Humana Medicare Advantage Plans Missouri 2025

Choosing the right Humana Medicare Advantage plan in Missouri for 2025 just got easier. In this straightforward guide, we dive into some of Humana’s potential plan options and possible benefits that may be exclusive to Missouri residents.

You’ll find exactly what you need to compare, contrast, and comprehend the possible changes for Humana Medicare Advantage Plans Missouri for 2025, enabling you to make an informed decision with confidence.

Expect clear and actionable information ahead – just the essentials mapped out for you.

Key Takeaways

- Humana and UnitedHealthcare will likely continue to dominate the Missouri Medicare Advantage market, with Humana currently having at least 140 counties, reflecting a strategic growth to cater to both urban and rural areas despite some accessibility challenges.

- Humana’s Medicare Advantage plans in Missouri include HMO, PPO, and PFFS options, and will likely emphasize flexibility, comprehensive benefits including prescription drug coverage, and network access with possible benefits like dental, vision, and hearing coverage.

- Some potential cost considerations for Missouri beneficiaries may entail analyzing varying premiums, cost-sharing details such as copayments and deductibles, and out-of-pocket maximums, with an enrollment process that will likely hinge on eligibility criteria such as age, disability, and residency, and may include special provisions for dual-eligible plans.

Compare Plans in One Step!

Enter Zip Code

Missouri’s Medicare Advantage Landscape

Missouri’s Medicare Advantage market will likely include Champion Health Plan, Peak Health, and Verda Health Plan of Texas which might offer some Medicare Advantage plans that could cater to a diverse range of needs.

On the other hand, certain co-branded partnerships such as Humana with Walgreens, Select Health with Kroger, and Alignment Health with Rite Aid could potentially offer customized plan options.

Top Providers: Humana and others

Humana will likely be the leading force in the Medicare Advantage market in Missouri, representing roughly half of the enrollment in 2023. Their dominance could be attributed to:

- Extensive coverage

- Comprehensive benefits

- Competitive Pricing

- Outstanding star ratings evaluated by the Centers for Medicare & Medicaid Services.

Beneficiaries may have a wide array of potential plan options, their plans could be recognized for their comprehensive benefits and cost-effectiveness.

Potential Market Expansion: New counties and plan availability

In previous years, Humana’s expansive reach was made evident with its inclusion of at least 140 counties. Humana will likely provide plans in states like:

- Missouri

- Maryland

- Maine

- Michigan

- Minnesota

- And many others

This expansion may be driven by Humana’s strategic growth, the urbanicity of a county, and opportunities to re-enter the individual market.

Rural vs. Urban Areas: Differences in plan offerings and accessibility

The landscape of Medicare Advantage may not be uniform across Missouri. While urban areas saw about a 7% increase in enrollment, rural areas experienced at least 13% growth in 2022.

Medicare beneficiaries in rural areas, however, could potentially face unique challenges such as possible coverage denials from Medicare Advantage plans for rural hospitals, limited access to necessary services during disasters, and challenges in obtaining healthcare services due to provider network barriers.

Despite these obstacles, providers may be taking measures to bridge the accessibility gap, supporting rural providers, possibly expanding access to care in rural areas, and transforming the rural health delivery system.

Humana’s Potential Medicare Advantage Offerings in Missouri

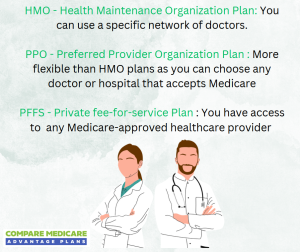

Humana, in its commitment to cater to diverse healthcare needs, could potentially offer a variety of Medicare Advantage plans in Missouri. These include Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Private Fee-for-Service (PFFS) options.

Each plan type has its unique features, benefits, and network restrictions.

Humana may also offer free language interpreter services that might facilitate clear communication with beneficiaries who do not speak English.

Plan Types: HMO, PPO, and PFFS

Humana offers three types of plans to cater to different healthcare preferences:

- PPO plans offer more flexibility, allowing beneficiaries to choose any doctor or hospital that accepts Medicare without being restricted to a network.

- PFFS plans offer access to any Medicare-approved healthcare provider who agrees to the terms and conditions of the plan.

Each plan type presents a variety of choices, all with their unique benefits and compromises.

Prescription Drug Coverage: Possible Inclusion and cost-sharing details

Prescription drug coverage could potentially become an integral part of some of the Humana Medicare Advantage plans. By potentially offering at least three distinct Medicare Part D prescription drug plans, Humana may categorize prescription drugs into tiers based on their cost and coverage.

Beneficiaries may verify whether specialty drugs could be included in their coverage and potentially obtain detailed cost-sharing information by logging into MyHumana, using Humana’s search tool, or contacting Humana directly.

Network Restrictions: Provider networks and referrals

Humana’s network of Medicare-approved providers will likely be extensive, possibly offering both Medicare Advantage HMO and PPO options. Beneficiaries may be able to seek medical care from any doctor within or outside of the network.

While the HumanaChoice PPO Medicare Advantage plan offers flexibility in physician selection, there are no limitations for accessing specialists across all plans.

Possible Extra Benefits and Services

Humana could potentially go beyond the norm by offering extra benefits and services to its Medicare Advantage plan members.

These might include dental, vision, and hearing coverage that might be included as comprehensive healthcare benefits.

Possible Dental, Vision, and Hearing Coverage: Scope and limitations

Humana believes in comprehensive health coverage. That’s why, in addition to regular health benefits, some Humana Medicare Advantage plans in Missouri may also provide dental, vision, and hearing benefits.

However, some of these benefits may vary in scope and limitations.

The potential dental benefit coverage could potentially include:

- Cleanings and preventive care

- X-rays

- Fillings

- Root canals

- Extractions

- Crowns

- Dentures

- Orthodontic treatment

Cost Considerations for Missouri Beneficiaries

Choosing a Medicare Advantage plan involves more than just comparing the potential benefits. The costs that may be associated with each plan may also play a significant role in determining the right plan.

From the potential premiums to cost-sharing mechanisms like copayments and deductibles, and out-of-pocket maximums, understanding how these factors could affect your overall healthcare budget may help you make an informed choice.

Premiums: Comparing costs for different plan types

When it comes to premiums, one size doesn’t fit all. The possible costs of premiums for HMO, PPO, and PFFS plans vary. The specific costs will likely be contingent on the plan and the provider.

Beneficiaries should also consider comparing the possible benefits, costs, and coverage of different plans comprehensively to help them identify the most suitable option for their needs.

Cost-Sharing: Copayments, coinsurance, and deductibles

Cost-sharing might also be a fundamental part of certain Humana’s Medicare Advantage plans. By potentially splitting the costs of certain healthcare services between the insurer and beneficiaries, some cost-sharing mechanisms like copayments, coinsurance, and deductibles could potentially make healthcare more affordable.

However, some of the specifics of certain cost-sharing mechanisms may differ based on the selected plan.

Out-of-Pocket Maximums: Possible limitations on annual expenses

Out-of-pocket maximums may act as a safety net, potentially limiting the amount you must spend on healthcare services in a year.

Once you reach your out-of-pocket maximum, you may not have to pay anything for covered services for the rest of the planned year. However, these maximums could vary among different plan types like HMO, PPO, and PFFS.

Enrollment Process and Eligibility Criteria

Understanding the enrollment process and eligibility criteria is an important step in joining a Humana Medicare Advantage plan. With initial, annual, and special enrollment periods, there are various opportunities to join or switch plans.

Eligibility is typically based on being enrolled in both Medicare Part A and Part B, and additional qualifications may involve receiving Social Security Disability Insurance (SSDI) benefits for 24 months or having a disability determination from the Railroad Retirement Board.

Enrollment Periods: Initial, Annual, and Special Enrollment Periods

The Initial Enrollment Period, which spans from January 1 to March 31, is the first opportunity to join a Medicare Advantage plan. If you miss this period, you can join or switch plans during the Annual Enrollment Period from October 15 to December 7.

Finally, the Special Enrollment Period and the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31, allow beneficiaries to make changes like switching to a different Medicare Advantage plan or moving from Original Medicare to a Medicare Advantage plan.

Eligibility Requirements: Age, disability, and residency

To qualify for a Humana Medicare Advantage plan, individuals must meet the following criteria:

- Be 65 years of age or older

- Have a disability that meets the criteria for eligibility

- Be under the age of 65 and have received disability benefits from Social Security or the Railroad Retirement Board for a minimum of 24 months

Additionally, residency in the state of Missouri is a requirement.

Dual Eligible Special Needs Plans: Options for those eligible for both Medicare and Medicaid

If you qualify for both Medicare and Medicaid, you may be eligible for Humana’s Dual Eligible Special Needs Plans (D-SNPs). These plans could potentially offer extensive coverage and might include supplementary benefits like dental, vision, and hearing services.

To enroll, one must meet the eligibility criteria for both Medicare and Medicaid, and the enrollment process can be initiated by calling 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST, where one of our licensed agents can aid you.

Navigating Humana’s Provider Network

Once you’ve enrolled in a plan, the next step is to navigate Humana’s provider network. Here are some important steps members might want to follow:

- Use online tools to find in-network providers.

- Identify possible preferred pharmacies for lower-cost options.

- Understand out-of-state coverage provisions for travel and emergency care.

Each step is crucial in ensuring you get the most out of your plan.

Finding In-Network Providers: Online tools and directories

Humana’s ‘Find a doctor’ or ‘Provider search’ tool on its website could be a great resource for finding in-network healthcare providers.

By entering your location or zip code and adjusting the search radius, you may be able to access a list of in-network providers that match your criteria.

This tool can be accessed on the Humana website or by contacting their customer service.

Preferred Pharmacies: Lower-cost options and accessibility

Prescription costs may be a significant part of healthcare expenses. Some of Humana’s preferred pharmacy programs could potentially help you save.

By potentially offering medications at a reduced cost at participating lower-cost preferred pharmacies like CenterWell Pharmacy™, preferred pharmacies may be able to significantly reduce some of your out-of-pocket expenses on certain prescriptions.

Summary

Navigating the Medicare Advantage landscape could be a complex process, but with the right knowledge, it may become a lot simpler.

Whether you’re drawn to the possibility of having Humana’s extensive coverage, the flexibility of its HMO, PPO, and PFFS plans, the potential benefits, or the comprehensive cost considerations, Humana could potentially offer a variety of plans that may be tailored to meet diverse healthcare needs.

Remember, the best plan is the one that best fits your health needs and budget. So, equip yourself with the right knowledge, weigh your options, and make an informed decision.

Frequently Asked Questions

→ What is new in Humana in 2025?

In 2025, some of Humana’s Medicare Advantage plans might include dental, vision, and hearing benefits, possibly providing enhanced coverage for beneficiaries. For additional details about the plans for the 2025 calendar year, be sure to keep checking back to this website for updates.

→ What are the advantages of Humana Medicare Advantage?

Some of the advantages of Humana Medicare Advantage could potentially include its broad range of choices for doctors and medical offices compared to Original Medicare and the possibility of lowering overall costs for complex medical needs.

→ What types of Medicare Advantage plans does Humana provide in Missouri?

Humana provides a variety of Medicare Advantage plans in Missouri, including HMO, PPO, and PFFS options. You have multiple options to choose from based on your needs.

→ How can I find in-network providers with Humana in Missouri?

To find in-network providers with Humana in Missouri, you may use the ‘Find a doctor’ or ‘Provider search’ tool on Humana’s website, which will likely allow you to search for providers based on your location or zip code.

ZRN Health & Financial Services, LLC, a Texas limited liability company