Medicare Advantage Plans Pennsylvania 2026

Are you trying to find the best Medicare Advantage Plans in Pennsylvania? This article will guide you through the different types of plans, their potential benefits, and how to choose the one that fits your healthcare needs. This article will also review some of top-rated plans for 2024 and provide insights into enrollment periods.

Key Takeaways

- Medicare Advantage plans in Pennsylvania provide at least the same coverage as Original Medicare but some might include additional benefits like dental, vision, hearing, and prescription drug coverage, which might contribute to their rising popularity among beneficiaries.

- There will likely be several types of Medicare Advantage plans available in Pennsylvania, including HMOs, PPOs, SNPs, and PFFS plans, each catering to different healthcare needs and preferences.

- Eligibility for Medicare Advantage plans requires enrollment in Medicare Part A and B, with specific enrollment periods, including the Initial Enrollment Period and Annual Enrollment Period, crucial for timely access to coverage.

Compare Plans in One Step!

Enter Zip Code

Overview of Medicare Advantage Plans in Pennsylvania

Medicare Advantage plans, also known as Medicare Part C, could offer Pennsylvania residents a robust alternative to Original Medicare (Parts A and B). These plans must provide at least the same level of coverage as Original Medicare, but some might include additional benefits such as dental, hearing, or vision coverage, and sometimes prescription drug coverage, which are not typically included in Original Medicare. This potential coverage could make a difference in the overall healthcare experience, possibly providing more comprehensive care and potentially reducing out-of-pocket costs.

In Pennsylvania, the popularity of Medicare Advantage plans has been steadily rising in recent years, with approximately 49% of Medicare beneficiaries opting for these plans over Original Medicare in 2023. This trend might be driven by the variety of plans available and potential benefits.

For instance, some Pennsylvania Medicare Advantage plans might include prescription drug coverage, which could be a critical factor for many seniors managing chronic conditions. Knowing the various plan types and their potential benefits enables informed healthcare decisions.

Types of Medicare Advantage Plans Available

Pennsylvania will likely offer a diverse array of Medicare Advantage plans, each tailored to meet different healthcare needs and preferences. The primary types of plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Special Needs Plans (SNPs), and Private Fee-for-Service (PFFS) plans.

Each type has its own structure, benefits, and network rules, making it crucial to understand these differences for choosing the best plan.

Health Maintenance Organization (HMO) Plans

HMO plans are designed with a network of healthcare providers. This structure helps guide members to receive care within the established system. Members typically need to choose a primary care physician (PCP) who coordinates all healthcare services and provides referrals to specialists within the network. This network-based approach can help manage costs effectively and ensure comprehensive care, but it also means that out-of-network services are generally not covered, except in emergencies.

One of the potential advantages of HMO plans is their lower cost compared to other plan types. Focusing on in-network care and preventive services may allow these plans to potentially offer lower premiums and out-of-pocket expenses.

Pennsylvania residents seeking an affordable option with comprehensive coverage may find HMO plans compelling.

Preferred Provider Organization (PPO) Plans

PPO plans offer greater flexibility in choosing healthcare providers compared to HMO plans. Members can receive care from any provider who accepts the plan, but costs are typically lower when using in-network providers. This flexibility makes PPO plans an attractive option for those who want the freedom to see specialists without needing referrals and who are willing to pay a bit more for the privilege.

In-network care under PPO plans generally incurs lower costs, whereas out-of-network care comes with higher expenses. This structure allows for a balance between flexibility and cost management, making PPO plans suitable for individuals who prioritize having a broad choice of providers and are comfortable navigating the associated costs.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are specifically designed to cater to individuals with unique healthcare needs. These plans are tailored for people with chronic conditions, institutionalized individuals, or those who are dual-eligible for Medicare and Medicaid. SNPs offer specialized care coordination and benefits that address the specific needs of their members, ensuring they receive the appropriate care and support.

For example, SNPs might include additional services like care coordination, case management, and specialized provider networks. These plans are an excellent choice for individuals who need focused and continuous care for managing complex health conditions.

Private Fee-for-Service (PFFS) Plans

PFFS plans provide considerable flexibility when selecting healthcare providers. This allows members to have more options in their healthcare decisions. Members can see any provider who agrees to the plan’s terms and conditions, which can be a considerable advantage for those who want maximum flexibility in their healthcare choices. However, it’s essential to confirm that your providers accept the PFFS terms before receiving care to avoid unexpected costs.

These plans can be particularly beneficial for individuals who travel frequently or live in areas with limited network options. Allowing members to choose their providers, PFFS plans offer a level of autonomy appealing to some Medicare beneficiaries.

Top-Rated Medicare Advantage Plans in Pennsylvania

Pennsylvania will likely offer a wide range of Medicare Advantage plans, and the quality of these plans is reflected in their CMS star ratings. The available plans will likely be evaluated based on several factors, which might include member satisfaction, quality of care, and customer service, with ratings ranging from one to five stars.

Top-rated plans, such as those from UPMC For Life and Highmark Blue Cross Blue Shield, have received high member satisfaction ratings. These five-star rated plans are likely recognized for their high-quality services, possibly making them some of the best Medicare Advantage plans available in Pennsylvania.

Opting for a high-star-rated plan could ensure peace of mind, as these plans are vetted for quality and performance.

Prescription Drug Coverage in Certain Medicare Advantage Plans

Some Medicare Advantage plans might offer prescription drug coverage. This coverage is regulated by Medicare Part D guidelines. Understanding the plan’s formulary, which is the list of medications covered by the plan, could be crucial. Medications will likely be categorized into five tiers, with Tier 1 being the least expensive generic drugs and Tier 5 being more expensive specialty drugs.

When choosing a Medicare Advantage plan, consider the prescription drug plans you might use regularly and their respective tiers. The formulary may include at least two medications in every major drug category, possibly ensuring a broad range of treatments could be available.

Assessing the potential premium costs, deductibles, and specific drugs covered could also help minimize out-of-pocket prescription drug expenses.

Eligibility and Enrollment for Medicare Advantage Plans

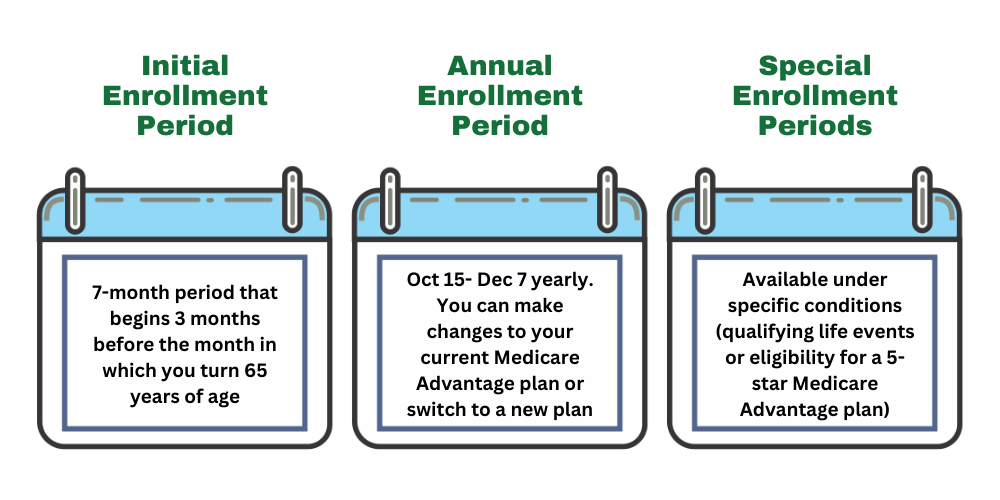

Eligibility for Medicare Advantage plans requires enrollment in both Medicare Part A and Part B and residency within the plan’s service area. Knowing the various enrollment periods ensures timely access to Medicare Advantage coverage.

These periods include the Initial Enrollment Period, Annual Enrollment Period, and Special Enrollment Period, each offering specific windows for enrolling or making changes to your plan. Let’s delve into these periods to ensure you don’t miss out on your enrollment opportunity.

Initial Enrollment Period

The Initial Enrollment Period (IEP) begins three months before your 65th birthday, continues through your birth month, and ends three months after. For those qualifying due to disability, the IEP starts 21 months after the onset of Social Security Disability Insurance (SSDI) benefits.

Enrolling during this period grants access to the benefits provided by Medicare Advantage plans without delay.

Annual Enrollment Period

The Annual Enrollment Period (AEP) for Medicare Advantage plans runs from October 15 to December 7 each year. During this time, you can make changes to your Medicare Advantage plan, such as switching plans or returning to Original Medicare. This period is key for reviewing your current healthcare needs and ensuring your plan continues to meet them.

Additionally, the Medicare Advantage Open Enrollment Period from January 1 to March 31 allows you to switch to another Medicare Advantage plan or revert to Original Medicare if needed. Reviewing your plan’s potential benefits and costs annually could be vital to making necessary adjustments during these enrollment windows.

Special Enrollment Periods

Special Enrollment Periods (SEPs) provide opportunities to enroll or make changes to your Medicare Advantage plan outside of the standard enrollment periods due to qualifying life events. Events such as losing existing health coverage or moving out of your plan’s service area can trigger an SEP, allowing you to adjust your coverage accordingly.

Knowing these special circumstances ensures coverage continuity even when life changes unexpectedly.

How to Choose the Right Medicare Advantage Plan

Choosing the right Medicare Advantage plan will likely involve considering several possible factors to ensure the plan aligns with your healthcare needs. First, evaluate the coverage options that may be provided by the plan, including whether it meets your individual healthcare requirements. Confirming that your preferred healthcare providers and hospitals may be in the plan’s network could help avoid unexpected costs.

Next, assess the plan’s potential prescription drug coverage. Verify that the medications you regularly use are included in the plan’s formulary and understand the tier and potential costs. This step may significantly impact your out-of-pocket expenses and overall satisfaction with the plan.

Finally, consider any additional perks the plan might offer, such as dental, vision, and hearing coverage. These additional perks could enhance your health and well-being, possibly making your Medicare Advantage plan more valuable and tailored to your lifestyle.

Summary

Medicare Advantage plans in Pennsylvania will likely offer a range of options to meet diverse healthcare needs. From HMO and PPO plans to SNPs and PFFS plans, each type provides unique benefits. Understanding these plans, along with the top-rated options, and enrollment periods, is crucial for making informed decisions about your healthcare.

Choosing the right plan will likely involve evaluating coverage options, provider networks, and potential benefits. With this comprehensive guide, you should feel empowered to navigate the Medicare Advantage plans and select a plan that best suits your needs. Remember, your health is invaluable, and choosing the right plan can significantly impact your quality of life.

Frequently Asked Questions

→ What are Medicare Advantage plans?

Medicare Advantage plans, or Part C, offer at least the same coverage as Original Medicare while potentially incorporating additional benefits such as prescription drugs, dental, vision, and hearing aids. These plans could enhance your healthcare experience significantly.

→ How do I enroll in a Medicare Advantage plan?

To enroll in a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B and can do so during the Initial Enrollment Period, Annual Enrollment Period, or Special Enrollment Periods. Make sure to review these timelines to ensure your enrollment is timely.

→ What is the difference between HMO and PPO plans?

HMO plans limit you to a network of providers and require referrals from a primary care physician, whereas PPO plans provide greater flexibility by allowing you to see any provider without referrals.

→ What should I consider when choosing a Medicare Advantage plan?

When choosing a Medicare Advantage plan, members should prioritize coverage options, provider networks, and the potential inclusion of additional benefits such as hearing, vision, and dental coverage. This could help ensure you select a plan that best meets your healthcare needs.

→ Are prescription drugs covered under Medicare Advantage plans?

Yes, some Medicare Advantage plans may include prescription drug coverage, but it’s essential to check the specific plan’s formulary to confirm that your medications are included.

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.