Blue Cross Medicare Advantage Plans for 2026

Are you seeking a Medicare Advantage plan for 2026 that could offer comprehensive coverage and potential benefits that may go beyond traditional Medicare?

Some of the Blue Cross Medicare Advantage plans might be a good option for you. Some plans might not only provide extensive coverage, but they may also include prescription drug coverage. There may also be Special Needs Plans for individuals with specific medical conditions.

Keep reading to gain valuable insight into the potential features, costs, and enrollment processes of these exceptional plans.

Key Takeaways

- Some of the Blue Cross Medicare Advantage Plans offerings may provide comprehensive coverage and benefits, that may include vision and hearing care.

- HMO & PPO plans may offer cost-saving options with varying out-of-pocket costs, as well as Special Needs Plans tailored to meet chronic condition needs.

- Enrollment periods allow for plan changes. Experts suggest Blue Cross Medicare Advantage plans are a viable choice for quality healthcare.

Compare Plans in One Step Right Now!

Enter Zip Code

Understanding Blue Cross Medicare Advantage Plans

A majority of the Blue Cross and Blue Shield Medicare Advantage plans will likely be designed to offer comprehensive Medicare coverage through private health insurance companies that may be approved to participate in the Medicare program.

Some of these Medicare plans might include added services such as hearing aids and vision services, which might make them a more attractive option than Original Medicare alone.

Some of the Blue Cross Medicare Advantage plans may also offer supplemental benefits such as dental and vision services, which could increase their overall value.

Comprehensive Coverage

Blue Cross Medicare Advantage plans will likely encompass Original Medicare benefits and may include additional services such as vision and hearing care, potentially providing a well-rounded healthcare solution for beneficiaries.

Some of these plans could offer coverage for eye exams, eyeglasses, and contact lenses, possibly ensuring that your vision care needs could be met. Moreover, hearing aids may also be covered as part of the durable medical equipment benefit, although particular coverage limits, costs, and other considerations may vary by plan.

Comparing Blue Cross HMO and PPO Medicare Advantage Plans

When evaluating a Blue Cross Medicare Advantage plan, comparing the two main plan types, Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO), is a key step.

HMO plans require you to select a primary care provider and obtain referrals for specialist visits, while PPO plans offer more flexibility in choosing providers and may have higher out-of-pocket costs for out-of-network services.

We will further examine the differences and similarities between HMO and PPO plans to assist you in making the most suitable choice for your healthcare needs.

HMO Plans

Blue Cross HMO Medicare Advantage Plans may provide cost-saving and value-added options in conjunction with Original Medicare benefits. Upon enrolling in an HMO plan, you’ll:

- Choose a Medical Group

- Select a primary care physician (PCP) from that group to coordinate your healthcare needs

- Require referrals from your PCP for specialist visits

- The specialist must be from the same medical group.

Though the average out-of-pocket costs for Blue Cross HMO Medicare Advantage Plans may vary by plan and insurer, they generally offer a wide range of services, including:

- Hospital stays

- Doctor visits

- Preventive care

- Prescription drugs

PPO Plans

Blue Cross PPO Medicare Advantage plans provide bundled options that may include prescription drug coverage, along with:

- Medical benefits

- Dental benefits

- Vision benefits

- Hearing benefits

All of these benefits are combined in one plan. PPO plans offer more flexibility than HMO plans when selecting healthcare providers, as you can visit any doctor or specialist without a referral.

However, out-of-pocket costs for out-of-network services may vary by plan, and it’s crucial to consult plan documents or contact Blue Cross directly for precise information.

In essence, PPO plans may provide a higher degree of flexibility in choosing providers than HMO plans, but they may come with higher costs for out-of-network services.

Navigating Potential Costs and Savings with Blue Cross Medicare Advantage

Comprehending the possible costs and potential savings that may be linked to certain Blue Cross Medicare Advantage plans could be important for making a well-considered choice.

Comprehending the possible costs and potential savings that may be linked to certain Blue Cross Medicare Advantage plans could be important for making a well-considered choice.

Some key points to consider may include:

- How these plans may offer lower monthly premiums than other plans.

- Certain caps on spending along with coinsurance or copays, could help save money on healthcare expenses.

- All Medicare Advantage plans provide a maximum annual out-of-pocket expense, a feature not available with Original Medicare.

Monthly Premiums

Factors that could influence the monthly premiums of certain plans could include:

- Enrollment in Special Needs Plans (SNPs)

- Medicare Part B premium

- Cost of the Advantage Plan

- Additional payments for low-income subsidy (LIS) enrollees.

Blue Cross Blue Shield may also offer programs and incentives that could help reduce monthly premiums, such as extending Affordable Care Act (ACA) tax credits.

Out-of-Pocket Costs

The possible out-of-pocket costs, also known as out-of-pocket expenses, for some of the Blue Cross Medicare Advantage plans, may vary depending on the specific plan and network size.

The possible out-of-pocket costs, also known as out-of-pocket expenses, for some of the Blue Cross Medicare Advantage plans, may vary depending on the specific plan and network size.

Special Needs Plans (SNPs) From Blue Cross

Blue Cross may offer Special Needs Plans (SNPs) for individuals with specific medical conditions or who qualify for both Medicare and Medicaid.

Some of these plans may be designed to provide targeted care and coordination of care among primary providers that could meet the unique needs of individuals with chronic conditions or who may require additional assistance.

Dual Special Needs Plans (D-SNPs)

D-SNPs will likely be designed to provide support for individuals eligible for both Medicare and Medicaid. Some plans may offer:

- Additional benefits and tailored care

- Benefits of Original Medicare Parts A and B with prescription drug coverage

- Supplemental benefits such as dental coverage, eyeglasses, and hearing aids.

Blue Cross might customize its care that could be provided through their D-SNPs by:

- Offering education regarding the plan and benefits

- Aiding with prior authorizations for healthcare services

- Constructing a care plan tailored to the individual’s needs

Chronic Condition SNPs (C-SNPs)

C-SNPs may provide comprehensive care for individuals who may suffer from diabetes, heart conditions, lung disease, or kidney disease.

Some of these plans could be designed to provide targeted care and coordination of care among primary providers to meet the unique needs of individuals with chronic conditions in a professional manner.

Institutional Special Needs (I-SNPs)

I-SNPs will likely be designed for individuals who anticipate residing in a long-term care or skilled nursing facility, or who require intermediate care for 90 days or more.

Some plans may provide a combination of the benefits of Original Medicare Parts A and B and might include prescription drug coverage, as well as additional benefits that may go beyond standard Medicare coverage, such as:

Some plans may provide a combination of the benefits of Original Medicare Parts A and B and might include prescription drug coverage, as well as additional benefits that may go beyond standard Medicare coverage, such as:

- Vision

- Dental

- Hearing

- Integrated services

Those who may be anticipating extended care in a long-term care, or skilled nursing facility, or require intermediate care for 90 days or longer might be eligible for I-SNPs.

Enrollment Periods and Plan Changes

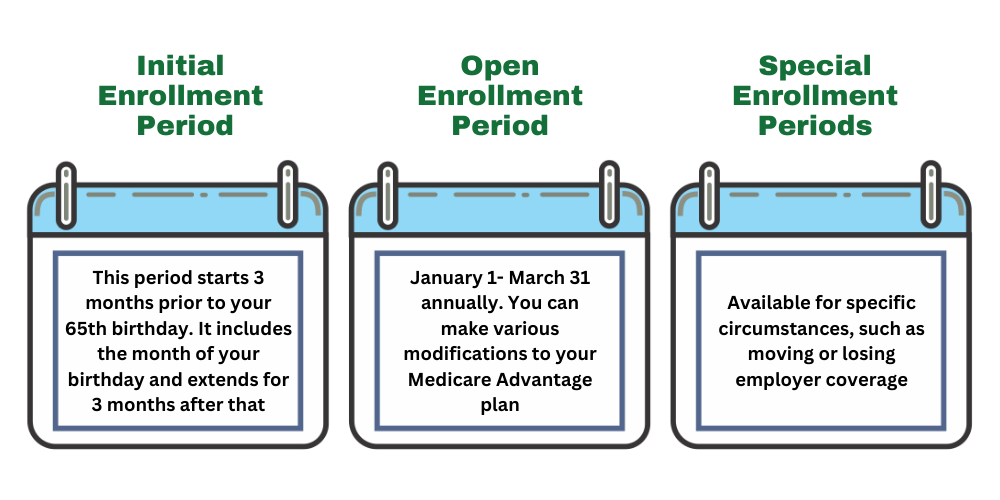

Enrollment periods and plan changes are important components of Blue Cross Medicare Advantage plans.

To join a Blue Cross Medicare Advantage plan, you must first enroll in Medicare Part A and Part B. There are distinct enrollment periods for these plans, such as the Initial Enrollment Period,

Open Enrollment Period, and Special Enrollment Period, each allowing for different plan changes and enrollment opportunities.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Initial Enrollment Period

Original Medicare (Part A or Part B) may only be enrolled during the Initial Enrollment Period. This period is limited and is activated upon eligibility.

This period starts three months before your 65th birthday. It includes the month of your birthday and extends for three months after that.

During the Initial Enrollment Period, you could enroll in a Blue Cross Medicare Advantage Plan by adhering to the enrollment timeline and following the steps provided by Blue Cross.

Open Enrollment Period

The Open Enrollment Period for Blue Cross Medicare Advantage Plans commences on January 1st and concludes on March 31st annually.

During this period, you can make various modifications to your Medicare Advantage plan, such as:

- Transitioning to another Medicare Advantage Plan with or without drug coverage

- Shifting from a Medicare Advantage Plan to Original Medicare

- Joining a Medicare Advantage Plan if you have recently enrolled in Part A and/or Part B due to an exceptional situation

- Altering your Medicare health plans and prescription drug coverage.

Special Enrollment Periods

Special Enrollment Periods are available for specific circumstances, such as moving or losing employer coverage.

They provide an opportunity to make changes to your Blue Cross Medicare Advantage plan outside of the regular enrollment periods.

For example, you may disenroll from your Medicare Advantage Plan at any time during the trial period, which is the 12-month period following your Medicare Advantage coverage.

Expert Opinions on Blue Cross Medicare Advantage Plans

Experts will likely assert that certain Blue Cross Medicare Advantage plans could emphasize the holistic health of the individual and potentially provide satisfactory service to their beneficiaries.

With a vast provider network of over 1.7 million doctors and hospitals across the United States, Blue Cross Blue Shield could ensure that you may have access to a wide range of healthcare professionals.

Taking into account the potential coverage, possible benefits, and robust provider networks that may be offered by some of the Blue Cross Medicare Advantage plans, you could make a well-considered choice that best aligns with your healthcare needs.

Summary

Some of the Blue Cross Medicare Advantage plans may offer comprehensive coverage and additional benefits that could cater to a variety of healthcare needs.

With options such as HMO and PPO plans, as well as Special Needs Plans for individuals with specific medical conditions or who qualify for both Medicare and Medicaid, some plans could provide tailored care and flexible options that may suit different situations.

By understanding the potential costs, enrollment periods, and possible plan changes that might be associated with certain Blue Cross Medicare Advantage plans, you can make a well-informed decision that best supports your healthcare journey.

Frequently Asked Questions

→ What is the difference between Medicare PPO and Medicare Advantage?

PPO plans tend to be more expensive than HMO plans but may also provide more flexibility with out-of-network services and might include additional benefits like vision and hearing care.

HMO plans will likely be more affordable, but they could require you to receive care within the network and might not allow you to join a separate drug plan.

→ What are 4 types of Medicare Advantage plans?

Medicare Advantage Plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service (PFFS) plans, and Special Needs plans (SNPs).

→ Is Blue Cross Blue Shield Medicare?

Blue Cross Blue Shield will likely offer a variety of Medicare Advantage plans with Original Medicare benefits that may also include additional coverage.

Some of the potential benefits of participating in a Blue program could be that some plans might offer reliable care trusted by more doctors, while the Anthem Blue Cross and Blue Shield plan may include a Medicare contract and a state Medicaid program. Enroll to explore these options today.

→ What additional benefits might be included in Blue Cross Medicare Advantage plans?

Some of the Blue Cross Medicare Advantage plans may include additional benefits such as dental, vision, and hearing, which could provide beneficiaries with comprehensive coverage.

ZRN Health & Financial Services, LLC, a Texas limited liability company