Can I Change Medicare Advantage Plans in January?

Are you considering a change in your Medicare Advantage plan but unsure if January is the right time? This article has you covered.

People may ask if they can change Medicare Advantage plans in January? This article will guide you through the process of changing Medicare Advantage plans in January, understanding the various enrollment periods, and ensuring you can make an informed decision that meets your healthcare needs.

This article will discuss the eligibility criteria, options that might be available during Open Enrollment, and the importance of comparing plans before switching. Special Enrollment Periods and their triggers will also be covered, along with important factors to consider when preparing for the switch.

Key Takeaways

- January’s Medicare Advantage Open Enrollment Period allows beneficiaries to switch between Original Medicare and MA, or enroll in a stand-alone Prescription Drug Plan until March 31st.

- Special Enrollment Periods provide the opportunity to make changes outside of Open Enrollment due to qualifying life events or circumstances.

- Carefully assess healthcare coverage needs when comparing plans, check drug formularies, understand out-of-network costs, and prepare for the transition process by gathering documentation and informing providers.

Compare Plans in One Step!

Enter Zip Code

Understanding January's Medicare Advantage Open Enrollment Period

January’s Medicare Advantage Open Enrollment Period may offer a valuable opportunity for beneficiaries to make changes to their plans.

This period allows you to switch between Original Medicare and Medicare Advantage, or even change to a different Medicare Advantage plan altogether.

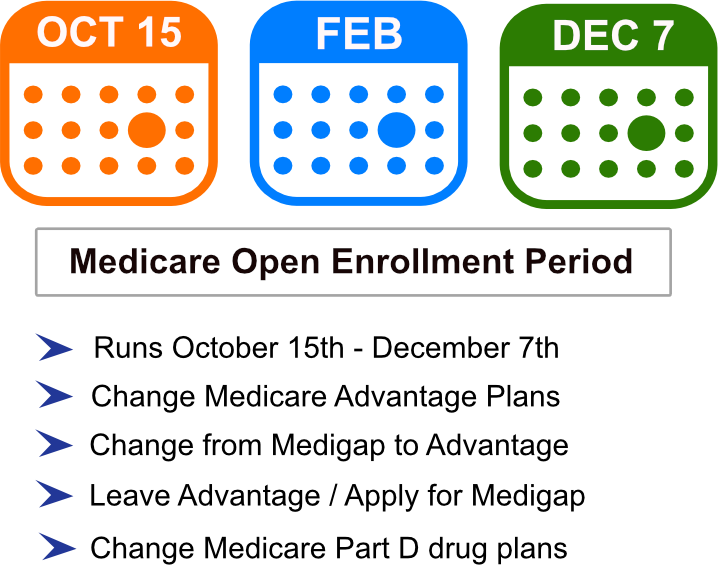

The Medicare open enrollment period, also known as the annual election period, runs from October 15 to December 7. This is the window when you can change your health and drug plans for the following year.

During this time, you could:

- Return to Original Medicare with or without a Part D prescription drug plan

- Enroll in a stand-alone Medicare Prescription Drug Plan until March 31st

Being aware of these timeframes and optimizing the initial enrollment period and open enrollment period could be key to aligning your healthcare coverage with your needs.

Eligibility for Medicare Advantage Open Enrollment

The Medicare Advantage Open Enrollment period in January will likely be designed for those already enrolled in a Medicare Advantage Plan.

Enrollment in a Medicare Advantage plan by January 1 will likely render you eligible for the Medicare Advantage Open Enrollment Period, operational from January 1 to March 31. During this time, you can switch Medicare Advantage plans or return to traditional Medicare.

However, there may be two exceptions to eligibility for the Medicare Advantage Open Enrollment. The first is if you qualify for Extra Help, a federal program might be able to assist with certain costs.

The second exception is that you cannot select an MA MSA plan during the Open Enrollment Period, but you may still enroll in a Medicare prescription drug plan.

Options Available During Open Enrollment

Open Enrollment will likely offer a range of choices, allowing you to switch plans, add or drop Part D coverage, such as a Medicare prescription drug plan, or revert to Original Medicare.

You can switch Medicare Advantage plans during Open Enrollment by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST, or your plan provider to cancel your current plan, comparing different plans to find the one best suited for you, and enrolling in the new plan using the available enrollment options.

You may also add, switch, or drop your Medicare drug coverage, including a Medicare prescription drug plan, during the Medicare Advantage Open Enrollment. Any changes you make will be effective as of January 1st.

How to Make Changes During Open Enrollment

Whether you want to change your Medicare health plan or your prescription drug coverage plan, it’s crucial to understand the steps involved in making changes during Open Enrollment. To make these changes, you can either contact your plan provider or use this website.

By entering your zip code into any of the zip code boxes on this website, you can:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your situation

Remember, you may only make alterations to your current Medicare Advantage plan during designated periods.

Special Enrollment Periods: Qualifying for a Plan Change Outside of Open Enrollment

Sometimes, life events or circumstances may prompt you to change your Medicare Advantage plan outside of the Open Enrollment period.

In such cases, Special Enrollment Periods (SEPs) could come to the rescue. These periods allow you to make changes to your plan due to specific life events or situations, ensuring you have continuous healthcare coverage.

Events Triggering a SEP

Special Enrollment Periods could be initiated by events such as relocation, loss of coverage, or changes in healthcare providers.

For instance, if you move to a new area, you may become eligible to enroll in a new Medicare Advantage plan outside the usual enrollment periods.

Similarly, if you lose your current health coverage, such as employer-sponsored insurance or Medicaid, you may be eligible for a Special Enrollment Period to change your Medicare Advantage plan.

Knowing the circumstances that could initiate a SEP will likely assist in making timely alterations to your healthcare coverage, thereby avoiding possible coverage gaps or lapses.

Understanding SEP Rules and Timeframes

The rules and timeframes for Special Enrollment Periods may vary based on the qualifying event. Each situation could have specific requirements and documentation that may be necessary to initiate the SEP.

Ensuring that the necessary information is submitted within the specified time frame could potentially facilitate a successful SEP enrollment process.

To make alterations during a SEP, you should contact your plan provider or utilize this website.

Comparing Medicare Advantage Plans Before Switching

Before transitioning to a new Medicare Advantage plan, it might be necessary to:

- Compare your options and confirm that the new plan satisfies your healthcare requirements.

- Assess your health coverage needs.

- Check prescription drug coverage.

- Consider provider networks when comparing plans.

Assessing Your Health Coverage Needs

When evaluating your healthcare coverage needs, consider potential factors such as:

- Premiums

- Provider networks

- Drug formularies

- Out-of-pocket costs

- Plan benefits

- Health savings account eligibility

- Your personal health needs

You may want to consider your health condition and any specialized care you may require. Considering your specific healthcare requirements could enable you to select a plan that suits your situation optimally within the plan’s service area.

Checking Prescription Drug Coverage

Confirming that your medications are included in your new plan’s formulary is imperative. A formulary is a list of prescription drugs covered by a Medicare Advantage Plan.

To determine if your medication is included in the formulary, you can visit your plan’s website or contact their customer service.

If your medication is not included in the new plan’s formulary, you may request a formulary exception or explore other alternatives, such as trying the preferred medication first and requesting coverage for your medication if it proves ineffective or causes harm.

Network Considerations

Selecting a plan that encompasses your preferred doctors and hospitals within its network will likely be of utmost importance.

When comparing Medicare Advantage plans, consider the Medicare coverage, network coverage, and accessibility, ensuring that your preferred healthcare providers, hospitals, and specialists may be included in the plan’s network.

If your preferred physician is not in your new plan’s network, you may need to find a different doctor within the network or incur out-of-network costs if you continue seeing your preferred physician.

It’s important to consult with your plan to understand the specific coverage and costs that might be associated with out-of-network care.

Preparing for the Switch: What You Need to Know

Once the decision to switch Medicare Advantage plans has been made, preparing for the transition is necessary. This will likely involve gathering the required documentation, comprehending the transition process, and informing your healthcare providers about your new plan.

Documentation and Information Required

When enrolling in a new Medicare Advantage plan, you’ll likely need to have the following information ready:

- Medicare card

- Social Security number

- Current plan information

- Name

- Address

- Date of birth

- Medicare number

Other personal information may also be required.

Having precise information and documentation ready could assist in ensuring an efficient enrollment process and a smooth transition to your new plan.

Transitioning to New Coverage

Transitioning to a new Medicare Advantage plan might include waiting periods or coverage gaps.

Managing these possible gaps may be necessary and involves reviewing your current plan, examining new plan options, coordinating with healthcare providers, using transitional coverage, and planning for prescription medications in advance.

By taking these steps, you can ensure a smooth transition to your new plan and maintain continuous healthcare coverage.

Communicating with Providers About Your New Plan

Informing your healthcare providers about your new plan is essential for a smooth transition. Provide them with the following information:

- The name and contact information of your new plan

- Your new plan’s member ID number

- The effective date of your new plan

- Any potential changes in coverage or benefits compared to your previous plan

Effective communication with your providers may help ensure that your healthcare needs are met and enable you to continue receiving the care you require under your new plan.

Impact of Changing Plans on Existing Medigap Policies

Changing Medicare Advantage plans may affect your existing Medigap policies. Before making a change, consider the potential impact on your Medigap policy, as you may encounter obstacles, such as being denied coverage due to pre-existing conditions or experiencing changes in coverage and costs.

Comprehending the possible impacts of plan switching on your existing Medigap policy could assist you in making a well-informed decision and avert unforeseen outcomes.

Summary

Changing Medicare Advantage plans in January is possible and may be beneficial if your current plan no longer meets your healthcare needs.

Understanding the Open Enrollment Period, Special Enrollment Periods, and the process of comparing and switching plans could empower you to make an informed decision.

Remember to assess your health coverage needs, check prescription drug coverage, consider network accessibility, and communicate with your healthcare providers about your new plan.

With careful planning and preparation, you can successfully transition to a new Medicare Advantage plan that better suits your needs.

Frequently Asked Questions

→ Is it too late to change Medicare Advantage plans?

It is not too late to change Medicare Advantage plans if you enrolled within the past three months. Make sure to act soon if you’d like to switch!

→ What is the cut-off date to change Medicare plans?

Medicare’s Annual Election and Open Enrollment Period takes place from October 15 through December 7 each year, allowing individuals enrolled in a Medicare Advantage plan to make a one-time election to change plans or switch to Original Medicare.

During this period, it is also possible to add, drop, or change Medicare drug coverage.

→ How do I switch to another Medicare Advantage plan?

During the Medicare Advantage Open Enrollment Period (January 1 – March 31), you can switch to another Medicare Advantage plan or disenroll and return to Original Medicare by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Ensure that disenrollment and enrollment requests are submitted at the same time to avoid errors.

→ What potential factors should I consider when comparing Medicare Advantage plans?

When comparing Medicare Advantage plans, it may be important for you to consider your individual healthcare needs, coverage for prescription drugs, access to providers through a plan’s network, and any other benefits the plan might offer.

→ How can I find out if my preferred doctors and hospitals are in a plan’s network?

To find out if your preferred doctors and hospitals are part of a plan’s network, check the plan’s website or contact customer service.

ZRN Health & Financial Services, LLC, a Texas limited liability company