Can I Change Medicare Advantage Plans Anytime?

When it comes to changing Medicare Advantage plans, people may have numerous questions, such as When can you change? What’s the easiest way to shop for a new plan? Are my plan benefits changing?

You might be wondering if you can change Medicare Advantage plans anytime. With various enrollment periods and potential consequences, it’s essential to approach plan changes with careful thought and preparation.

This article aims to demystify the process, giving you the confidence to make well-informed decisions about your healthcare coverage.

Key Takeaways

- Understand the various enrollment periods and their potential implications to make timely decisions about healthcare coverage.

- Take proactive steps such as communicating with healthcare providers, reviewing prescription drug coverage, and maintaining accurate records for a successful transition to a Medicare Advantage plan.

- Compare plans based on network, potential inclusion of prescription drug coverage, possible costs & services needed to find the best fit for your needs.

Compare Plans in One Step!

Enter Zip Code

Understanding Medicare Advantage Plan Changes

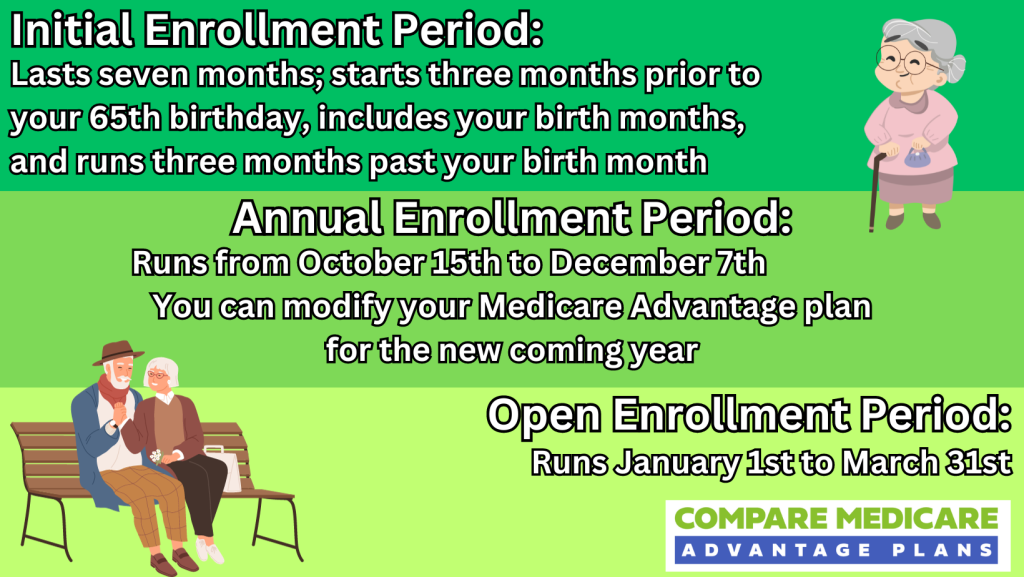

The Medicare Advantage plan changes can be made during specific periods, namely the Initial Enrollment Period, Annual Election Period, and Medicare Advantage Open Enrollment Period.

These periods could provide ample opportunities to review and adjust your Medicare coverage according to your evolving healthcare needs.

However, certain exceptions known as Special Enrollment Periods may allow for plan changes under specific circumstances, such as moving, losing coverage, or plan termination. Grasping these windows of opportunity could be key to making timely decisions about your Medicare Advantage plan.

Each enrollment period serves a unique purpose, catering to different stages in your Medicare journey.

Awareness of these periods and their potential implications could lead to more effective decisions about your healthcare coverage.

Initial Enrollment Period

The Initial Enrollment Period is your first chance to choose a Medicare Advantage plan when you become eligible for Medicare.

This period typically spans seven months, beginning three months before the month you turn 65 and ending three months after the month you turn 65, barring circumstances in which you qualify for Medicare due to a disability.

During this time, you have the option to join a Medical Savings Account Plan or switch to traditional Medicare between January 1st and March 31st.

You should carefully consider the Medicare Advantage plan you enroll in during the Initial Enrollment Period. Possible factors to consider may include:

- Coverage

- Network

- Costs

- Prescription drugs

- Quality ratings

- Flexibility

Taking these factors into account could help you select the most suitable plan for your needs within the plan’s service area.

Annual Election Period

The Annual Election Period is the time when you can change your Medicare Advantage or Part D Prescription Drug Plan each year.

Occurring annually from October 15 to December 7, this period allows eligible individuals to modify their Medicare coverage, such as switching to an alternate Medicare Advantage plan or altering their Part D prescription drug plan.

Maximizing the Annual Election Period will likely require:

- Reviewing your current plan

- Considering other available plans

- Scrutinizing the possible benefits, costs, and provider networks

- Enrolling in a new plan before the deadline

Being proactive and thorough during this period could lead to better healthcare coverage and potentially save you money in the long run.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period (MA OEP) is another window of opportunity to modify your Medicare coverage, similar to the Medicare Open Enrollment Period.

Running from January 1 through March 31, the MA OEP allows individuals enrolled in Medicare Advantage plans to switch to a different Medicare Advantage plan or revert to Original Medicare with or without a Part D prescription drug plan.

To change your Medicare Advantage plan during the MA OEP, reviewing your current plan, considering other accessible plans, and enrolling in a new plan before March 31st is necessary.

Timeliness and diligence during this period may help you secure the most appropriate healthcare coverage for your needs, possibly ensuring a smooth transition.

Special Enrollment Periods: Exceptions to the Rule

Special Enrollment Periods (SEPs) are exceptions that could enable individuals to make alterations to their Medicare Advantage plan beyond the regular enrollment windows, provided certain criteria are met.

These periods might offer flexibility and cater to unique circumstances, such as relocating to a new area, losing employer health coverage, or experiencing plan termination or significant changes.

Understanding the eligibility criteria for SEPs will likely enable you to make informed decisions about your healthcare coverage, even in unexpected situations.

Each Special Enrollment Period may be designed to address specific circumstances, allowing you to make changes to your Medicare Advantage plan when life takes an unexpected turn.

Awareness of these exceptions could allow you to maintain control over your healthcare coverage and navigate Medicare complexities with ease.

Moving to a New Area

Relocating to a new area could prompt a Special Enrollment Period in Medicare Advantage. This period allows you to enroll in or disenroll from a Medicare Advantage Plan or Part D plan within two months of your move.

Since companies might only provide their plans in specific areas, moving to a new location may necessitate selecting a new plan that is available in your new area.

Initiating your Special Election Period before relocation is recommended to guarantee a smooth transition. This could allow you to secure a new Medicare Advantage plan and potentially avoid any gaps in coverage.

Additionally, verifying your new plan’s network and provider options may also help you maintain the continuity of care when moving to a new area.

Losing Employer Health Coverage

Losing employer health coverage may qualify you for a Special Enrollment Period to enroll in a Medicare Advantage plan.

Generally, the SEP spans eight months, commencing from the month following the termination of group health plan coverage or employment. During this time, you may sign up for a Medicare Advantage plan, potentially ensuring you could maintain healthcare coverage despite the loss of employer-sponsored benefits.

Maximizing this time-sensitive opportunity might require reporting the loss of qualifying health coverage within 60 days before or after the loss of coverage and enrolling in a plan within 30 days of the loss of coverage or the life event that triggered the special enrollment.

By acting promptly and diligently, you can secure new healthcare coverage and potentially minimize the impact of losing employer health benefits.

Plan Termination or Significant Changes

In the event of plan termination or substantial changes to your Medicare Advantage plan, you may be eligible for a Special Enrollment Period (SEP) to switch plans.

The SEP typically lasts for two months following the month in which coverage ended, providing you the opportunity to investigate alternative Medicare Advantage Plans and make a well-informed decision about your healthcare coverage.

During this time, researching and comparing different Medicare Advantage plans to find one that best suits your needs and preferences is necessary.

By being proactive and thorough in your search, you can ensure a smooth transition when you switch Medicare Advantage plans and maintain the continuity of care you deserve.

The Process of Changing Medicare Advantage Plans

Changing Medicare Advantage plans involves several key steps: comparing available options, enrolling in a new plan, and disenrolling from your current plan.

By understanding this process and following the necessary steps, you could ensure a smooth transition when you decide to change Medicare Advantage plans to a new plan that better meets your healthcare needs.

Comparing Plans

When considering a change in your Medicare Advantage plan, comparing different plans to find the one that best fits your needs is key. Certain factors to consider may include:

- Network

- Prescription drug coverage

- Costs

- Coverage

- Availability

- Services Needed

Taking these factors into account could help you select the most suitable plan for your needs.

Various resources may also exist to help you compare Medicare Advantage plans, such as Humana tools and eHealthInsurance. Utilizing these tools will likely enable you to make a wise decision about the best Medicare Advantage plan for your unique healthcare needs.

Enrolling in a New Plan

Once you have selected a new Medicare Advantage plan, the next step is to enroll. You can enroll by calling 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. Our licensed agents can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Be prepared to provide your Medicare number and the date your Parts A and B coverage commenced when enrolling in a new plan.

Enrolling in your new plan during an eligible enrollment period, such as the Annual Election Period or the Medicare Advantage Open Enrollment Period, is necessary. Enrolling promptly could ensure a seamless transition and helps you maintain continuous healthcare coverage.

Disenrolling from Your Current Plan

Disenrolling from your current Medicare Advantage plan is an essential part of the process when changing plans. To disenroll, you must:

- Contact your plan provider directly and inform them of your decision to disenroll.

- Request a disenrollment notice, which will be mailed to you.

- Upon receipt of the notice, complete it and return it to your plan provider.

Exiting your current plan during a designated disenrollment period, such as the Medicare Advantage Disenrollment Period (MADP) or the Medicare Advantage Open Enrollment Period, will likely guarantee a smooth transition without penalties or restrictions.

By following the appropriate steps and timelines, you may successfully disenroll from your current plan and transition to your new Medicare Advantage plan with ease.

Potential Consequences of Switching Plans

These potential changes could have significant implications for your healthcare experience and expenses. By understanding the potential consequences of changing plans, you can make a more informed decision about whether a plan change is the best course of action for your healthcare needs.

Awareness of these potential consequences could enable you to take the necessary steps to mitigate any negative impact on your healthcare experience.

By comparing plans, reviewing prescription drug coverage, and communicating with healthcare providers, you could potentially ensure a smooth transition to a new Medicare Advantage plan that better meets your needs.

Provider Network Changes

One of the potential consequences of changing Medicare Advantage plans might be a change in your provider network. As each plan will likely have its network of doctors, hospitals, and other healthcare providers, switching plans may necessitate finding new providers if your current ones may not be included in the new plan’s network.

This could affect the availability and consistency of care you receive and potentially result in higher out-of-pocket costs.

To avoid any disruptions in care or unexpected costs, verifying your new plan’s network and provider options before making the switch may be necessary.

By ensuring that your preferred healthcare providers could be included in the new plan’s network, you might need to maintain the continuity of care and avoid potential issues related to provider network changes.

Drug Coverage Differences

Different Medicare Advantage plans may also have varying prescription drug coverage, which could impact your medication costs. As each plan has its own formulary or list of covered medications, the medications you previously took may not be covered, or the cost-sharing requirements might change when you switch to a Medicare prescription drug plan.

It is essential to review the potential drug coverage details of Medicare Advantage plans before making a decision.

To avoid unexpected costs or gaps in medication coverage, reviewing the formulary of any potential new plan could help ensure that your medications are covered, and being aware of any changes in costs is necessary.

By comparing prescription drug coverage between plans, you can make an informed decision about the best Medicare Advantage plan for your unique healthcare needs.

Out-of-Pocket Cost Variations

When transitioning to a different Medicare Advantage plan, there may be variations in out-of-pocket costs. Some of these costs may include:

- Coinsurance

- Copays

- Deductibles

- Prescription drug costs

These costs may vary depending on the specific plan. Reviewing the particulars of each plan to understand how the costs could fluctuate and how these differences may impact your healthcare expenses is necessary.

By taking the time to research and compare different Medicare Advantage plans, you will likely gain a better understanding of the potential variations in out-of-pocket costs and make a more informed decision about the best plan for your unique healthcare needs and budget.

Tips for a Smooth Transition

Ensuring a smooth transition when changing Medicare Advantage plans may involve a combination of communication, research, and record-keeping.

Actively engaging with healthcare providers, reviewing prescription drug coverage, and maintaining accurate records could help minimize potential disruptions in your healthcare experience and optimize your new Medicare Advantage plan.

Implementing these tips may not only help you transition smoothly but could also empower you to make more informed decisions about your healthcare coverage.

As you navigate the complexities of Medicare Advantage plans, being proactive and diligent will likely be key to securing the best healthcare coverage for your unique needs.

Communicating with Healthcare Providers

Notifying your healthcare providers about any potential changes to your Medicare Advantage plan could be key to avoiding potential issues.

By keeping your providers in the loop, you could ensure that they may be aware of your new coverage and can make the necessary adjustments to billing and referrals. Regular communication with healthcare providers may also promote better health outcomes and facilitate coordination of care.

To ensure a seamless transition, you might want to provide your healthcare providers with the following information:

- The effective date of your new plan

- The name and contact information of your new Medicare Advantage plan

- Any changes in coverage or benefits

- Any modifications in your healthcare providers or network

By proactively communicating with your healthcare providers, you could minimize confusion and potential billing errors.

Reviewing Prescription Drug Coverage

Reviewing your new plan’s prescription drug coverage will likely be essential to ensure your medications are covered and to avoid unexpected costs.

To effectively review your drug coverage, you may want to examine the materials sent by your new plan, utilize the Medicare Plan Finder, consider your current medications, assess the formulary, weigh the costs, and obtain assistance if necessary.

By carefully examining your new plan’s prescription drug coverage, you could avoid potential gaps in medication coverage and unexpected out-of-pocket expenses.

This proactive approach to reviewing drug coverage could potentially ensure that your healthcare needs are met and possibly minimize disruptions in your medication regimen.

Keeping Records

Keeping track of your plan changes, such as enrollment and disenrollment dates, is essential for tracking your Medicare Advantage plan history and ensuring a smooth transition.

Keeping accurate records could facilitate a seamless transition and provide evidence of prior coverage and healthcare services. This could be invaluable in the event of discrepancies or complications that may arise during the transition process.

In addition to tracking your plan changes, maintaining records may also enable you to compare the potential benefits, costs, and coverage of multiple plans and make a judicious decision when selecting a new plan.

By staying organized and keeping accurate records, you can stay on top of your healthcare coverage and navigate the complexities of Medicare Advantage plans with ease.

Summary

Changing Medicare Advantage plans might be a complex process, but with the right knowledge and preparation, it is manageable.

By understanding the various enrollment periods, exceptions, and potential consequences, you can make well-informed decisions about your healthcare coverage.

Remember to communicate with healthcare providers, review prescription drug coverage, and keep accurate records to ensure a smooth transition. With these tips in mind, you can confidently navigate the world of Medicare Advantage plans and secure the best healthcare coverage for your unique needs.

Frequently Asked Questions

→ How do I switch to another Medicare Advantage plan?

To switch to another Medicare Advantage plan, contact one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST during the annual Medicare Advantage Open Enrollment Period.

Make sure to submit disenrollment and enrollment requests at the same time to avoid errors.

→ Why are people choosing Medicare Advantage plans?

People might choose Medicare Advantage plans due to the lack of prior authorization and quick payments from insurers.

→ Can you switch from Medicare Advantage to original Medicare without penalty?

Yes, you may be able to switch from Medicare Advantage to Original Medicare without penalty during the first year of enrollment. Additionally, if you previously left a Medigap policy for Medicare Advantage, your trial right allows you to switch back to the Medigap policy without penalty.

→ What is the biggest advantage of Medicare Advantage?

One of the biggest advantages of certain Medicare Advantage plans may be the broad range of provider networks, reduced out-of-pocket costs, and flexible coverage for services. These could potentially result in paying more for medical care or being unable to access desired health services.

→ What should I consider when comparing different Medicare Advantage plans?

When selecting a Medicare Advantage plan, be sure to consider certain factors such as network, prescription drug coverage, costs, coverage, availability, and services needed. This could help you find the most suitable plan for your needs.

ZRN Health & Financial Services, LLC, a Texas limited liability company