Best Medicare Advantage Plans in Oklahoma for 2025

Deciding on the right healthcare coverage will likely be an essential aspect of ensuring peace of mind and financial security.

Some of the Medicare Advantage plans in Oklahoma for 2025 will likely offer numerous benefits and could cater to individual healthcare needs, possibly making them an attractive option for many.

Navigating the potential Medicare Advantage may be complex, but this comprehensive guide will help you understand your options and make an informed decision for your healthcare future.

This article will explore the various Medicare Advantage plan types that may be available in Oklahoma, learn about prescription drug coverage, explore the potential financial considerations for Medicare beneficiaries, and gain insights into the resources and support available that could help you make the best choice for your healthcare needs with Medicare Advantage Plans Oklahoma.

Key Takeaways

- This article will provide an overview of the various Medicare Advantage options that may be available in Oklahoma, including plan types, coverage details, and enrollment timings.

- Residents who meet eligibility requirements can enroll in a Medicare Advantage plan during designated periods to access comprehensive medical and prescription drug coverage.

- Our licensed agents’ advice, this website, and local support could be invaluable resources for selecting the right Medicare Advantage plan that meets individual healthcare needs.

Compare Plans in Oklahoma Right Now!

Enter Zip Code

Navigating Your Medicare Advantage Options in Oklahoma

Grasping the various Medicare Advantage options in Oklahoma will likely be key to making an optimal decision regarding your healthcare coverage.

With a potentially wide range of plan types, coverage details, and enrollment timings, it’s essential to have a clear overview of your options and know what to look for when comparing plans.

From Health Maintenance Organization (HMO) plans to Preferred Provider Organization (PPO) plans, and even Special Needs Plans (SNPs), there will likely be a variety of potential Medicare Advantage plans that have been designed to cater to diverse healthcare needs.

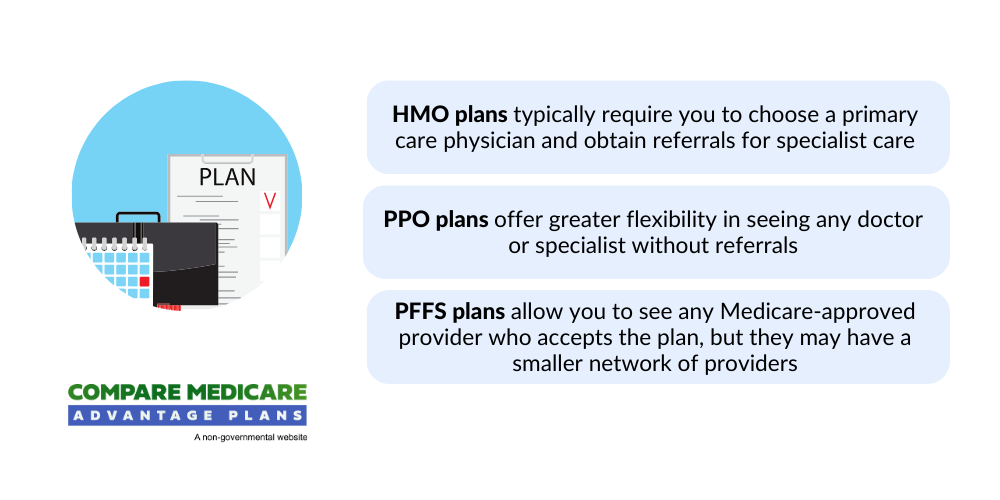

Exploring Plan Types: HMO, PPO, and More

Oklahoma will likely offer a variety of Medicare Advantage plans, each with a unique set of potential benefits and requirements. These plans include:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS)

- Special Needs Plans (SNP)

Each type of plan is regulated by the Centers for Medicare & Medicaid Services and will likely have a network of medical practitioners and hospitals, distinct regulations for coverage, and differing levels of flexibility in selecting healthcare providers.

Comprehending the differences between these plans may be necessary for choosing the optimal option for your distinct healthcare needs. Some differences to take note of:

- HMO plans may require choosing a primary care physician and obtaining referrals for specialist care.

- PPO plans may offer greater flexibility in seeing any doctor or specialist without referrals.

- PFFS plans typically provide the freedom to visit any Medicare-approved provider who accepts the plan’s terms and conditions but may have a more restricted network of providers.

Members should compare Medicare Advantage plans to identify the ideal match for their requirements, considering the right Medicare Advantage plan insurer.

Deciphering Coverage Details

Once you’ve familiarized yourself with the potential different plan types, it’s time to dive into the coverage details. Medicare Advantage plans in Oklahoma may provide the same coverage as Original Medicare (Parts A and B), with some plans potentially offering additional benefits such as dental, vision, and prescription drug coverage.

Members should carefully review the coverage details of each plan, including the formulary (the list of covered drugs) and the possible limitations and exclusions that may apply.

Additionally, you should watch for any potential financial assistance, such as the Medicare Savings Program or Extra Help, which could potentially help lower your Medicare Part D prescription drug costs. Comprehending these coverage details and comparing various plans could help you choose the best plan for your healthcare requirements.

Timing Your Enrollment Wisely

Enrolling in a Medicare Advantage plan in Oklahoma involves adhering to specific periods and deadlines. The Initial Enrollment Period (IEP) usually begins three months before your 65th birthday month and ends three months after your birthday month. This period allows you to enroll in a Medicare plan without facing any penalties.

In addition to the IEP, there’s the Medicare Advantage Open Enrollment Period, which occurs annually between January 1 and March 31. During this time, you can switch between Medicare Advantage and Original Medicare or change your Medicare Advantage plan.

There’s also the Annual Medicare election period, which runs from October 15 to December 7, allowing you to add, drop, or switch to a different Medicare Part D prescription plan. Be sure to mark your calendar and enroll during the appropriate time frames to avoid potential penalties or coverage gaps.

To enroll, call one of our licensed agents at 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST. They can provide comprehensive information, personalized guidance, and ongoing assistance to navigate the enrollment process for private insurance companies, making it easier for beneficiaries to make informed decisions about their healthcare.

Eligibility and Enrollment Process for Oklahoma Medicare Advantage Plans

After understanding your potential options, you should learn about the eligibility and enrollment process for Medicare Advantage plans in Oklahoma.

To be eligible for a plan, you must meet the medicare eligibility requirements, which typically include being enrolled in Medicare Part A and Part B and not being enrolled in a Medigap plan.

Eligibility is available to seniors aged 65 and above, as well as those with a qualifying disability, such as receiving at least 24 Social Security or Railroad Retirement Board (RRB) Disability Insurance payments, or having End-Stage Renal Disease (ESRD) or amyotrophic lateral sclerosis (ALS).

The enrollment process may vary depending on the chosen plan and the specific enrollment period. You should be prepared to provide your Medicare ID and Original Medicare (Part A and Part B) effective dates when enrolling in a Medicare Advantage plan.

Also, remember that you’re allowed to enroll in Medicare Advantage plans during the Open Enrollment Period, which takes place between January 1 and March 31.

Who Qualifies for Medicare Advantage?

The minimum age requirement for Medicare Advantage in Oklahoma is 65, where some individuals may be automatically enrolled in Medicare when they reach this age if they are already receiving Social Security or Railroad Retirement benefits.

However, it’s important to note that individuals who are not seniors may also be eligible for Medicare Advantage in Oklahoma if they meet specific disability requirements.

Those with qualifying disabilities may include those with ALS, ESRD, or other disabilities that could potentially qualify them for disability benefits. Be sure to check this website around the fall for updates and to find out what the 2025 benefits might be.

The Enrollment Journey

The first step is to ensure you’re enrolled in both Medicare Part A and Part B. Then, you’ll need to join a plan during one of the designated enrollment periods, such as:

- The Initial Enrollment Period (IEP)

- The Medicare Advantage Open Enrollment Period

- The Special Enrollment Period (SEP) if you qualify due to specific life events or circumstances.

When enrolling, be prepared to provide the necessary information found on your Medicare card, which may include your Medicare ID and Original Medicare (Part A and Part B) effective dates.

By adhering to these steps and enrolling at the right times, you may confirm your Medicare Advantage plan and appreciate the reassurance of comprehensive healthcare coverage. Also, consult with one of our licensed insurance agents to help you find a plan that meets your specific medication needs.

To enroll, call 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Prescription Drug Coverage in Medicare Advantage Plans

Prescription drug coverage will likely be an essential aspect of any healthcare plan. In some Medicare Advantage plans in Oklahoma, Part D prescription drug coverage might be integrated into the plan, possibly providing seamless access to the medications you need.

Understanding the possible ins and outs of Part D coverage and how it could be incorporated into Medicare Advantage plans will likely be crucial for managing your healthcare costs and ensuring you have access to the medications you require.

Understanding Part D Integration

Part D prescription drug coverage may sometimes be integrated into certain Oklahoma Medicare Advantage plans, possibly providing a convenient solution for managing your medication needs.

This could mean that prescription drug coverage might be included as part of the overall plan benefits, which could allow Medicare beneficiaries to receive both medical and prescription drug coverage through a single plan.

When selecting a Medicare Advantage plan, it’s important to consider the Medicare prescription drug coverage that may be offered, as this could greatly impact your healthcare costs and access to necessary medications.

Be sure to review each plan’s formulary (the list of covered drugs) and any possible limitations or exclusions that may apply to ensure you choose a plan that could provide the right coverage for your specific medication needs.

Managing Costs and Networks

Managing prescription drug costs and navigating pharmacy networks may also be essential aspects to potentially maximize the value of your Medicare Advantage plan.

To effectively manage prescription drug costs, members should select a plan that may provide comprehensive coverage for the medications they need and could potentially offer cost-effective options.

Pharmacy networks may also play a key role in controlling prescription drug costs, as they may enable plan sponsors to negotiate beneficial terms with pharmacies, such as substantial drug discounts and potentially decreased dispensing fees.

By utilizing preferred pharmacy networks and considering formularies, you could help keep your prescription drug costs in check and make the most of your Medicare Advantage plan.

Potential Advantages of Choosing a Medicare Advantage Plan in Oklahoma

Choosing a Medicare Advantage plan in Oklahoma may offer numerous benefits that might go beyond basic healthcare coverage. Some of these plans may include additional benefits such as:

- Dental

- Vision

- Hearing

Furthermore, certain Medicare Advantage plans in Oklahoma may also be tailored to meet individual health needs, possibly offering a range of plan types and coverage options that could suit your specific healthcare requirements.

Beyond Basic Care: Additional Benefits

Some of the Medicare Advantage plans in Oklahoma may offer a variety of additional benefits that could potentially help enhance your healthcare experience. Some of these benefits may include coverage for dental and vision care and prescription drug coverage.

When choosing a Medicare Advantage plan, members should consider the potential benefits that may be offered, as they could greatly impact their overall healthcare experience and possible costs.

For example, some of the dental benefits may include routine cleanings, fillings, crowns, root canals, extractions, and dentures, while vision coverage may include routine vision exams and an allowance for glasses. Be sure to review the details of each plan to find one that might offer the additional benefits you need. You may also consult with one of our licensed insurance agents to help you find a plan that meets your medication needs.

Tailored Plans for Individual Health Needs

Some of the Medicare Advantage plans in Oklahoma could be tailored to meet individual health needs and preferences, possibly ensuring you could receive the best possible healthcare coverage for your specific situation. Some of these Medicare Advantage plans may include additional coverage for services such as:

- Dental

- Vision

- Hearing

- Prescription drugs

They may also offer various levels of cost-sharing and provider networks that could suit individual preferences.

To customize your Medicare Advantage plan, some of the potential factors to consider are:

- Your health conditions

- Preferred physicians

- Prescription medications

- Flexibility requirements

- Budget constraints

By taking these possible factors into account and comparing different Medicare plans, you could find the Medicare Advantage plan that best meets your individual healthcare needs.

Possible Financial Considerations for Medicare Beneficiaries

Understanding the potential financial considerations for Medicare beneficiaries in Oklahoma may be essential for making the most of your healthcare coverage.

From comparing the potential plan costs to exploring assistance programs and possible savings opportunities, it may be crucial to have a clear understanding of the financial aspects of Medicare Advantage plans.

Comparing Plan Costs

When comparing the potential Medicare Advantage plans in Oklahoma, it’s important to consider the possible costs associated with each plan, which might include premiums, copayments, and coinsurance.

In addition to premiums, be sure to consider other costs such as deductibles, copayments, and coinsurance amounts, as these could greatly impact your overall healthcare expenses.

Resources and Support for Oklahoma Medicare Advantage Enrollees

Oklahoma Medicare Advantage enrollees will likely have access to a wealth of resources and support that could help them make informed decisions about their healthcare coverage.

From expert advice to educational tools and community programs, there will likely be numerous resources available that could ensure you have the information and assistance you need to navigate your Medicare Advantage options.

Summary

Some of the Medicare Advantage plans in Oklahoma may offer numerous benefits and could be tailored to meet individual healthcare needs.

By understanding the various plan types, potential coverage options, and enrollment timings, as well as taking advantage of available resources and support, you could make an informed decision about your healthcare coverage.

Don’t miss the opportunity to secure the best possible healthcare plan for your needs. Embrace the advantages of Medicare Advantage in Oklahoma and enjoy the peace of mind that comes with comprehensive healthcare coverage.

Frequently Asked Questions

→ What are the advantages of a Medicare Advantage plan?

Some of the Medicare Advantage plans might come with low out-of-pocket costs and possibly offer a broad range of choices for doctors, possibly making it easier to find the right healthcare services for you.

→ What are 4 types of Medicare Advantage plans in Oklahoma?

Medicare Advantage Plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service (PFFS) plans, and Special Needs plans (SNPs).

→ How to apply for Medicare in Oklahoma?

To apply for Medicare in Oklahoma, contact one of our licensed insurance agents by calling 1-833-641-4938 (TTY 711), Mon-Fri 8 am-9 pm EST.

Compare Medicare Advantage Plans by County:

Compare Medicare Advantage Plans by City:

Compare Medicare Advantage Plans by Company:

ZRN Health & Financial Services, LLC, a Texas limited liability company