Medicare Advantage Plans North Carolina 2026

Curious about the potential Medicare Advantage plans in North Carolina

Key Takeaways

- Medicare Advantage Plans in North Carolina provide comprehensive coverage, including all Medicare Part A and B services, sometimes offering additional benefits like dental, vision, and hearing coverage.

- North Carolina offers various types of Medicare Advantage Plans, including HMO, PPO, and Special Needs Plans, each with distinct features and eligibility requirements.

- Enrollment in Medicare Advantage Plans requires being enrolled in Medicare Part A and B, with specific enrollment periods and processes to follow for timely access.

Compare Plans in One Step!

Enter Zip Code

Understanding North Carolina Medicare Advantage Plans 2026

Medicare Advantage Plans, also known as Part C, could provide an alternative way to receive Medicare benefits through private insurance companies that adhere to Medicare guidelines. These plans cover all Medicare Part A (hospital insurance) and Part B (medical insurance) services, and some might include prescription drug coverage under Part D. These various benefits could make them a comprehensive option for many beneficiaries.

Some Medicare Advantage Plans may offer additional benefits that could go beyond what is covered by Original Medicare. These might include vision, dental, and hearing coverage, as well as prescription drug coverage. Each plan may have its own set of rules regarding costs and service access, which could mean that members might experience varying out-of-pocket costs and potential network restrictions.

Types of North Carolina Medicare Advantage Plans Available

In North Carolina, a variety of Medicare Advantage Plans will likely be available to cater to different healthcare needs. These include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs). Each type of plan offers distinct features and benefits, which will be explored in the following subsections.

HMO Plans

HMO Medicare Advantage Plans generally require members to select a primary care physician (PCP) and obtain referrals for specialist visits. This system ensures coordinated care and helps manage healthcare costs effectively. In North Carolina, HMO plans boast a network of over 60,000 providers, giving members a broad range of choices for their healthcare needs.

One of the potential benefits of HMO plans could be their lower premiums and out-of-pocket costs compared to other Medicare Advantage options. However, members must use the plan’s network of doctors and hospitals, except in emergencies or urgent care situations, which are covered regardless of network restrictions.

These various perks could make HMO plans an attractive option for many beneficiaries seeking comprehensive and cost-effective healthcare coverage.

PPO Plans

PPO Medicare Advantage Plans offer greater flexibility in choosing healthcare providers and do not usually require referrals for specialist visits. This flexibility allows members to see any doctor without a referral, though out-of-network services may come with higher costs.

While members are encouraged to use the plan’s network for potentially reduced out-of-pocket expenses, they retain the option to seek care from providers outside the network, albeit at a higher cost.

PPO plans will likely be designed to cover almost all medically necessary services included in Original Medicare, likely ensuring comprehensive healthcare access for members.

Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are tailored for individuals with specific health needs, potentially offering customized benefits that align with their conditions. These plans are designed for those with chronic illnesses or who are eligible for both Medicare and Medicaid.

The availability of SNPs in North Carolina might vary by county, as insurance companies determine where they operate. SNPs could provide additional services not typically covered by Original Medicare.

Overview of North Carolina Medicare Advantage Plans 2026

Medicare Advantage Plans in North Carolina, also known as Part C, are provided by private companies approved by Medicare. These plans generally cover all benefits offered by Original Medicare. Beneficiaries may also receive additional benefits through certain Medicare Advantage Plans, including vision, dental, and hearing services.

Coverage options and out-of-pocket costs might vary among different Medicare Advantage Plans in North Carolina. Plans will likely be subject to annual changes, and members are notified of any altered benefits and costs before the next enrollment period. Emergency and urgent care services are always covered by Medicare Advantage Plans, regardless of network restrictions.

Possible Services and Benefits

Medicare Advantage Plans must include nearly all the services covered by Original Medicare. This means that beneficiaries will likely expect comprehensive coverage for hospital, medical, and emergency services.

Some Medicare Advantage Plans may offer additional benefits not found in Original Medicare, such as vision, hearing, and dental coverage. While Medicare Advantage Plans provide most Medicare services, they might establish different out-of-pocket costs and rules for accessing care compared to Original Medicare.

Enrollment Process for North Carolina Medicare Advantage Plans 2026

Enrolling in a Medicare Advantage Plan requires individuals to have both Medicare Part A and Part B. TUnderstanding the different enrollment periods is crucial for timely coverage.

When to Enroll

The Initial Enrollment Period for Medicare starts three months before you turn 65 and ends three months after your birthday month. This seven-month period is critical for those not automatically enrolled in Medicare to avoid penalties.

For those eligible for premium-free Part A, coverage typically begins the month they turn 65, while Part B starts based on when they enroll. The General Enrollment Period for Medicare occurs annually from January 1 to March 31, with coverage starting on July 1 for those who missed their initial enrollment.

If enrolling in a Medicare Advantage Plan, both Medicare Part A and Part B must be in effect at the time of enrollment.

Different Enrollment Periods

The General Enrollment Period occurs from January 1 to March 31 each year for those who missed their Initial Enrollment Period. During this period, individuals can enroll in a Medicare Advantage Plan to ensure timely coverage.

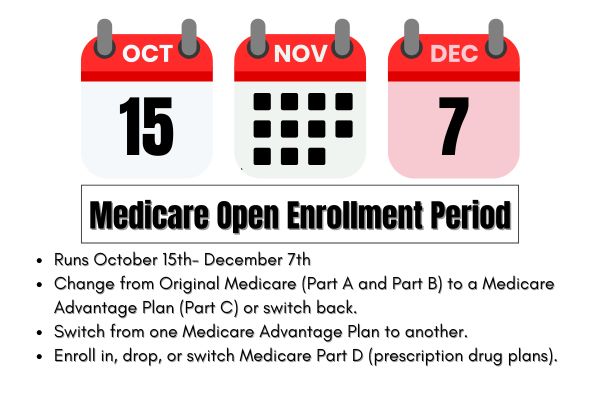

The Open Enrollment Period occurs annually from October 15 to December 7, allowing beneficiaries to join, switch, or drop Medicare Advantage Plans. The Medicare Advantage Open Enrollment Period from January 1 to March 31 allows existing enrollees to switch plans or revert to Original Medicare.

Special Enrollment Periods are available for individuals who experience specific life events, such as moving or losing other coverage, allowing them to enroll outside standard periods.

OEP, AEP, Special Enrollment

The Open Enrollment Period (OEP) for Medicare Advantage and Part D is from October 15 to December 7 each year. This period allows beneficiaries to make changes to their Medicare Advantage plans, including switching plans or returning to Original Medicare.

The Medicare Advantage Open Enrollment Period is from January 1 to March 31 each year. During this time, existing enrollees can switch plans or revert to Original Medicare without penalty. Special Enrollment Periods provide additional opportunities for enrollment due to life changes such as moving or losing other health coverage.

Potential Costs Associated with North Carolina Medicare Advantage Plans 2026

The Medicare Advantage Plans in North Carolina may have various costs, such as premiums, deductibles, and co-pays that beneficiaries need to consider.

Premiums and Co-Pays

Some Medicare Advantage Plans may require beneficiaries to pay additional out-of-pocket costs such as premiums, deductibles, copayments, and coinsurance. Premiums might vary widely based on the specific plan and provider.

In North Carolina, the average monthly premium for Medicare Advantage Plans might vary significantly, with some plans offering lower premiums than Original Medicare. Co-pay amounts for specific services may also range.

Out-of-Pocket Maximums

Certain Medicare Advantage Plans may offer an annual out-of-pocket maximum, which could limit the total amount beneficiaries have to pay for covered services in a year. This potential financial protection could ensure that once the maximum is reached, the plan covers up to 100% of the remaining costs for covered services.

The out-of-pocket maximum may vary depending on the plan selected. This potential cap could provide significant financial security compared to Original Medicare, which does not have an out-of-pocket maximum.

Potential Services and Benefits

Medicare Advantage Plans typically cover nearly all services included in Medicare Part A and Part B. Emergency and urgent care services are always included, ensuring comprehensive coverage for critical situations. Certain plans may also offer additional benefits like vision, hearing, and dental coverage that Original Medicare does not cover.

How to Qualify for North Carolina Medicare Advantage Plans 2026

Eligibility for Medicare Advantage Plans in North Carolina typically requires individuals to be enrolled in both Medicare Part A and Part B. Residents must also live in the service area of the Medicare Advantage Plan they wish to join. Some plans may have additional eligibility criteria, such as being under 65 and receiving Social Security Disability for a certain duration.

Individuals must not have end-stage renal disease (ESRD) when enrolling in a Medicare Advantage Plan, with some exceptions allowing continued coverage. Individuals can enroll by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Contracted Network and Access to Care

Health Maintenance Organization (HMO) plans will likely necessitate members to use specified local healthcare providers for coverage, except in emergencies. Preferred Provider Organization (PPO) plans offer more flexibility by allowing members to access healthcare outside the contracted network, though at potentially higher costs.

Some HMO Medicare Advantage plans may not require referrals to see specialists, likely simplifying access to care for members. Medicare Advantage plans in North Carolina typically require members to utilize a specific network of local physicians and hospitals for covered services.

Comparing North Carolina Medicare Advantage Plans to Original Medicare

Medicare Advantage plans provide all the benefits of Original Medicare, and sometimes additional services like dental, hearing, and vision care.

Coverage Differences

Some Medicare Advantage plans may include additional health benefits not covered by Original Medicare, such as vision, dental, and hearing coverage.

Cost Comparisons

Out-of-pocket costs for Medicare Advantage plans may vary significantly based on the services and providers chosen, unlike the more standardized costs of Original Medicare.

Emergencies and Referrals

Medicare Advantage Plans ensure coverage for both emergency and urgent care services without the need for prior approval. This ensures that members could receive necessary care in critical situations. For non-emergency or non-urgent services, Medicare Advantage Plans may require referrals to see specialists.

The process for referrals and access to care may differ among various Medicare Advantage Plans, affecting how patients seek specialist services. Plans are obligated to inform members about any changes in the referral policy or network providers before the next enrollment period.

Even if a provider leaves a plan’s network during the year, the plan must still ensure access to qualified healthcare professionals.

Summary

Navigating the complexities of Medicare Advantage Plans in North Carolina might be challenging, but understanding the different types of plans, covered services, enrollment periods, and potential costs could help you make an informed decision. From HMO and PPO plans to SNPs, each option offers unique benefits tailored to meet various healthcare needs.

Making a well-informed choice about your Medicare Advantage Plan could significantly impact your healthcare experience. By considering the potential benefits, network requirements, and possible financial protections offered by these plans, you can select the best option to suit your health and lifestyle needs. Remember to review your plan annually to ensure it continues to meet your needs and take advantage of open enrollment periods to make any necessary changes.

Frequently Asked Questions

→ What is a Medicare Advantage Plan?

A Medicare Advantage Plan, or Part C, is a health plan provided by private insurers that encompasses all Medicare Part A and B services, sometimes including additional benefits. This structure could offer more comprehensive coverage tailored to individual health needs.

→ What types of Medicare Advantage Plans are available in North Carolina?

In North Carolina, you can choose from Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs), each designed to meet varying healthcare requirements. Consider your specific needs to determine which plan type is best for you.

→ How do I enroll in a Medicare Advantage Plan?

To enroll in a Medicare Advantage Plan, you need to have both Medicare Part A and Part B, and you can do so during specific enrollment periods such as the Initial, General, Open, or Special Enrollment Periods. Ensure you check these periods to successfully enroll in the plan that fits your needs.

→ What additional benefits could Medicare Advantage Plans in North Carolina offer?

Some Medicare Advantage Plans in North Carolina may provide additional benefits like vision, dental, hearing services, and prescription drug coverage, possibly enhancing your overall healthcare experience. These potential benefits could make these plans an enticing option for those seeking more comprehensive coverage.

→ What are the potential costs associated with Medicare Advantage Plans?

The costs of Medicare Advantage Plans might include premiums, deductibles, copayments, and coinsurance. Additionally, certain plans may offer an out-of-pocket maximum, which could cap the total expenses for covered services.

ZRN Health & Financial Services, LLC, a Texas limited liability company