Largest Medicare Advantage Plans for 2025

Navigating the world of Medicare might seem overwhelming, but finding the right Medicare Advantage plan will likely be essential to ensure you receive the best coverage and benefits tailored to your needs.

This article will explore some of the largest Medicare Advantage plans in 2025, comparing their potential offerings and discussing possible factors to consider when making your choice. By understanding the differences between plans and providers, you can make an informed decision and secure the most suitable healthcare coverage for your unique situation.

Key Takeaways

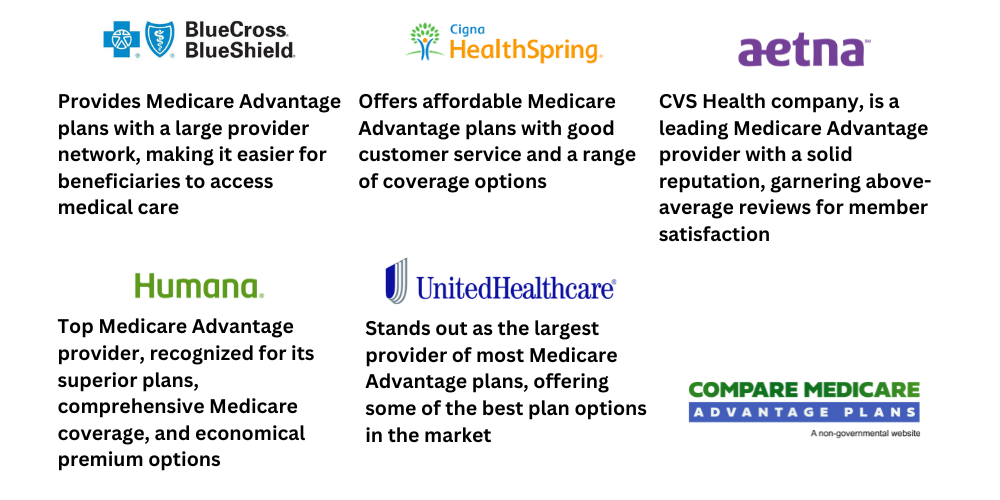

- UnitedHealthcare, Humana, Blue Cross Blue Shield, Aetna, and Cigna have been projected to be some of the largest providers of Medicare Advantage plans in 2025.

- Possible factors such as premiums, out-of-pocket costs, and provider networks should be considered when selecting a plan.

- Comparing Medicare Advantage vs Original Medicare and Medigap may be important for choosing the best-fit coverage option in 2025. SNPs might offer customized benefits for certain health conditions.

Compare Plans in One Step!

Enter Zip Code

Largest Medicare Advantage Plans in 2025

UnitedHealthcare, Humana, Blue Cross Blue Shield, Aetna, and Cigna have been projected to be some of the significant players in the Medicare Advantage market in 2025.

These providers might offer an array of potential coverage options and benefits. Thus it might be beneficial to analyze their potential offerings for the best alignment with your healthcare needs.

For additional information for any of the listed providers, be sure to contact one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

UnitedHealthcare

UnitedHealthcare might stand out as the largest provider of most Medicare Advantage plans, possibly offering some of the best plan options in the market. Their plans will likely be available in numerous states, possibly making them one of the most widespread Medicare Advantage plans nationwide.

One of the potential advantages of United Healthcare’s Medicare Advantage plans may be the plethora of supplementary programs and discounts they could offer. These might include:

- Vision

- Hearing

With a 4 out of 5-star rating from CMS, United Healthcare will likely demonstrate its quality and dedication to customer satisfaction. The provider may also partner with entities like Select Health, Kroger, Alignment Health, and Rite Aid to augment their possible offerings.

Humana

Humana could be another top Medicare Advantage provider, recognized for its superior plans, comprehensive Medicare coverage, and economical premium options. Their Medicare Advantage plan will likely be available in several states, Washington, D.C., and Puerto Rico, possibly providing a wide range of options for beneficiaries.

Humana has had an average overall Medicare star rating of 4.3 out of 5, possibly showcasing its commitment to quality healthcare services. Their plans could provide coverage to about 89% of counties in the United States.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) could provide Medicare Advantage plans with a large provider network, possibly making it easier for beneficiaries to access medical care. With an average rating of 3.9 stars out of 5, BCBS could be a reliable choice for Medicare Advantage coverage.

While some of the BCBS Medicare Advantage plans might cost more than plans from other providers, they may be advantageous if you require coverage at a wide variety of medical offices and see multiple doctors.

You should be aware that each BCBS company operates independently, possibly leading to significant differences in their potential plan offerings, customer satisfaction, and extra benefits between companies. The lists of in-network providers may also differ from plan to plan, so it’s beneficial to scrutinize your options.

BCBS Medicare Advantage plans will likely offer comprehensive coverage of Part A and B services and sometimes additional benefits such as:

- Hearing aids

- Dental coverage

- Vision coverage

- Prescription drug coverage

Aetna

Aetna, a CVS Health company, has been recognized as one of the leading Medicare Advantage providers with a solid reputation, garnering above-average reviews for member satisfaction. They will likely offer several Medicare Advantage plans, including HMO-POS plans, PPO plans, and Dual Special Needs Plans (DSNP).

Some of Aetna’s Medicare Advantage plans may also provide coverage for medical and prescription drug expenses, as well as other benefits and services that could be tailored to individual needs.

Besides comprehensive coverage, some of Aetna’s Medicare Advantage plans may offer a variety of potential benefits like hearing, vision, and dental coverage.

Their focus will likely be on providing tailored coverage and benefits, possibly making Aetna a reliable choice for those seeking a Medicare Advantage plan.

Cigna

Cigna will likely offer affordable Medicare Advantage plans with good customer service and a range of coverage options. They provide both HMO and PPO plans, possibly catering to various preferences and needs.

Some of Cigna’s Medicare Advantage plans may also provide comprehensive coverage, including:

- Dental

- Vision

- Prescription coverage

- Hearing and fitness benefits

Their commitment to affordability and customer satisfaction might make Cigna an attractive choice for beneficiaries who may be seeking a Medicare Advantage plan.

With competitive Medicare Advantage rates, Cigna could be a strong contender for cost-effective plans. Cigna will likely provide both HMO and PPO options, possibly giving beneficiaries a range of choices when selecting the plan that aligns best with their needs.

Potential Factors to Consider When Choosing a Medicare Advantage Plan

When choosing a Medicare Advantage plan, you should weigh the potential factors that could directly affect your healthcare experience and costs such as:

- Monthly premiums

- Out-of-pocket costs

- Provider networks

- Additional benefits

A careful review of these potential factors could help you select a plan that aligns with your healthcare needs and financial circumstances.

You may also want to consider the plan’s ratings and reviews from both the Centers for Medicare & Medicaid Services (CMS) and other rating agencies such as A.M. Best and J.D. Power. These ratings could give you an idea about the plan’s quality and customer satisfaction, possibly aiding you in making a decision based on sufficient information.

Remember to examine the plan’s potential benefits in detail and confirm that your medications are included in the formulary. Other aspects to consider may be:

- the size of the provider network

- monthly premium costs

- coverage for services you may need

By thoroughly evaluating these potential factors, you may be able to find the best Medicare Advantage plan that meets your unique needs and explore the best Medicare Advantage plans available in your area.

Comparing Medicare Advantage Plans: HMO, PPO, PFFS, SNP

When examining your potential Medicare Advantage options, it’s necessary to understand the differences between the four plan types:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS)

- Special Needs Plans (SNP)

Each plan type will likely have its own set of rules and coverage options, so it may be crucial to select the one that best aligns with your healthcare needs and preferences.

HMO plans typically require you to choose a primary care physician and obtain referrals for specialist care, while PPO plans allow for greater flexibility in provider selection.

PFFS plans to determine how much they will pay doctors and other healthcare providers, allowing beneficiaries to receive plan-covered services from any eligible provider in the US. SNPs are designed to meet the needs of beneficiaries with particular health conditions or circumstances, providing tailored coverage and benefits.

By familiarizing yourself with the nuances of each plan type, you could make an informed decision when selecting the Medicare Advantage plan that best suits your healthcare needs.

How to Enroll in a Medicare Advantage Plan

To enroll in a Medicare Advantage plan, you first need to obtain approval for Original Medicare from Social Security.

Once approved, you can enroll in a Medicare Advantage plan by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. The Medicare Advantage program offers an annual enrollment period, which starts on January 1. It ends on March 31 annually.

Outside of the annual enrollment period, you may still be eligible to enroll in a Medicare Advantage plan during a Special Enrollment Period (SEP) if you have experienced a qualifying life event or if your current plan’s contract terms have changed or your current health plan coverage has been lost.

Make sure to review your eligibility and the timing of your enrollment to ensure a smooth transition to your new plan.

When choosing a Medicare Advantage plan, you may want to consider some of the potential factors:

- Compare options available in your service area

- Consider monthly premiums

- Evaluate out-of-pocket costs

- Review provider networks

- Look for additional benefits

By carefully evaluating these possible factors and understanding the enrollment process, you can make an informed decision when choosing a Medicare Advantage plan.

The Potential Impact of CMS Star Ratings on Medicare Advantage Plans

CMS Star Ratings could significantly influence enrollment decisions and affect the performance of Medicare Advantage plans.

These ratings, on a scale from 1 to 5 stars (with 5 stars being the highest), will likely evaluate the quality of Medicare Advantage plans bad may offer useful information when comparing options.

In 2023, about 73% of Medicare Advantage enrollment was with plans with 4 or higher stars. Quality performance scores have been shown to impact enrollment performance, with contracts experiencing an increase in their star ratings.

These statistics could highlight the importance of considering CMS Star Ratings when selecting a Medicare Advantage plan.

By taking these ratings into account, you could make a more informed decision when choosing a Medicare Advantage plan that meets your healthcare needs and expectations.

Possible Benefits Offered by Top Medicare Advantage Plans

Certain Medicare Advantage plans may offer extra benefits that could potentially improve your healthcare experience and provide more coverage. Some of these benefits may include:

- Vision coverage

- Dental coverage

- Hearing coverage

These additional benefits could make a significant difference in the overall value and appeal of a Medicare Advantage plan for Medicare Advantage enrollees, including Medicare beneficiaries

When comparing Medicare Advantage plans, it’s essential to consider these extra benefits and how they could impact your healthcare experience. By selecting a plan that might offer additional benefits tailored to your needs, you could potentially maximize the value of your Medicare Advantage plan and possibly get comprehensive coverage.

Medicare Advantage vs. Original Medicare: Pros and Cons

Medicare Advantage plans and Original Medicare will likely have distinct advantages and disadvantages. Some Medicare Advantage plans may provide additional benefits and coverage options compared to Original Medicare but may have more restrictive provider networks and prior authorization requirements.

Original Medicare might offer potential cost savings and provider flexibility, but some plans may have high out-of-pocket costs, including prescription drug costs. Certain Medicare Advantage plans, on the other hand, could provide similar coverage to Original Medicare and sometimes additional features such as prescription drug coverage and extra services.

When choosing between Medicare Advantage and Original Medicare, it may be necessary to balance the pros and cons of each to find the best fit for your healthcare needs and financial situation. By understanding the differences between the two options, you could make an informed decision that aligns with your unique circumstances.

Medicare Advantage vs. Medigap: Differences and Considerations

If you’re considering supplemental coverage for Original Medicare, it may be necessary to understand the differences between Medicare Advantage and Medigap plans.

Medigap plans could provide extra coverage for those enrolled in Original Medicare but might exclude prescription drugs, while some Medicare Advantage plans could serve as an alternative to Original Medicare, possibly including additional benefits.

Medigap plans may also have higher premiums, but lower out-of-pocket expenses than certain Medicare Advantage plans.

Additionally, Medigap plans may also not have networks like Medicare Advantage plans, which could allow you to visit any doctor or specialist who accepts Medicare.

When assessing your options for supplemental coverage, it will likely be necessary to understand the differences between Medicare Advantage and Medigap plans. By comparing the coverage, possible costs, and flexibility of each option, you could make an informed decision that best meets your healthcare needs and financial situation.

Special Needs Plans (SNPs) in Medicare Advantage

Special Needs Plans (SNPs) are a sub-type of Medicare Advantage plans, specifically designed to cater to beneficiaries with specific health conditions or circumstances by potentially providing customized coverage and benefits.

These plans may be available to individuals who meet the criteria of having an additional qualifying condition or being eligible for both Medicare and Medicaid.

SNPs will likely offer specialized coverage, additional benefits, and care coordination, possibly making them an attractive choice for beneficiaries with specific health conditions or circumstances.

However, it’s important to consider potential limitations when evaluating SNPs, such as limited eligibility, network restrictions, and condition-specific coverage. By understanding the unique features and potential restrictions of SNPs, you can make an informed decision when selecting a Medicare Advantage plan that best suits your healthcare needs.

Summary

Understanding the various Medicare Advantage plans and their potential offerings will likely be crucial for finding the best coverage for your unique healthcare needs.

By comparing some of the largest Medicare Advantage providers, considering possible factors such as premiums, provider networks, and additional benefits, and exploring the differences between plan types, you could make an informed decision that aligns with your healthcare preferences and financial situation.

With the right Medicare Advantage plan, you could potentially ensure comprehensive coverage and peace of mind as you navigate your healthcare journey.

Frequently Asked Questions

→ Which Medicare Advantage plan has the largest network?

UnitedHealthcare might offer the largest Medicare Advantage network, with 1.3 million physicians and care professionals and 6,500 hospitals and care facilities nationwide. Its plans have been highly rated and could offer a broad array of options.

→ Who has the best Medicare Advantage plan?

Based on data from previous years, Humana will likely be the best Medicare Advantage plan due to its good ratings, affordable cost, and excellent coverage. In recent years, AARP/UHC has sold the most plans while Blue Cross Blue Shield has been accepted by most doctors.

→ Why are people choosing Medicare Advantage plans?

People might choose Medicare Advantage plans due to the lack of denial rates and quick payments from insurers.

→ What is the difference between Original Medicare and Medicare Advantage plans?

Original Medicare consists of Parts A and B coverage, while some Medicare Advantage plans are offered by private insurers and provide the same coverage as Original Medicare and might offer prescription drug coverage.

→ How do I enroll in a Medicare Advantage plan?

To enroll in a Medicare Advantage plan, you must first be approved for Original Medicare by Social Security.

Once approved, you can then enroll by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. The annual enrollment period for Medicare Advantage runs from January 1 to March 31.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.