Difference Between Medicare and Medicaid

When navigating the United States’ healthcare system, understanding the potential differences between Medicare and Medicaid is essential. At their core, Medicare is a federal program that primarily serves individuals over 65 or those with certain disabilities, whereas Medicaid is a joint federal and state program that will likely be aimed at assisting those with limited income and resources.

This article will delineate the distinct eligibility requirements, potential coverage details, and possible financial implications of each program, helping you to identify which one may apply to your situation.

Key Takeaways

- Medicare is a federal health insurance program mainly for people aged 65 and over or with certain disabilities, potentially offering different parts covering hospital care, medical services, prescription drugs, or alternative Medicare Advantage plans.

- Medicaid is a joint federal and state program providing health coverage to individuals with limited income and resources, with varying eligibility and potential benefits by state, which may include services not typically covered by Medicare.

- Dual eligibility might allow qualified individuals to benefit from both Medicare and Medicaid, potentially lowering healthcare costs through a wider range of services and might covering expenses such as certain Medicare premiums, deductibles, and copays.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare: A Federal Health Insurance Program

We’ll start with Medicare. This federal health insurance program, also known as medical insurance, mainly caters to individuals aged 65 and over, and could potentially provide additional coverage for younger individuals with particular disabilities.

Medicare will likely operate uniformly across the United States, ensuring every enrollee gets the same services regardless of where they reside.

Medicare’s structure could be quite comprehensive, with four parts, each may cover different services:

- Part B includes medical services

- Part C, also known as Medicare Advantage, may offer an alternate method of receiving certain Medicare benefits

- Part D could potentially assist in covering prescription drug expenses.

The Components of Medicare

Upon further examination of Medicare’s components, Original Medicare, comprising Parts A and B, may include inpatient health care in places such as hospitals and similar establishments, and may also include hospice care and select home health services. Meanwhile, some of Medicare Part B could cover specific doctor’s services, outpatient care, medical supplies, and preventive services.

In contrast, a Medicare Advantage plan, or Part C, is a type of Medicare health plan that may be offered by private companies that contract with Medicare. It provides all the benefits of Parts A and B and may also include additional benefits such as vision, dental, and hearing, and might incorporate prescription drug coverage as well.

Enrollment and Eligibility for Medicare

In terms of Medicare enrollment, eligibility largely hinges on age or disability. The program is designed for individuals who are 65 years of age or older. However, there may be exceptions for younger individuals with specific conditions such as a disability, End-Stage Renal Disease (ESRD), or ALS.

For those who may already be receiving Social Security benefits, enrollment in Medicare will likely be automatic. However, if you’re not yet receiving these benefits, you’ll need to sign up manually through the Social Security Administration. It’s important to note that, even if you’re not ready to retire, you should still sign up for Medicare three months before turning 65 to avoid late enrollment penalties.

The Potential Costs of Joining Medicare

Grasping the expenses that could be tied to Medicare is crucial in planning your healthcare budget. While Part A may offer premium-free for most enrollees, Parts B, C, and D will likely come with varying costs, which may include:

- Premiums

- Deductibles

- Copayments

- Coinsurance

Comprehending these potential expenses and planning accordingly is key when deciding which parts of Medicare to sign up for.

Deciphering Medicaid: State and Federal Health Coverage

Now, we’ll turn our attention to Medicaid, a combined federal and state program that will likely provide health coverage to individuals with limited income and resources. Unlike Medicare, which operates uniformly across the country, Medicaid programs could vary greatly from state to state, both in terms of eligibility criteria and the possible benefits offered.

Eligibility for Medicaid will likely be determined by income, family size, and other factors, with certain allowances for retaining assets. Moreover, Medicaid might offer benefits that Medicare typically doesn’t cover, potentially including nursing home care and personal care services.

How Medicaid Works

Medicaid will likely provide comprehensive health care coverage, which may include hospital insurance benefits such as:

- Inpatient and outpatient hospital care

- Labs and X-rays

- Certain screenings

- Home health services

- Doctor services

- Nursing home care (in some cases)

This breadth of possible coverage may ensure that low-income individuals and families could have access to a wide range of health services.

But Medicaid’s potential benefits may not stop there. Each state could have the flexibility to introduce optional benefits that could go beyond the obligatory coverage. Some of these additional benefits could include:

- coverage for prescription drugs

- clinic visits

- dental care

- vision care

- different types of therapies

Some of these potential benefits could provide more comprehensive healthcare coverage for individuals. The result is a program that could potentially offer a wider range of benefits than Medicare, particularly for those with limited resources.

Applying for Medicaid

While Medicare has defined enrollment periods, you can enroll any time by calling one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. This flexibility could make it easier to access Medicaid coverage when you need it.

Eligibility will likely be determined by a variety of factors, which may include income, family size, and sometimes assets. In some states, individuals with incomes above the Medicaid limit may still qualify through a ‘spend down’ process, which might involve incurring potential medical expenses until they meet the eligibility criteria. Our licensed agents can provide you with additional details.

Applying for Medicaid requires several documents, including:

- Driver’s license, photo ID card, or passport

- Social security card

- Proof of income such as pay stubs and income tax returns

- Documentation of assets including property and retirement accounts

- Car registration

If you are unsure of your eligibility or need help with the application process, our agents will be there to help.

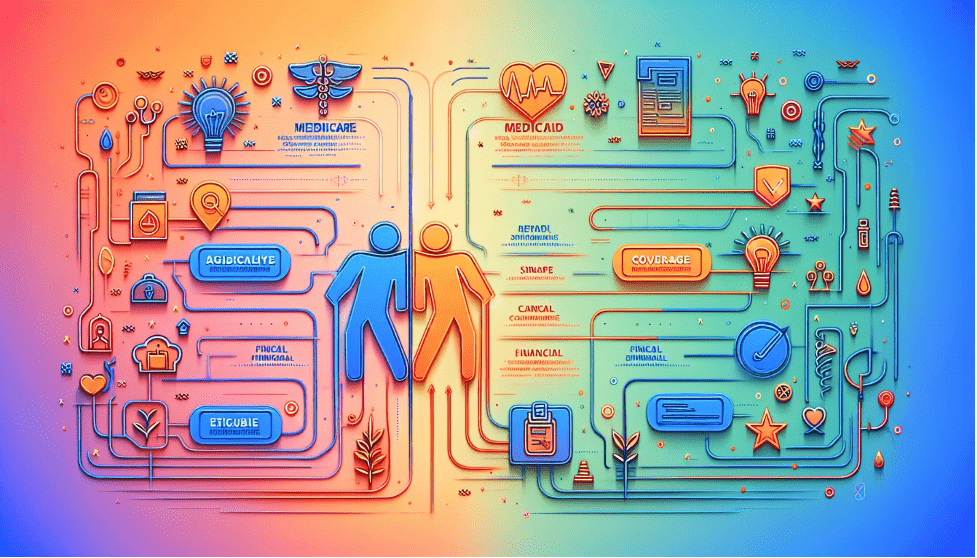

Key Differences Between Medicare and Medicaid

Having analyzed both Medicare and Medicaid, it’s now time to highlight some of the main distinctions between these two programs. While both may provide health coverage, they do so in different ways, with varying eligibility criteria, coverage scopes, and financial aspects.

Primarily, Medicare eligibility may be determined by age or disability, whereas Medicaid may primarily be income-based. In terms of coverage, Medicare will likely focus on hospital and medical services, while Medicaid could offer a broader scope, possibly including long-term care and home health services.

Finally, in terms of potential costs, Medicare may have varying expenses that will likely depend on the part, while Medicaid may offer free or low-cost with limited out-of-pocket expenses.

Eligibility Criteria: Age vs. Income

A closer look at the eligibility criteria for Medicare and Medicaid reveals clear differences. For Medicare, eligibility is primarily based on age or specific disabilities. Specifically, the program is designed for individuals 65 years of age or older, with exceptions for younger individuals with certain conditions such as End-Stage Renal Disease (ESRD) or ALS.

On the other hand, Medicaid eligibility is primarily income-based. Various other factors such as family size and assets may also come into play depending on the state’s specific criteria. This could potentially make Medicaid more accessible for low-income individuals and families who might not qualify for Medicare.

Potential Coverage Scope: What’s Included?

When it comes to coverage scope, Medicare and Medicaid also differ significantly.

Medicare will likely provide specific medical and hospital services which may include:

- Inpatient hospital care

- Skilled nursing facility care

- Hospice care

- Lab tests

- Surgery

- Home health care

It may also offer coverage for certain prescription drugs through Medicare Part D, an optional program that may be available to some Medicare beneficiaries.

Medicaid, on the other hand, could potentially cover a wider range of services that may not be covered by Medicare, such as:

- long-term nursing home care

- personal care services

- dental care (in certain states)

- vision care (in certain states)

- physical therapy (in certain states)

- transportation to and from medical appointments (in certain states)

The possibility of having a broader range of benefits could make Medicaid a more comprehensive health coverage option for low-income individuals and families.

Financial Aspects: Potential Premiums and Out-of-Pocket Costs

The financial aspects of Medicare and Medicaid are another major point of difference. For Medicare, costs may vary depending on the part. For instance, Part A could potentially be premium-free for most enrollees, Parts B, C, and D might come with varying costs, which may include premiums, deductibles, copayments, and coinsurance.

In contrast, Medicaid could offer free or low-cost, that may come with limited out-of-pocket expenses. This possibility could make Medicaid a more accessible option for low-income individuals and families who might struggle to afford the varying costs that may be associated with Medicare.

Dual Eligibility: When You Qualify for Both Medicare and Medicaid

What occurs when a person qualifies for both Medicare and Medicaid? This scenario may be referred to as dual eligibility, which could potentially allow individuals to benefit from both programs’ coverage, possibly providing supplementary financial aid and comprehensive healthcare.

Dual eligibility may be particularly beneficial for low-income seniors and people with disabilities, as Medicaid could potentially cover:

- Medicare premiums

- deductibles

- copays

- funding nursing home and personal care services that may not be covered by Medicare

However, navigating dual coverage could be complex and may require additional support.

Navigating Dual Coverage

Managing dual coverage will likely entail:

- Synchronizing the potential benefits between Medicare and Medicaid

- Medicare taking precedence in paying for certain services that may be covered under its program

- Medicaid bridging the gaps by potentially covering residual Medicare cost-sharing amounts

- Medicaid may offer additional benefits that may not be covered by Medicare

However, managing dual coverage could be challenging due to fragmented care, complex eligibility requirements, and the need to navigate multiple entities and systems. Therefore, dual-eligible individuals must understand how to coordinate their potential benefits and take full advantage of both programs.

Possible Benefits of Dual Eligibility

There may be substantial benefits to being dual eligible for both Medicare and Medicaid. Firstly, it could potentially result in lower healthcare costs, as Medicaid may cover certain Medicare premiums, deductibles, and copays, possibly reducing out-of-pocket expenses.

Secondly, dual eligibility may also provide access to a wider range of services and personalized support from both programs. Individuals with dual eligibility might avail of additional benefits such as:

- long-term nursing home care

- personal care services

- durable medical equipment

- doctor visits

These benefits may be unavailable to individuals who only qualify for either Medicaid or Medicare.

Additional Support Programs

In addition to Medicare and Medicaid, other government health insurance programs might offer Medicare supplement insurance and supplementary assistance for eligible individuals.

These could include the Children’s Health Insurance Program (CHIP) and Medicare Savings Programs. These programs will likely be designed to potentially provide further support to individuals and families who need it, possibly helping to cover a wider range of healthcare costs.

These health insurance programs may be particularly helpful for individuals with specific needs or circumstances. For example, CHIP may provide health insurance for children from families with incomes that may be too high for Medicaid but too low for private insurance, while Medicare Savings Programs could potentially help low-income individuals pay for certain Medicare premiums, deductibles, and coinsurance costs.

Children’s Health Insurance Program (CHIP)

The Children’s Health Insurance Program (CHIP) may offer economic health coverage to children from families whose incomes might surpass the Medicaid eligibility threshold. This may also extend coverage to pregnant women in certain states.

CHIP will likely provide comprehensive health coverage, which might include essential benefits that may be customized by each state. Furthermore, CHIP may also include coverage for dental and vision care for children, possibly ensuring that they receive the comprehensive care they need during their formative years.

Medicare Savings Programs

Some Medicare Savings Programs may aim to help low-income individuals afford some of their Medicare premiums, deductibles, and coinsurance costs. These programs could potentially provide significant financial relief for eligible individuals, possibly reducing the financial burden of certain healthcare costs.

There will likely be several different Medicare Savings Programs, each could have its separate eligibility criteria based on income and assets. These programs may be particularly helpful for individuals who qualify for Medicare but struggle to afford the associated costs.

Summary

While both Medicare and Medicaid may offer health coverage, they could do so in distinct ways, possibly catering to different groups of people based on age, disability, and income.

Understanding these differences will likely be crucial in making informed decisions about your healthcare. Whether you qualify for one, both, or the potential additional support programs like CHIP or the Medicare Savings Programs, it’s essential to explore all your options to ensure you get the coverage you need.

Frequently Asked Questions

→ What is the difference between Medicare and Medicaid?

The main difference between Medicare and Medicaid is that Medicare is a federal program providing health coverage based on age or disability, while Medicaid is a joint federal and state program that will likely offer coverage based on low income. Therefore, Medicare is based on age and disability whereas Medicaid is based on income and resources.

→ What is Medicaid?

Medicaid is a joint federal and state program that will likely provide health coverage to low-income families, possibly offering benefits that may not be covered by Medicare. It was created in 1965 and is funded by both the federal government and the states.

→ What is dual eligibility?

Dual eligibility refers to qualifying for both Medicare and Medicaid and will likely provide access to the possible benefits from both programs.

→ What are the advantages of Medicare Advantage?

Some Medicare Advantage plans may offer lower-cost plans with comprehensive coverage, which may provide beneficiaries with peace of mind.

ZRN Health & Financial Services, LLC, a Texas limited liability company