Best Medicare Advantage Plans Vermont 2025

Comparing Medicare Advantage plans may be both rewarding and challenging. For Vermont residents, understanding the available options and making the right choice is crucial to ensuring a healthy and secure future.

This comprehensive guide will provide you with valuable insights into some of the best Medicare Advantage plans in Vermont and may help you make informed decisions based on your unique needs and preferences.

From plan types to enrollment periods, possible benefits, and helpful resources, this article covers all the essential aspects of Medicare Advantage plans in Vermont. Strap in for a journey through the Green Mountain State’s diverse Medicare landscape and discover the path to a healthier, happier life.

Key Takeaways

- Vermont offers five private health insurance providers offering a variety of Medicare Advantage plans, including HMOs, PPOs, and SNPs.

- Some of these plans may offer varying prescription drug coverage with different costs, tiers, and networks for beneficiaries to consider when selecting the plan that could best suit their needs and budget.

- Vermont may also provide financial assistance programs such as Medicaid Services that could help cover certain healthcare costs for eligible individuals.

Compare Plans in One Step!

Enter Zip Code

Vermont Medicare Advantage Plan Providers

Vermont is home to five private health insurance providers that may offer a variety of Vermont Medicare plans, catering to the diverse needs of its residents.

The types of Medicare Advantage plans that may be available in Vermont include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Special Needs Plans (SNPs).

We will examine these plan types and their offerings.

HMO Medicare Advantage Plans in Vermont

HMO Medicare Advantage Plans in Vermont may be provided by:

- Humana

- MVP HEALTH CARE

- UnitedHealthcare

- Vermont Blue Advantage

- Wellcare

Some of these plans will likely be regulated by the federal government and operate within a network of healthcare providers. As a beneficiary, you’ll typically need to select a primary care physician (PCP) from the plan’s network, and referrals may be required for specialist visits.

However, certain services, like yearly screening mammograms, may not require a referral.

Choosing an HMO plan means embracing a managed-care format that provides a network of healthcare providers and requires referrals for specialist care. These plans are generally more affordable than PPO plans, but they offer less flexibility in choosing healthcare providers.

PPO Medicare Advantage Plans in Vermont

PPO Medicare Advantage Plans in Vermont are offered by Vermont Blue Advantage and are known for their flexibility when it comes to choosing healthcare providers. You can see any healthcare provider you like, but you’ll have higher out-of-pocket costs if you choose an out-of-network provider.

The most comprehensive PPO plans in Vermont are provided by:

- Humana

- MVP HEALTH

- UnitedHealthcare

Special Needs Plans (SNPs) in Vermont

Special Needs Plans (SNPs) in Vermont are tailored to meet the needs of specific groups, such as those with chronic conditions or those eligible for both Medicare and Medicaid.

Special Needs Plans (SNPs) in Vermont are tailored to meet the needs of specific groups, such as those with chronic conditions or those eligible for both Medicare and Medicaid.

These plans may offer targeted benefits that could be tailored to the unique healthcare needs of their beneficiaries.

Chronic Condition Special Needs Plans (C-SNPs) are available in Vermont for the following health conditions:

- Diabetes

- Chronic heart failure

- Chronic lung disorders

- Cardiovascular disorders

- HIV/AIDS

Dual-Eligible Special Needs Plans (D-SNPs) cater to individuals eligible for both Medicare and Medicaid, offering additional benefits and support at no extra cost.

Reviewing the plan options available in your area is necessary as the specific details and coverage of D-SNPs in Vermont may vary.

Comparing Vermont Medicare Advantage Plans

To choose the right Vermont Medicare Advantage Plan, you may need to compare various aspects of the available plans, such as the possibility of having prescription drug coverage, potential benefits, and overall costs and value.

We will examine each of these aspects in more detail to assist you in making a decision.

Prescription Drug Coverage in Vermont Medicare Advantage Plans

Prescription drug coverage that may be offered in some Vermont Medicare Advantage Plans could vary significantly, with different costs, tiers, and networks to consider.

Each plan will likely have a formulary, which lists all covered medications and their corresponding tiers. Different plans may have different price levels, but each level may have prices for particular drugs.

When selecting a plan, it may be wise to consider the following:

- Make sure your preferred or local pharmacies could be included in the plan’s network.

- Consider the costs that may be associated with each tier and the medications you need.

- Comparing the drug coverage of various plans could help you find the one that best suits your needs and budget.

Possible Benefits Offered by Vermont Medicare Advantage Plans

Potential benefits that may be offered by some Vermont Medicare Advantage Plans may include:

- Dental coverage

- Vision coverage

- Prescription drug coverage

- Hearing aids

Please note that the availability of these benefits may vary by plan.

While these potential benefits might enhance your overall healthcare experience, it’s essential to consider any potential restrictions or conditions that may apply to the benefits offered by each plan.

Understanding the specifics of each plan’s possible benefits could allow you to select a plan that best suits your healthcare needs and preferences.

Evaluating Potential Costs and Value in Vermont Medicare Advantage Plans

Evaluating the possible costs and value in certain Vermont Medicare Advantage Plans may involve comparing potential:

- Premiums

- Deductibles

- Copayments

- Out-of-pocket maximums

To calculate the total annual cost of a Vermont Medicare Advantage Plan, you may refer to the 2024 Centers for Medicare & Medicaid Services (CMS) Star Rating, which will likely consider various factors such as:

- Coverage

- Cost

- Network

- Prescription drug coverage

- Possible benefits

- Quality of care

- Flexibility

Taking the time to compare some Medicare Advantage plans may allow you to assess the value of a Vermont Medicare Advantage Plan and make the best choice for you, considering various factors that may include the Medicare Advantage plan insurer and other Medicare plans.

Enrollment and Eligibility for Vermont Medicare Advantage Plans

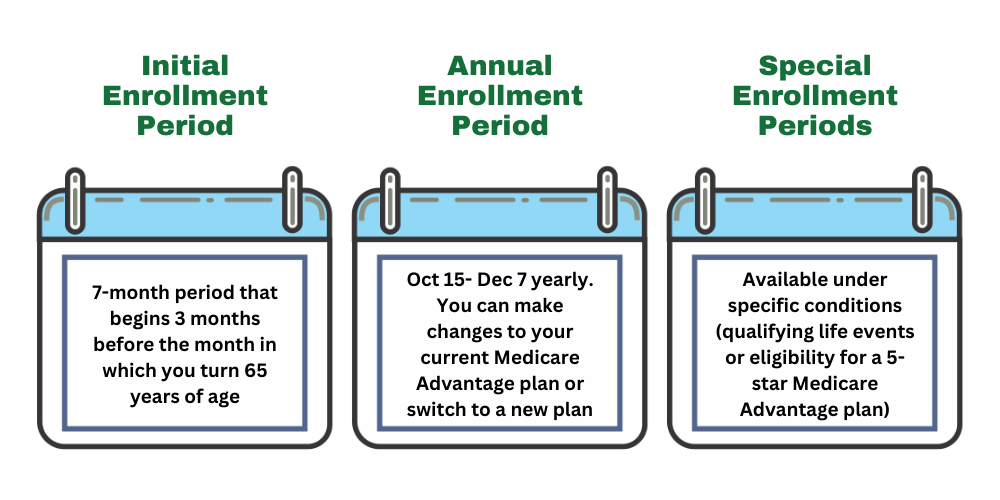

Enrollment and eligibility for Vermont Medicare Advantage Plans depend on specific enrollment periods, including the Initial Enrollment Period, Annual Election Period, and Special Enrollment Periods.

Each enrollment period has its own set of rules and requirements, which will be discussed in more detail below.

Initial Enrollment Period

The Initial Enrollment Period is a seven-month window that starts three months before the month of your 65th birthday and continues for seven months. This period is your first opportunity to enroll in a Medicare Advantage Plan.

During the Initial Enrollment Period, you can enroll in a Medicare Advantage Plan if you are eligible for Medicare and meet the enrollment requirements. If you want to change your plan during this period, you can do so.

Annual Election Period

The Annual Election Period occurs from October 15 to December 7 each year, allowing beneficiaries to:

- Change or enroll in Medicare Advantage Plans

- Transition from Original Medicare to a Medicare Advantage Plan

- Enroll in a Medicare Prescription Drug Plan (Part D)

- Change your Medicare Prescription Drug Plan

Prepare for the Annual Election Period by:

- Reviewing your current plan

- Researching and comparing different plans

- Assessing your healthcare needs

- Seeking assistance from Medicare or a licensed insurance agent

Stay informed and make the most of this opportunity to possibly secure the best healthcare coverage for your needs.

Special Enrollment Periods

Special Enrollment Periods may be granted for specific life events or circumstances, such as moving or losing employer-sponsored coverage. These periods usually last for 60 days, starting from the occurrence of a qualifying life event.

To apply for a Special Enrollment Period, visit the Vermont Health Connect website and fill out the form for exceptional circumstances, or contact Medicare for more information on special enrollment periods.

You may need to provide documentation to demonstrate eligibility for a Special Enrollment Period.

Navigating Vermont's Medicare Potential Savings Programs and Medicaid Services

Vermont’s Medicare Savings Programs and Medicaid Services could potentially provide financial assistance to eligible Medicare beneficiaries for certain premiums, copayments, and services that may not be covered by Medicare Part A and Part B.

For those who may have low income and limited assets, this assistance might be a lifeline, possibly helping to cover the costs of essential healthcare services.

To learn more about some of Vermont’s Medicare Savings Programs and Medicaid Services, contact the Vermont State Health Insurance Program or the Vermont Department of Financial Regulation, Insurance Division.

These organizations may provide guidance and support to assist you in navigating the complexities of financial assistance for healthcare in Vermont.

Helpful Resources for Vermont Medicare Advantage Beneficiaries

Navigating the world of Medicare Advantage Plans in Vermont may be complex, but you don’t have to do it alone.

There will likely be several helpful resources that may be available to assist you, such as the Vermont State Health Insurance Program, the Vermont Department of Financial Regulation, the Insurance Division, and the Medicare Rights Center.

These organizations could potentially provide counseling, advocacy, and information on affordable healthcare options for older adults and people with disabilities.

These programs may be able to assist you in understanding your potential Medicare Advantage plan benefits, navigating the healthcare system, and making decisions about your healthcare coverage.

Don’t hesitate to reach out to these resources for guidance and support as you explore your Vermont Medicare Advantage plan options.

Summary

Understanding some of the ins and outs of certain Vermont Medicare Advantage Plans may be essential for making the most informed decision about your healthcare coverage.

By thoroughly examining the available plan types, comparing potential costs and benefits, and considering enrollment periods and eligibility requirements, you may choose the plan that best suits your unique needs and preferences.

Remember, there may be a wealth of resources available that could assist you in your journey, including the Vermont State Health Insurance Program, the Vermont Department of Financial Regulation, the Insurance Division, and the Medicare Rights Center. Utilize these resources to ensure that you can make the best decision for your healthcare future.

Frequently Asked Questions

→ What are the advantages of a Medicare Advantage plan?

Some Medicare Advantage plans may offer a broad range of choices for doctors and medical offices, may require prior authorization for services, and could potentially provide coverage far from home.

→ Is Medicare Advantage available in Vermont?

Yes, Medicare Advantage will likely be available in Vermont. Some plans could potentially include prescription drug benefits, vision and hearing benefits, and a dental allowance.

→ What are 4 types of Medicare Advantage plans in Vermont for 2025?

Medicare Advantage Plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS) plans, and Special Needs Plans (SNPs).

→ How do I compare Vermont Medicare Advantage Plans?

To compare the potential Vermont Medicare Advantage Plans, look into their potential offerings of prescription drug coverage, possible benefits, and total costs to get the best value.

→ When can I enroll in a Vermont Medicare Advantage Plan?

You can enroll in a Vermont Medicare Advantage Plan during the Initial Enrollment Period, Annual Election Period, or Special Enrollment Period, depending on your eligibility.

Compare Medicare Plans By County:

Compare Medicare Plans By Company:

ZRN Health & Financial Services, LLC, a Texas limited liability company

Russell Noga is the CEO of ZRN Health & Financial Services, and head content editor of several Medicare insurance online publications. He has over 15 years of experience as a licensed Medicare insurance broker helping Medicare beneficiaries learn about Medicare, Medicare Advantage Plans, Medigap insurance, and Medicare Part D prescription drug plans.