Medicaid vs Medicare Differences

When it comes to healthcare coverage, understanding the differences between Medicaid and Medicare will likely be crucial.

This article compares eligibility, possible coverage options, and costs to help you determine which program aligns with your needs. Navigate the complexities of Medicaid and Medicare’ with this guide will likely be designed to empower your healthcare decisions without overwhelming detail.

Key Takeaways

- Medicare may be federally funded for seniors 65+ and individuals with certain disabilities, with coverage split into Parts A, B, C, and D, whereas Medicaid will likely be state-funded, possibly aiding low-income people of all ages with a broad range of services.

- Eligibility for Medicare will likely be based on age or disability, with potential costs including premiums, co-pays, and deductibles; Medicaid eligibility may be income-based with minimal out-of-pocket expenses, possibly making it affordable for low-income individuals.

- Dual eligibility might allow qualified individuals to receive combined benefits from Medicare and Medicaid, potentially maximizing coverage and minimizing personal healthcare expenses.

Compare Plans in One Step!

Enter Zip Code

Medicaid vs Medicare: A Comprehensive Comparison

Medicare and Medicaid have been two prominent health insurance programs in the United States. The federal health insurance program Medicare will likely be for people aged 65 or older.

These plans could provide coverage for certain younger individuals with disabilities and those with End-Stage Renal Disease.

On the other end of the spectrum, Medicaid is a state program that has been designed to assist Americans of all ages with limited income, possibly covering their medical and long-term custodial care expenses.

Eligibility Criteria

The eligibility requirements for these programs are quite distinct. Medicare eligibility will likely hinge on age or disability, with individuals who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease qualifying for this health insurance program. On the other hand, Medicaid may be primarily for low-income Americans of all ages, with specific income thresholds determined by each state.

Possible Coverage Offered

Some of these programs may also differ in the coverage they might offer. Medicare will likely provide coverage through its four parts:

- Part A covers hospitalization

- Part B covers medically necessary services and equipment

- Part C, known as Medicare Advantage, includes additional benefits

- Part D provides prescription drug coverage.

On the contrary, Medicaid may offer a diverse range of services, which might not be covered by Medicare.

This extensive coverage, coupled with its role as the primary payer of long-term care in the United States, could make Medicaid a vital lifeline for many low-income individuals and families.

Potential Costs and Premiums

Poem of these programs may also have distinct cost structures. Medicare enrollees will likely be responsible for their coverage costs, which might include monthly premiums, co-pays, and deductibles.

Conversely, Medicaid recipients may incur minimal to no out-of-pocket expenses, possibly making it a more affordable option for those with limited financial resources and reducing their overall medical costs.

Medicare Advantage Plan Enrollment

If you are new to Medicare, the best time to enroll in a Medicare Advantage plan is between the time period three months before turning age 65, your birthday month, and three months after your 65th birth month. This is called the Initial enrollment period.

Your coverage will begin on the first of the month after the date that you signed up during your Initial enrollment period.

Already Enrolled in Medicare?

If you are already enrolled in Medicare and want to enroll in a Medicare Advantage plan (also called Medicare Part C), then you can switch and enroll in one during the Medicare Annual Enrollment period. This period runs between October 15th and December 7th of every year.

Your coverage will then begin on January 1st of the following year.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

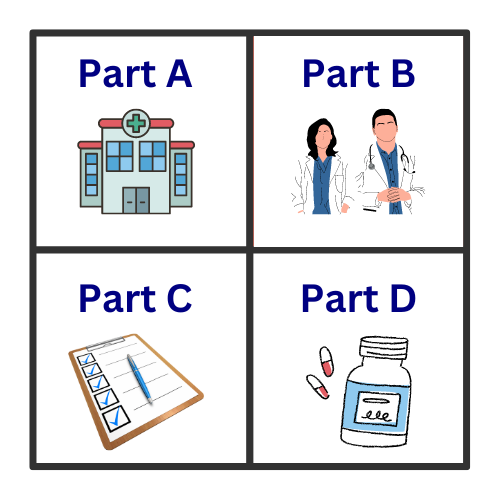

Medicare Breakdown: Understanding Parts A, B, C, and D

Medicare is comprised of four parts – A, B, C, and D – possibly offering a diverse range of coverage options, each with a set of possible benefits and costs. A thorough understanding of these components could help eligible individuals choose a plan that best meets their needs.

Part A: Hospital Insurance

Medicare Part A, often referred to as hospital insurance, covers:

- Inpatient hospital care

- Skilled nursing facility care

- Hospice care

- Home health care

This coverage may be provided without a premium for most enrollees who have paid Medicare taxes while working. Thus, for those eligible, Part A could offer a robust safety net for hospital-related expenses.

Part B: Medical Insurance

Complementing Part A is Medicare Part B, which covers medically necessary services and equipment. This may include:

- Clinical research

- Ambulance services

- Durable medical equipment

- Mental health services

- Outpatient care

Unlike Part A, Part B may also come with a standard premium that will likely depend on the individual’s or their spouse’s work history and payment of Medicare taxes.

Part C: Medicare Advantage Plans

Medicare Part C, also known as Medicare Advantage, could provide an alternative method for receiving Original Medicare benefits and sometimes additional coverage. These plans will likely be offered by private insurance companies approved by Medicare and may include supplementary benefits such as vision, dental, and hearing services, which may not be covered by Original Medicare.

Medicare supplement insurance could also be an option for those looking for additional coverage beyond what Medicare Advantage might offer.

However, it should be noted that depending on the Medicare Advantage plan and services used, some Medicare Advantage plans might result in higher out-of-pocket expenses for some individuals.

Part D: Prescription Drug Coverage

Last but not least is Medicare Part D, which offers prescription drug coverage for various prescription drugs. The costs that may be associated with Part D will likely depend on the chosen plan, and enrollees may be responsible for monthly premiums, an annual deductible, and out-of-pocket copayments for specific prescriptions.

Comprehending the details of Part D will likely be important for individuals who require regular medication, given its potential to affect out-of-pocket healthcare costs.

Navigating Medicaid: Eligibility, Benefits, and Application Process

As a state-dependent program, understanding the nuances of Medicaid may be a bit more complicated but is just as important, especially for low-income individuals and families who may depend on this program for their healthcare needs.

State-Specific Eligibility

One of the potential aspects of Medicaid may be its state-specific eligibility criteria. While Medicaid is a joint federal and state program, the income and resource rules for qualification may vary significantly from one state to another. Thus, it’s important to understand the specific requirements in your state of residence to ascertain eligibility.

Possible Benefits and Services

Some of Medicaid’s benefits could include a wide array of services. In addition to federally mandated coverage such as inpatient and outpatient hospital services, physician services, and family planning, Medicaid may also offer additional state-specific coverage options.

Applying for Medicaid

There will likely be several steps involved in applying for Medicaid. These may include:

- Identifying the type of Medicaid needed

- Assessing potential automatic eligibility

- Gathering required supporting documents

- Reaching out to the state’s Medicaid office for specific application guidelines.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Dual Eligibility: Combining Medicare and Medicaid Coverage

Summary

Understanding the differences between Medicaid and Medicare could be key to making informed decisions about health coverage. While both programs may aim to support individuals in accessing healthcare, they may also cater to different populations and potentially offer distinct benefits and costs.

By comprehensively understanding these programs – from eligibility criteria to coverage options and costs – individuals can select the plan that best suits their needs and financial situation.

Frequently Asked Questions

→ What is the difference between Medicare and Medicaid?

The main difference between Medicare and Medicaid is that Medicare is for individuals aged 65 and older, or those with disabilities, regardless of income, while Medicaid may provide health coverage for people with very low incomes. These programs have been designed to provide health insurance to different segments of the population.

→ Do you pay for Medicare?

Some people may get Medicare Part A for free, but some may have to pay a premium depending on their eligibility.

→ Who is eligible for Medicaid and Medicare?

If you are 65 or older, have certain disabilities, or have End-Stage Renal Disease, you are eligible for Medicare. Medicaid will likely be available to low-income individuals of all ages, with income thresholds varying by state.

→ What does Medicare Part C, also known as Medicare Advantage, cover?

Medicare Part C, also known as Medicare Advantage, covers Original Medicare benefits as well as possible coverage for vision, dental, and hearing services through private insurance companies.

ZRN Health & Financial Services, LLC, a Texas limited liability company