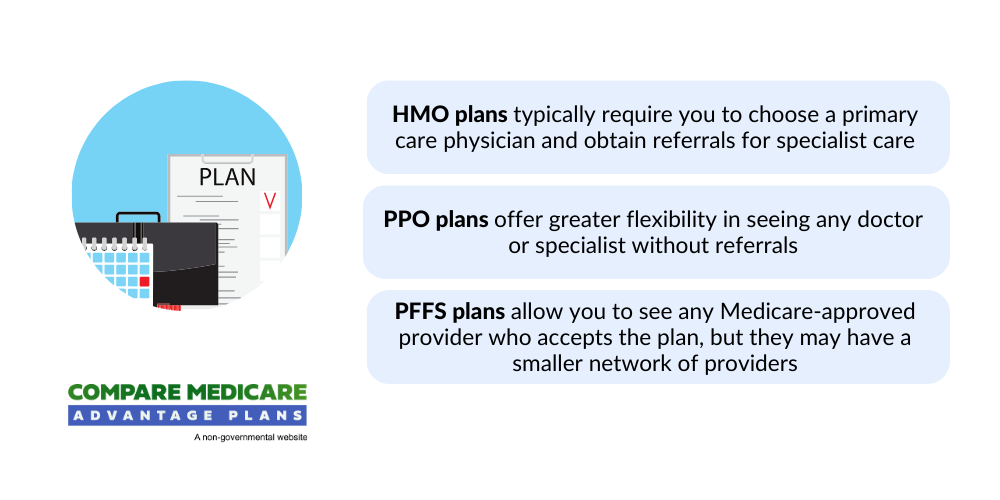

Types of Medicare Advantage Plans

There will likely be several types of Medicare Advantage plans available, which may include many Medicare Advantage plans such as:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Special Needs Plans (SNP)

- Medical Savings Account (MSA) plans

- Private Fee-for-Service (PFFS) plan

Each type of plan could offer unique features and benefits, possibly allowing you to select the best option for your healthcare needs.

HMO plans require you to see in-network providers and select a primary care physician to coordinate your healthcare, while PPO plans offer more flexibility by allowing you to use both in-network and out-of-network providers.

SNPs cater to individuals with specific health conditions, and MSAs combine a high-deductible insurance plan with a medical savings account to cover healthcare expenses. Understanding the differences between these plan types is crucial in making an informed decision about your healthcare coverage.

How to Choose the Right Plan

Choosing the right Medicare Advantage plan for your needs may require careful consideration of several factors, which may include:

- The type of benefits you require

- Your geographic location

- Coverage area

- Monthly premium costs

- Star ratings

- Out-of-pocket costs

- Medications

- Preferred doctors and facilities

- Plan type

By reviewing and evaluating these factors, you can make an informed decision about the best Medicare Advantage plan for you.

For additional information, feel free to contact one of our licensed agents, who can provide comprehensive information and personalized guidance making it easier for beneficiaries to make informed decisions about their healthcare. You can reach them at 1-844-350-0776 (TTY user 711) Mon-Fri 8am-9pm Est

Prescription Drug Coverage in Medicare Advantage Plans

Prescription drug coverage might be a critical component of certain Medicare Advantage plans. Some of these plans may include Medicare Part D coverage, which could potentially provide outpatient prescription drug benefits that may come through private plans that contract with Medicare.

Knowing the potential role of Part D in Medicare Advantage plans and comparing drug coverage options could be key to selecting the optimal plan for your medication needs.

The Role of Part D

Part D will likely play a crucial role in certain Medicare Advantage plans by providing outpatient prescription drug coverage to enrollees. This voluntary benefit might be offered through private plans that have a contract with Medicare, possibly ensuring that you could have access to the medications you need at an affordable cost.

Including Part D in your Medicare Advantage plan may also offer additional benefits, such as cost assistance with dental and vision care, and might be able to help reduce your overall healthcare expenses.

Comparing Drug Coverage Options

To compare the potential drug coverage options between different Medicare Advantage plans, follow these steps:

- Use the Medicare Plan Finder tool on Medicare.gov.

- Input your regular medications.

- Evaluate the benefits, costs, and coverage of various plans.

- Compare plans side-by-side.

- Make an informed decision about which plan offers the best drug coverage for your needs.

It’s also essential to research each plan’s coverage of medications, as not all plans cover the same drugs. Review the plan’s formulary, or the list of covered drugs, to ensure that your medications are included.

This could help you avoid any unexpected out-of-pocket costs and potentially ensure that you may have access to the medications you need.

Enrollment Periods and Switching Plans

The process of enrolling in a Medicare Advantage plan or changing plans may be intricate. Understanding the various enrollment periods, including the Initial Enrollment Period and the Open Enrollment Period, could be pivotal to not miss the chance to enroll in or change plans when necessary.

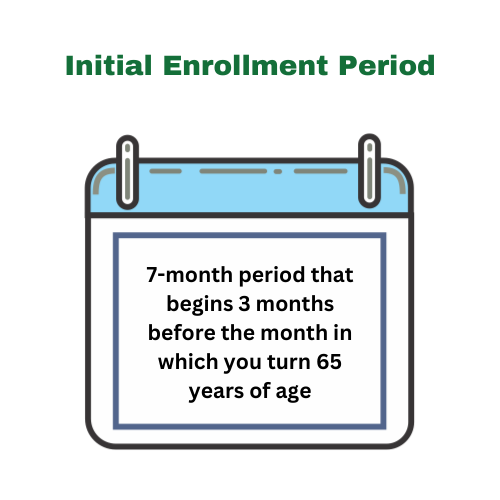

Initial Enrollment Period

The Initial Enrollment Period is your first opportunity to enroll in a Medicare Advantage plan after becoming eligible for Medicare.

This period begins three months before your 65th birthday, includes the month of your birthday, and ends three months after your birthday month.

It’s essential to take advantage of this period to enroll in a Medicare Advantage plan that best meets your healthcare needs.

To enroll in a Medicare Advantage Plan during the Initial Enrollment Period, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

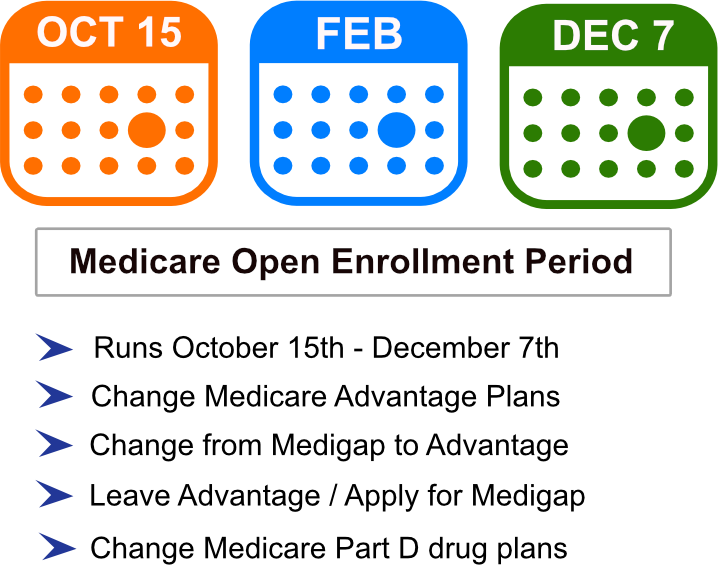

Open Enrollment Period

The Open Enrollment Period is an annual event that takes place from January 1 to March 31 each year. During this time, individuals can:

- Switch or enroll in Medicare Advantage plans

- Review their coverage, including their drug formulary, to ensure their plan continues to meet their healthcare needs

- Make changes and select a new plan if their current plan is no longer suitable

During the Open Enrollment Period, you can make one switch between Medicare Advantage plans or switch back to Original Medicare.

You could also add or remove prescription drug coverage if needed. It’s essential to carefully consider your healthcare needs and preferences during this period to ensure that you have the best possible coverage for the upcoming year.

Possible Costs and Out-of-Pocket Expenses

Comprehending the potential costs and out-of-pocket expenses that may be tied to Medicare Advantage plans could be key to managing your healthcare budget. Every health plan will likely have a specific amount to be paid monthly to avail it.

Additionally, some plans may have a maximum out-of-pocket cost which could be the upper limit of expenses covered for health care services annually. Out-of-pocket costs might rapidly add up if you plan on looking for medical care outside of your regular network. Plans that could offer zero premiums, even though they sound appealing, may come with high out-of-pocket maximums.

By being aware of these costs and planning accordingly, you can better manage your healthcare expenses.

Potential Factors Affecting Costs

There will likely be several factors that could influence the cost of certain Medicare Advantage plans, including:

- Payment methodology based on benchmarks

- Risk adjustment based on health status and other characteristics of enrollees

- Health status and healthcare use

- Supplemental coverage and premiums for that coverage

- Certain Medicare Advantage plan benefits

- Healthcare costs

- Provider networks

- Regional market dynamics

- Premiums, deductibles, copayments, and coinsurance

These factors could play a role in determining the cost of Medicare Advantage plans.

One of the most prominent factors will likely be the location, as premiums might tend to be more cost-effective in urban, densely populated areas, while rural regions may experience higher premiums due to factors such as limited healthcare facilities and providers.

Another factor that may affect the cost of certain Medicare Advantage plans could be the provider network. Some providers may influence the cost of plans through the negotiation of reimbursement rates and the size of the provider network.

By understanding the various factors that could affect costs, you can make informed decisions about which Medicare Advantage plan is the best fit for your budget.

Managing Out-of-Pocket Expenses

Managing out-of-pocket expenses may be challenging, but there will likely be several strategies you could employ to minimize some of these costs. One approach could be to select a plan with a reduced out-of-pocket maximum limit, which might protect against exorbitant medical costs.

Additionally, some Medicare Advantage plans may provide lower-than-required caps on out-of-pocket expenses for doctor and hospital visits.

Preventive care may be another essential aspect of managing out-of-pocket expenses. Some Medicare Advantage plans may provide full coverage for preventive care services, such as screenings, vaccinations, and counseling, without requiring any out-of-pocket payments from the beneficiary.

By taking advantage of these potential services and focusing on early detection and treatment of health conditions, you may be able to help reduce out-of-pocket costs and prevent more costly medical interventions in the future. In addition to Medicare Advantage, some Medicaid services may also play a crucial role in providing healthcare coverage for eligible individuals.

Navigating Networks and Providers

Navigating a plan’s network within Medicare Advantage plans may be intricate, but knowing how these networks work and how to locate preferred doctors and facilities might be key to ensuring you get the healthcare coverage you need.

In this section, we’ll discuss the differences between in-network and out-of-network providers, as well as guide selecting the best healthcare providers for your needs.

In-Network vs. Out-of-Network Providers

In-network providers have an established agreement with your insurance company to accept reduced rates, whereas out-of-network providers do not have a contract with your health insurance plan.

Utilizing in-network providers might lead to lower costs for you, and might be able to ensure that the services they provide are eligible for reimbursement under your plan. On the other hand, seeing an out-of-network provider might result in increased expenses and limited coverage.

To determine if your preferred doctor or hospital is included in a particular Medicare Advantage plan’s network, consult the plan’s website or contact them directly.

Generally, these options may have a searchable directory or a list of providers who accept their plan. By ensuring that your preferred providers are in-network, you could potentially minimize your out-of-pocket costs and receive the best possible care.

Tips for Finding Preferred Doctors and Facilities

Locating preferred doctors and facilities within a Medicare Advantage plan’s network is essential for receiving the best healthcare coverage possible.

To find in-network providers, you could consult your plan’s website, or search for in-network doctors by ZIP code.

In addition to utilizing some of these online tools, members may also ask friends, family, and colleagues for recommendations or referrals. Personal experiences may provide valuable insight into the quality of care that may be provided by different doctors and healthcare facilities.

By thoroughly researching your options, you can ensure that you receive the best possible care within your Medicare Advantage plan’s network.

Comparing Medicare Advantage to Other Coverage Options

Although some Medicare Advantage plans may provide numerous benefits and extra coverage options, comparing these plans to other Medicare coverage options, such as Original Medicare and Medicare Supplement (Medigap) plans, is important.

By understanding the potential differences between these options, you can make an informed decision about which type of coverage is best suited to your healthcare needs and preferences.

Medicare Advantage vs. Original Medicare

A majority of the Medicare Advantage plans may consolidate Part A and Part B into one plan, while Original Medicare might maintain them as separate plans. Some of the Medicare Advantage plans may also provide additional benefits that could go beyond what is covered by Original Medicare, such as possible cost assistance with dental and vision care, prescription drug coverage, and an annual cap on healthcare expenses.

On the other hand, Original Medicare might offer more flexibility in terms of provider choice, as you may be able to visit any healthcare provider that accepts Medicare.

In terms of healthcare quality, there is generally no significant difference between Medicare Advantage plans and Original Medicare. Both options could provide similar benefits and coverage, ensuring that you may receive the healthcare you need regardless of which plan you choose.

Medicare Advantage vs. Medicare Supplement (Medigap)

Medicare Advantage and Medigap will likely offer two distinct options for individuals with Medicare. Medigap coverage will likely be supplemental to Original Medicare and could help cover certain out-of-pocket expenses such as deductibles, copayments, and coinsurance.

In contrast, Medicare Advantage may act as an alternate method of obtaining certain Medicare benefits and may include additional benefits such as vision, dental, and prescription drug coverage.

When deciding between Medicare Advantage and Medigap, it’s essential to consider factors such as your healthcare needs, provider preferences, and budget. By comparing these two options, you can ensure that you select the best coverage for your unique healthcare needs and preferences.

Summary

Some of the Medicare Advantage plans may provide a comprehensive alternative to Original Medicare, potentially offering additional benefits and coverage options that could be tailored to your individual needs. By researching the top providers, understanding the various types of plans, and carefully considering your healthcare needs, you can confidently select the best Medicare Advantage plan for you.

Remember to review your coverage options during enrollment periods and stay informed about your healthcare choices, ensuring that you may receive the best possible care and coverage throughout your healthcare journey.

Frequently Asked Questions

→ What are 4 types of Medicare Advantage plans for 2025?

Medicare Advantage plans come in four types: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-for-Service (PFFS), and Special Needs plans (SNPs).

→ Who has the highest star-rated Medicare Advantage plans?

Based on data from previous years, Humana Insurance Company will likely be the highest-rated Medicare Advantage plan, according to industry experts.

→ What are the advantages of having a Medicare Advantage plan?

Some of the Medicare Advantage plans may offer a broad range of plan choices and access to providers, potentially leading to reduced out-of-pocket costs and increased coverage.

→ What additional benefits could Medicare Advantage plans typically offer compared to Original Medicare?

Some of the Medicare Advantage plans may offer additional benefits such as vision, dental, and hearing coverage, as well as prescription drug coverage through Part D, compared to Original Medicare.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.