Humana Medicare Advantage Plans 2025

Compare plans & rates for 2025

Enter Zip Code

Medicare Advantage Plans for 2025 - Compare & Enroll Here!

At CompareMedicareAdvantageplans.org, we’ve spent years assisting individuals in comparing and enrolling in various Medicare Advantage Plans with ease.

You can enroll right here on this website or get help from our licensed insurance agents. We’re dedicated to making the process straightforward, helping you secure the best coverage annually.

Don’t forget to save this website and tell your friends and family about this website, as we’re always ready to assist!

Top Medicare Advantage Providers in 2025

In 2025, Humana will likely continue its commitment to offering a broad spectrum of Medicare Advantage plans, such as HMO, PPO, SNP, and PFFS, addressing the varied needs and preferences of those with Medicare. With hundreds of Medicare Advantage plans offered throughout the country for people to enroll in, (the number of plans vary by area), Humana provides services to Medicare beneficiaries across the country.

Other popular companies for 2025 include United Healthcare and Aetna. These plans may include extensive benefits beyond what Original Medicare covers, like dental, vision, and hearing aid benefits. The specifics of the plan benefits for 2025 have not yet been revealed. The details and premiums for these plans are expected to be released in early fall.

Humana’s dedication to delivering a high-quality customer experience has led it to be ranked number one among health insurers for three years in a row.

As a leading Medicare Advantage insurance provider on a national scale, Humana’s key focuses include:

- Healthcare for retirees

- Holistic health and wellness

- Catering to people from all walks of life, including those with disabilities

Comparing Humana’s 2025 Medicare Advantage Plans

For 2025, Humana’s Medicare Advantage plans will be available in four main categories:

- HMO (Health Maintenance Organization): This plan has a more restricted network of healthcare providers than PPO and PFFS plans, which offer greater flexibility.

- PPO (Preferred Provider Organization): This plan allows more flexibility in selecting healthcare providers compared to HMO plans.

- PFFS (Private Fee-for-Service): Similar to PPO, this plan also provides more flexibility than HMO plans in choosing healthcare providers.

- SNPs (Special Needs Plans): These are specialized plans designed for individuals with specific conditions.

Each type of plan has its own set of features regarding network limitations, cost-sharing options, and benefits. In the following sections, we’ll delve into the distinct characteristics of each plan type and how they influence your healthcare experience.

Humana’s Medicare HMO Plans for 2025

The HMO (Health Maintenance Organization) plans from Humana are usually characterized by:

- Requiring members to use healthcare providers within their network.

- Needing referrals to visit specialists.

- It is more cost-effective but less flexible compared to other plan types.

- Providing a consistent copay structure for in-network services.

According to their offerings in the past, a significant limitation of HMO plans is the network restriction, which can be especially challenging for those in rural areas to find accessible healthcare providers.

However, Humana’s 2025 HMO plans will likely come with notable benefits, which may include comprehensive dental, vision, and hearing coverage, enhanced dental benefits, and a possible limit on yearly out-of-pocket expenses, including for hearing services.

To locate in-network providers for Humana’s 2025 HMO plans, beneficiaries can use their online searchable directory or consult with one of our licensed insurance agents.

Humana Medicare PPO Plans 2025

Typically PPO (Preferred Provider Organization) plans offer more flexibility than HMO plans, as they may allow members to visit out-of-network providers, albeit at a higher cost.

Humana’s PPO Medicare Advantage plans have a cost-sharing structure that probably includes copayments for both services and prescription drugs. The specific amounts vary based on the plan and the services used.

When weighing Medicare Advantage HMO versus PPO options, it’s crucial to consider the differences in flexibility and cost-sharing structures.

These plans also typically have an annual cap on out-of-pocket expenses, offering financial protection to beneficiaries.

Humana Medicare Special Needs Plans 2025

Special Needs Plans (SNPs) from Humana are a distinct kind of Medicare Advantage plan that typically combines all the benefits of Original Medicare (Parts A and B) with prescription drug coverage (Part D). These plans are particularly crafted for individuals who either have specific qualifying conditions or are eligible for both Medicare and Medicaid.

Types of Special Needs Plans Humana will likely offer to its users in 2025:

- Chronic Condition Special Needs Plans (C-SNPs): These plans are designed to cater to individuals with chronic health conditions such as diabetes, cardiovascular disorders, chronic heart failure, chronic lung disorders, and other qualifying conditions. C-SNPs usually focus on providing specialized care tailored to these specific health issues.

- Dual-Eligible Special Needs Plans (D-SNPs): Aimed at individuals who qualify for both Medicare and Medicaid, D-SNPs typically allow you to combine all your Medicare and Medicaid benefits into one streamlined plan. This makes managing your healthcare more straightforward and efficient.

Possible Additional Benefits Offered by Humana

Humana’s Medicare Advantage plans often come with added perks that increase the overall value of these plans. These extra benefits typically include:

- Vision coverage, which may include eye exams and glasses.

- Hearing coverage, potentially covering hearing aids and related services.

Variation in Dental Coverage and Additional Benefits from Humana

The range of dental coverage in Humana’s Medicare Advantage plans can vary, and most plans have a yearly limit on the amount they cover for dental services.

These added perks not only enhance the healthcare experience for Medicare beneficiaries but also contribute significantly to their overall well-being.

Medicare Advantage Plan Enrollment Period 2025

The process to enroll in Humana’s Medicare Advantage plans for 2025 varies based on your specific circumstances. Some distinct deadlines and requirements apply to new members, current members, and those who are retiring.

In the upcoming sections, we’ll provide a comprehensive breakdown of the enrollment process.

This will include key dates and steps for each category of members, ensuring a smooth transition to your selected Medicare Advantage plan.

Leveraging these resources can help beneficiaries comprehend their coverage options, including Medicaid services, and make an optimal choice for their healthcare requirements.

Enrollment in Humana's Medicare Advantage Plans for 2025

Enrollment for New Medicare Members in Humana Medicare Advantage Plans 2025

Your first opportunity to enroll in Medicare is called the Initial Enrollment Period, which lasts for 7 months. If you qualify for Medicare due to your age, this period begins 3 months before your 65th birthday and ends 3 months after the month you turn 65.

Here’s a step-by-step guide for new members to enroll:

- Verify Eligibility: Typically, eligibility requires being 65 years old or older, or receiving Social Security Disability Insurance (SSDI) benefits for 24 months. Ensure that factors like national origin, age, and disability status do not hinder enrollment.

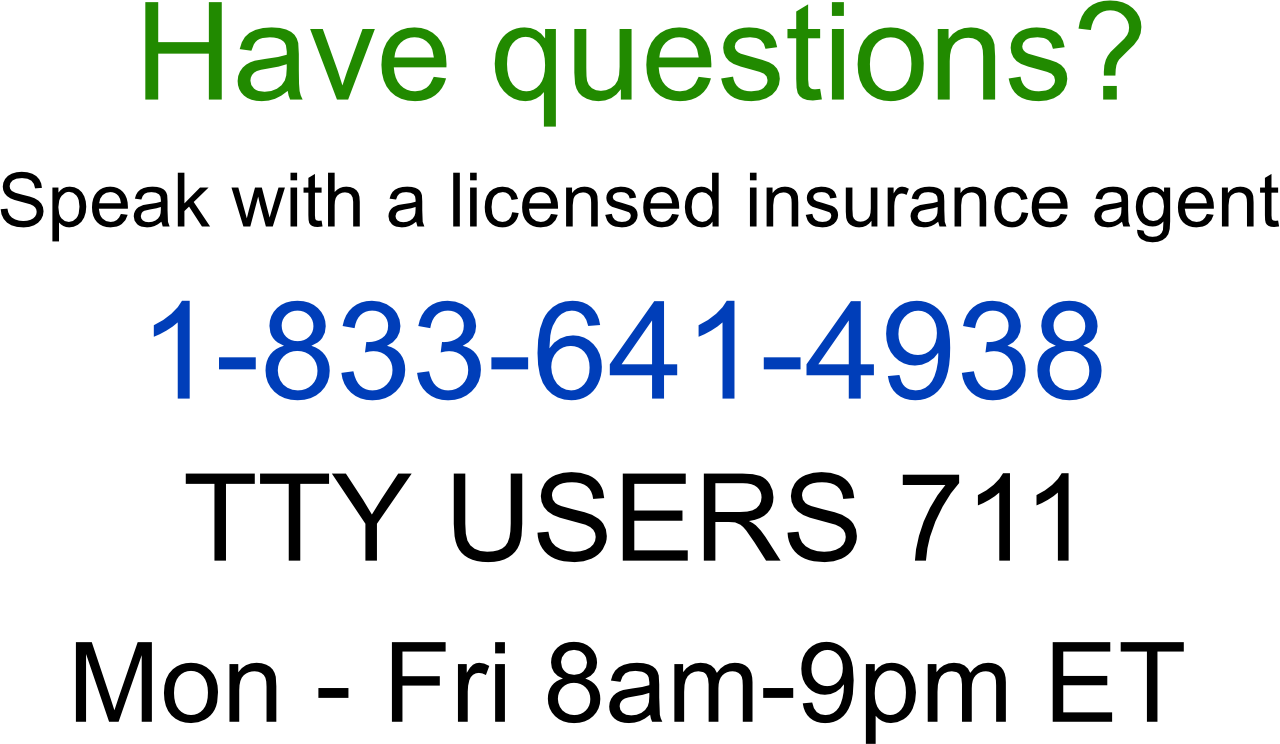

- Explore Plans: Look into the Medicare Advantage plans available in your area. You can locate these plans by entering your ZIP code in the designated box on this page. Or you can call our licensed insurance agents at 1-833-641-4938. They will help you find a plan that meets your specific medication needs.

- Assess Plan Options: Compare the benefits, costs, and network coverage of different plans.

- Select the Appropriate Plan: Choose the plan that best suits your healthcare needs.

Enrollment for Existing Medicare Members in Humana’s Medicare Advantage Plans

If you’re already a member of a Humana Medicare Advantage plan, you can make changes to your plan during two key periods:

- Annual Election Period (AEP): From October 15 to December 7, 2024.

- Medicare Advantage Open Enrollment Period (OEP): From January 1 to March 31, 2025.

During these periods, existing members can review and compare different Medicare Advantage plans, adjusting their coverage as needed.

To change your plan:

- Review and compare the options, focusing on benefits, costs, and network coverage.

- Choose a new plan and switch by contacting one of our licensed insurance agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

- Note that the availability of plans and benefits may vary (by location, etc.)

Understanding Coverage Variations in Rural and Urban Areas

Enrollment for Retiring Members

If you’re retiring, it’s important to enroll in a Humana Medicare Advantage plan within the first three months of your Medicare eligibility for timely coverage. Retiring members who are at least 65 years old and enrolled in Medicare Parts A and B can sign up for a new plan during the fall 2024 annual enrollment period, starting October 23, for coverage effective January 1, 2025.

For retiring members to enroll:

- Confirm your eligibility for Medicare.

- Research the available Humana plans in your area.

- Select the plan that best meets your needs.

- Enroll by contacting us during the Fall 2024 annual enrollment period, either online, by phone, or in person. 1-833-641-4938

- Coordinate with any other insurance, like employer-sponsored retiree health benefits, for a smooth transition to your new Medicare Advantage plan.

Once you’ve chosen a plan, you can enroll during the AEP.

After enrolling, new members should:

- Choose a primary care physician (PCP) within Humana’s network.

- Coordinate with any other insurance coverage they have, like employer-sponsored retiree health benefits, to ensure a smooth transition to their new Medicare Advantage plan.

Humana’s Medicare Advantage plans present different coverage options depending on whether you are in a rural or urban area. Generally, urban locations offer a wider array of plan choices and provider networks.

Key differences in coverage between rural and urban areas can include:

- The number of in-network providers available.

- Access to specialized healthcare services.

- The availability and proximity of healthcare facilities.

Summary