Medicare Advantage Plans Indiana 2026

Looking for information on the potential Medicare Advantage plans in Indiana

Key Takeaways

- Some Medicare Advantage Plans in Indiana may provide additional benefits that could go beyond Original Medicare, such as vision, dental, and hearing coverage.

- Medicare Advantage plans in Indiana include various types such as HMO, PPO, and Special Needs Plans, each designed to meet distinct healthcare needs.

- The enrollment process includes several key periods, with the Annual Enrollment Period running from October 15 to December 7, ensuring beneficiaries can select or change their plans effectively.

Compare Plans in One Step!

Enter Zip Code

Understanding Indiana Medicare Advantage Plans 2026

In today’s health insurance environment, Medicare Advantage plans could be an alternative to Original Medicare, possibly offering a range of additional benefits and services. These plans are available to all beneficiaries enrolled in Original Medicare.

Eligibility for Medicare in Indiana extends to individuals aged 65 and older or those with specific disabilities. Enrollment periods are structured to provide flexibility, with opportunities such as Initial Enrollment, Open Enrollment, and special enrollment periods triggered by specific life events.

Beneficiaries should verify that their healthcare providers are within the plan’s network to maximize the possible benefits and potentially achieve significant savings.

Types of Indiana Medicare Advantage Plans Available

Indiana will likely offer a diverse range of Medicare Advantage plans designed to meet varying healthcare needs and preferences. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type of plan offers distinct features and benefits, likely providing beneficiaries with multiple options to choose the one that best suits their lifestyle and health requirements.

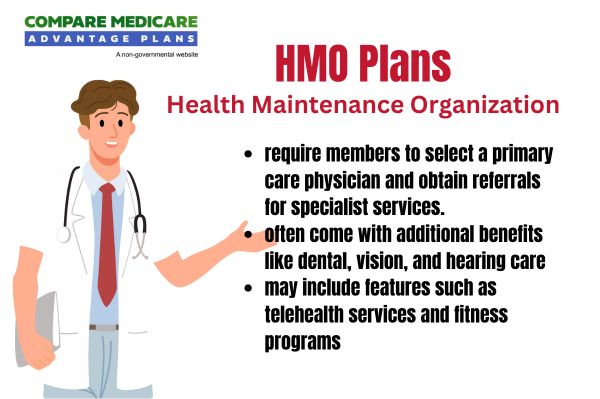

HMO Plans

Health Maintenance Organization (HMO) plans have been a popular choice in Indiana, requiring members to use a network of specific doctors and hospitals for their care, except in emergencies. These plans emphasize coordinated care, where a primary care physician oversees the services provided to enrollees, ensuring that all healthcare needs are met efficiently.

These various benefits could make HMO plans an attractive option for those who prefer a structured and comprehensive approach to their healthcare.

PPO Plans

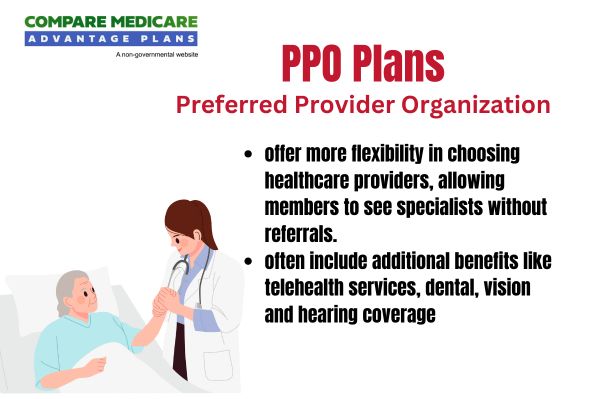

Preferred Provider Organization (PPO) plans offer more flexibility compared to HMO plans, allowing members to seek care from both in-network and out-of-network providers, albeit at a higher cost. This flexibility means members do not need a referral to see a specialist, likely providing greater autonomy in managing their healthcare.

However, this freedom might come with higher out-of-pocket costs when using out-of-network providers. Despite this, PPO plans could be a comprehensive choice for those who value flexibility and broader access to care.

Special Needs Plans (SNPs)

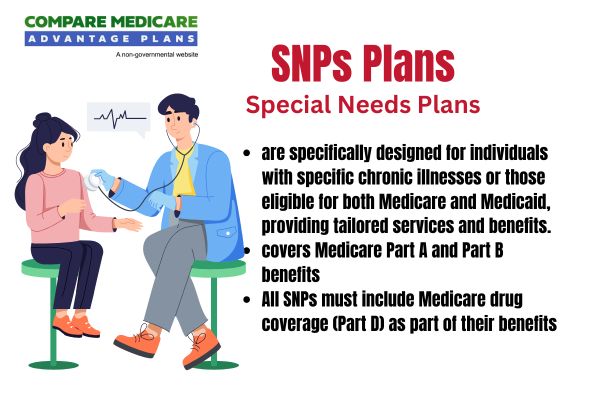

Special Needs Plans (SNPs) will likely be tailored for individuals with specific health conditions or unique circumstances, such as those with chronic conditions or living in institutions. These plans could provide tailored healthcare services and benefits that cater to their specific needs, possibly ensuring comprehensive care for vulnerable populations.

There are three primary types of SNPs: Dual Eligible SNPs for those with both Medicare and Medicaid, Chronic Condition SNPs focused on specific diseases and chronic medical conditions, and Institutional SNPs for individuals residing in care facilities. These plans may also include care coordination services, which could be integral in managing the complex healthcare needs of their members effectively.

Overview of Indiana Medicare Advantage Plans 2026

Indiana has been home to approximately 1.4 million individuals enrolled in the Medicare program, placing it among the top 20 states for Medicare beneficiaries in the U.S.

Eligible Medicare members in Indiana will likely be accessible to a broad spectrum of beneficiaries. Moreover, some Medicare Advantage plans may also provide more benefits than Original Medicare, which might include services such as dental, vision, and hearing coverage.

Covered Services and Potential Benefits

Medicare Advantage plans in Indiana cover a wide range of medical services, including hospital stays and outpatient care. Certain plans may offer prescription drug services under both HMO and PPO structures, potentially providing comprehensive coverage for enrollees.

In addition to these core services, beneficiaries may also get access to additional health benefits, including dental, vision, and hearing services.

Possible Benefits of Indiana Medicare Advantage Plans

One of the potential advantages of Indiana Medicare Advantage Plans might be their financial attractiveness. Some plans may offer lower monthly premiums, likely making them an economical choice for beneficiaries. Certain plans may also offer coverage for additional benefits, such as dental, vision, and hearing care.

Some plans may also integrate prescription drug coverage, possibly giving members access to necessary medications without the need for a separate plan.

Enrollment Process for Indiana Medicare Advantage Plans

The enrollment process for Indiana Medicare Advantage plans involves several key periods and deadlines to ensure coverage. Members will retain their selected Medicare Advantage plan from the previous year unless they make any changes during the Annual Enrollment Period.

When to Enroll

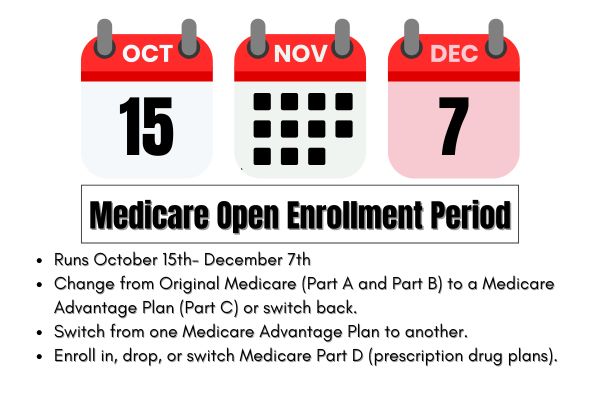

The Annual Enrollment Period (AEP) is a crucial time for enrolling in Medicare Advantage plans, typically running from October 15 to December 7 each year. Enrollment for Medicare Advantage plans begins on October 15 and ends on December 31, giving individuals ample time to review and select their plans. It’s important to enroll by December 31 to maintain continuous coverage.

A Special Enrollment Period from December 8 to February 28 is available for those whose plans are discontinued, allowing for a seamless transition to a new plan. Individuals must enroll in a new plan by December 31 to avoid losing coverage. This ensures that members are not without essential healthcare coverage.

Members can enroll by using this website or by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Different Enrollment Periods

Medicare offers multiple enrollment periods, each designed to accommodate different needs and circumstances. The Initial Enrollment Period is when individuals first become eligible for Medicare, typically around their 65th birthday. The General Enrollment Period occurs from January 1 to March 31 each year, allowing those who missed their initial enrollment to sign up. Special Enrollment Periods (SEPs) are triggered by specific life events, such as moving out of a plan’s service area or losing other coverage, offering flexibility for unique situations.

If an individual moves outside their plan’s service area, they can switch to a new Medicare Advantage Plan or revert to Original Medicare. This period extends from the month before the move to two full months afterwards.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) allows beneficiaries to switch plans or change their coverage from January 1 to March 31 each year. During this time, Medicare Advantage enrollees can switch their plans or revert to Original Medicare, providing an essential opportunity to reassess and adjust their healthcare coverage.

The Annual Enrollment Period (AEP), occurring from October 15 to December 7, enables beneficiaries to enroll in or change their Medicare plans effective January 1.

Special Enrollment Periods (SEPs) are triggered by specific life events, allowing beneficiaries to enroll or switch plans outside the typical enrollment windows. These enrollment windows provide critical opportunities for members to ensure their healthcare needs are met without interruption.

Potential Costs Associated with Indiana Medicare Advantage Plans 2026

Understanding the potential costs associated with Indiana Medicare Advantage plans could be crucial for making informed decisions. Some plans may even include additional benefits such as vision and dental coverage without any extra premium, possibly making them a cost-effective option for many beneficiaries.

Out-of-Pocket Maximums

Some Medicare Advantage plans in Indiana may provide a lower out-of-pocket maximum compared to traditional Medicare, possibly providing cost savings for beneficiaries. Certain Medicare Advantage plans might include an annual limit on out-of-pocket expenses for covered medical services, likely offering financial protection to members.

The out-of-pocket maximum amount may vary by plan, likely ensuring different coverage options to meet the diverse financial needs of members. This potential cap could provide a financial safeguard against high healthcare costs, likely making these plans a secure choice for managing medical expenses.

How to Qualify for Indiana Medicare Advantage Plans 2026

To enroll in a Medicare Advantage plan in Indiana, you must first be registered for Original Medicare, which includes Part A and Part B. Individuals can qualify for a Special Enrollment Period if they experience specific life changes, such as relocating outside their plan’s service area. Eligible individuals can also enroll during the Annual Enrollment Period, which occurs from October 15 to December 7 each year.

When choosing a Medicare Advantage plan, it’s important to consider your healthcare needs and budget, including whether you require out-of-network services. Some plans may offer extra benefits like dental, vision, and hearing coverage, which could be a significant factor in qualifying and selecting a plan. These considerations could help ensure that you select a plan that best fits your personal healthcare requirements.

Contracted Network and Access to Care

Medicare Advantage plans offer a variety of provider networks, including PPO and HMO options, which might affect access to care and costs. These plans provide access to a broad network of healthcare providers and hospitals, possibly ensuring that members receive care within their local communities.

Members can use this website to verify if their preferred doctors and hospitals are in-network, ensuring they receive the maximum benefits from their plan. The availability of additional benefits, such as dental and vision coverage, may vary based on the selected network of Medicare Advantage plans.

This comprehensive network access could potentially ensure that members can maintain their health without the stress of navigating out-of-network charges.

Comparing Indiana Medicare Advantage Plans to Original Medicare

Indiana will likely offer numerous Medicare Advantage plans, which could provide a range of coverage options compared to Original Medicare. Some of these plans may offer additional benefits and services, possibly making them a compelling choice for many beneficiaries.

Coverage Differences

Certain Medicare Advantage plans may include additional benefits that could go beyond Original Medicare, such as dental, vision, and hearing services. Some Medicare Advantage plans may also offer prescription drug coverage, while Original Medicare typically does not include drug coverage. Some plans could also provide higher levels of care management and support services compared to Original Medicare. These differences will likely highlight the comprehensive nature of Medicare Advantage plans.

Cost Comparisons

Members of Medicare Advantage plans could potentially benefit from reduced out-of-pocket expenses compared to traditional Medicare. This cost-effective approach might make Medicare Advantage plans a financially attractive alternative to Original Medicare.

Emergencies and Referrals

Emergencies are a critical aspect of healthcare, and Medicare Advantage plans are designed to provide coverage during these times. In the event of an emergency, members can receive care from any provider, regardless of whether they are in-network or out-of-network. This ensures that beneficiaries could receive timely and necessary medical attention without worrying about network restrictions.

For non-emergency specialist visits, Medicare Advantage plans might require referrals from a primary care physician, especially in HMO plans. This referral process helps coordinate care and possibly ensures that all healthcare providers are aware of the patient’s medical history and treatment plans. This coordinated approach could lead to better health outcomes and more efficient use of healthcare resources.

Summary

Indiana Medicare Advantage plans

As you consider your options

Frequently Asked Questions

→ Are there any 5 star Medicare Advantage plans?

Yes, there are multiple 5-star rated Medicare Advantage plans available in 13 states and Puerto Rico, as recognized by CMS as of 2025.

→ What are the different types of Medicare Advantage plans available in Indiana?

Medicare Advantage plans in Indiana include HMO, PPO, and Special Needs Plans (SNPs), tailored to various healthcare needs and preferences. Each type provides different benefits and access options to suit your specific requirements.

→ When is the Annual Enrollment Period for Medicare Advantage plans?

The Annual Enrollment Period for Medicare Advantage plans occurs from October 15 to December 7 each year. This is the time to review and make changes to your Medicare coverage.

→ What additional benefits could Medicare Advantage plans offer compared to Original Medicare?

Some Medicare Advantage plans may provide extra benefits like dental, vision, and hearing services that Original Medicare does not cover. These benefits could potentially enhance your overall healthcare experience significantly.

→ How could out-of-pocket maximums benefit Medicare Advantage plan members?

Out-of-pocket maximums could potentially cap member’s medical expenses, possibly providing financial protection against high healthcare costs. This could potentially ensure that members can manage their expenses more predictably and possibly avoid unexpected financial burdens.

ZRN Health & Financial Services, LLC, a Texas limited liability company