Medicare Advantage Plans for Hearing Aids

Are you looking for Medicare Advantage plans for hearing aids that might offer coverage? You’ve come to the right place! As you may already know, Original Medicare will likely not provide coverage for hearing aids, leaving many seniors struggling to cover the high costs of these essential devices.

In this article we’ll guide you through the different types of Medicare Advantage plans, their hearing aid coverage, and how you can find the best plan to suit your needs.

Key Takeaways

- Some of the Medicare Advantage Plans may offer additional benefits such as hearing aid coverage, while Original Medicare may only cover tests conducted by an audiologist.

- Certain factors like location, type of plan, and income level will likely affect the amount of coverage for hearing aids in certain Medicare Advantage plans.

- Navigating the enrollment process involves familiarizing oneself with relevant deadlines and planning options to make an informed decision.

Compare Plans in 1 Step!

Enter Zip Code

Understanding Medicare Advantage Plans

Some Medicare Advantage plans will likely act as private insurance alternatives to Original Medicare that could offer a variety of additional benefits, which may include coverage for hearing aids.

While Original Medicare may only cover certain types of hearing aids, such as bone-anchored hearing aids (BAHAs) and cochlear implants, some of these Medicare Advantage plans could potentially provide more comprehensive hearing aid coverage.

Besides hearing aids, some of the Medicare Advantage plans may also cover:

- Vision

- Over-the-counter drugs

Given this broad coverage, it is understandable why many seniors might opt for these Medicare Advantage plans to meet their healthcare requirements.

Comparing Original Medicare and Medicare Advantage

One of the potential differences between Original Medicare and Medicare Advantage will likely lie in their approach to hearing aid coverage. While Original Medicare might cover hearing tests conducted by an audiologist if symptoms such as hearing loss or tinnitus are present, these plans might not provide coverage for hearing aids themselves.

On the other hand, some of the Medicare Advantage plans may offer supplemental hearing coverage, possibly providing benefits for hearing aids and hearing exams.

According to a Kaiser Family Foundation study, individuals with Original Medicare and a Medicare Supplement plan (Medigap) could potentially have lower healthcare expenses than those with a Medicare Advantage plan.

However, it is necessary to thoughtfully assess the possible pros and cons of each choice, keeping in mind factors such as hearing aid coverage, network limitations, and possible expenses to ascertain the most suitable plan for your needs.

Types of Medicare Advantage Plans

There will likely be several types of Medicare Advantage plans available, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Private Fee-for-Service (PFFS) plans. Each type of plan has its own unique features and approach to cost management.

For example, different types of health insurance plans, including federal health insurance program options, have different features and requirements:

- HMO plans focus on managed care and requires members to choose a primary care physician (PCP) and obtain referrals to visit specialists.

- PPO plans offer more freedom in choosing healthcare providers and do not require referrals.

- PFFS plans do not use cost-controlling measures such as referrals or network restrictions, offering even greater flexibility.

Comprehending the differences among these plan types could guide you in making a knowledgeable choice about the most suitable Medicare Advantage plan for you.

Potential Medicare Advantage Plans and Hearing Aid Coverage

While Original Medicare might not cover hearing aids, certain Medicare Advantage plans may offer this coverage.

Medicare Advantage plans (Part C) could potentially provide benefits for hearing aids and hearing exams, possibly making them an attractive option for those with hearing loss who may require hearing aids.

However, it is necessary to consider the possible price of hearing aids and potential coverage limitations or restrictions when evaluating hearing aid benefits in these Medicare Advantage plans.

In general, specific benefits and coverage amounts may vary depending on the plan selected.

Potential Hearing Aid Benefits in Medicare Advantage Plans

Some of the Medicare Advantage plans may offer coverage for hearing services, possibly including some of the following related to hearing loss:

- Hearing tests

- Hearing aids

- Fittings

- Maintenance

However, it’s essential to examine the exact details of each plan, as they could vary significantly in terms of coverage limitations and frequency of certain services.

For instance, some plans might have an annual spending limit for hearing aids, while others may limit how often hearing aids can be replaced within a specific time frame. Take these possible factors into account when evaluating the hearing aid benefits of a Medicare Advantage plan to ensure it aligns with your personal hearing aid coverage needs.

Potential Factors Affecting Hearing Aid Coverage

Several factors could influence hearing aid coverage in Medicare Advantage plans, such as:

- income level

- specific plan benefits

- and the individual’s hearing needs

The type of plan selected could also have a significant impact on hearing aid coverage, as certain Medicare Advantage plans may provide coverage for hearing aids, while others may not.

Location will likely be another factor that could affect coverage, as certain benefits and plans may differ depending on the carrier and region. It’s essential to consider the specific Medicare Advantage plans that may be available in your area to determine what extent of hearing aid coverage could be provided, as well as any additional benefits that may be included.

How to Choose a Medicare Advantage Plan with Hearing Aid Coverage

When choosing a Medicare Advantage plan that may include hearing aid coverage, it’s essential to take into account your needs and preferences. Some potential factors to consider when looking for Medicare Advantage plans with hearing aid coverage may include:

- Possible coverage limitations

- Prior authorization or medical necessity requirements

- The network of preferred hearing aid providers or suppliers that might offer discounted rates

It’s also necessary to inspect any potential extra charges or expenses that may be linked to the plan’s hearing aid coverage.

By meticulously assessing these factors and comparing the potential advantages of different Medicare Advantage plans, you may identify the optimal plan that could meet your needs and guarantee you receive the required hearing aid coverage.

Evaluating Potential Plan Benefits

To evaluate plan benefits, members might want to start by comparing the potential coverage for hearing aids, hearing tests, and other related services across different Medicare Advantage plans. Keep in mind that some of these benefits may vary significantly between plans, so it’s essential to review the specific details of each plan to understand the extent of hearing aid coverage that could be provided.

In addition to coverage, consider the possible cost-sharing requirements, such as premiums, copayments, and coinsurance, as well as the network of providers that could be associated with the plan.

By scrutinizing these factors closely, members can make a knowledgeable choice about which Medicare Advantage plan might provide the most suitable hearing aid coverage for their unique situation.

Considering Possible Costs and Limitations

When assessing the potential costs and limitations, it’s important to consider the possible premiums, copayments, coinsurance, and coverage restrictions that may be associated with some of the hearing aid coverage in certain Medicare Advantage plans.

Keep in mind that certain coverage restrictions could significantly impact hearing aid benefits, such as annual caps on the amount covered for hearing aids or potential limitations on the frequency of hearing aid replacements.

In some cases, certain plans that may have restricted coverage could result in similar out-of-pocket costs as those incurred without insurance.

By taking these potential factors into account and comparing the possible costs and restrictions of different Medicare Advantage plans, you can ensure that you select a plan that provides the required hearing aid coverage without straining your budget.

Additional Sources of Financial Assistance for Hearing Aids

It may also be worth exploring other financial assistance programs, such as state mandates, charitable organizations, and discount programs, that may help alleviate some of the burdens of hearing aid costs. By investigating these additional resources, you can ensure that you obtain the required hearing aid coverage without burdening your financial resources.

State Mandates and Medicaid

State mandates and Medicaid potential coverage for hearing aids may vary significantly by state and age group. Some states might have specific mandates for hearing aid coverage, while others could provide more comprehensive coverage through Medicaid.

It’s important to review the particular Medicaid policies in your state to determine the extent of hearing aid coverage provided.

Keep in mind that some of the Medicaid coverage for hearing aids may also vary depending on age group, with some states providing coverage for younger beneficiaries but not for those aged 21 and older.

By investigating the specific coverage requirements and eligibility criteria of your state, you can ascertain your eligibility for assistance through state mandates and whether Medicaid covers hearing aids.

Charitable Organizations and Discount Programs

Charitable organizations, such as the Hearing Loss Association of America and the Starkey Hearing Foundation, will likely provide financial assistance for hearing aids. Additionally, the Hearing Industries Association (HIA) directory could be a valuable resource for locating potential financial assistance programs for hearing aids.

Some other discount programs could be another option for reducing hearing aid costs. Examples may include:

Some other discount programs could be another option for reducing hearing aid costs. Examples may include:

- Discounts offered through membership organizations like AARP and AAA

- Discounted pricing for veterans through the VA Health Benefits program

- Discounted pricing for EyeMed vision enrollees through Amplifon

By investigating these charitable organizations and discount programs, you can find extra assistance to help cover the costs of hearing aids.

Over-the-Counter Hearing Aids: An Alternative Option

If you’re looking for a more affordable alternative to traditional hearing aids, some over-the-counter (OTC) hearing aids may be the solution for you. These devices will likely be designed for adults aged 18 and over with mild to moderate hearing loss and might not require a prescription or hearing exam before purchase.

Potential Benefits and Limitations of OTC Hearing Aids

Some of these OTC hearing aids could potentially offer numerous hearing benefits, such as lower costs and more accessibility compared to prescription hearing aids. Thanks to recent FDA regulations, OTC hearing aids will likely be widely available and regulated as medical devices for adults with hearing loss.

However, there might be some limitations to OTC hearing aids. Some of these offer will likely offer less customization and support compared to prescription devices, and might not be suitable for those with more severe hearing loss.

It’s necessary to balance the potential advantages and drawbacks of OTC hearing aids to decide if they’re the appropriate solution for your hearing needs.

Navigating the Medicare Advantage Enrollment Process

Once you’ve decided to enroll in a Medicare Advantage plan with hearing aid coverage, the next step is to navigate the enrollment process. Understanding enrollment periods, deadlines, and where to find information on plan options is vital to ensure a smooth enrollment experience.

By acquainting yourself with the enrollment process and actively researching plan options, you may make a knowledgeable choice and identify the ideal Medicare Advantage plan with hearing aid coverage to meet your needs.

Enrollment Periods and Deadlines

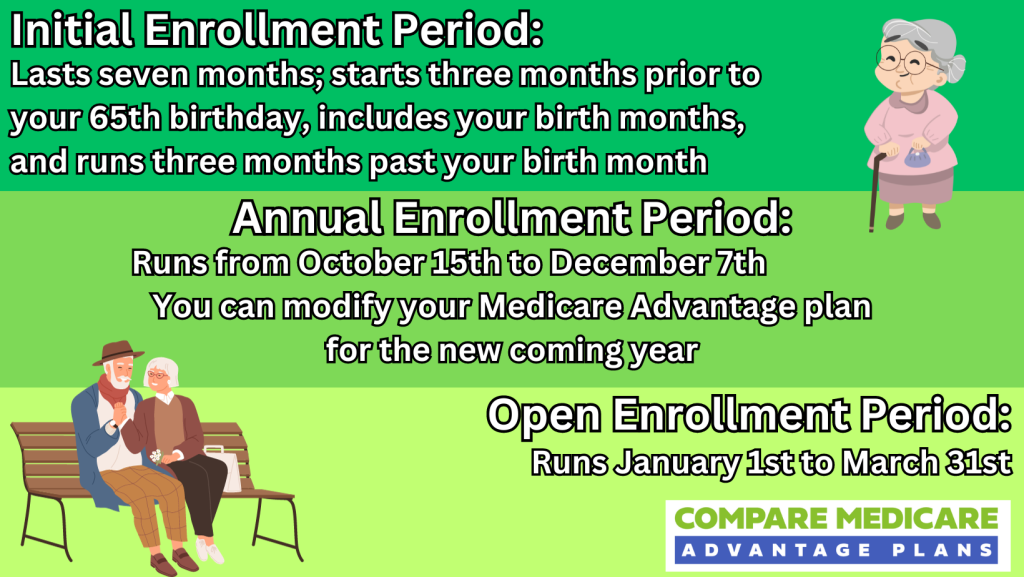

There are specific enrollment periods and deadlines for joining or switching Medicare Advantage plans.

The annual Medicare open enrollment period, which runs from October 15th to December 7th, is the most common time for individuals to enroll in or switch plans. Additionally, there may be special enrollment periods that allow you to change plans or switch to traditional Medicare between January 1st and March 31st annually.

It’s important to be aware of these deadlines, as missing the enrollment period may result in having to wait until the next enrollment period to join or switch plans, and could lead to additional penalties or fees.

By keeping an eye on enrollment periods and deadlines, you can ensure that you don’t miss the chance to enroll in the optimal Medicare Advantage plan for your hearing aid needs.

To enroll in a plan, just call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Finding Information on Plan Options

To find information on various Medicare Advantage plans, this website could be a great resource. By entering your zip code into any of the zip code boxes on this website, you can:

- Compare different Medicare Advantage and Prescription Drug Plans

- Focus on drug coverage and costs to find the perfect fit for your healthcare needs

- Input your information and sort through a variety of plans

- Weigh the pros and cons of each based on your situation

Licensed insurance agents could also aid beneficiaries, as they possess the necessary qualifications, such as a health insurance license, and have AHIP certifications so that they could assist with Medicare Advantage plans.

By investigating the potential plan options and consulting with a certified insurance agent, you can gain access to the broad range of plan options and expert guidance, which will likely aid you in making a knowledgeable choice about which Medicare Advantage plan could provide the most suitable hearing aid coverage for your unique situation.

Summary

Finding the right Medicare Advantage plan with hearing aid coverage is essential for individuals with hearing loss.

By understanding the different types of Medicare Advantage plans, evaluating potential plan benefits and costs, and exploring additional sources of financial assistance, you can make an informed decision and find the perfect plan to suit your needs.

Remember to stay informed about enrollment periods and deadlines, and seek guidance from a licensed insurance agent if needed. With the right plan in place, you can ensure that you receive the necessary hearing aid coverage that could improve your quality of life.

Frequently Asked Questions

→ Will hearing aids be covered by Medicare?

Although Medicare may not cover the cost of hearing aids, Medicare may offer coverage for other related services. Medicare Parts A and B may not cover the cost of hearing aids, fittings, or hearing exams for prescribing hearing aids.

→ Does Original Medicare cover hearing aids?

Unfortunately, Original Medicare might not cover hearing aids, but some Medicare Advantage plans may include coverage for them at no extra cost.

→ What types of Medicare Advantage plans are available?

Medicare Advantage plans are available in various forms, such as Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Private Fee-for-Service (PFFS) plans.

→ Are there additional sources of financial assistance for hearing aids beyond Medicare Advantage plans?

Yes, there will likely be additional sources of financial assistance for hearing aids that could go beyond Medicare Advantage plans, such as the VA, Medicaid, and charitable organizations and discount programs.

ZRN Health & Financial Services, LLC, a Texas limited liability company