Does Medicare Cover Rehab After Stroke?

Recovery from a stroke will likely require rehabilitation, and an immediate concern for many may be the cost of such care. You might wonder if Medicare covers rehab after a stroke. Yes, Medicare could help mitigate these costs by covering some of the necessary rehab services.

This article will unpack exactly what that could entail, what you need to know about different Medicare plans and tips for managing potential out-of-pocket expenses.

Key Takeaways

- Medicare will likely provide comprehensive stroke rehabilitation coverage, including inpatient and outpatient services such as physical, occupational, and speech therapy, which may be contingent upon medical necessity and might have potential limits on duration and coverage.

- Some of the Medicare Advantage plans may offer additional benefits beyond Original Medicare for stroke rehab, which could include extended therapy services and ancillary services, while Medigap plans may assist with certain out-of-pocket costs like copayments and deductibles.

- Medicare will likely cover preventative screenings and services that could reduce the risk of future strokes and may even provide benefits for durable medical equipment and up to 100 days in Skilled Nursing Facilities post-stroke, which could highlight the critical importance of understanding coverage specifics to optimize your potential benefits.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Coverage for Stroke Rehabilitation

Medicare’s coverage for stroke rehabilitation will likely be comprehensive, covering both inpatient and outpatient services. This might include physical, occupational, and speech therapy services. The objective of these therapy sessions is to facilitate the recovery of muscle strength, coordination, speech skills, and other essential functions to support stroke survivors on their recovery journey.

The landscape of Medicare coverage might seem complex, but its primary aim for stroke rehabilitation will likely be to facilitate the necessary medical care and rehabilitation for stroke recovery. Whether it’s outpatient care or inpatient rehabilitation, the right coverage could greatly support the recovery process.

Inpatient Rehabilitation Facilities and Medicare

Navigating the nuances of Medicare Part A and its potential coverage for inpatient rehabilitation services for stroke patients might seem daunting. Yet, understanding the criteria for coverage could help stroke survivors optimally utilize these potential benefits.

To qualify for Medicare Part A coverage of inpatient rehabilitation for stroke patients, it will likely be necessary for the doctor to determine that the rehabilitation is medically essential for treating the patient following the stroke.

It may also be vital to comprehend the duration and possible costs that might be linked to this coverage. Medicare may provide coverage for up to 90 days of inpatient rehab following a stroke, which could greatly benefit stroke survivors during their recovery process. However, it’s important to be aware of possible deductibles, coinsurances, and limits when Medicare may be the sole insurance for inpatient rehabilitation.

Outpatient Rehabilitation Services Under Medicare Part B

Medicare Part B could significantly contribute to the recovery of stroke patients by potentially covering outpatient rehabilitation services like physical and occupational therapy. However, for Medicare to provide coverage, a doctor may be required to certify that the outpatient physical therapy is medically necessary.

While there might be a cap on the number of therapy sessions, Medicare may extend coverage beyond these limits if it has been deemed medically necessary and approved, which could be beneficial for stroke survivors.

However, beneficiaries must be prepared to cover up to 20% of coinsurance of the Medicare-approved amount for the outpatient rehabilitation services, in addition to any excess charges.

Speech Therapy and Stroke Recovery

The essential role of speech therapy in stroke rehabilitation might include:

- Assessing and supporting stroke survivors to minimize aspiration and choking risks

- Providing dysphagia therapy

- Utilizing singing therapy to retrain the brain and help patients regain the ability to speak.

Speech therapy services for stroke patients will likely be covered by Medicare Part B if it has been considered medically necessary and administered by qualified healthcare professionals. With Medicare Part B typically covering up to 80% of the expenses for medically necessary speech therapy sessions related to stroke recovery.

The Role of Medicare Advantage Plans in Stroke Rehab

Authorized private insurance companies may provide Medicare Advantage plans and may also act as an alternative to Medicare Supplement Insurance for those recovering from a stroke. Some of these potential plans might offer significant benefits for stroke patients, including:

- Comprehensive coverage of services

- Longer-term therapy

- Ancillary services for regaining mobility and functionality

- Access to specialized neurology and rehabilitation experts

In addition to the extensive coverage, some Medicare Advantage plans may also offer extended coverage beyond the scope of Original Medicare, which could encompass vision, dental, and hearing services, which could be especially advantageous post-stroke. Since some of these Medicare Advantage plans may provide some of these additional benefits, it could make them a popular choice for many beneficiaries.

Comparing Medicare Advantage Plans

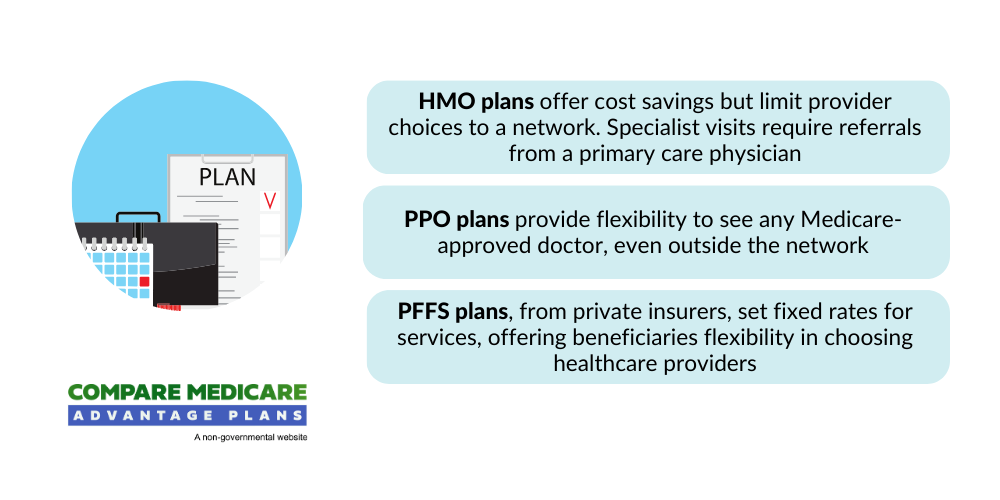

Medicare Advantage plans that provide coverage for stroke rehabilitation will likely consist of:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Each of these plans could provide distinct benefits related to inpatient and outpatient stroke rehab care.

Some of the costs that could be linked with stroke rehab may significantly fluctuate for Medicare Advantage Plans. Hence, before enrolling, evaluating the potential inclusion of preferred providers and rehabilitation facilities within the plan’s network is crucial.

Supplementing Your Stroke Rehab Coverage with Medigap

Medicare Supplement plans, also known as Medigap, could help to provide coverage for expenses like copayments and deductibles that Original Medicare might not cover could be of considerable help to Medicare beneficiaries, especially stroke survivors who may require additional Medicare Supplement Insurance.

Some of the more comprehensive Medicare Supplement plans may provide extensive coverage for strokes, which could assist in covering the cost-sharing of services that might not be fully paid by Original Medicare.

Some of the Medigap plans may also offer assistance in lowering medical expenses by providing coverage for supplementary costs like copayments, coinsurance, and deductibles that may not be included in Original Medicare.

Medigap Plan C and Medigap Plan F could also cover the Medicare Part B deductible, possibly offering financial assistance for individuals who may be facing substantial medical expenses.

Durable Medical Equipment for Stroke Patients

Durable Medical Equipment (DME) could play a significant role in the recovery journey of stroke patients. Medicare will likely cover DME such as walkers and wheelchairs for stroke patients, provided they have a doctor’s prescription.

Grasping the criteria for Medicare’s coverage of DME is vital. Medicare might provide coverage for a portion of the expenses for walkers that have been recommended as a means of mobility following a stroke. Generally, both 2-wheel and 4-wheel walkers may be eligible for coverage, with Medicare assuming at least 80% of the overall expense.

Preparing for Potential Future Strokes

Possible risk factors for recurrent strokes may include:

- Hypertension

- Dyslipidemia

- Diabetes

- Age

- Atrial fibrillation

- Smoking

- Prior cerebrovascular events

Embracing lifestyle changes may notably diminish the risk of conditions like clogged arteries and atherosclerosis, which could aid in the prevention of future strokes.

Medical tests and procedures may also aid in predicting future stroke risks. Medicare could include coverage for preventive services and screenings for stroke, potentially bolstering endeavors in stroke prevention and overall health upkeep.

Navigating Skilled Nursing Facilities After a Stroke

Some patients may need skilled nursing care after a stroke. Medicare Part A covers Skilled Nursing Care when it has been deemed medically vital post-stroke, and the patient meets the Skilled Nursing Facility (SNF) criteria.

Medicare might provide coverage for up to 100 days of care in a Skilled Nursing Facility for stroke recovery, which may be contingent upon the patient’s need for medically necessary inpatient rehab as determined by a physician.

Maximizing Outpatient Care Benefits

Medicare Part B will likely cover vital outpatient rehabilitation services for stroke patients. This might include physical therapy, occupational therapy, and speech therapy, depending on the medical necessity that has been established by a physician.

While there may be a cap on the number of therapy sessions, Medicare may extend coverage beyond these limits if it has been deemed medically necessary and approved.

Summary

Navigating the healthcare system after a stroke might be challenging. However, understanding the coverage provided by Medicare and its different parts, along with the potential supplemental coverage options, could offer relief and support during the recovery journey.

Whether you’re exploring inpatient rehabilitation facilities, outpatient rehabilitation services, or the possible benefits of speech therapy, Medicare will likely provide comprehensive coverage that could significantly aid in the recovery journey. It’s all about understanding the right coverage for your specific needs.

Frequently Asked Questions

→ How many days will Medicare pay for rehab after a stroke?

Medicare will likely cover up to 90 days of inpatient rehab after a stroke, after which you might have to use your lifetime reserve days to continue coverage.

→ What does Medicare cover for stroke rehabilitation?

Medicare may cover comprehensive stroke rehabilitation, which might include inpatient and outpatient services such as physical, occupational, and speech therapy.

→ Does Medicare cover durable medical equipment for stroke patients?

Yes, Medicare may cover durable medical equipment like walkers and wheelchairs for stroke patients with a doctor’s prescription.

→ What is a Medigap plan and how could it benefit stroke survivors?

A Medigap plan, also known as a Medicare Supplement plan, could potentially benefit stroke survivors by helping to cover certain expenses like copayments and deductibles that Original Medicare may not fully cover. This additional coverage could be particularly helpful for stroke survivors who may have ongoing medical needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.