Medicare Advantage Plans South Carolina 2026

Curious about the Medicare Advantage Plans in South Carolina? This article will explain the types of plans, their potential benefits, costs, and how to enroll. Find everything you need to make an informed choice regarding Medicare Advantage Plans in South Carolina.

Key Takeaways

- Medicare Advantage Plans in South Carolina offer all Original Medicare benefits and sometimes additional services like dental, vision, and hearing coverage.

- Eligibility for these plans requires enrollment in Medicare Part A and B, along with awareness of designated enrollment periods to avoid gaps in coverage.

- Comparing different Medicare Advantage Plans could be essential to find the best fit, considering possible factors like potential costs, network providers, and CMS star ratings for quality assessment.

Compare Plans in One Step!

Enter Zip Code

Overview of Medicare Advantage Plans in South Carolina

Medicare Advantage Plans, also known as Medicare Part C, could provide a convenient way for Medicare beneficiaries to receive their healthcare through private insurance companies. These plans are designed to offer all the benefits of Original Medicare (Part A and Part B) while sometimes adding extra perks that could significantly enhance your healthcare experience. Unlike Original Medicare, which is managed by the federal government, Medicare Advantage Plans are managed by private insurers, giving them the flexibility to potentially offer additional benefits and services.

One of the potential attractions of Medicare Advantage Plans might be the range of additional benefits they could offer. Some plans might include dental, vision, and hearing coverage, which are not covered under Original Medicare.

This could potentially mean you get access routine check-ups, corrective eyewear, and hearing aids, all under one comprehensive plan. Additionally, some plans may also include prescription drug coverage, which could help manage medication costs and possibly ensure you have access to necessary prescription drugs without the need for a separate Part D plan.

Another potential advantage of Medicare Advantage plans could be their managed care approach, which may be associated with a Health Maintenance Organization (HMO). These plans could provide coordinated care, which means your healthcare providers work together to ensure you receive comprehensive and continuous care. This may also lead to better health outcomes and a more streamlined healthcare experience, including Medicare Advantage coverage and Medicare Advantage plan options.

With various plan options available, Medicare beneficiaries in South Carolina could choose a plan that best fits their healthcare needs and preferences.

Types of Medicare Advantage Plans Available

In South Carolina, there are four primary categories of Medicare Advantage Plans, each could offer unique features and benefits to cater to different healthcare needs.

Understanding these options can help you choose the plan that best suits your requirements.

Potential Benefits of Medicare Advantage Plans

Some Medicare Advantage Plans may offer a plethora of benefits that might extend beyond what Original Medicare provides. Some of these additional benefits could enhance your overall healthcare experience and possibly ensure that all your healthcare needs are met comprehensively.

Potential Costs Associated with Medicare Advantage Plans

Understanding the potential costs associated with Medicare Advantage Plans is crucial for making an informed decision. These costs might vary based on several factors, including the coverage offered, the insurance company, and the plan’s location.

Enrollment Periods and Eligibility

Enrolling in a Medicare Advantage Plan requires meeting specific Medicare Advantage plan eligibility criteria and understanding the designated enrollment periods. This could ensure you can access the coverage you need when you need it.

To be eligible for Medicare Advantage Plans in South Carolina, you must be enrolled in both Medicare Part A and Part B, be 65 years or older, or have a qualifying disability. Additionally, you cannot be enrolled in a Medigap plan simultaneously. Understanding these requirements is crucial for determining your eligibility and planning your healthcare coverage accordingly.

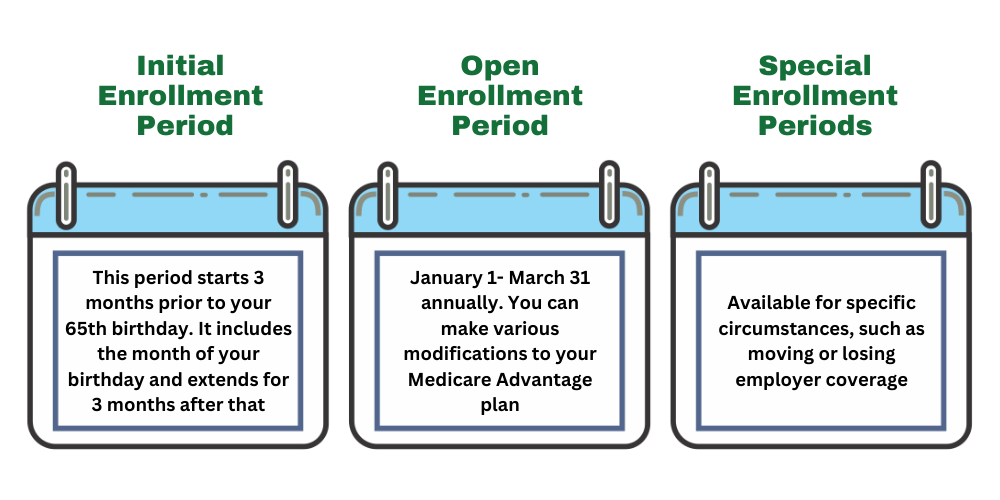

There are three main enrollment periods for Medicare Advantage Plans: the Initial Enrollment Period (when you first become eligible for Medicare), the Annual Election Period (from October 15 to December 7 each year), and Special Enrollment Periods (for specific circumstances like moving out of your plan’s service area). Knowing these periods helps ensure timely access to coverage and avoids any gaps in your health insurance.

The importance of timely enrollment cannot be overstated. Missing these periods can result in delayed access to necessary healthcare services and potential financial penalties. Therefore, marking these dates and preparing ahead of time is critical for maintaining continuous health coverage.

Comparing Medicare Advantage Plans

With numerous Medicare Advantage Plans available, comparing them is essential to find the one that best fits your healthcare needs. This process will likely involve evaluating several factors.

When comparing plans, you should consider the potential monthly premiums, deductibles, copayments, coinsurance, and out of pocket costs. These costs might vary significantly between plans, possibly affecting your overall healthcare expenses. Members should also review the plan’s network providers, which may include doctors, hospitals, and other facilities contracted with the insurance company. Ensuring your preferred providers are in-network could help manage costs and maintain continuity of care.

Additionally, utilize available tools and checklists to aid in comparing different plans. The Centers for Medicare and Medicaid Services (CMS) provides a star rating system to evaluate the quality and performance of Medicare Advantage Plans. This rating system can be a valuable resource in selecting a plan that meets your needs.

Top-Rated Medicare Advantage Providers in South Carolina

Choosing the right Medicare Advantage Plan may also involve considering the top-rated providers in South Carolina. These ratings could significantly influence your decision, possibly ensuring you opt for a plan with high-quality service and member satisfaction.

Star ratings from the CMS are crucial for evaluating the quality and performance of Medicare Advantage Plans. The highest-rated plan in South Carolina received in 2023 was a 4.5-star rating, though no plans achieved a perfect five-star rating. This highlights the competitive nature of the market, with several plans vying for top spots based on quality and service.

Providers such as Humana, Aetna Medicare, Blue Cross Blue Shield of South Carolina, Cigna Healthcare, UnitedHealthcare, and Clear Spring Health may offer highly rated plans in the state. These providers have been recognized for their comprehensive coverage and high member satisfaction, including their covered services, potentially making them reliable choices for Medicare beneficiaries seeking quality healthcare coverage.

Summary

Navigating the world of Medicare Advantage Plans in South Carolina might seem daunting, but understanding the types of plans available, their potential benefits, associated costs, and the top providers could make the process much smoother. Whether you’re considering a switch or enrolling for the first time, this guide aims to provide you with the necessary information to make an informed decision.

Remember, the right Medicare Advantage Plan may offer comprehensive health coverage, additional benefits, and peace of mind. Stay informed, compare your options carefully, and choose a plan that best suits your healthcare needs and budget.

Frequently Asked Questions

→ Does South Carolina offer Medicare Advantage plans?

Yes, South Carolina will likely offer Medicare Advantage plans that might offer a wide range of potential benefits like prescription drugs, dental, vision, and hearing coverage. This could significantly enhance your overall healthcare experience.

→ What are Medicare Advantage Plans?

Medicare Advantage Plans, or Part C, are private insurance plans that offer all the benefits of Original Medicare, and some might include extra services like dental, vision, and prescription drug coverage. These plans could provide a more comprehensive healthcare solution for eligible individuals.

→ What types of Medicare Advantage Plans are available in South Carolina?

In South Carolina, the available types of Medicare Advantage Plans include Health Maintenance Organization (HMO) Plans, Preferred Provider Organization (PPO) Plans, Private Fee-for-Service (PFFS) Plans, and Special Needs Plans (SNP). Each type offers different benefits and provider networks to meet your healthcare needs.

→ How do I compare different Medicare Advantage Plans?

To effectively compare different Medicare Advantage Plans, focus on potential costs such as premiums, deductibles, and copayments, along with examining provider networks and CMS star ratings. Utilizing comparison tools such as Comparemedicareadvantageplans.org can streamline your evaluation process.

ZRN Health & Financial Services, LLC, a Texas limited liability company